If you’re a veteran looking to purchase a home, the VA home loan program is one of the most competitive options available. However, navigating the process can be confusing, especially when it comes to the Certificate of Eligibility (COE). In this comprehensive guide, we’ll break down everything you need to know about the CoE and why it’s crucial for veterans like you to get it in advance.

What is the Certificate of Eligibility?

The Certificate of Eligibility, often referred to as the COE, is a document that confirms your eligibility for a VA home loan. It’s the first step in accessing the benefits of this exceptional program. While the COE itself doesn’t guarantee a loan, it’s a vital prerequisite.

How to Obtain Your Certificate of Eligibility

Getting your COE is straightforward and can be done in two ways:

- Through Your eBenefits Portal: You can access and download your COE via your eBenefits portal, simplifying the process.

- With Assistance from a VA Loan Specialist: Mortgage loan originators, such as myself, who specialize in VA loans, have direct access to the Department of Veterans Affairs. We can assist you in obtaining your COE quickly and efficiently.

Understanding VA Entitlement

The COE states that a veteran’s basic entitlement is $36,000. This may sound limiting, but it’s essential to clarify what this means. Entitlement, in this context, equates to the VA’s guarantee or insurance on your loan. If you, as a veteran, were to default on the loan, the VA would step in and cover 25% of the lender’s losses.

The $36,000 basic entitlement is not a loan limit. It’s a foundation. When you multiply this by four, you get $144,000. This means that a veteran can obtain a VA loan of up to $144,000 with no down payment.

Bonus Entitlement: Unlocking Higher Loan Limits

The VA acknowledges that real estate values have risen over time. To accommodate this, they introduced bonus entitlement. When you add the basic entitlement of $36,000 to the bonus entitlement, which is typically $145,500, and multiply the total by four, you get an impressive $726,200. This is the maximum loan amount you can secure with no down payment.

The Blue Water Initiative Act

In 2020, the Blue Water Initiative Act lifted the cap on VA loans, allowing veterans to purchase homes of any price with no down payment. However, this only applies if you don’t already have an existing VA loan.

Multiple VA Loans

Here’s a little-known fact: Veterans with sufficient entitlement can use it to obtain multiple VA loans. If you have an existing VA loan, the remaining entitlement can be applied to a new home purchase. This flexibility offers veterans unique opportunities in the housing market.

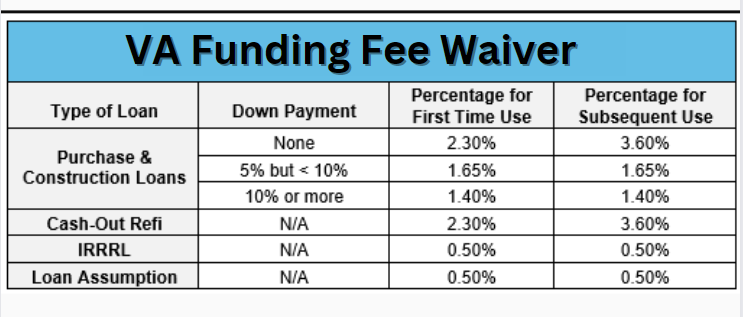

VA Funding Fee Waiver

If you have a VA service-connected disability of 10% or greater, your VA funding fee will be waived. This fee waiver can save you significant money when obtaining your VA loan. If you want to know how to Get a $100 Loan with No Credit Check.

Conclusion

The Certificate of Eligibility is your ticket to accessing the incredible benefits of the VA home loan program. It’s essential to understand how entitlement works and how it can unlock opportunities for homeownership. To embark on your journey to homeownership with a VA loan, connect with a VA loan specialist like myself who can guide you through the process. Your dream of homeownership is within reach with the VA home loan program.

Frequently Asked Questions (FAQs)

What is a Certificate of Eligibility (COE)?

A Certificate of Eligibility (CoE) is a document issued by the Department of Veterans Affairs (VA) that confirms a veteran’s eligibility for a VA home loan. It is a crucial step in the VA home loan application process.

How can I obtain my Certificate of Eligibility (COE)?

You can obtain your CoE through your eBenefits portal or by working with a mortgage loan originator who specializes in VA loans. They can assist you in obtaining the CoE efficiently.

What is VA loan entitlement, and how does it work?

VA loan entitlement is essentially the VA’s guarantee or insurance on a portion of your loan. The basic entitlement is $36,000, but it can be multiplied by four to determine the maximum loan amount you can secure with no down payment. Bonus entitlement can further increase this limit.

Can I have more than one VA loan?

Yes, veterans with sufficient entitlement can obtain multiple VA loans. If you have an existing VA loan, you can use the remaining entitlement to purchase another home. This flexibility is one of the unique benefits of VA loans.

Is the VA funding fee always required, or are there exceptions?

The VA funding fee is typically required with VA loans, but there is an exception. Veterans with a VA service-connected disability of 10% or greater are eligible to have their VA funding fee waived. This waiver can result in significant savings when obtaining a VA loan.