Welcome to our informative guide on payday loans direct lenders. In this in-depth exploration, we aim to equip you with the crucial knowledge required to confidently secure a payday loan. These financial tools can serve as a vital resource during unforeseen financial challenges. Our mission is to empower you with the insights needed to make well-informed decisions, ensuring you navigate the world of payday loans effectively and with confidence.

Understanding Payday Loans

Payday loans, often referred to as cash advances, offer quick access to modest sums, typically $100 to $2,000, with repayment due on your next paycheck. The overview explains how payday loans work, their purpose in bridging financial gaps, and their accessibility, thanks to lenient credit checks. Readers will gain a foundational understanding of these loans’ mechanics, setting the stage for deeper exploration in subsequent sections.

Payday loans, often referred to as cash advances or paycheck advances, are short-term loans designed to bridge financial gaps between paychecks. These loans provide quick access to small amounts of money, typically ranging from $100 to $2,000, which borrowers must repay with their next paycheck, you can apply $100 loan with no credit check.

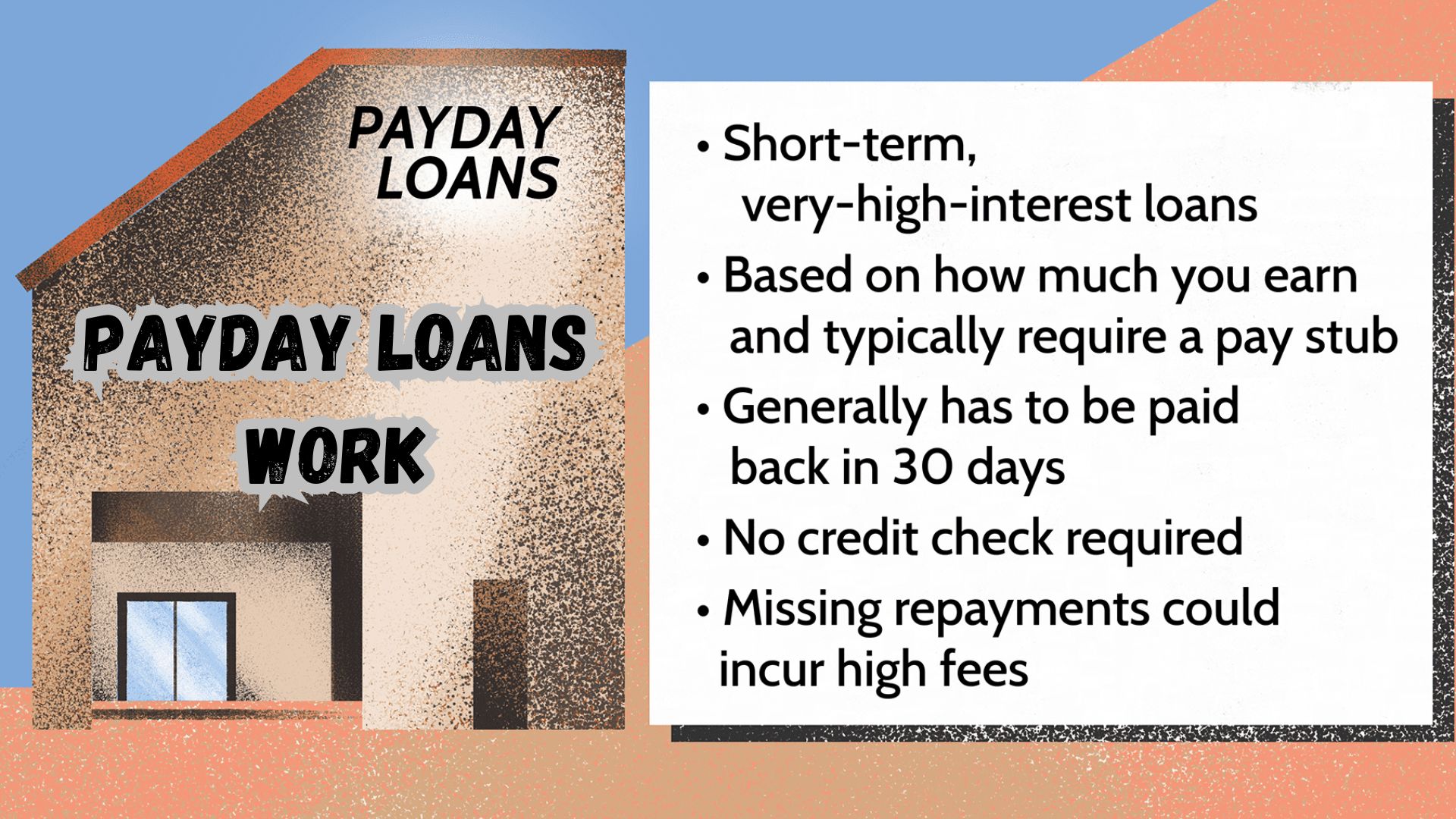

How Payday Loans Work

The process is straightforward. Borrowers request a loan amount based on their immediate financial needs and income. Lenders assess the borrower’s eligibility based on criteria such as income, age, and residency. Unlike traditional loans, payday loans do not rely heavily on credit scores, making them accessible to a broader range of individuals.

Choosing the Right Lender

Choosing the Right Lender is a crucial step in the payday loan journey. This section emphasizes the importance of selecting a reputable lender with transparent terms and ethical practices. It guides readers on leveraging platforms like MakeHelpOf for lender reviews and insights. By making informed choices about lenders, borrowers can ensure a smooth and reliable payday loan experience, setting the stage for a successful financial partnership.

The Importance of a Reputable Lender

Selecting a reputable lender is the cornerstone of a successful payday loan experience. A trustworthy lender ensures transparency, fair terms, and ethical lending practices. It’s crucial to research and choose a lender with a solid reputation.

MakeHelpOf: Your Lending Companion

To assist you in this process, we recommend visiting MakeHelpOf, a comprehensive platform that offers reviews of various lenders, including Ace Cash Express. MakeHelpOf allows you to explore the experiences of other borrowers and gain insights into a lender’s reliability and customer satisfaction.

Eligibility Criteria

Eligibility Criteria of Payday Loans outlines the fundamental requirements borrowers must meet to access these short-term financial solutions. This section provides a clear picture of the prerequisites, such as a steady income source, minimum age of 18, and residency in the applicable state. It also touches on factors like bankruptcy status and military involvement, emphasizing the importance of meeting these criteria to qualify for a payday loan. Understanding eligibility is essential to initiate the loan application process confidently.

Understanding Eligibility Requirements

To qualify for a payday loan from a direct lender, you need to meet certain eligibility criteria:

- Steady Income: Lenders require proof of a consistent source of income, which may include employment or other regular income streams.

- Residency: Typically, payday loan eligibility is based on your residency in the state where you’re requesting the loan. State laws and regulations govern payday lending.

- Age: You must be at least 18 years old to apply for a payday loan.

- Bankruptcy: Most lenders will not approve loans for individuals currently involved in an ongoing bankruptcy case.

- Military Service: Active-duty military members are often ineligible for payday loans due to federal lending regulations.

- Identification: You will need a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Contact Information: A valid phone number is required for communication.

- Bank Account: You’ll need a savings or checking account for loan disbursement.

Meeting these criteria is essential to initiate the payday loan application process successfully.

Loan Amounts and Terms

Loan Amounts and Terms dives into the flexible options available within the world of payday loans. It explores the range of loan amounts, typically from $100 to $2,000, and the varying loan terms that can extend up to six months. This section underscores the importance of reviewing loan terms diligently, ensuring borrowers have a comprehensive understanding of the specific loan offer before accepting it. It serves as a critical guide to tailor payday loans to individual financial needs effectively.

Understanding Loan Options

Payday loans offer flexibility in terms of loan amounts and repayment periods. However, these options can vary based on state regulations and individual lenders. Here’s what you need to know:

- Loan Amounts: The amount you can borrow typically ranges from $100 to $2,000. However, the specific amount available to you depends on your income, state of residence, and the lender’s policies.

- Loan Terms: Payday loans are designed to be short-term, usually with terms of up to six months. It’s crucial to review the terms of each loan option carefully, as they can vary between lenders.

- Interest Rates (APR): Payday loans often come with high Annual Percentage Rates (APRs), with rates that can reach up to 900%. This is due to the short-term nature of the loans and the associated higher risks for lenders.

The Application Process

The application process for a payday loan is relatively simple and can be completed online. Here are the steps to follow:

- Research and Choose a Lender: Begin by researching and selecting a reputable lender, such as Ace Cash Express.

- Visit the Lender’s Website: Go to the lender’s website and locate the online application form.

- Complete the Application: Fill out the application form accurately, providing all required information.

- Choose Your Loan Amount: Specify the loan amount you need based on your immediate financial requirements.

- Choose Your Funding Method: Decide whether you prefer funds to be deposited directly into your bank account or if you’d like to visit an offline store for cash disbursement.

- Review Your Application: Before submitting your application, review it carefully to ensure all information is accurate.

- Submit Your Application: Click the “Submit” or “Apply Now” button to submit your application to the lender for review.

The lender will evaluate your application and, if approved, will disburse the funds based on your chosen method. Online applications typically result in direct deposits into your bank account.

Loan Availability by State

Payday loan availability varies by state due to differing regulations and laws governing these loans. Before applying, it’s essential to determine whether payday loans are accessible in your state. Refer to MakeHelpOf’s website for detailed information on state-specific availability.

In-Store vs. Online Payday Loans

Payday loans are available through both in-store and online channels. The choice between these options depends on your preferences and needs:

- Online Applications: Applying online offers convenience, with funds typically transferred directly into your bank account. This method is suitable for those who prefer a seamless digital experience.

- In-Store Applications: Visiting an offline store allows for face-to-face interaction with lenders and immediate cash disbursement. This option is ideal for individuals who prefer a physical presence and immediate access to funds.

Understanding APRs for Payday Loans

Payday loans are known for their high APRs, which can be as high as 900%. This is a reflection of the higher interest rates associated with short-term loans. It’s important to grasp the implications of these rates before committing to a payday loan.

While payday loans can provide quick financial relief, they should be used cautiously and only when necessary. Before taking this step, consider alternative financial options that may have lower associated costs.

Conclusion

Payday loans from direct lenders can be a valuable resource in times of financial need. However, they come with specific terms, conditions, and higher costs. To make the most of this financial option:

- Research and choose a reputable lender.

- Understand eligibility requirements.

- Review loan amounts and terms.

- Be aware of APRs and associated costs.

- Complete the application process accurately.

By following these steps and using payday loans responsibly, you can effectively address short-term financial challenges while building a foundation for long-term financial stability. Remember to explore alternative financial solutions whenever possible and make informed decisions to secure your financial future.

Frequently Asked Questions (FAQs)

What is a payday loan, and how does it work?

A payday loan is a short-term, small-dollar loan designed to help individuals cover immediate financial needs until their next paycheck. It typically ranges from $100 to $2,000. Borrowers must repay the loan, along with fees and interest, when they receive their next paycheck. Payday loans are known for their accessibility and quick approval process, making them a valuable resource for addressing unexpected expenses.

Are payday loans available in all states?

No, payday loan availability varies by state due to differing regulations and laws governing these loans. Some states have strict regulations in place, while others permit payday lending with certain restrictions. Before applying for a payday loan, it’s essential to check whether they are accessible in your state and understand the specific rules that apply.

What are the eligibility requirements for a payday loan?

Eligibility criteria for payday loans typically include having a steady source of income, being at least 18 years old, having a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and residing in the state where you’re requesting the loan. Additionally, applicants should not be involved in an ongoing bankruptcy case and should not be active-duty military members.

How do I choose a reputable payday lender?

Choosing a reputable payday lender is crucial to ensure a positive borrowing experience. Start by researching lenders and reading reviews from other borrowers on platforms like MakeHelpOf.com. Look for lenders with transparent terms, fair interest rates, and ethical lending practices. Ensure the lender complies with state regulations and provides clear information about loan terms and fees.

What should I consider before taking out a payday loan?

Before taking out a payday loan, consider the following:

- Assess your financial need: Determine whether the expense is essential and whether there are alternative sources of funds.

- Understand the terms: Review the loan amount, interest rates (APR), and repayment terms carefully.

- Budget for repayment: Ensure you can repay the loan on time to avoid additional fees and interest.

- Explore alternatives: Consider other financial options, such as personal loans, credit cards, or assistance from family and friends, which may have lower costs.

Taking these factors into account will help you make an informed decision about whether a payday loan is the right choice for your financial situation.