Today, we’re here to shed light on a solution that can come to your rescue – quick 1 hour payday loans. We understand that having a poor credit history can make obtaining a loan seem impossible, leaving you feeling stuck and stressed. But fear not, payday loans are designed to provide you with the financial assistance you need, even if you have bad credit. These loans can be a lifeline during challenging times, offering swift access to cash with minimal hassle. We understand that navigating the world of loans can be confusing, and you may have heard conflicting information about payday loans. Our aim is to provide you with a clear understanding of the process and the benefits they offer so you can make an informed decision.

The Best 1 Hour Payday Loans Providers

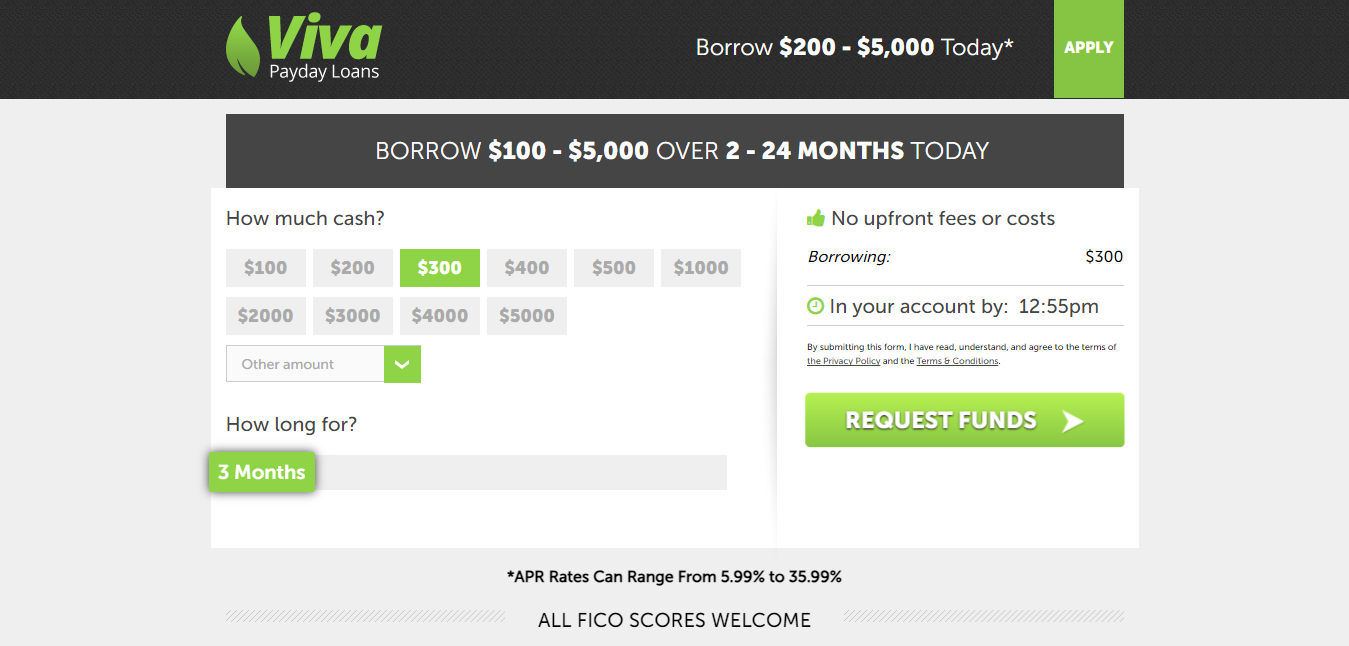

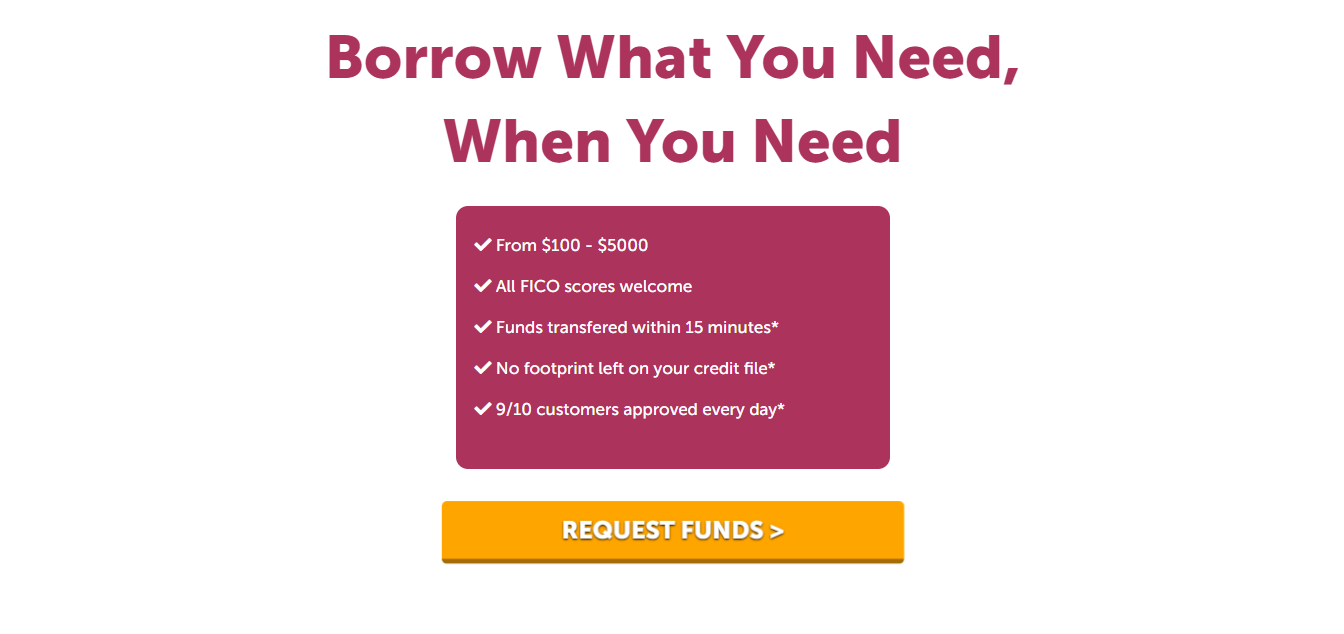

Viva Payday Loans

Viva Payday Loans is the best option for individuals looking for no-credit-check loans and loans for bad credit with same-day approval. The brand is known for its small to medium-sized loans of up to five thousand dollars, which makes it perfect for those who need quick cash but don’t want to borrow a large sum. With Viva Payday Loans, you’ll be able to repay the loan according to your salary schedule. The eligibility requirements are also simple, and you’ll be able to deal directly with the lender. Another great thing about Viva Payday Loans is that bad credit borrowers are welcome, which means that even if you have a low credit score, you can still apply for a loan.

Big Buck Loans

Big Buck Loans is the overall best option for unsecured urgent and secured emergency loans for bad credit borrowers without collateral. The brand allows you to borrow up to five thousand dollars, which is perfect for individuals who need a larger sum of money. Additionally, the processing time is very speedy, so you’ll be able to get your loan quickly. Big Buck Loans also offers discrete borrowing, which means that you can apply for a loan 100% online without having to go to a physical location. The interest rates are also competitive, and the loan amounts and terms are flexible, making it easier for you to find a loan that fits your needs.

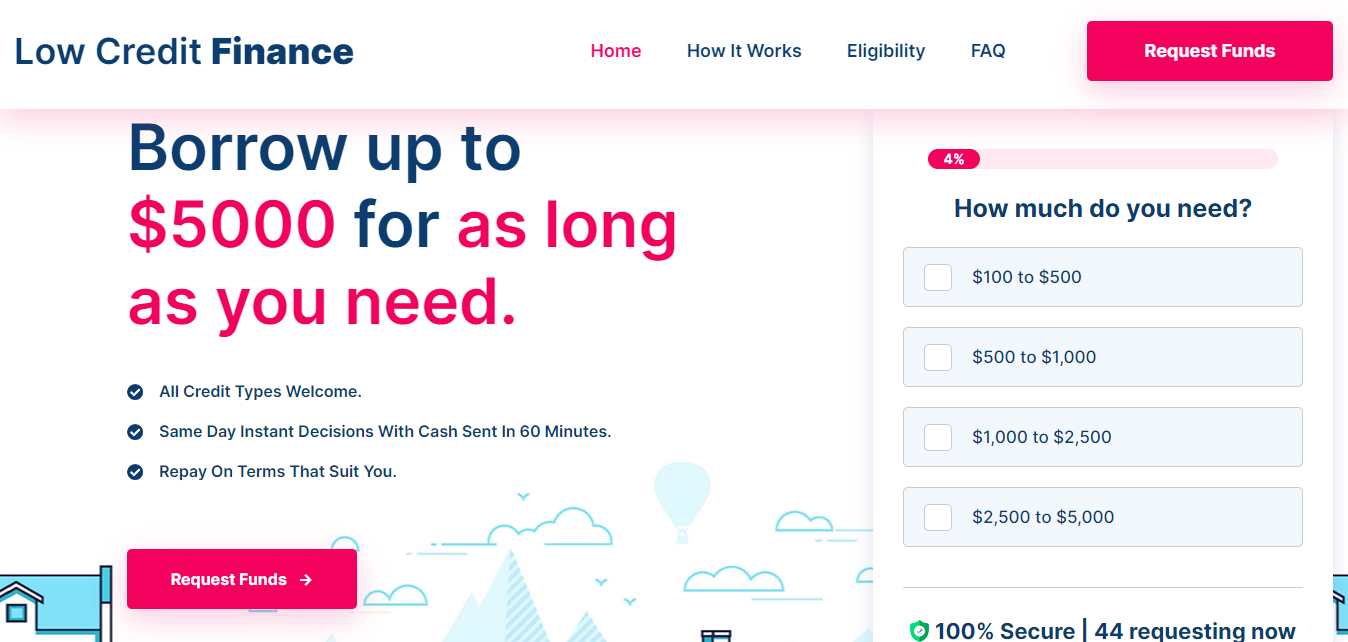

Low Credit Finance

Low Credit Finance is the best option for loans with quick 1 hour payday loans approval. The eligibility requirements for Low Credit Finance are quite simple: you must be 18 years or older with an income of one thousand dollars or more per month. You must also be a US citizen or resident, and only a select few bank accounts with direct deposit are accepted. Low Credit Finance offers loans to individuals who have bad credit or no credit, which means that even if you have a low credit score, you can still apply for a loan. you can also get payday loans online no credit check with instant approval

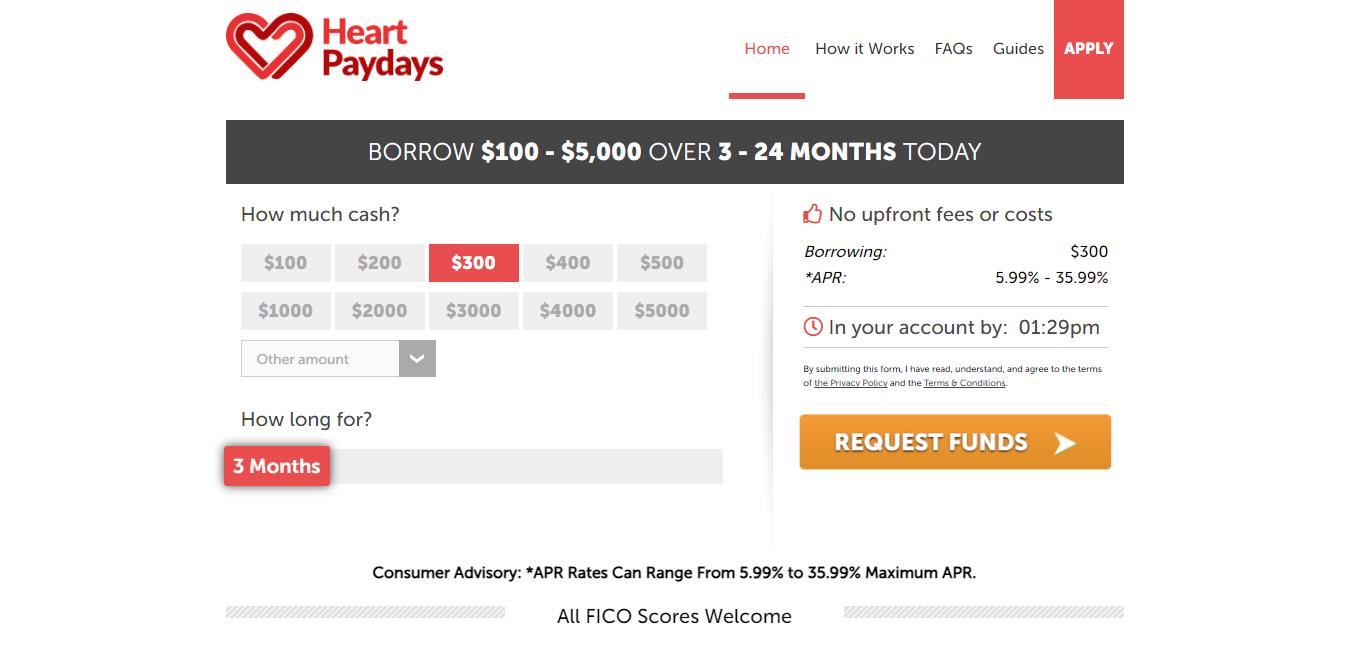

Heart Paydays

Heart Paydays, is the top-rated loan service for installment loans with bad credit and no credit check. If you’re someone with a low credit score and are in need of an installment loan, Heart Paydays is the perfect option for you. The brand offers loans up to five thousand dollars, and you can even apply for small loans of one hundred dollars. The eligibility requirements are quite simple: you must be 18 years or older with a minimum income of one thousand dollars per month, and you’ll need a valid ID that shows you’re a legal resident or citizen of the US. Even if you have bad credit, Heart Paydays offers options that are available to you.

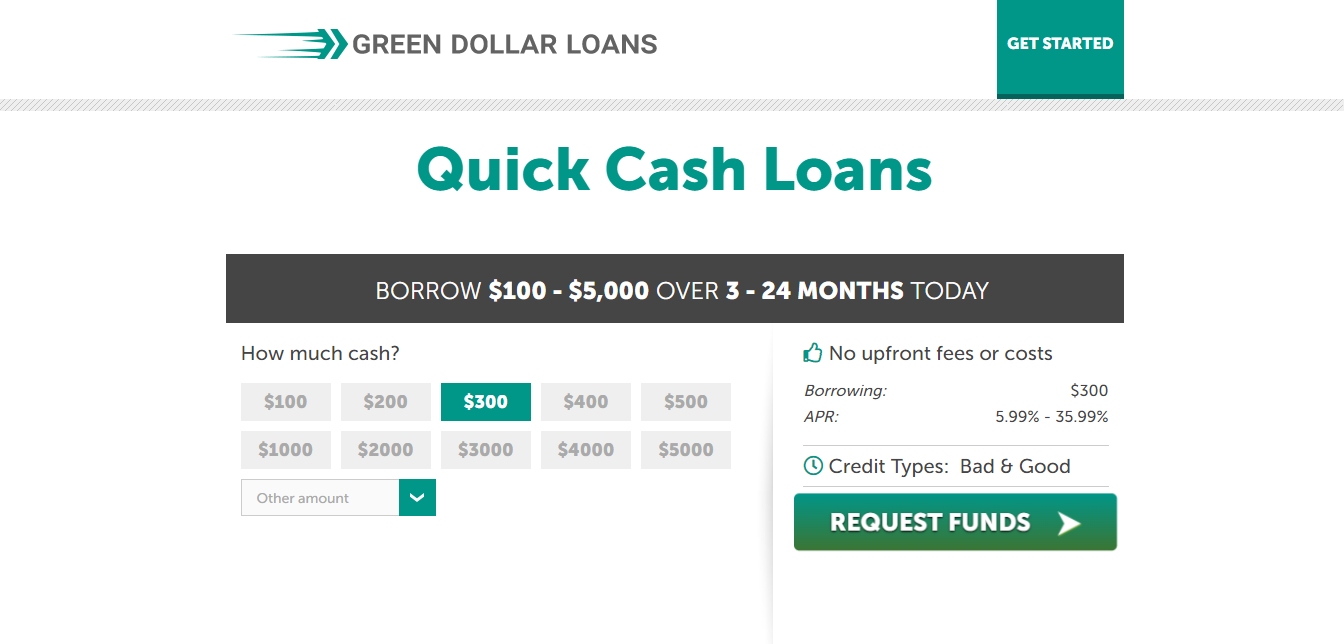

Green Dollar Loans

Green Dollar Loans is the best platform to discover loans for self-starters, entrepreneurs, and borrowers without formal employment. The brand is perfect for individuals who may not have a traditional job or payslip but are still in need of a loan. You can get up to five thousand dollars with Green Dollar Loans, and the application process is quick and easy. However, you’ll need to provide supporting documents such as proof of income, proof of address, and a valid copy of your ID. The interest rates for Green Dollar Loans range from 5.99% to 35.99% depending on the lender.

Conclusion

When you’re in need of quick 1 hour payday loans, there are several reputable options available to you. Whether you have bad credit, no credit, or unique financial circumstances, these trusted providers can offer you the financial assistance you need.

Before applying for any payday loan, it’s essential to approach the process responsibly. Evaluate your financial situation carefully and borrow only what you can comfortably repay on your next payday. These loans are designed to address short-term financial needs, and responsible use can prevent undue financial stress.

Frequently Asked Questions (FAQs)

What is a 1 hour payday loans, and how does it work?

A 1 hour payday loans is a short-term loan designed to provide quick access to cash, often within an hour of approval. These loans are typically repaid on your next payday. To apply, you’ll need to provide basic personal and financial information, and the lender will assess your eligibility and creditworthiness.

Can I get a one-hour payday loan with bad credit?

Yes, many 1 hour payday loans providers are willing to work with individuals with bad credit or no credit history. These loans are often designed to be more accessible than traditional bank loans, making them a potential option for those with less-than-perfect credit.

What is the maximum amount I can borrow with a one-hour payday loan?

The maximum loan amount for one-hour payday loans varies by lender. However, these loans are typically small to medium-sized, ranging from a few hundred dollars to a few thousand dollars. The exact amount you can borrow depends on your income, credit history, and the lender’s policies.

Are there any risks associated with one-hour payday loans?

Yes, there are risks to be aware of. One-hour payday loans often come with higher interest rates than traditional loans, so it’s essential to repay them promptly to avoid accumulating excessive interest charges. Failing to repay on time can lead to financial difficulties and a cycle of debt.

How do I find a reputable one-hour payday loan lender?

To find a reputable lender, do your research. Look for lenders with a transparent fee structure, clear terms and conditions, and positive customer reviews. Check if the lender complies with state regulations, as this can provide additional consumer protections. Always read the loan agreement carefully before signing.