Are you concerned about the safety of your valuable devices like smartphones and tablets? If so, you’re in the right place! Dive into this enlightening guide about “ATT Insurance Claims.”

The ATT Insurance Claim service serves as a safety net for your precious gadgets. This well-crafted insurance ensures your peace of mind by offering coverage for a number of incidents such as accidental damage, theft, and even loss for your device.

Curious about how deductibles work in this scenario, or how to file a claim when the need arises? Wondering about the device replacement process or concerned about the availability of your device model in case of a replacement? Go through our article to get all the answers.

What are the ATT Insurance Claims?

ATT insurance claim refers to the process through which customers of AT&T can file a claim to receive coverage or replacement for their insured mobile devices, such as smartphones and tablets, in the event of certain mishaps.

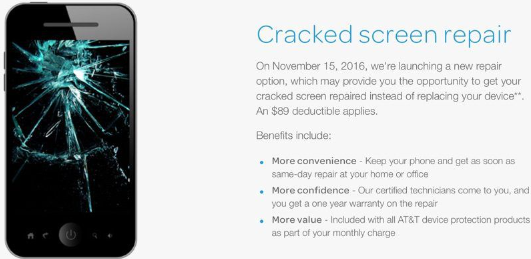

This insurance, often termed as “mobile insurance,” is designed to provide protection for devices against various incidents like accidental damage (e.g., drops, cracks), theft, and loss. You can also get free tablets from Assurance Wireless.

Understanding Deductibles

Just like other forms of insurance, the ATT Mobile Insurance Pack comes with a deductible. A deductible is the amount you need to pay out of pocket before your insurance coverage kicks in. For AT&T’s mobile insurance, the deductible is $199. This means that if your device is damaged, lost, or stolen, you’ll need to pay this amount before receiving a replacement.

Eligibility and Coverage Limitations

Before applying for ATT insurance claim, it is important to be aware of the eligibility requirements and the limitations. Here are the details:

- Eligibility Criteria: All customers who have an active AT&T device are generally eligible, but specific plan details should be checked to confirm eligibility.

- Coverage Limitations: The insurance covers a variety of incidents; however, it’s crucial to review the policy documentation for any exclusions or limitations related to different incident types.

Device Replacement Process

If your device is damaged or stolen, don’t worry; ATT Insurance Claims has a streamlined replacement process in place. Here’s how it works:

- File a Claim: When your device is in trouble, file a claim with AT&T. You can do this by contacting their dedicated support team.

- Deductible Payment: As mentioned earlier, you’ll need to pay the $199 deductible.

- Quick Replacement: Once the deductible is paid, AT&T will ship a replacement device to you the very next day. They are known for their swift service, ensuring you’re back up and running in no time.

- Yearly Limit: Keep in mind that you can only make two claims per year. Once you’ve reached this limit, AT&T won’t provide additional replacements until the next year.

Device Availability

One common concern is whether you’ll receive the same device model in case of damage or loss. AT&T aims to replace your device with an equivalent one. However, the specific replacement device may vary based on availability. If your current device is no longer in stock, AT&T will offer you an alternative option.

Expert Support

AT&T’s Mobile Insurance Pack also provides you with access to expert support. You can reach out to a dedicated support team through a special phone number or chat line. These experts are well-versed in your specific device and can assist you with any questions or issues you may encounter.

Cancellation

The AT&T Mobile Insurance Pack is available for a monthly fee of $10. The great news is that you can cancel it at any time without incurring additional charges. So, if you ever decide you no longer need insurance coverage, you can easily opt-out.

Privacy and Security

AT&T takes measures to protect your personal information during claim filing and when using Mobile Locate. Your personal data is completely protected with them. However, users have a responsibility to secure their devices and information.

Mobile Locate Feature

One valuable feature of the AT&T Mobile Insurance Pack is the Mobile Locate option. This feature allows you to track and locate your lost device. You can use an app on your smartphone to pinpoint the device’s location, making it easier to recover it.

However, there’s a catch: the Mobile Locate app is available for iOS, Android, and BlackBerry devices, but it is not compatible with Windows 8 or Windows RT devices. This means that if you lose a Windows RT device, the app won’t be of assistance. AT&T may have other methods for tracking lost Windows devices, but this information is not readily available.

Conclusion

In summary, the AT&T Mobile Insurance Pack offers valuable protection for your devices, with a few key points to remember:

- There’s a $199 deductible for claims.

- You can make up to two claims per year.

- Replacement devices may vary based on availability.

- Expert support is available for device-related inquiries.

- You can cancel the insurance at any time for a $10 monthly fee.

- The Mobile Locate feature is handy for tracking lost devices, but it’s not available for all device types.

While the insurance pack provides peace of mind, it’s important to understand the terms and limitations. If you have any specific questions about your AT&T insurance coverage or want to explore options for other types of devices, be sure to contact AT&T directly or visit a store for personalized assistance.

Don’t let unexpected mishaps catch you off guard. Consider the AT&T Mobile Insurance Pack to safeguard your devices and enjoy worry-free mobile usage.

Frequently Asked Questions (FAQs):

1. What is the deductible for ATT insurance claims?

The deductible for ATT insurance claims is $199. This is the amount you must pay out of pocket before receiving a replacement device.

2. How many claims can I make in a year with AT&T insurance?

You can make up to two claims per year with AT&T insurance. Once you’ve reached this limit, additional claims won’t be honored until the next year.

3. What happens if my device is no longer available for replacement?

If your device is no longer in stock, AT&T will offer you an equivalent replacement. The specific device you receive may vary based on availability.

4. Is expert support available for device-related inquiries?

Yes, AT&T’s Mobile Insurance Pack provides access to expert support through a dedicated phone number and chat line. These experts are knowledgeable about your specific device and can assist with your questions.

5. Can I cancel AT&T insurance at any time, and what is the cost?

Yes, you can cancel ATT Insurance Claims at any time, and there is a monthly fee of $10. If you decide you no longer need the coverage, you can opt out without additional charges.