Are you tired of waiting for weeks to get your hands on a new credit card? Do you want the flexibility to start making purchases right away? If so, you’re in luck because we have some fantastic options for you. In this article, we’ll introduce you to the world of instant approval credit cards, a game-changer in the world of personal finance.

Instant Approval Credit Cards

Instant Approval Credit Cards are exactly what they sound like – credit cards that you can use as soon as you’re approved, without the usual waiting period. We’ve curated a list of four such cards that can put spending power in your hands almost instantly. Plus, if you’re worried about your credit score, don’t be! We have options for all credit profiles, including those with less-than-perfect credit.

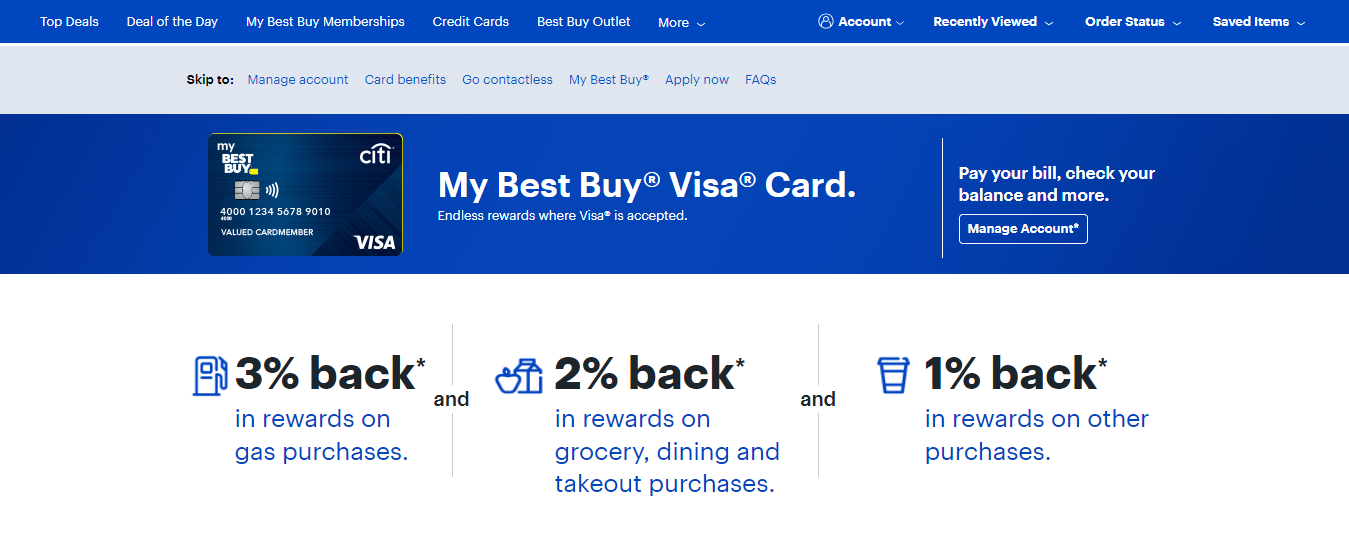

1. Best Buy City Visa Card

The first card on our list is the Best Buy City Visa Card. With this card, you can shop at Best Buy’s online store and get your hands on the latest gadgets without delay. Here’s how it works:

- Visit the Best Buy website and load up your shopping cart with your desired items.

- When you’re ready to pay, you’ll have the option to apply for the Best Buy City Visa Card.

- Once approved, you can use your new credit right away for your purchase.

Depending on the current promotion, you might even enjoy perks like 0% interest for the first 12 to 18 months or cashback rewards. Keep in mind that you can only use this card immediately for your first purchase; subsequent purchases will require you to wait for the physical card.

2. Amazon Rewards Visa Card

If you’re an avid Amazon shopper, the Amazon Rewards Visa Card is perfect for you. Here’s how to access instant credit with this card:

- While checking out on Amazon, scroll down to the payment options.

- You’ll see an offer to apply for the Amazon Rewards Visa Card.

- Upon approval, you’ll receive an Amazon gift card, usually with a generous value, which you can use instantly for your purchase.

Just like with the Best Buy card, the Amazon card has introductory offers that vary based on the card type and the timing of your application. It’s essential to check the current promotions when applying.

3. eBay MasterCard

eBay is a treasure trove for unique and hard-to-find items, and the eBay MasterCard can make your shopping experience even better. The process is familiar:

- Apply for the eBay MasterCard, and upon approval, you’ll likely receive an introductory offer.

- This offer could include discounts, zero-interest financing for a set period, or other benefits.

- Start shopping on eBay and use your new credit immediately for your purchase.

Just like Amazon and Best Buy, eBay’s card provides you with quick access to credit, but remember that it’s usually limited to your initial purchase.

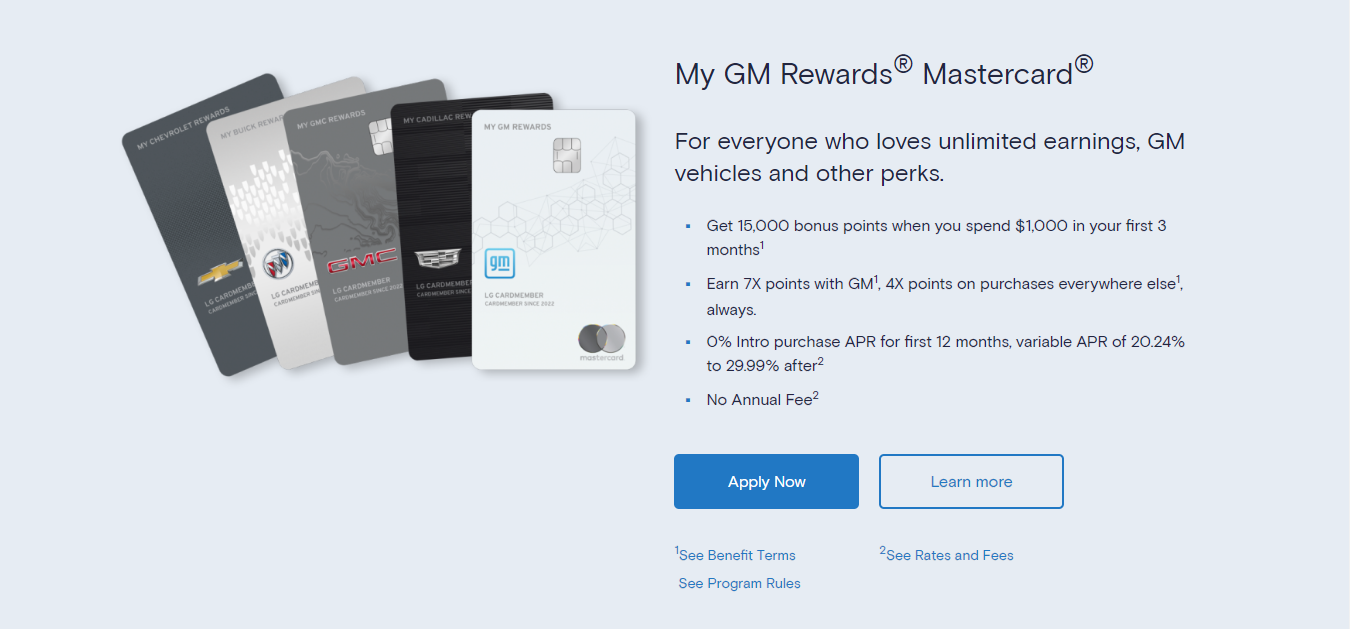

4. Marcus GM MasterCard

Our final recommendation is the Marcus GM MasterCard, which stands out from the others due to its versatility. Here’s why:

- When approved for this card, you’ll receive a virtual card immediately upon setting up your online account.

- This virtual card can be used anywhere, not just for specific websites or retailers.

- You have the freedom to make purchases wherever MasterCard is accepted.

This flexibility makes the Marcus GM MasterCard a standout choice for those who want instant credit without restrictions.

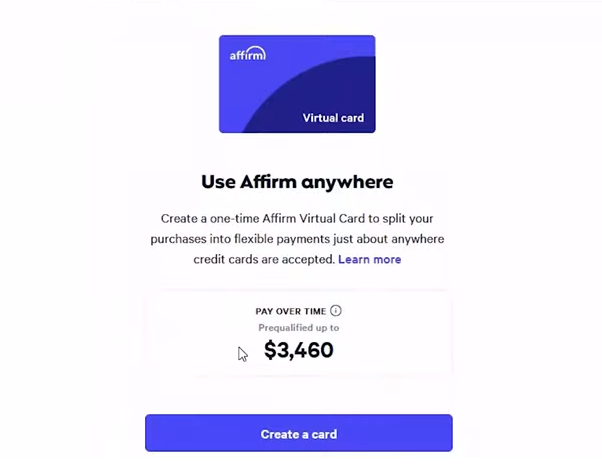

Bonus: Affirm Virtual Card

If your credit score isn’t in great shape, don’t despair! The Affirm Virtual Card is here to help. Affirm now offers a virtual card that allows you to shop online anywhere, regardless of their merchant partnerships. Here’s how it works:

- Apply for the Affirm Virtual Card, even with less-than-perfect credit.

- Upon approval, you’ll receive a virtual card with a credit limit.

- Shop online wherever you like and use the virtual card for your purchases.

Keep in mind that the Affirm Virtual Card has a 24-hour usage window, so be sure to make your purchases promptly. If you need the best credit card to rebuild your credit.

Conclusion

Instant approval credit cards are a game-changer for anyone who wants to start shopping right away. Whether you’re into electronics, online marketplaces, or just want versatile credit options, these cards have you covered. Check out our recommendations and unlock the power of instant credit today. Remember, the choice is yours, and your spending possibilities are endless!

Frequently Asked Questions (FAQs)

What are instant approval credit cards, and how do they work?

Learn about the concept of instant approval credit cards and the process of obtaining one.

Who can apply for instant approval credit cards?

Find out if you qualify for instant approval credit cards and what factors may affect your eligibility.

What are the advantages of using instant approval credit cards?

Explore the benefits of having a credit card you can use immediately upon approval.

Are there any drawbacks or limitations to instant approval credit cards?

Discover potential downsides and restrictions associated with instant approval credit cards.

What are the best practices for managing and maximizing instant approval credit cards?

Get tips on how to make the most of your instant approval credit card while maintaining financial responsibility.