Student loan debt in the United States has reached an astonishing $1.7 trillion, creating financial stress and anxiety for millions of borrowers. In response to this mounting crisis, discussions about student loan forgiveness and cancellation have gained momentum. However, not all loans are eligible for forgiveness, and understanding the various types of student loans is essential. In this comprehensive guide, we will delve deep into the world of student loan forgiveness, eligibility criteria, and the critical distinctions between federal and private student loans.

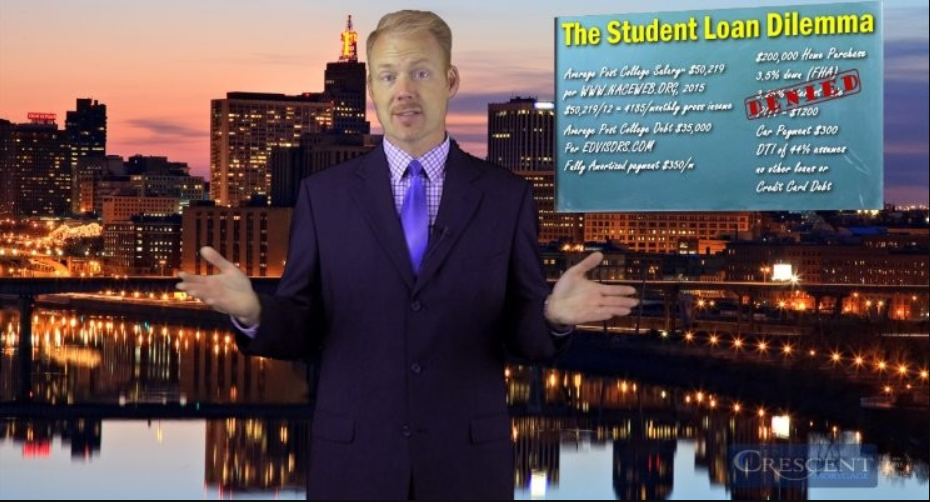

The Student Loan Dilemma

The financial burden of student loans is a reality for countless Americans. With the cost of higher education steadily rising, students and their families often find themselves grappling with the decision to take out loans to fund their education. These loans can be a means to an end, enabling access to education and future career prospects. However, they can also become an overwhelming financial burden, hindering individuals from achieving their financial goals and milestones.

As the student loan debt crisis continues to escalate, conversations about solutions have become increasingly prevalent. Among the proposed remedies, student loan forgiveness stands out as a potential lifeline for borrowers struggling to manage their debt. But before delving into the specifics of loan forgiveness, it’s essential to understand the fundamental differences between two broad categories of student loans: federal and private. Additionally, considering the impact of education loan interest is crucial when assessing the overall financial implications of borrowing for education.

Federal Student Loans vs. Private Student Loans

Federal student loans are issued and backed by the U.S. Department of Education. These loans are designed to provide accessible and affordable financing for higher education & Private student loans, on the other hand, are offered by private lenders, such as banks, credit unions, and online lenders.

Federal Student Loans

Federal Student Loan Forgiveness:

- Grace Period: One significant advantage of federal student loans is the grace period. During this period, borrowers are not required to make payments on their loans, and interest typically does not accrue. This grace period extends until after the borrower graduates, leaves school, or drops below half-time enrollment.

- Interest Rates: Federal student loans offer fixed interest rates, which means that the interest rate remains the same throughout the life of the loan. This provides borrowers with predictability in their monthly payments. It’s important to note that this stability in interest rates is specific to federal student loans and should not be confused with the Paycheck Protection Program (PPP) loans, which are designed to provide financial assistance to businesses during economic crises. PPP loans operate under a different set of rules and terms compared to federal student loans.

- Income-Driven Repayment (IDR) Plans: Federal student loans offer various repayment plans, including IDR plans, which are tailored to the borrower’s income and family size. Under an IDR plan, monthly payments are capped at a percentage of the borrower’s discretionary income, making them more manageable.

- Loan Forgiveness: Federal student loans offer several forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, which forgive a portion or all of the remaining loan balance under specific conditions.

Private Student Loans

These loans are not backed by the federal government and come with distinct features:

- Payment During School: Unlike federal student loans, private student loans may require borrowers to make payments while still enrolled in school. This can lead to immediate financial pressure on students and their families.

- Interest Rates: Private student loans may have fixed or variable interest rates. Variable rates can change over time, potentially leading to fluctuating monthly payments. Borrowers should carefully consider the terms and implications of variable interest rates.

- Lack of Federal Protections: Private student loans do not come with the same borrower protections as federal loans. This includes the absence of income-driven repayment plans and the limited availability of forgiveness programs.

Loan Forgiveness and Eligibility

The concept of student loan forgiveness offers hope to borrowers seeking relief from their debt burdens. Forgiveness programs exist to alleviate the financial strain caused by student loans, but eligibility criteria and conditions vary.

Federal Student Loan Forgiveness

Income-Driven Repayment (IDR) Plans

One of the most significant advantages of federal student loans is the availability of income-driven repayment (IDR) plans. Under these plans, borrowers’ monthly payments are based on their income and family size. After making payments for a specified period (usually 20 to 25 years, depending on the plan), any remaining loan balance is forgiven. This forgiveness can provide significant relief to borrowers who have been making manageable payments over the years.

Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness (PSLF) is a federal program designed for borrowers working in public service or nonprofit organizations. To qualify for PSLF, borrowers must meet specific criteria:

- Be employed full-time by a qualifying public service or nonprofit organization.

- Make 120 qualifying monthly payments while working for an eligible employer.

- Have Direct Loans (or consolidate other federal loans into a Direct Consolidation Loan).

After meeting these requirements, the remaining loan balance is forgiven, tax-free. PSLF provides valuable relief for those dedicated to public service careers.

Teacher Loan Forgiveness

Teachers serving in low-income schools or educational service agencies may be eligible for Teacher Loan Forgiveness. This program offers forgiveness of up to $17,500 on certain federal loans for eligible teachers who meet specific requirements. Teachers must teach full-time for five consecutive academic years in a designated low-income school or educational service agency to qualify.

Private Student Loans and Forgiveness

Unlike federal student loans, private student loans generally do not offer forgiveness programs. Borrowers with private loans must repay their debt according to the terms and conditions specified in their loan agreements. Refinancing federal loans into private loans may lead to the loss of federal benefits, including forgiveness options.

Death Discharge: A Critical Distinction

Beyond forgiveness, another crucial distinction between federal and private student loans relates to what happens in the event of a borrower’s death.

- Federal Student Loans: In a tragic scenario where a borrower with federal student loans passes away, the debt is discharged, and the burden does not transfer to their family or estate. Federal student loan debt does not become a financial burden for surviving family members.

- Private Student Loans: Private student loans, however, do not provide the same level of protection. If a borrower with private student loans passes away, the debt may become the responsibility of their parents, spouse, or heirs. This can lead to additional financial stress during an already challenging time.

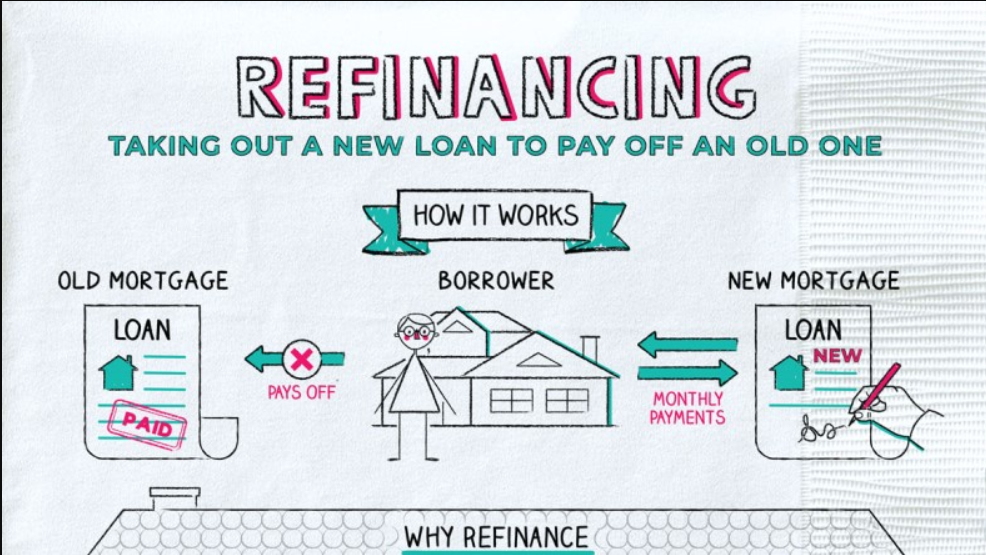

The Pitfalls of Loan Refinancing

While loan refinancing can be a viable strategy for some borrowers to secure a lower interest rate or adjust the terms of their loans, it’s crucial to recognize the potential pitfalls, especially when it comes to federal student loans.

Borrowers who refinance their federal loans into private loans may forfeit essential federal benefits, including:

- Income-Driven Repayment Plans: Refinancing federal loans into private loans eliminates access to income-driven repayment plans, which can help borrowers manage payments based on their income and family size.

- Loan Forgiveness: Refinancing can disqualify borrowers from federal loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness.

- Death Discharge: The protection offered by federal student loans in the event of a borrower’s death is lost when federal loans are refinanced into private loans.

Conclusion

When navigating the complex landscape of student loans, knowledge is power. Understanding the distinctions between federal and private student loans, as well as the potential for Student loan forgiveness and repayment options, is essential for borrowers. Before signing on the dotted line or considering loan refinancing, take the time to ask questions, seek expert guidance, and assess the long-term consequences of your choices. Many borrowers have unknowingly missed out on valuable forgiveness benefits by refinancing federal loans into private ones. As the student loan debt crisis continues to evolve, informed decision-making is crucial. By arming yourself with knowledge and making thoughtful choices, you can better manage your education financing and potentially alleviate the burden of student loan debt in the future. Remember that your financial future is at stake, and it’s worth the effort to make well-informed decisions regarding your student loans.

Frequently Asked Questions

What is student loan forgiveness, and how does it work?

Student loan forgiveness is a program that allows borrowers to have a portion or the entirety of their student loan debt forgiven under specific conditions. For federal student loans, forgiveness often comes after making a set number of qualifying payments over a specified period. Some common forgiveness programs include Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness. Private student loans generally do not offer forgiveness options.

Who is eligible for Public Service Loan Forgiveness (PSLF)?

To be eligible for PSLF, borrowers must meet the following criteria:

- Work full-time for a qualifying public service or nonprofit organization.

- Make 120 qualifying monthly payments while employed by an eligible employer.

- Have Direct Loans (or consolidate other federal loans into a Direct Consolidation Loan).

Can private student loans be forgiven?

Private student loans typically do not offer forgiveness programs like federal loans. Borrowers with private loans are generally required to repay the full loan amount according to the terms outlined in their loan agreements. Refinancing federal loans into private loans may result in the loss of federal forgiveness options.

What happens to student loan debt in the event of the borrower’s death?

For federal student loans, if the borrower passes away, the debt is discharged, and the responsibility does not transfer to their family or estate. However, for private student loans, the debt may become the responsibility of the borrower’s parents, spouse, or heirs.

Should I consider refinancing my student loans?

Refinancing student loans can be a beneficial strategy for some borrowers, especially those seeking lower interest rates or different loan terms. However, it’s essential to weigh the pros and cons carefully. When refinancing federal loans into private loans, borrowers may lose access to federal benefits like income-driven repayment plans and loan forgiveness programs. It’s crucial to consider your individual financial situation and long-term goals before making a decision.