When it comes to your beloved furry friend’s health, you want to ensure they receive the best care possible without breaking the bank. That’s where best pet insurance comes into play. Pet insurance can help alleviate the financial burden of unexpected medical expenses for your pet, giving you peace of mind and allowing you to focus on your pet’s well-being.

Here we will walk you through the ins and outs of pet insurance, helping you make an informed decision that suits both your pet’s needs and your budget. We’ll also provide you with a list of the top pet insurance providers in the market, each catering to different aspects of pet care. So, let’s dive in!

Understanding Pet Insurance

Before we delve into the best pet insurance providers, let’s first understand what pet insurance is and how it works.

What is Pet Insurance?

Pet insurance is a financial safety net for your furry companions. It works similarly to health insurance for humans, covering a portion of your pet’s medical expenses in case of accidents, illnesses, or other covered events. This can include surgeries, hospitalizations, diagnostic tests, medications, and more.

Factors to Consider When Choosing Pet Insurance

Selecting the right pet insurance policy can be a daunting task, considering the variety of providers and coverage options available. To make an informed decision, consider the following factors:

1. Coverage Options

Different pet insurance companies offer various coverage options, including accident-only coverage, illness coverage, and wellness or preventive care coverage. Selecting a policy that caters to your pet’s unique requirements is crucial.

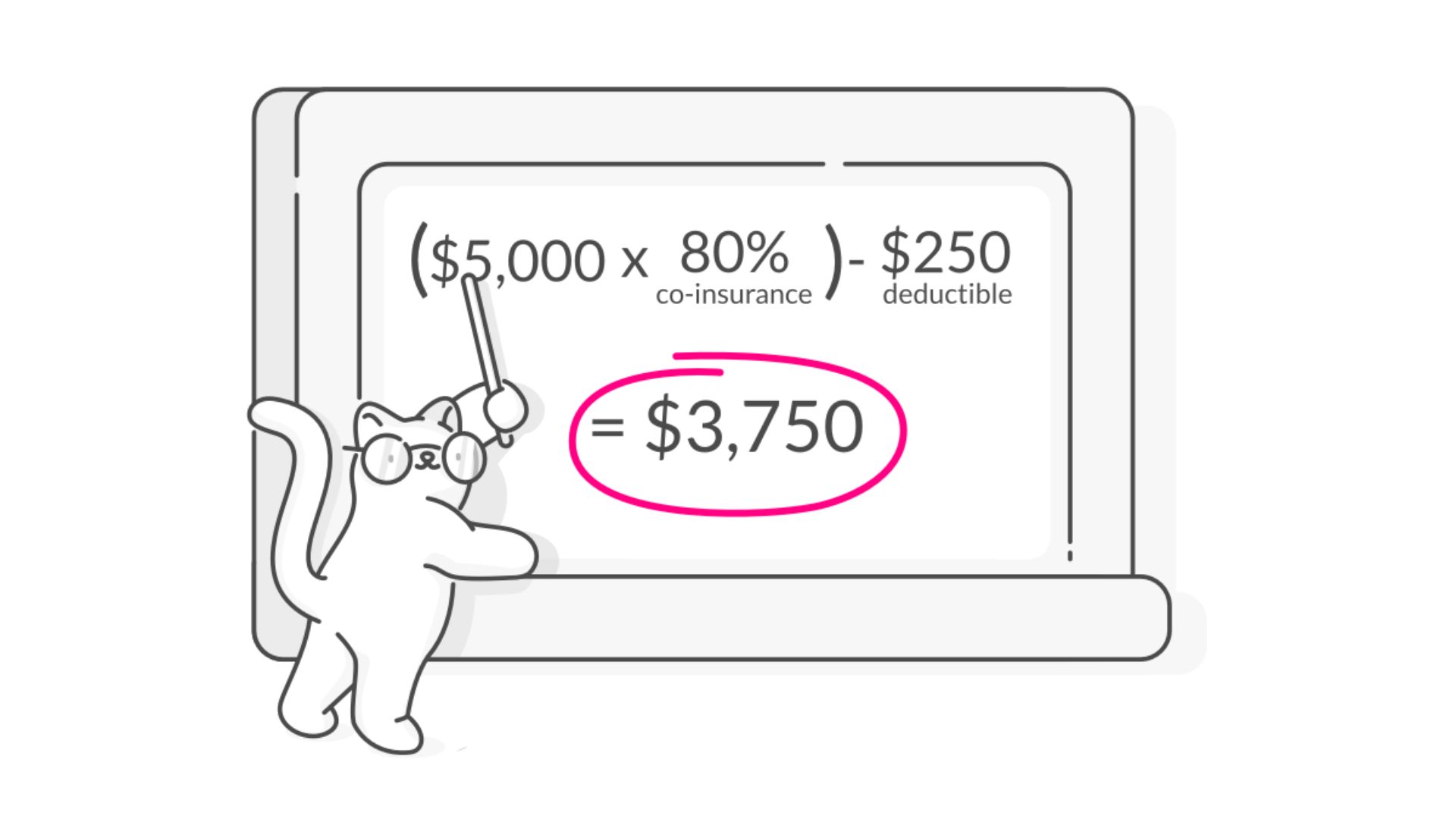

2. Deductibles and Reimbursement Rates

Deductibles are the amount you pay out of pocket before the insurance kicks in. Reimbursement rates determine how much of the eligible expenses the insurance provider will cover. Ensure these factors are within your budget and offer suitable coverage.

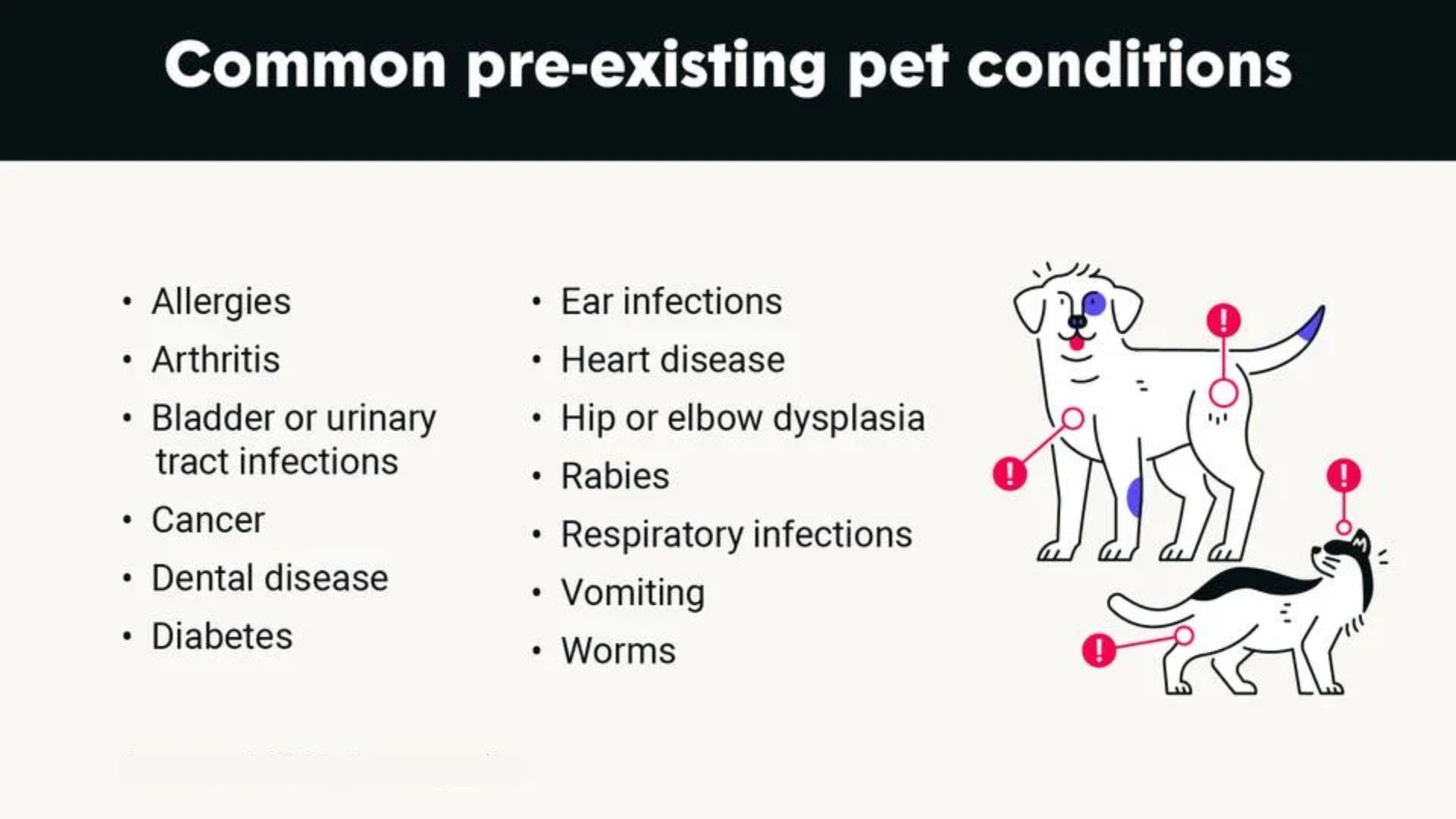

3. Pre-Existing Conditions

Most pet insurance policies do not cover pre-existing conditions. It’s crucial to understand how each provider defines and handles pre-existing conditions and whether they offer any coverage for them.

4. Annual Limits

Check for annual limits on coverage. Some policies have a maximum amount they will pay out in a year. Make sure the limit aligns with your expectations and your pet’s potential medical needs.

5. Waiting Periods

Many pet insurance policies have waiting periods before coverage begins. Be aware of these waiting periods, especially if you need immediate coverage.

6. Age and Breed of Your Pet

Some insurance providers may have age restrictions for coverage or different pricing based on your pet’s breed. Ensure the policy you choose is suitable for your pet’s age and breed.

The Top Best Pet Insurance Providers

Now that you have a better understanding of what to look for in pet insurance, let’s explore the top pet insurance providers in the market but always prefer low income vet for your pet:

1. Spot – Best for No Caps

Spot is a newcomer to the pet insurance market but has gained recognition for its comprehensive coverage. It offers accident and illness coverage that includes X-rays, MRI, CT scans, surgery, hospitalization, prescription food, and medication. With no maximum compensation restrictions, it’s an excellent choice for worry-free coverage.

For applying the insurance follow the stapes:

- Visit the Spot Pet Insurance website.

- Fill out the online application form with details about your pet.

- Choose from various coverage options and payment structures.

- Review the plan and complete the application process.

2. Pumpkin – Best for Puppies

Pumpkin offers affordable plans tailored for puppies. Their preventive care packs include an annual wellness exam, vaccinations, and a yearly fecal test. Pumpkin also covers conditions like surgery, hospitalization, and behavioral issues. Their flexibility in deductibles and reimbursements makes it ideal for budget-conscious pet owners.

For applying the insurance follow the stapes:

- Go to the Pumpkin Pet Insurance website.

- Complete the online application form, providing information about your pet.

- Customize your plan and consider adding a non-insurance Preventive Care Pack for comprehensive coverage.

- Review your selections and finalize the application.

3. Figo – Best for 100% Coverage

Figo provides easy online access, robust coverage, and 24/7 access to a live vet. They offer three plan tiers covering hereditary, congenital, and chronic illnesses. Figo stands out by potentially refunding up to 100% of your vet fees, providing unmatched coverage.

For applying the insurance follow the stapes:

- Visit the Figo Pet Insurance website.

- Select your desired plan and coverage options.

- Provide essential information about your pet in the online application.

- Choose your deductible and reimbursement preferences.

- Finalize your coverage and gain access to 24/7 vet support.

4. Embrace – Best for Dental Illness

Embrace offers substantial coverage for dental illnesses, including extractions, root canals, crowns, and more. Their deductibles decrease over time, and if your pet stays healthy, you can eventually have a zero deductible. With a wide range of coverage options, Embrace is an excellent choice for dental care.

For applying the insurance follow the stapes:

- Go to the Embrace Pet Insurance website.

- Fill out the online application form, including details about your pet.

- Choose from different coverage options, including dental coverage.

- Opt for flexible deductibles that can decrease over time with no claim reimbursement.

5. Pets Best – Best for Competitive Pricing

Pets Best offers competitive pricing with no maximum age limit. They provide accident, illness, and hereditary condition coverage. You can also add wellness coverages for routine care. Their pricing options cater to various budgets, making it accessible for pet owners.

For applying the insurance follow the stapes:

- Visit the Pets Best Pet Insurance website.

- Explore their Essential, Plus, or Elite plans.

- Complete the online application with essential information about your pet.

- Consider adding wellness coverage for preventive care.

- Review your selections and submit the application.

6. Lemonade – Best for Innovation and Affordability

Lemonade’s AI-powered platform simplifies the insurance process. They offer accident and illness coverage with optional preventive care riders. With affordable premiums starting at $10 a month, Lemonade combines innovation with cost-effectiveness.

For applying the insurance follow the stapes:

- Download the Lemonade app or visit their website.

- Customize your pet insurance coverage.

- Select your deductible and add riders like wellness coverage.

- Complete the online application process with ease through their AI-powered platform.

7. ASPCA – Best for Your Pet Budget

ASPCA offers flexible pricing with low monthly payments. They cover accidents, illnesses, hereditary conditions, and behavioral health issues. With options to add preventative care riders, ASPCA accommodates pet owners looking to manage their budgets.

For applying the insurance follow the stapes:

- Visit the ASPCA Pet Insurance website.

- Explore their pet insurance policies underwritten by the United States Fire Insurance Company.

- Learn about their network-free coverage, allowing you to visit any vet in the USA or Canada.

- Access a 24/7 pet telehealth line for assistance.

8. Petplan – Best for Cats

Petplan insures pets starting from six weeks old, with no age limit. Their coverage includes hereditary and congenital conditions and comprehensive dental care. While they don’t cover preventive care, they offer extensive coverage for various cat breeds.

For applying the insurance follow the stapes:

- Go to the Petplan Pet Insurance website.

- Fill out the online application form, including details about your pet.

- Insure pets as young as six weeks old with coverage for various conditions.

- Choose your deductible and reimbursement rate to match your needs.

9. Trupanion – Best for Hereditary Conditions

Trupanion stands out by offering single insurance for dogs and cats that covers hereditary conditions like hip dysplasia. Their lifetime per-condition deductible ensures you only pay once for chronic conditions.

For applying the insurance follow the stapes:

- Visit the Trupanion website.

- Simplify pet insurance with their single coverage for dogs and cats.

- Apply online by providing your pet’s information and selecting your deductible.

- Take advantage of their unique lifetime per condition deductible.

10. Nationwide – Best for Exotic Animals

Nationwide is the only pet insurance company that offers coverage for exotic animals, including birds, reptiles, and small mammals. They provide comprehensive insurance for unconventional pets, making them the top choice for exotic pet owners.

For applying the insurance follow the stapes:

- Visit the Nationwide Pet Insurance website.

- Contact them to inquire about coverage for your specific pet, including exotic animals.

- Choose from Whole Pet with Wellness, Major Medical, or Pet Wellness plans.

- Follow their application process as guided by their representatives.

Conclusion

Choosing the best pet insurance for your furry companion involves careful consideration of your pet’s needs, your budget, and your preferences. With this guide and the top pet insurance providers listed, you can make an informed decision to ensure your pet receives the best possible care without financial stress. Remember to review each provider’s specific terms and conditions before making your final choice.

Frequently Asked Questions (FAQs)

What is pet insurance, and how does it work?

Pet insurance is a financial product designed to help cover the cost of medical care for your pets. It works by paying a portion of eligible veterinary expenses, such as surgeries, treatments, medications, and diagnostic tests, after you’ve met your deductible. You choose a policy, pay premiums, and when your pet needs medical attention, you submit a claim to the insurance provider for reimbursement.

What does pet insurance typically cover?

Pet insurance coverage can vary by provider and policy, but most plans cover accidents and illnesses. This includes injuries from accidents, treatments for illnesses, surgeries, hospitalizations, prescription medications, and diagnostic tests. Some policies also offer coverage for hereditary and congenital conditions, dental care, and preventive/wellness care, depending on the plan you choose.

Are pre-existing conditions covered by pet insurance?

In general, pre-existing conditions are not covered by pet insurance. A pre-existing condition is any health issue that your pet had before the policy’s effective date or during the waiting period. It’s essential to review each insurance provider’s policy regarding pre-existing conditions, as some may offer limited coverage or exclusions depending on the circumstances.

How much does best pet insurance cost?

The cost of pet insurance varies based on several factors, including your pet’s age, breed, location, coverage level, deductible, and the insurance provider. On average, monthly premiums can range from $20 to $50 or more, but this can vary significantly. It’s advisable to obtain quotes from multiple insurance companies to find a policy that fits your budget.

Is pet insurance worth it?

Whether pet insurance is worth it depends on your individual circumstances and your pet’s health. It can provide peace of mind and financial security when unexpected medical expenses arise. Consider factors like your pet’s age, breed, and potential health risks, as well as your ability to cover unexpected veterinary bills out of pocket. Evaluate different policies and choose one that aligns with your pet’s needs and your financial situation