If you’re in the market for a credit card that allows you to shop for stunning diamond jewelry while enjoying exclusive benefits, the Zales Diamond Card might be the perfect fit for you. In this comprehensive guide, we’ll explore the features, perks, and application process for the Zales Credit Card, which is exclusively available at Zales, the renowned diamond store. We’ll also provide some tips on how to maximize the benefits of this card and use it to your advantage. So, whether you’re planning an engagement, a wedding, or simply want to add a touch of elegance to your jewelry collection, keep reading to discover all about the Zales Credit Card.

Zales Credit Card Overview

The Zales Credit Card is your key to a world of breathtaking diamond jewelry and exclusive perks. This credit card is exclusively available for use at Zales stores and their online website. Here’s a quick overview of what you can expect when you decide to apply for the Zales Diamond Card:

Free Shipping: One of the first benefits that catch your eye is the promise of free shipping with no minimum purchase. This means you can start your diamond shopping spree without any added shipping costs.

Credit Score Requirement: Before you proceed with the application, it’s essential to note that a decent credit score is necessary. We recommend a credit score of 700 or higher to improve your chances of approval. Remember, a good credit score opens doors to various financial opportunities, including credit cards like the Zales Diamond Card.

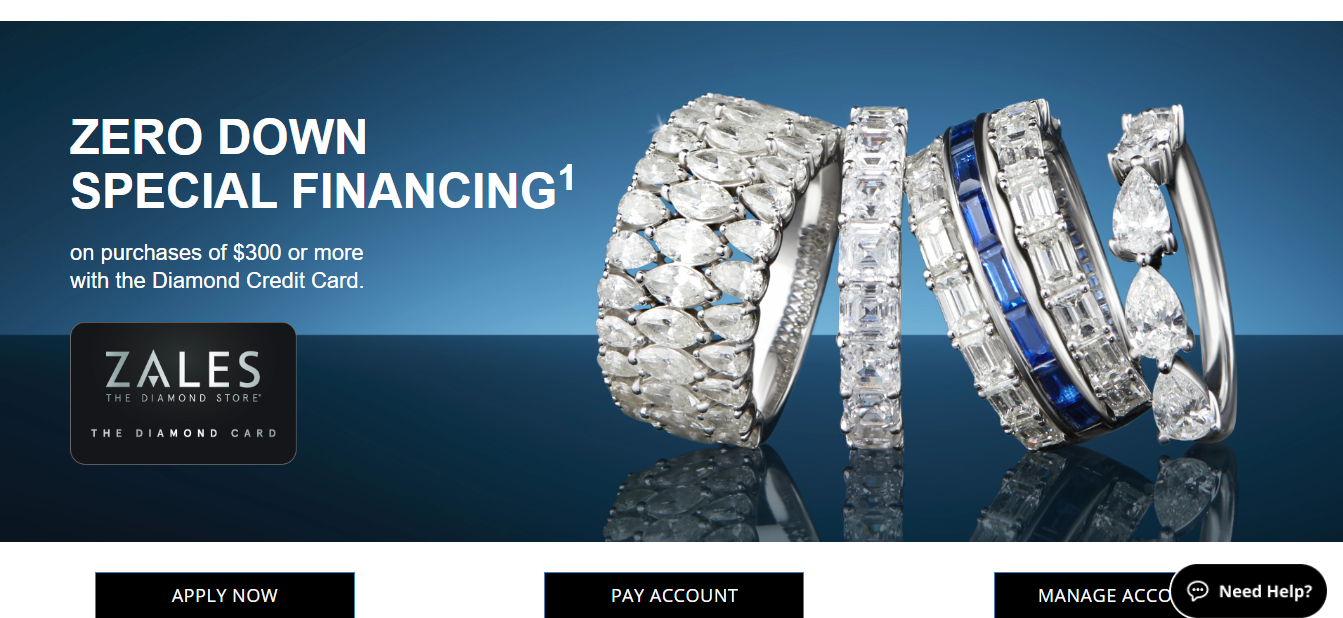

Special Financing Options

One of the most appealing aspects of the Zales Credit Card is the special financing options it offers. These options are designed to cater to your budget and make your diamond shopping experience even more affordable. Here are the special financing choices available with the Zales Credit Card:

- 6 Months Financing: For purchases of $300 or more, you can enjoy zero-interest financing for six months. This allows you to spread out your payments and make your diamond jewelry more accessible.

- 12 Months Financing: If you’re making a more significant purchase, the 12-month financing option is available. This lets you enjoy a year of zero-interest payments on your purchase.

- 18 Months Financing: Planning an even more substantial purchase? With a minimum purchase of $3,000, you can benefit from 18 months of zero-interest financing, giving you flexibility in your payments.

- 36 Months Financing: For purchases of $7,500 or more, the 36-month financing option comes into play. While there is a 16.9% annual percentage rate, paying off the balance within the specified time frame ensures you won’t incur any interest charges.

It’s important to consider your budget and the terms of these financing options to choose the one that best suits your needs. Financing is an excellent option if you plan to build your credit, as timely payments are likely to be reported to credit bureaus. However, if you can, paying in full within the zero-interest period is an attractive option. Furthermore, you can gather information about venmo credit card, which is of substantial value, essentially serving as a comprehensive guide.

Diamond Credit Card Perks

The Zales Diamond Card is not just about financing; it also offers an array of exclusive benefits to its cardholders. Here’s what you can anticipate:

- Welcome Gifts: Upon approval, you’ll receive a $50 welcome gift to kickstart your diamond shopping journey.

- Birthday Gift: Celebrate your special day with an extra $100 off your purchase when you use your Zales Credit Card.

- Card Holder Anniversary Gift: As a loyal Zales Credit Card holder, you’ll receive an exclusive anniversary gift, further enhancing your diamond collection.

- Free Shipping: Enjoy free shipping every day when you shop at Zales, making it more convenient to get your hands on that exquisite diamond piece.

How to Apply for the Zales Credit Card

Applying for the Zales Credit Card is a straightforward process, whether you prefer to visit a physical Zales store or apply online. Here are the steps to follow:

Applying Online

- Check Your Credit Score: Before you start your application, make sure your credit score is at least 650. While a higher score can increase your chances of approval, Zales often accepts applicants with a minimum score of 650.

- Create an Online Zales Account: Visit the Zales website and create an online account. This step is crucial because you’ll need this account to complete your application.

- Start Your Application: Once you have your online account set up, click on the “Apply Now” button. This will take you to the Zales Diamond Card application page. Fill in the required information, and you’ll receive a decision on your application.

- Instant Approval: If your application is instantly approved, you’ll gain immediate access to your credit, allowing you to start shopping for dazzling diamond jewelry right away.

Applying In-Store

If you prefer to apply in person at a Zales store, here’s what you need to do:

- Find a Zales Store: Use Google to search for “Zales near me” to locate the nearest Zales store in your area.

- Visit the Store: Head to the Zales store and let the staff know you’d like to apply for the Zales Credit Card.

- Complete the Application: Fill out the application provided by the store, and you’ll typically receive a decision on your application shortly.

Remember that having your online Zales account set up can speed up the process if you decide to shop online after being approved for the Zales Diamond Card.

Alternatives to the Zales Credit Card

While the Zales Credit Card offers an attractive financing option for diamond jewelry enthusiasts, it’s essential to explore alternative options before making a decision. Here are a few alternatives to consider:

- Traditional Credit Cards: Many traditional credit cards offer competitive interest rates and rewards programs. They can be used not only at Zales but also at various other retailers, providing more flexibility in your spending choices. Look for credit cards with low interest rates and rewards that align with your preferences.

- Store Credit Cards: If you’re looking for store-specific benefits similar to the Zales Credit Card, consider other store credit cards. Some jewelry retailers and department stores offer their own credit cards with special discounts and financing options for jewelry purchases.

- Personal Loans: Personal loans can be a convenient way to finance your diamond jewelry purchase. They typically offer fixed interest rates and fixed monthly payments, making it easier to budget for your jewelry investment. Be sure to compare loan terms and interest rates to find the most favorable option.

- Online Financing Platforms: Several online financing platforms specialize in providing installment loans for retail purchases. These platforms offer competitive interest rates and convenient online application processes. Research and compare different platforms to find the one that suits your needs.

- Layaway Programs: Some jewelry stores, including Zales, may offer layaway programs where you can reserve your chosen jewelry piece and pay for it over time without accruing interest charges. While this may require patience, it can be an interest-free way to secure your desired diamond jewelry.

Before making a decision, carefully assess your creditworthiness, budget, and preferences. It’s essential to choose the financing option that aligns with your financial goals and allows you to enjoy your diamond jewelry while managing your finances responsibly. dditionally, you can collect information about care credit card, a resource of considerable value that essentially acts as a comprehensive guide.

Conclusion

the Zales Credit Card opens doors to a world of stunning diamond jewelry and exclusive perks. With special financing options, welcome gifts, and the convenience of online shopping, it’s a valuable tool for those with a passion for diamonds. However, it’s crucial to meet the credit score requirements and create an online Zales account for a smooth application process. While the Zales Credit Card is a fantastic option, it’s wise to consider alternative financing methods to find what best suits your needs. Whether you’re planning a special occasion or simply want to indulge in the beauty of diamonds, the Zales Credit Card is a valuable addition to your financial toolkit. Explore your options, maintain a good credit score, and embark on your diamond shopping journey with confidence

Frequently Asked Questions

When will I receive my credit card?

The article mentions that the timeline for receiving your Zales Credit Card may vary, but you should typically expect it to arrive by mail within a few weeks after your application is approved.

What is the minimum credit score required for approval?

According to the article, Zales typically approves applicants with a credit score of at least 650. It also suggests that having a higher credit score can enhance your chances of approval and potentially provide you with a higher credit limit.

What are the special financing options available with the Zales Credit Card?

The article outlines the special financing options offered by the Zales Credit Card, including 6 months, 12 months, 18 months, and 36 months financing, with varying minimum purchase requirements and zero-interest periods for qualifying purchases.

How can I apply for the Zales Credit Card online?

The article provides a step-by-step guide for applying for the Zales Credit Card online, which includes creating an online Zales account and clicking on the “Apply Now” button on the Zales website to start the application process.

How can I apply for the Zales Credit Card in-store?

The article explains that if you prefer to apply for the Zales Credit Card in person at a Zales store, you can search for the nearest store using Google, visit the store, and complete the application provided by the store’s staff. The decision on your application is typically made shortly after.