In the ever-evolving landscape of business financing, the Small Business Administration (SBA) loan program has emerged as a beacon of hope for entrepreneurs seeking capital to fuel their dreams. If you’re an aspiring or established business owner, understanding the intricacies of SBA loan interest rates is paramount. Join us on a comprehensive journey as we unravel the mysteries, benefits, and nuances of SBA loans, and learn how they can be your ticket to entrepreneurial success.

The Enigma of SBA Loans Unveiled

To embark on this enlightening journey, let’s start by demystifying the realm of SBA loans. These loans are unique in that they are backed by the Small Business Administration but funded by financial institutions, primarily traditional banks and specialized non-bank SBA lenders, in the chain of small loans you check $100 loan with no credit checks. What sets non-bank SBA lenders apart is their exclusive focus on SBA lending, resulting in more streamlined processes and quicker approvals.

The Crucial Distinction

It’s vital to grasp that SBA loans can be obtained through two distinct avenues: traditional banks and non-bank lenders. Each route has its unique advantages and characteristics.

Traditional Banks: While reputable and well-established, traditional banks often subject borrowers to a longer, more arduous approval process. They may have stringent criteria and might not offer as much guidance and support throughout the application journey.

Non-Bank SBA Lenders: Specialized non-bank SBA lenders, on the other hand, are renowned for their agility. Their exclusive focus on SBA lending means they are well-versed in the intricacies of the program and can offer more personalized assistance, often resulting in swifter approvals.

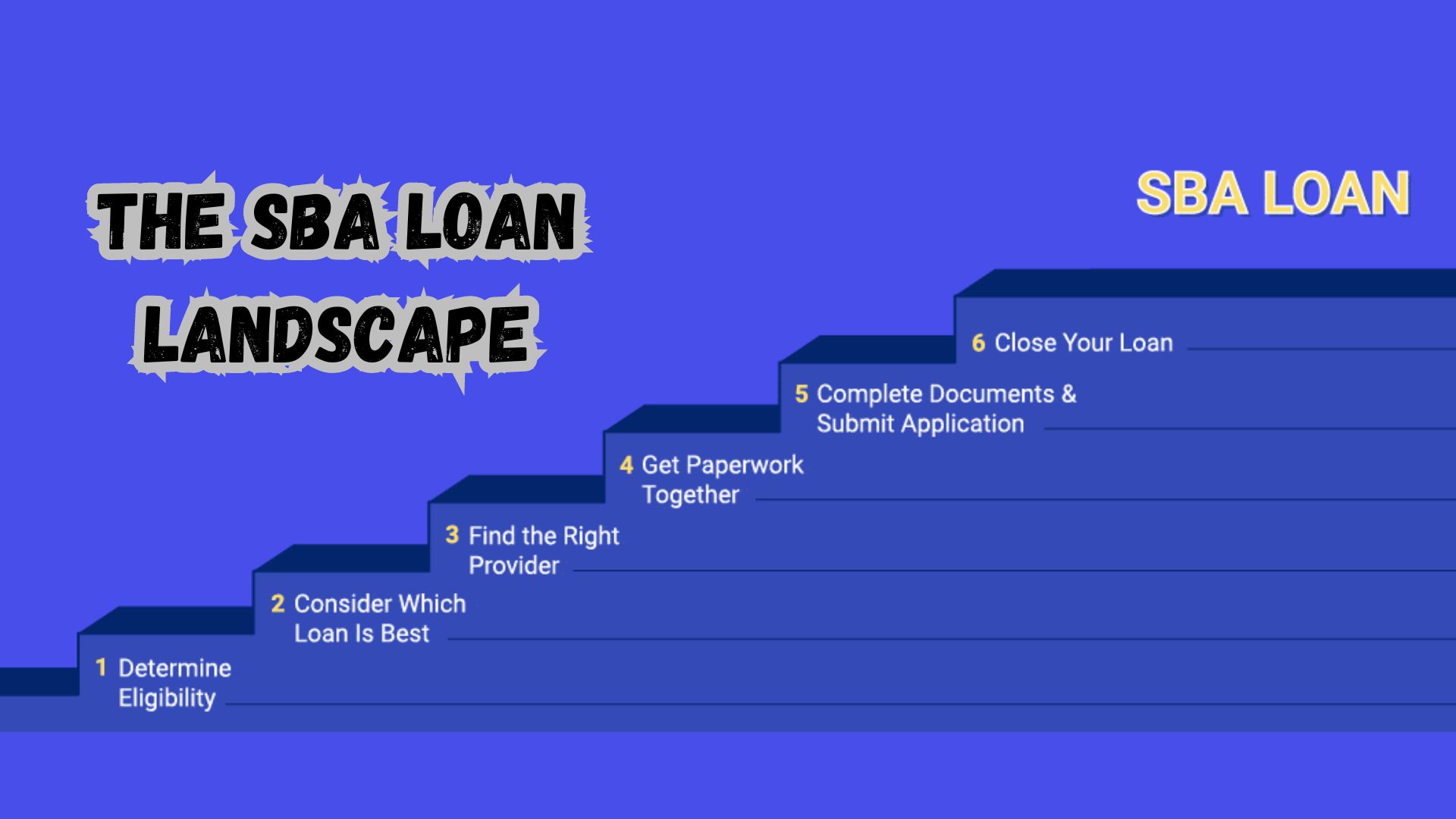

The SBA Loan Landscape: A Two-Pronged Approach

When it comes to SBA loans, you’ll encounter two powerful choices: the versatile 7A and the specialized 504 loans, instead of 504 loan you can apply for section 504. These options cater to unique business needs, offering entrepreneurs a strategic advantage. Whether you require working capital or aspire to invest in real estate, understanding these distinct SBA loan programs can be your key to unlocking the financial support your venture deserves.

The Versatile 7A Loan

The 7A loan is akin to a Swiss Army knife in the world of business financing. This loan serves as a working capital injection, offering entrepreneurs the financial flexibility they need to grow and thrive. Key features of the 7A loan include:

- Repayment Term: The 7A loan boasts a 10-year repayment term, providing borrowers with ample time to manage their finances effectively.

-

Loan Amount: One of the most appealing aspects of the 7A loan is its potential to secure up to five million dollars in financing. However, it’s essential to note that some banks may require real estate collateral for larger loan amounts.

The 504 Loan for Real Estate Ventures

If your entrepreneurial journey involves real estate acquisitions, the 504 SBA loan should be on your radar. This loan is tailor-made for purchasing real estate and offers the following advantages:

- Minimal Down Payment: With the 504 loan, you only need to provide a 10 percent down payment, making it an attractive option for those looking to acquire property without depleting their resources.

-

Extended Repayment Term: The 504 loan extends its repayment term to 25 years, providing borrowers with long-term financial stability.

Deciphering the Riddle of Interest Rates

Interest rates play a pivotal role in every loan, and SBA loans are no different. To navigate this financial landscape effectively, it’s essential to demystify the factors that influence SBA loan interest rates. By gaining clarity on how these rates are determined, you can make informed choices that align with your business objectives, ensuring a prosperous financial future.

The Prime Rate and Beyond

SBA lenders base their interest rates on the prime rate, which is set by financial institutions and serves as a benchmark for lending rates. The prime rate is dynamic and fluctuates based on economic conditions and the policies of the Federal Reserve.

Beyond the prime rate, SBA lenders add a margin that can range from zero to a maximum of 2.75 percent. This margin is influenced by various factors, including the lender’s policies and market conditions.

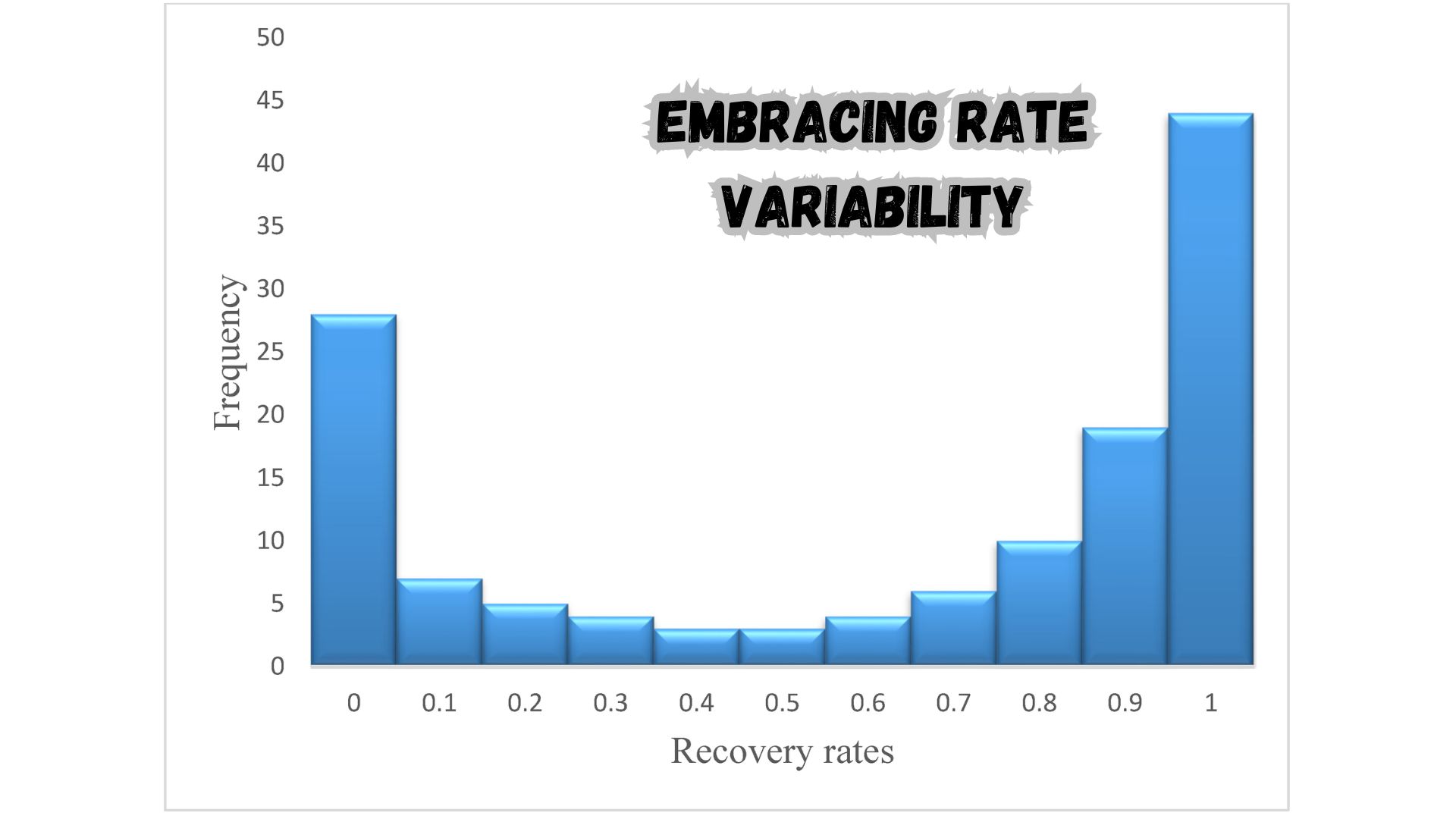

Embracing Rate Variability

Considering the current economic climate, where the prime rate has surged due to inflation, choosing a variable and adjusting rate option can be a strategic move. By opting for this approach, borrowers can potentially benefit from future rate decreases, which would result in lower overall interest costs.

Unlocking the Secrets to Rate Lock

Some banks offer the enticing option to lock in your interest rate, primarily when dealing with the 504 loan for real estate purchases. Rate locking provides borrowers with stability and predictability in their monthly payments.

However, for working capital loans, such as the 7A, the interest rate typically remains floating. This means it can fluctuate in tandem with changes in the prime rate. Understanding the pros and cons of rate locking versus floating rates is essential when deciding which SBA loan suits your business needs.

The Lender’s Role: A Critical Choice

Choosing the right lender holds immense sway over your SBA loan journey. Delve into the intricacies of lender selection as we explore how this decision can shape your entrepreneurial path. With the right lender by your side, you can streamline your SBA loan process, unlock valuable guidance, and enhance your chances of securing the financial backing your business deserves

Traditional Banks: A Mixed Bag

Traditional banks, often recognized by their illustrious names and extensive histories, do offer SBA loans. However, the journey with a traditional bank can be long and challenging. These banks tend to have stringent requirements and may not provide the comprehensive guidance that many borrowers seek.

Non-Bank SBA Lenders: A Breath of Fresh Air

Non-bank SBA lenders have emerged as a viable alternative for entrepreneurs seeking SBA loans. These lenders specialize exclusively in SBA lending, making them more nimble and accommodating. Their focused approach often translates into a smoother, more supportive application process.

National Business Capital: Your Strategic Ally

In the quest for SBA financing, one name stands out as a beacon of hope for entrepreneurs: National Business Capital. Founded by Joe Camberato, an entrepreneur and CEO himself, National Business Capital was established with a singular mission – to simplify business lending.

A Comprehensive Lending Hub

At the heart of National Business Capital’s mission is the idea of centralization. Their platform brings together a diverse array of lenders, including specialized non-bank SBA lenders who are renowned for their expediency. This means you can explore various financing options, all in one place.

In addition to SBA loans, National Business Capital offers an array of other financing products, including:

- Business Term Loans

- Lines of Credit

- Equipment Financing

- Accounts Receivable (AR) Financing

- Inventory Lending

The Power of Predictive Financing

One remarkable feature that sets National Business Capital apart is their proprietary SBA loan calculator. This innovative tool allows you to input your financial data, from tax returns to financial statements, providing an immediate indication of your eligibility for an SBA loan.

Imagine the time-saving benefits – no more enduring the agony of a lengthy application process, only to discover a disappointing rejection. With National Business Capital, you can confidently pursue your SBA loan, knowing your likelihood of approval from the outset.

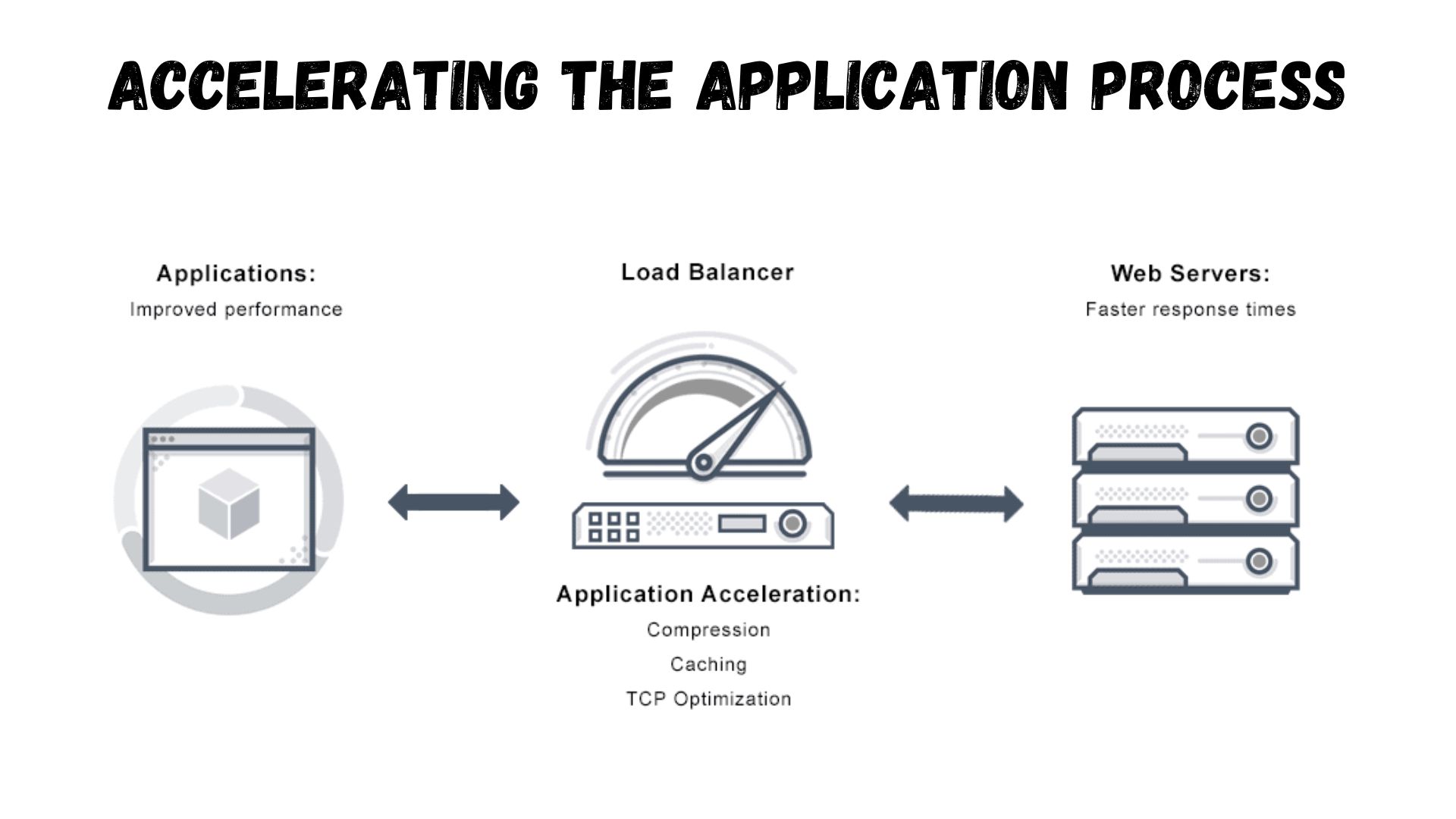

Accelerating the Application Process

Speed is of the essence in the world of business. National Business Capital’s streamlined process ensures that your SBA loan application moves swiftly through the pipeline. Leveraging their expertise and finely-tuned processes, they can typically secure funding for your SBA loan in about 45 to 60 days. This is approximately half the time it would take when working with a traditional bank.

The Essentials for SBA Loan Application

Before you dive headfirst into the SBA loan application process, it’s crucial to gather the necessary documentation. Here’s a checklist of what you’ll typically need:

- Personal Tax Returns: Three years of personal tax returns are usually required.

- Business Tax Returns: Similarly, prepare three years of business tax returns.

- Financial Statements: Provide three years of your company’s profit and loss statements, as well as balance sheets.

- Year-to-Date Balance Sheet: Include your year-to-date balance sheet.

- Personal Financial Statement: This document details your personal assets and liabilities.

A key prerequisite for SBA loan approval is that your business must demonstrate profitability in your most recent years’ tax returns. This profit should be sufficient to support the debt or loan amount you’re seeking.

Conclusion

Navigating the intricate landscape of SBA loans requires knowledge, strategy, and a reliable ally by your side. By understanding the factors that influence SBA loan interest rates, choosing the right lender, and leveraging resources like National Business Capital, you can embark on your entrepreneurial journey with confidence.

The world of SBA loans is no longer shrouded in mystery. It’s a realm where opportunity awaits those who dare to dream and possess the knowledge to turn those dreams into reality. Armed with this comprehensive understanding, you can confidently pursue SBA financing as a powerful tool to propel your business toward uncharted heights of prosperity.

We hope this extensive guide has shed light on SBA loan interest rates and the essential factors to consider when pursuing an SBA loan. With the right knowledge and support, your business can thrive, innovate, and make a lasting impact in the dynamic landscape of entrepreneurship. Your journey to success begins with a single step – and SBA loans might just be the stepping stone you’ve been seeking.

Frequently Asked Questions (FAQs)

What is an SBA loan, and how does it differ from a traditional business loan?

An SBA loan is a type of business loan backed by the Small Business Administration, a U.S. government agency. It differs from traditional business loans in that the SBA provides a guarantee to the lender, reducing the lender’s risk. This guarantee allows borrowers to access more favorable terms, such as lower interest rates and longer repayment periods.

What are the main types of SBA loans, and which one is right for my business?

The two primary types of SBA loans are the 7A loan and the 504 loan. The 7A loan is a versatile working capital loan, suitable for various business needs, while the 504 loan is specifically designed for real estate purchases. The choice between them depends on your business goals and financing requirements.

How are SBA loan interest rates determined, and can I lock in my rate?

SBA loan interest rates are typically based on the prime rate, with a margin added by the lender. The margin can vary but usually ranges from zero to a maximum of 2.75 percent. Some banks may offer the option to lock in your interest rate, especially for 504 loans. However, for 7A loans, the interest rate typically remains floating.

What are the advantages of working with non-bank SBA lenders over traditional banks?

Non-bank SBA lenders specialize exclusively in SBA lending, which often leads to faster loan processing times and more personalized support. Traditional banks, while reputable, may have longer approval processes and may not provide the same level of guidance throughout your application.

What documents and qualifications are required to apply for an SBA loan?

To apply for an SBA loan, you’ll generally need three years of personal and business tax returns, three years of financial statements (including profit and loss statements and balance sheets), and a personal financial statement. It’s also crucial that your business demonstrates recent profitability to support the requested loan amount. Requirements may vary slightly among lenders, so it’s advisable to check with your chosen lender for specific documentation needs.