Did you know that there are approximately 62.5 million millionaires worldwide? Contrary to what many believe, most of them were not born into wealth. In fact, 79% of those millionaires did not inherit their riches; they built their fortunes through smart financial habits. Take Ronald Reed, for instance, a former gas station attendant and janitor from Vermont who quietly amassed a whopping $8 million. Most people in his town didn’t even know he had that kind of money. After his passing, he left a significant portion of his wealth to a library and a hospital.

In your journey to becoming a millionaire, don’t overlook the potential support available through financial assistance programs. Many government and nonprofit organizations offer resources and guidance to help individuals with low incomes achieve their financial goals. Explore these programs to make your path to millionaire status even more attainable. While you may not be a millionaire yet, you can learn from the success of individuals like Ronald Reed, especially if you don’t have a high-paying job in a glamorous field like acting or professional sports. There are four simple habits that Ronald and many other millionaires have used to achieve their financial success.

Mastering Cash Flow

The first step on your journey to becoming a millionaire on a low income is to understand cash flow. In simple terms, it means living within your means and not spending more than you make. The wider the gap between your income and expenses, the faster you’ll build wealth. Most people struggle with this, as evidenced by low savings rates.

For instance, the median savings for those under 35 is a mere $3,240, while those aged 55 and older have a median savings of just $9,300. If you want to become a millionaire, you’ll need to change your approach. A great way to start is by meticulously categorizing your expenses. Tools like Rocket Money can help you track your spending and identify areas where you can cut back.

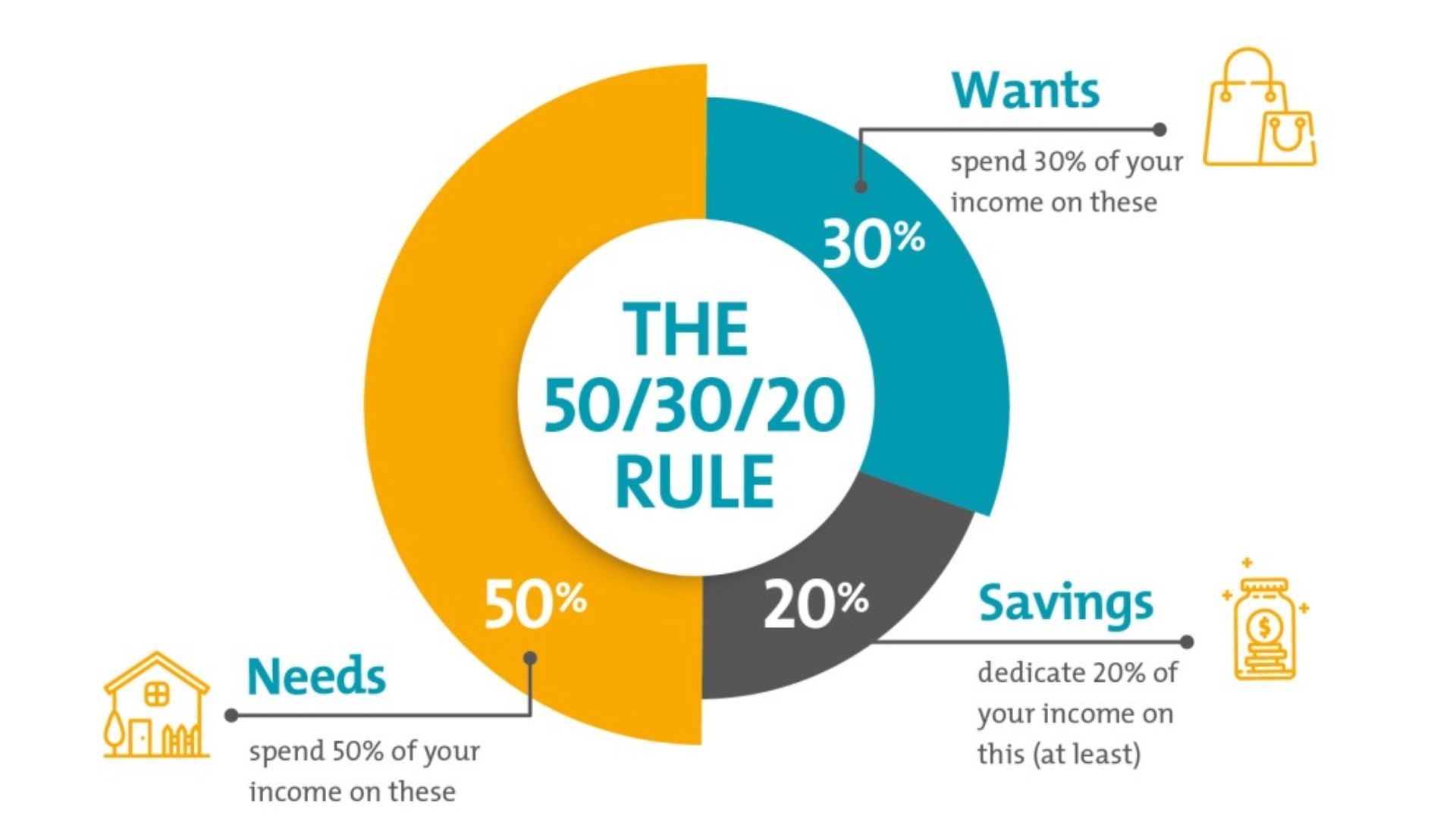

Follow the 50-30-20 Rule

Many people spend 80-90% of their income, leaving very little room for saving and investing. Instead, consider adopting the 50-30-20 rule:

- 50% of your income goes toward essential expenses like housing, transportation, and groceries.

- 30% is allocated for discretionary spending, which covers activities like dining out, vacations, and clothing.

- 20% should be dedicated to saving and investing.

This simple rule can help you rein in your expenses and prioritize your financial future. By reducing unnecessary spending, you’ll free up more money to put towards your savings and investments.

Set Clear Financial Goals

Establishing well-defined financial objectives is crucial to maintaining your financial course. Writing down your goals makes you 42% more likely to achieve them. Start by establishing a specific savings goal, whether it’s a set amount per week or month. Breaking down your path to becoming a millionaire into smaller, actionable steps can make the journey seem more attainable.

Cultivate a Wealthy Mindset

A wealthy mindset involves more than just positive thinking. It includes habits like gratitude, thinking long term, continuous education, surrounding yourself with supportive people, and valuing time over money.

- Gratitude: Appreciate what you have, which will reduce the urge to spend unnecessarily.

- Think Long Term: Avoid instant gratification and consider the long-term consequences of your financial decisions. Compound interest can work for or against you.

- Invest in Education: Continuously invest in yourself through books, courses, and self-improvement. A small investment in knowledge can lead to significant financial gains.

- Surround Yourself with Positivity: Surround yourself with people who inspire and support your financial goals. Positive financial influences can help you stay on the right path.

- Value Time Over Money: Strive to find ways to earn income that doesn’t require endless hours of work. Passive income streams and efficient use of your time are keys to financial freedom.

Invest in Your Future

Engaging in investments is an essential stride on the path to achieving millionaire status. Consider opening a high-interest savings account to build an emergency fund or start investing in assets like real estate or the stock market. Platforms like Webull can help you get started with investing.

Remember, even if you start with a small amount like $35 per week, your money can grow significantly over time. Here’s a glimpse of what you could have in the future:

- In 20 years: $115,000 to $150,000

- In 30 years: $343,000 to $530,000

- In 40 years: $960,000 to $1.7 million

Starting early is crucial, but it’s never too late to begin your journey to becoming a millionaire. The sooner you start, the more your money will work for you, multiplying your wealth and securing your financial future.

By adopting these four simple habits and cultivating a wealthy mindset, you can chart a course towards financial success, even on a low income. Embark on your path to millionaire status today.

Conclusion

In conclusion, achieving millionaire status on a low income is possible through smart financial habits, disciplined saving, and a wealthy mindset. By mastering cash flow, following a balanced budget, setting clear goals, and investing wisely, you can pave the way to financial success, regardless of your current income level. Start today, and watch your wealth grow over time.

Frequently Asked Questions

Can I really become a millionaire with a low income?

Yes, it’s possible. With smart financial planning, disciplined saving, and wise investments, you can accumulate wealth over time, even with a modest income.

How important is budgeting in achieving millionaire status?

Budgeting is crucial. It helps you control expenses, save more, and invest wisely. Following a budget ensures you’re on the right financial track.

What is the best investment strategy for someone on a low income?

Low-cost index funds, high-interest savings accounts, and assets like real estate can be good options. Consult a financial advisor to determine the best strategy for your specific circumstances.

How can I stay motivated on this journey to millionaire status?

Setting clear financial goals, tracking your progress, and regularly reviewing your plan can help maintain motivation. Surrounding yourself with supportive peers and mentors is also beneficial.

Are there government programs or resources that can assist individuals with low incomes in building wealth?

Yes, there are various government programs and nonprofit organizations that provide financial education, grants, and resources to help individuals with low incomes improve their financial situations. Research and explore these options to find assistance tailored to your needs.