Discover a game-changing strategy that’s been hidden in plain sight a money-saving trick for low-income seniors on SNAP. In this guide, we’ll unveil this valuable resource that can help stretch your budget and provide more financial security for seniors in need. Get ready to unlock the power of this secret for enhanced SNAP benefits. If you receive SNAP benefits and fall into the category of low-income seniors or individuals with disabilities, you’re in for an eye-opening revelation. The National Council on Aging (NCOA) has uncovered a little-known strategy that could significantly boost your monthly food stamp benefits. Shockingly, fewer than one in five eligible adults are utilizing this ingenious “medical expense deduction” trick, leaving more than 80 percent missing out on vital assistance.

Discovering the Power of the Medical Expense Deduction

Camellia’s story is a testament to the transformative potential of this strategy. Her monthly benefit skyrocketed from a meager $35 to a substantial $192, resulting in an impressive $157 monthly increase. In times when every dollar counts, missing out on this opportunity is a luxury low-income seniors can’t afford.

Unpacking the Medical Expense Deduction

The medical expense deduction is a feature within the SNAP (Supplemental Nutrition Assistance Program) that can have a profound impact on your eligibility and benefits. Here’s how it works: the SNAP office calculates your benefits by subtracting your out-of-pocket medical expenses from your total gross income. This reduction in your household income can make you eligible for more substantial food benefits. The beauty of this deduction lies in its limitless potential – there’s no maximum cap, meaning it could offset your entire income, granting you the maximum benefits every month.

However, there are some crucial points to keep in mind. advised some tricks for low-income seniors aged 60 and above or individuals with disabilities. To qualify, your monthly out-of-pocket medical expenses must surpass $35 on average. But the good news is, that the list of eligible medical expenses is more extensive than you might think.

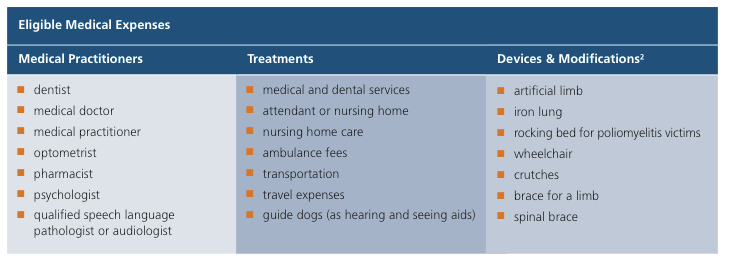

Eligible Medical Expenses

According to Federal Regulations, various expenses qualify as medical expenses, including but not limited to:

- Medical care

- Dental care

- Hospitalization costs

- Nursing home costs

- Health insurance premiums

- Deductibles and co-pays (including Medicare costs)

- Dentures, hearing aids, and prosthetics

- Service animals (including pet food and veterinary care)

- Eyeglasses and contacts

- Transportation and lodging (including mileage to and from medical appointments)

- Attendant, home health aide, homemaker, or child care services necessitated by age or disability

- Over-the-counter medications (prescribed by a doctor)

- Prescription drugs

Averaging Annual Expenses

One critical feature many states offer is the ability to average your annual expenses. This method can make it much easier to meet the $35 monthly threshold. For instance, if you have a significant but infrequent expense, like a yearly trip for specialized medical treatment, you can divide that cost across 12 months to meet the requirement.

Streamlining the Process

Navigating the paperwork might seem daunting, but many states offer simplified options. you can merely sign a declaration confirming your expenses, eliminating the need for extensive documentation. Camellia’s success story serves as inspiration. She submitted her medical expenses and saw her benefits soar from $35 to $192 monthly. While your results will depend on your income and medical expenses, it’s worth exploring this opportunity to secure much-needed assistance.

How to Claim the Medical Expense Deduction

The process for claiming this deduction varies by state, but the SNAP office is your go-to resource. They can provide guidance and requirements specific to your location. Additionally, online sources, food banks, and senior centers may offer assistance. In Florida, the Florida Policy Institute offers a user-friendly toolkit that simplifies the deduction request process. In other states, a sworn statement might be sufficient if you lack formal proof of expenses. Remember that the effort invested in this process can lead to a substantial increase in benefits, improving your overall quality of life.

Conclusion

For low-income seniors and individuals with disabilities, this deduction offers a lifeline, potentially transforming their monthly food stamp benefits and providing much-needed relief. Camellia’s remarkable journey from a $35 monthly benefit to an impressive $192 serves as a testament to the life-changing potential of this strategy. While individual outcomes may vary based on income, medical expenses, and local regulations, the message is clear: exploring the medical expense deduction is a step toward a more secure future.

Understanding the ins and outs of this deduction is key. It’s designed for seniors aged 60 and above or those with disabilities who incur at least $35 in monthly out-of-pocket medical expenses. The list of eligible expenses is comprehensive, encompassing medical and dental care, prescription drugs, and much more. Moreover, the ability to average annual expenses can make meeting the requirement more manageable.

Frequently Asked Questions

Who is eligible for the medical expense deduction within SNAP?

The medical expense deduction is primarily designed for seniors aged 60 and above or individuals with disabilities. To qualify, you need to have out-of-pocket medical expenses that exceed $35 per month on average.

What types of expenses can be considered as medical expenses for this deduction?

Eligible medical expenses can include medical and dental care, hospitalization costs, nursing home costs, health insurance premiums, deductibles, co-pays, dentures, hearing aids, prosthetics, service animals, eyeglasses, transportation costs to medical appointments, and more. The list is extensive and can vary by state.

How can I calculate my monthly out-of-pocket medical expenses for the deduction?

You can calculate your monthly out-of-pocket medical expenses by adding up all your qualifying medical expenses for the month. This can include bills, receipts, and invoices related to your medical costs. Some states allow you to average annual expenses to meet the $35 per month requirement.

Are the rules for the medical expense deduction the same in every state?

While there are federal guidelines for the medical expense deduction, individual states may have their own rules and may allow additional deductions for other expenses. It’s crucial to understand your state’s specific regulations, which can sometimes be more generous than federal guidelines.

Is there assistance available to help with the process of claiming the medical expense deduction?

Yes, there are resources available to assist you in claiming the deduction. You can reach out to your local SNAP office for guidance and requirements specific to your state. Additionally, some online sources, food banks, and senior centers may offer assistance in navigating the process, making it more accessible for those in need.