Are you a student aiming to build your credit while pursuing higher education? Whether you’re enrolled in a community college, a four-year university, or any other educational institution, a student credit card can be your ticket to financial independence. Discover the best student credit cards that offer a gateway to financial independence, lower interest rates, and cashback rewards. These cards are specifically designed for students and are often easier to get approved for than standard credit cards, making them an excellent choice for first-time credit builders.

7 Best Student Credit Cards

Let’s explore some of the best credit cards for students available right now. By the end, you’ll have a clear understanding of which card might be the best fit for your financial needs. Let’s dive in!

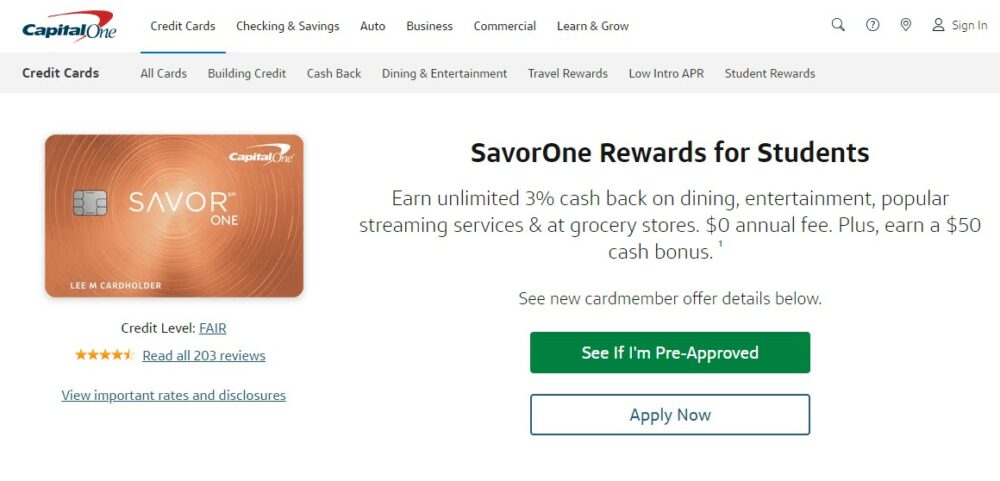

1. Capital One SavorOne Rewards for Students Card

Here is details of savorone credit card rewards for students:

- Welcome Offer: Earn $50 cash back after spending $100 in the first three months.

- Cash Back Rewards:

-

- 10% cash back on Uber and UberEats purchases until November 14, 2024.

- 8% cash back through the Capital One Entertainment portal (sports events, concerts, and more).

- 5% cash back on hotels and rental cars through the Capital One travel portal.

- 3% cash back on dining, entertainment (outside Capital One’s portal), popular streaming services, and grocery stores.

- 1% cash back on all other purchases.

- Annual Fee: None

Benefits:

- Complimentary Uber One membership, including a monthly subscription fee reimbursement.

- Access to Capital One’s travel, dining, entertainment, and shopping portals for additional rewards. Also check out best airline credit card available.

- Virtual card numbers for online security.

- No foreign transaction fees.

- Pre-approval tool available on Capital One’s website.

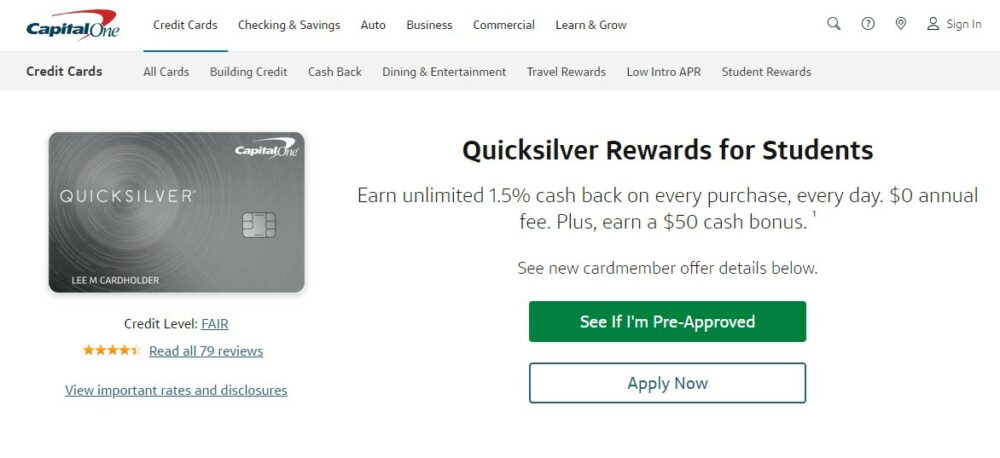

2. Capital One Quicksilver Rewards for Students Card

Given are details of quicksilver credit card rewards for students:

- Welcome Offer: Earn $50 cash back after spending $100 in the first three months.

- Cash Back Rewards:

-

- 10% cash back on Uber and UberEats purchases until November 14, 2024.

- 5% cash back on hotels and rental cars through the Capital One travel portal.

- 1.5% cash back on all other purchases.

- Annual Fee: None

Benefits:

- Complimentary Uber One membership, including a monthly subscription fee reimbursement.

- Access to Capital One’s travel, dining, entertainment, and shopping portals for additional rewards.

- Virtual card numbers for online security.

- No foreign transaction fees.

- Pre-approval tool available on Capital One’s website.

3. Bank of America Customized Cash Rewards for Students Card

Below are the details of BOA customized cash rewards for students card:

- Welcome Offer: Earn $200 cash back after spending $1,000 in the first 90 days.

- Cash Back Rewards:

-

- 3% cash back in a category of your choice (gas, online shopping, dining, travel, drug stores, or Home Improvement/furnishings).

- 2% cash back at grocery stores and wholesale clubs.

- 1% cash back on all other purchases.

- Annual Fee: None

Benefits:

- Better Money Habits portal for financial education.

- Balance Connect for overdraft protection.

- Digital wallet compatibility.

- Contactless chip compatibility.

- Free monthly FICO score access. If you have bad credit card score history check best credit cards to rebuild credit.

4. Bank of America Unlimited Cash Rewards for Student Card

Here are details of BOA unlimited cash rewards for student card:

- Welcome Offer: Earn $200 cash back after spending $1,000 in the first 90 days.

- Cash Back Rewards: 1.5% cash back on all purchases.

- Annual Fee: None

Benefits:

- Better Money Habits portal for financial education.

- Balance Connect for overdraft protection.

- Digital wallet compatibility.

- Contactless chip compatibility.

- Free monthly FICO score access.

5. Discover It Student Cashback Card

Given are information of discover it student cashback card:

- Welcome Offer: Cashback match – Discover matches all cashback earned in the first year.

- Cash Back Rewards:

-

- 5% cash back in rotating quarterly categories (e.g., digital wallet transactions, gas stations).

- 1% cash back on all other purchases.

- Annual Fee: None

Benefits:

- APR on purchases is 0% for the first six months.

- Online privacy protection.

- U.S.-based customer service.

- Social security number alerts.

- Freeze It feature for added security.

- No foreign transaction fees.

- No credit score required to apply.

6. Deserve Edu MasterCard

Discover the details of deserve edu mastercard:

- Cash Back Rewards: Depending on the card, you might earn between 1% to 3% cash back on everyday purchases.

- Annual Fee: Some Deserve Edu MasterCard products come with no annual fee, while others might have fees ranging from $25 to $75, depending on the card’s features and benefits.

Benefits:

- No Social Security Number (SSN) required; accepts Individual Taxpayer Identification Number (ITIN).

- Various Deserve Edu MasterCard products to choose from, tailored to different student needs.

- Pre-approval tool available.

- For specific details on each card product, visit the Deserve Edu MasterCard website.

7. Petal Card

The details of petal card are given below:

- Cash Back Rewards: Depending on your chosen Petal Card product, you could earn cashback rewards ranging from 1% to 3%.

- Annual Fee: Some Petal Cards have no annual fees, while others may have fees based on the card’s premium features, ranging from $20 to $60.

Benefits:

- No SSN required; accepts ITIN.

- Pre-approval tool available.

- Various Petal Card products to cater to diverse consumer needs.

Also, read our article on how to get business credit card if you are doing a business or thinking to start. Over time, you’ll be better positioned for financial success and achieving your future aspirations.

Common Mistakes to Avoid with Student Credit Cards

Navigating the world of credit as a student can be challenging. As you begin your journey to financial independence, it’s essential to be aware of the pitfalls and best practices. Here’s a guide to help you avoid common mistakes and manage your first credit card effectively.

1. Only Paying the Minimum Amount Due

- Mistake: Only paying the minimum amount due can lead to accumulating interest, increasing the overall debt you owe.

- Tip: Always aim to pay your full balance every month. If that’s not possible, pay more than the minimum to reduce interest accumulation.

2. Maxing Out Your Credit Limit

- Mistake: Using up your entire credit limit can negatively impact your credit score and lead to high interest charges.

- Tip: Keep your credit utilization below 30%. For example, if you have a credit limit of $1,000, try not to have a balance over $300.

3. Applying for Multiple Cards at Once

- Mistake: Every credit card application results in a hard inquiry on your credit report, which can lower your credit score.

- Tip: Space out your credit applications. If you’re denied for a card, investigate the reasons before applying for another one.

4. Ignoring Monthly Statements

- Mistake: Not reviewing your statements can cause you to overlook discrepancies or fraudulent charges.

- Tip: Regularly check your monthly statements for errors and report any suspicious activity immediately.

5. Not Setting a Budget

- Mistake: Spending without a plan can quickly lead to accumulating debt.

- Tip: Set a monthly budget for your credit card spending. This helps ensure you can comfortably pay off your balance at the end of the month.

6. Being Late on Payments

- Mistake: Late payments can result in fees, higher interest rates, and negative marks on your credit history.

- Tip: Set reminders or automate your payments to ensure you never miss a due date.

7. Not Understanding Your Card’s Terms and Fees

- Mistake: Ignoring the terms can result in unexpected fees and higher interest rates.

- Tip: Read the fine print. Understand the interest rates, annual fees, late fees, and other potential charges associated with your card.

8. Closing Old Cards After Upgrading

- Mistake: Closing an old or unused card can decrease your credit history length, negatively impacting your credit score.

- Tip: Even if you get a new card with better perks, consider keeping your older cards open, but ensure they don’t have annual fees that cost you. If they do, see if the issuer can switch you to a no-fee version.

Frequently Asked Questions

Q1. How can I apply for a student credit card if I don’t have a credit history?

Most student credit cards are designed for those with limited or no credit history, making them accessible to students. You can apply online through the issuer’s website or in person at a local bank branch.

Q2. What distinguishes a secured student credit card from an unsecured one?

A secured student credit card requires a security deposit, which acts as collateral. An unsecured card does not require a deposit but may have stricter approval requirements and potentially higher fees.

Q3. How can I use a student credit card to build my credit responsibly?

To build credit responsibly, make small, manageable purchases with your card, pay your bills on time and in full, and keep your credit utilization low (below 30% of your credit limit). Avoid maxing out your card and only apply for credit when needed.

Q4. Are there any benefits to having a student credit card beyond building credit?

Yes, many student credit cards offer additional perks like cashback rewards, access to online resources for financial education, and even discounts on specific categories of spending, such as dining or travel.

Q5. Can international students apply for student credit cards in the United States?

Yes, some credit card issuers accept Individual Taxpayer Identification Numbers (ITINs) instead of Social Security Numbers (SSNs). International students can explore cards that accommodate this, such as certain Deserve Edu MasterCard and Petal Card products.

Conclusion

In conclusion, selecting the best credit card for student is a crucial step toward building a strong financial foundation while pursuing your education. These cards offer unique benefits tailored to students, making them ideal for first-time credit builders. Remember to choose a card that suits your spending habits and financial goals, use it responsibly, and watch your credit score rise.