In today’s financial landscape, securing a loan traditionally meant pledging assets or collateral against the borrowed amount. However, times have changed, and there are now multiple opportunities to access funds without the need for collateral. If you’ve ever wondered how to secure an unsecured personal loan, this comprehensive guide is for you. We’ll explore nine different lenders that offer unsecured personal loans, ranging from $1,000 to $100,000, even if your credit score isn’t perfect.

What is an Unsecured Personal Loan?

An unsecured personal loan is a type of loan that doesn’t require you to pledge any assets as collateral. Unlike traditional loans, which often rely on the value of your possessions, unsecured loans focus on other factors like your creditworthiness and financial stability.

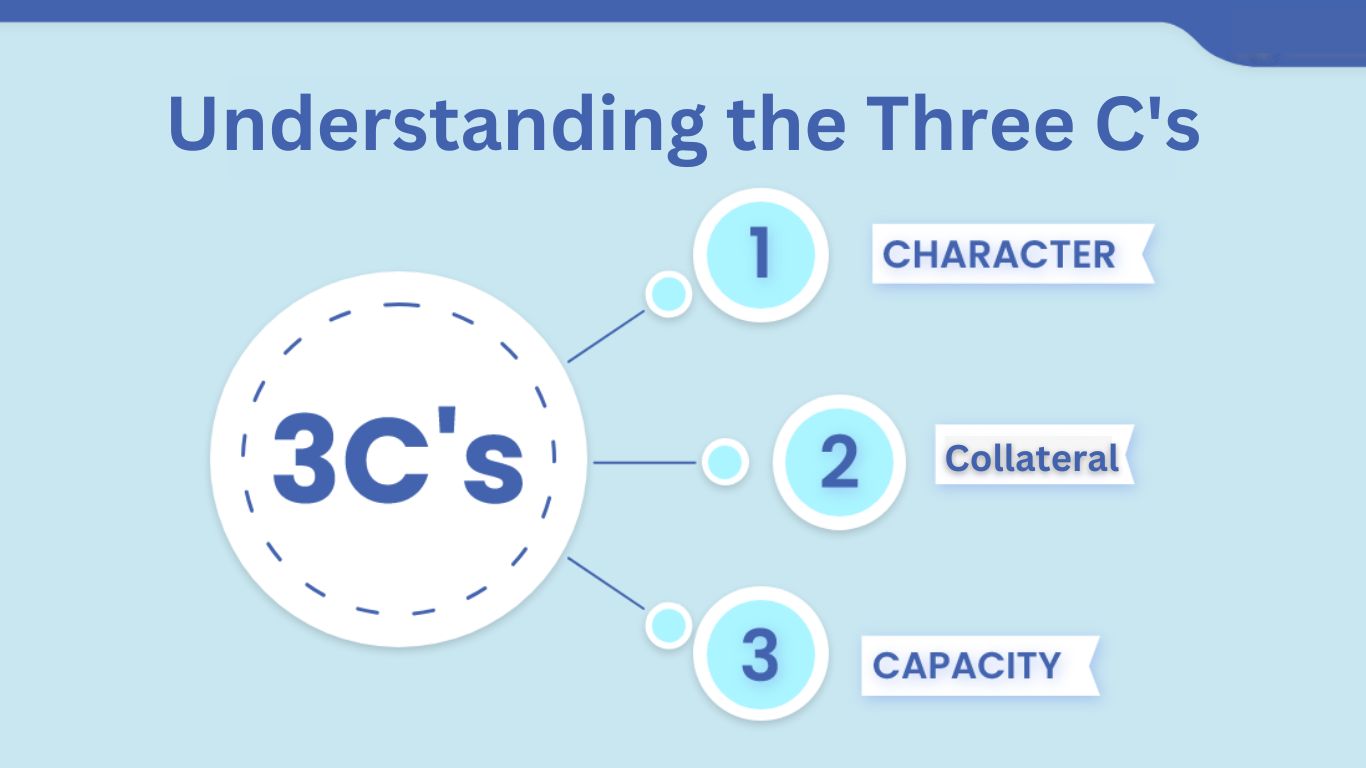

Understanding the Three C’s

Before we dive into the details of unsecured personal loans, let’s briefly explore the three C’s that lenders typically consider when evaluating your loan application:

- Character: Lenders assess your character by examining your credit history, the length of time you’ve lived at your current residence, your employment stability, and your overall financial responsibility.

- Capacity: Capacity refers to your ability to repay the loan. Lenders evaluate your current income, job stability, and skill level, as these factors determine your capacity to make timely payments.

- Collateral: Traditional loans often rely on collateral, which means lenders can seize your assets if you fail to repay. Unsecured loans, as the name suggests, do not require collateral.

The Shift Towards Unsecured Loans

In recent years, there has been a notable shift in lending practices, especially in response to the economic challenges posed by the pandemic. Lenders are increasingly focused on helping underserved communities, including minorities, women, and individuals from diverse backgrounds. This shift has opened up new opportunities for those who may not have substantial assets. Getting to more about discover personal loans.

Nine Lenders Offering Unsecured Personal Loans

Now, let’s explore nine lenders that offer unsecured personal loans, each with its unique features and requirements:

- Best Egg: Best Egg provides unsecured personal loans ranging from $2,000 to $50,000 for individuals with a minimum credit score of 700. They offer competitive interest rates.

- Figure: Figure offers unsecured personal loans with an APR starting at 5.75%. The loan amount is flexible, and there doesn’t appear to be a strict credit requirement.

- Old National Bank: This lender provides quick approval for unsecured loans with APRs between 8.12% and 17.51%. You can borrow up to $25,000, and there’s no apparent credit check.

- Lending Club: Lending Club offers loans ranging from $1,000 to $40,000 with APRs starting at 7%. The loan amount varies based on your needs and creditworthiness.

- LightStream: LightStream is known for offering large unsecured loans, with amounts of up to $100,000 and competitive APRs ranging from 3.99% to 19.99%. No credit check appears to be required.

- Marcus by Goldman Sachs: Marcus offers unsecured personal loans with APRs from 6.99% to 25%. You can borrow up to $40,000 with a credit score of 720 or higher.

- Happy Money: Previously known as Payoff, Happy Money specializes in debt consolidation loans with APRs ranging from 5.99% to 24.99%. Loans are available from $5,000 to $40,000 for borrowers with a credit score of at least 640.

- PenFed: PenFed, a credit union, offers unsecured personal loans with APRs between 6.74% and 17.99%. You can access loans of up to $50,000.

- SoFi: SoFi provides unsecured personal loans for good credit with amounts of up to $100,000. A credit score of at least 680 is required.

- Wells Fargo: Wells Fargo offers unsecured personal loans with a credit score requirement of 620 or higher. You can borrow up to $100,000.

- Upgrade and Upstart: Both lenders offer unsecured personal loans with credit checks and minimum credit score requirements. Upgrade requires a 620 credit score, while Upstart requires 600.

Conclusion

Accessing funds without collateral is now a reality, thanks to these reputable lenders offering unsecured personal loans. Whether you’re looking to consolidate debt, cover unexpected expenses, or pursue your financial goals, there are options available for individuals with varying credit profiles. Remember that responsible borrowing is essential, and understanding the terms and conditions of each loan is crucial to making informed financial decisions.

Frequently Asked Questions (FAQs)

What is an unsecured personal loan?

An unsecured personal loan is a type of loan that doesn’t require you to provide collateral, such as assets or property, as security. It’s solely based on your creditworthiness and financial stability.

How can I qualify for an unsecured personal loan with a low credit score?

While it can be challenging to secure an unsecured loan with a low credit score, some lenders specialize in serving borrowers with less-than-perfect credit. You may need to explore lenders with flexible credit requirements or consider improving your credit score before applying.

What is the typical loan amount and interest rate for unsecured personal loans?

Loan amounts and interest rates for unsecured personal loans vary widely depending on the lender, your credit score, and your financial profile. Generally, you can borrow anywhere from a few thousand dollars to $100,000 or more, with interest rates typically ranging from single digits to the mid-teens in percentage.

Are unsecured personal loans safe to use for debt consolidation?

Yes, unsecured personal loans can be a safe and effective way to consolidate high-interest debt, such as credit card balances. By consolidating your debts into a single loan with a lower interest rate, you can potentially save money and simplify your financial obligations.

What are the advantages of unsecured personal loans compared to secured loans?

unsecured personal loans offer several advantages, including not requiring collateral, faster approval times, and less risk to your personal assets. However, they may come with slightly higher interest rates compared to secured loans, which are backed by collateral like a home or car.