If you’re new to the world of credit cards, you might have come across the term “APR Credit Card” and wondered, “What is APR?” In this comprehensive guide, we’ll dive deep into the concept of APR, exploring what it is, how it works, and why it matters for your financial well-being. join us as we navigate the intricacies of this essential financial metric, empowering you to make informed and advantageous credit card decisions. By the end of this article, you’ll have a clear understanding of APR and its significance when it comes to credit cards.

What is APR?

APR stands for Annual Percentage Rate. It’s a crucial financial term used to calculate the cost of borrowing money on your credit card. The APR represents the annualized interest rate you’ll pay on outstanding credit card balances if you don’t pay them off in full each month.

Now, let’s address a common misconception: despite the term “annual” in its name, APR credit cards don’t necessarily apply on an annual basis. Credit card companies calculate APR daily, and it factors into your monthly statement.

How Does APR Work?

APR is a critical factor for credit cardholders who don’t pay their balances in full each month. If you carry over a remaining balance from one month to the next, you’re essentially borrowing money from your credit card issuer, and they charge you interest on that borrowed amount.

Here’s a key point to remember: If you consistently pay your entire credit card balance on time each month (not just the minimum payment), you won’t incur any interest charges. This responsible financial behavior is highly recommended because it prevents credit card companies from profiting from your debt.

However, if you choose to carry a balance, the APR becomes a significant factor. Credit card companies classify individuals who carry balances as “revolvers” because they allow the issuer to accumulate interest charges month after month.

How is APR Determined?

Your APR credit card is not a fixed rate; it varies from person to person. When you apply for a credit card, the issuer evaluates your credit score and credit history. Your creditworthiness plays a crucial role in determining the APR you’re offered.

In general, the better your credit score, the lower the APR you’re likely to receive. This means you’ll pay less in interest fees over time. Conversely, if your credit score is lower, you can expect a higher APR, resulting in higher interest costs over time.

Finding Your APR

To determine your credit card’s APR, you have a couple of options:

- Check Your Credit Card Statement: The APR should be listed in the fine print on your credit card statement. Look for a section labeled “Interest Rates” or similar terms.

- Contact Your Credit Card Issuer: If you can’t find the APR on your statement or have questions about it, reach out to your credit card issuer. They can provide you with this information over the phone.

How Credit Card Companies Calculate APR

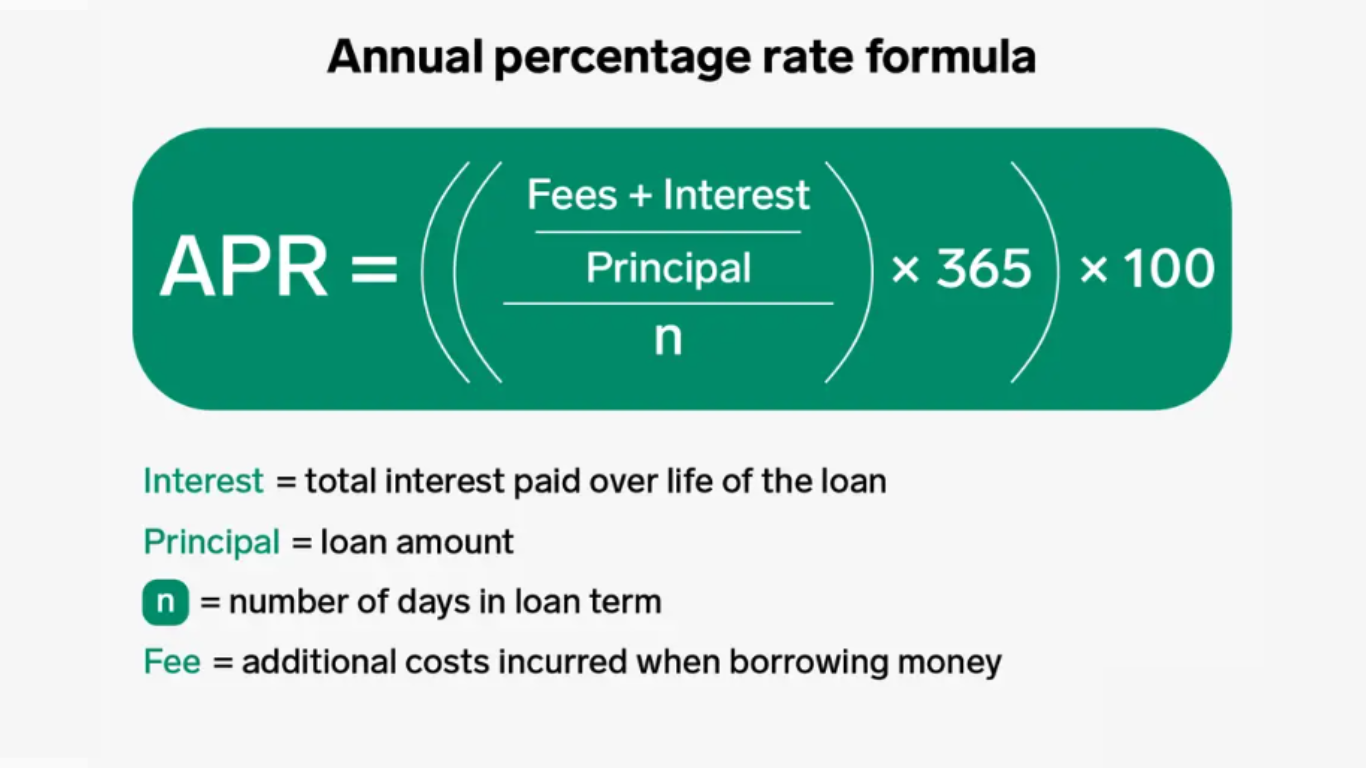

Credit card companies calculate your APR on a daily basis, and it’s applied to your average daily balance for each billing cycle. Here’s the basic formula:

- Calculate your Daily APR: Divide your Annual APR by 365 days.

- Determine your average daily balance: This is the average amount you owe on your credit card during a billing cycle.

- Calculate daily interest: Multiply your Daily APR by your average daily balance.

- Monthly interest charges: The daily interest is multiplied by the number of days in your billing period.

This process determines the interest charges you’ll see on your monthly credit card statement.

Shopping for Credit Cards: The Importance of APR

When you’re in the market for a new credit card, it’s crucial to understand the significance of APR. Ideally, you want to qualify for a credit card with the lowest possible APR. The average APR credit card typically hovers around 15%, so securing a card with a lower APR can lead to substantial savings on interest payments.

To improve your chances of qualifying for a credit card with a low APR, focus on building and maintaining a strong credit history and a high credit score. Lenders are more likely to offer favorable terms to individuals with excellent credit profiles. Also, understanding what is good APR for a credit card.

Conclusion

understanding APR is essential for responsible credit card use. While it might seem confusing at first, grasping the concept of APR, and how it affects your finances is crucial and how a credit card works. Remember that if you pay your credit card balance in full each month, APR won’t be a concern for you. However, if you carry a balance, a lower APR can save you money in the long run.

APR serves as a financial compass, guiding you through the labyrinth of credit card terms and conditions. It determines the cost of borrowing money through your credit card and how that cost compounds over time. Whether you’re a seasoned credit card user or just starting your financial journey, grasping APR’s nuances can empower you to take control of your finances.

Frequently Asked Questions (FAQs)

What are APR credit cards?

APR stands for Annual Percentage Rate. It is the interest rate you’ll pay on outstanding credit card balances if you don’t pay them in full each month. It’s a crucial factor in understanding the cost of borrowing money through your credit card.

How is APR determined for my credit card?

Credit card companies calculate your APR based on your credit score and credit history. The better your credit profile, the lower the APR you’re likely to receive. Conversely, a lower credit score may result in a higher APR.

Why does APR matter if I pay my credit card balance in full each month?

If you consistently pay your entire credit card balance on time each month, APR is less relevant to you because you won’t incur interest charges. Responsible credit card use means you won’t be paying interest, and APR won’t affect your finances.

How can I find out my credit card’s APR?

You can typically find your APR credit cards in the fine print on your credit card statement. If it’s not there or you have questions, you can contact your credit card issuer to obtain this information.

What can I do to secure a credit card with a lower APR?

To increase your chances of getting a credit card with a lower APR, focus on improving your credit score and maintaining a strong credit history. Lenders are more likely to offer favorable terms to individuals with excellent credit profiles.