Are you in the market for insurance and finding yourself torn between two industry giants, Farmers Insurance and State Farm? The decision can be overwhelming about the winner of Farmers Insurance vs State Farm, but fear not; we’re here to guide you through a comprehensive comparison that will help you make an informed choice that suits your unique needs and preferences. In this detailed article, we’ll explore every aspect of these two insurance powerhouses, delving into their histories, financial stability, customer satisfaction, premiums, credit score impact, age considerations, driving records, discounts, tech-savvy options, and much more. By the time you finish reading, you’ll have a clear understanding of which insurer is the right fit for you.

Farmers Insurance vs State Farm

Before we dive into the intricacies of this comparison, let’s get acquainted with the two contenders: State Farm and Farmers Insurance.

State Farm

Founded in 1922, State Farm has been a stalwart in the insurance industry for nearly a century. With a dominant position in the market, it commands over 16% of the nation’s insurance market share. This is no small feat considering the sheer number of insurance companies in the United States.

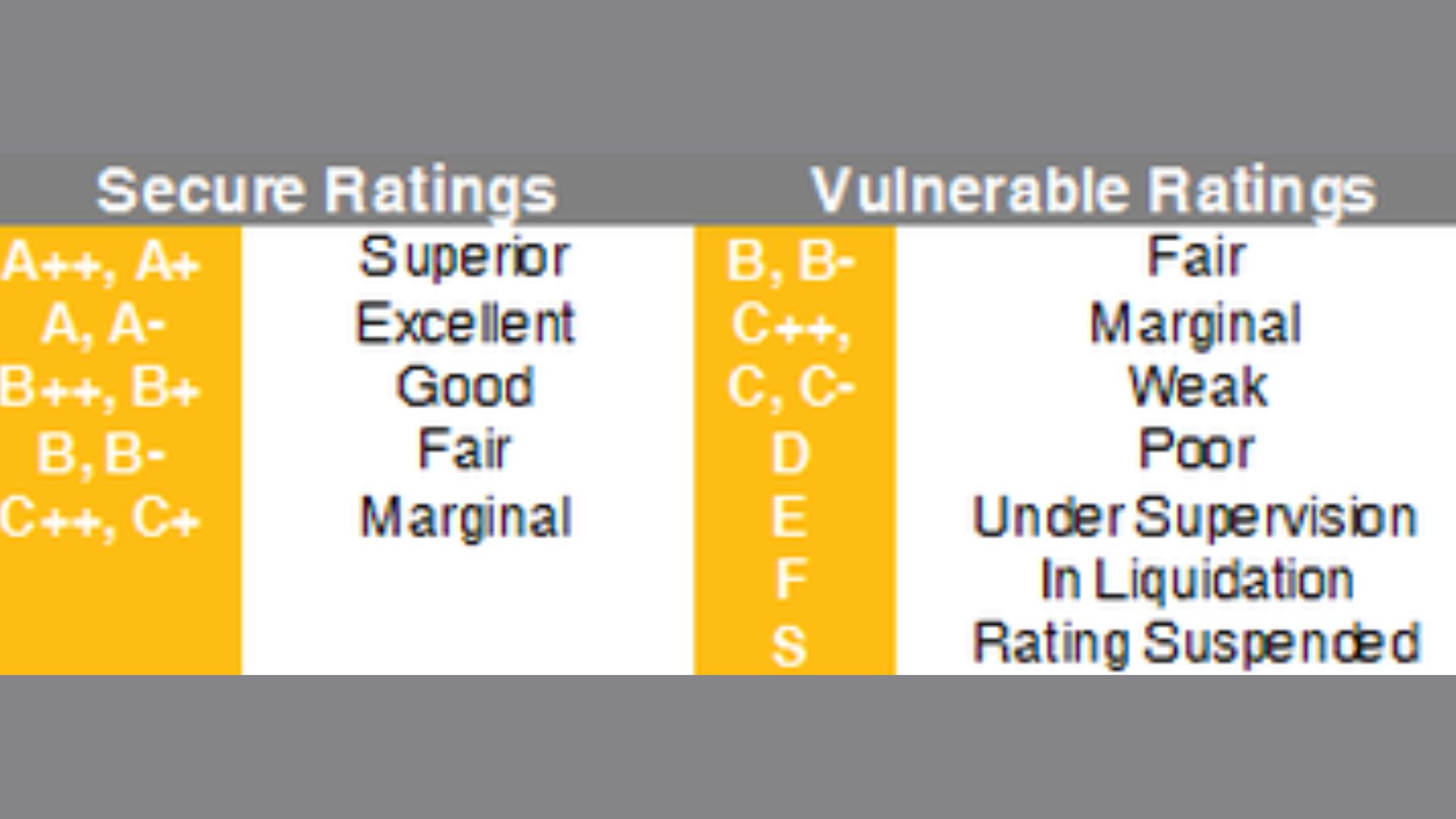

From a financial standpoint, State Farm boasts an A++ rating from AM Best, an independent rating agency. This rating signifies exceptional financial stability and the ability to meet its financial obligations promptly.

Customer satisfaction is another feather in State Farm’s cap, as it scores 881 on J.D. Power’s satisfaction scale. This high rating is indicative of customers’ overall positive experiences with the insurer.

One standout feature of State Farm is its “Drive Safe & Save” program, designed to reward safe driving habits. This telematics program allows policyholders to receive discounts based on their actual driving behavior, potentially leading to significant savings.

Farmers Insurance

Though Farmers Insurance may have a smaller market share compared to State Farm, it is by no means a minor player. With approximately 3-4% of the market share, Farmers Insurance is a considerable force in the insurance landscape.

What’s impressive is that Farmers Insurance serves over 10 million customers, a testament to its appeal and trustworthiness among policyholders.

Financially, Farmers Insurance holds an A- rating from AM Best, indicating sound financial health and stability. While it may not match State Farm’s A++ rating, an A- rating is still a sign of a solid financial foundation.

When it comes to customer satisfaction, Farmers Insurance scores a respectable 872 on the J.D. Power scale, proving that policyholders have generally positive experiences with the company.

One intriguing aspect of Farmers Insurance is its “Signal Program”. This program, which offers discounts based on safe driving behavior monitored through telematics, has garnered almost a five-star rating. Moreover, it provides extra incentives, such as cash rewards, for top-performing drivers.

With our introductions complete, let’s embark on a journey to compare these insurance giants across various dimensions.

Bank Rate Scores: State Farm vs. Farmers Insurance

To kick off our comparison, we turn to Bank rate, a trusted source for evaluating insurance providers. Bank rate provides an overall score that considers multiple factors, including customer feedback and financial stability.

In this regard, State Farm enjoys a commendable 4.5 rating, a testament to its strong performance across these crucial factors.

On the other hand, Farmers Insurance follows closely with a 3.8 rating. While this score is slightly lower than State Farm’s, it’s essential to read beyond the numbers and consider other factors before forming a judgment.

Financial Stability: AM Best Ratings

Financial stability is a critical factor to consider when choosing an insurance provider. After all, you want assurance that your insurer has the financial capacity to fulfill its obligations, especially in times of need.

State Farm, with its A++ rating from AM Best, stands as a paragon of financial strength. This rating signifies that State Farm is exceptionally well-prepared to meet its financial commitments, including paying claims promptly.

Farmers Insurance, while not reaching the pinnacle of an A++ rating, holds a solid A- rating. This rating reflects that Farmers Insurance maintains a robust financial foundation and is well-positioned to handle its financial responsibilities.

In essence, both insurers are financially sound, and your choice may come down to other considerations, such as your specific insurance needs and personal preferences.

Customer Satisfaction: J.D. Power Ratings

Understanding the level of customer satisfaction an insurance company provides can be a game-changer in your decision-making process. The J.D. Power ratings are a reliable indicator of how well insurers meet the expectations and needs of their policyholders.

State Farm, with its J.D. Power rating of 881, demonstrates a high level of customer satisfaction. This rating underscores that State Farm’s policyholders generally have positive experiences, reflecting its commitment to delivering excellent service.

Farmers Insurance, not far behind, boasts a J.D. Power rating of 872. This score showcases that Farmers Insurance also excels in customer satisfaction, leaving policyholders content with their insurance experiences.

While there is a slight difference in the ratings, both State Farm and Farmers Insurance have a strong track record of satisfying their customers. Therefore, your final choice may pivot on other crucial factors we will explore.

Premiums: The Cost of Coverage

Arguably, one of the most critical factors for policyholders is the cost of insurance coverage. Your premiums can significantly impact your budget, making it essential to evaluate how each insurer fares in this regard, also learn how to claim att insurance.

Minimum Coverage

Let’s begin with minimum coverage, a fundamental level of protection required in most states. State Farm generally offers competitive rates, with an average annual premium of around $539 for minimum coverage. Farmers Insurance, on the other hand, tends to be a bit pricier, with an average premium of approximately $808 for the same coverage.

However, it’s crucial to remember that insurance premiums can vary significantly depending on your location, driving history, and other personal factors. The key is to obtain personalized quotes from both insurers to get an accurate picture of the cost in your specific situation.

Full Coverage

If you’re seeking more comprehensive coverage, such as 100/300 coverage and above, the cost can differ significantly between State Farm and Farmers Insurance. On average, State Farm’s annual premium for full coverage is around $1,457, while Farmers Insurance averages around $2,000.

Again, these are averages and can fluctuate based on various factors. Therefore, it’s advisable to request customized quotes tailored to your specific needs and location.

To facilitate this process, you might consider using a service like Cover, which can gather quotes from up to 30 different insurance companies. Such services can save you time and potentially lead to substantial savings.

Credit Score Impact on Premiums

Your credit score is another pivotal factor that insurers consider when determining your premiums. The impact of your credit score on your insurance rates can be significant, so it’s essential to understand how each insurer approaches this aspect.

Poor Credit

If you have a less-than-ideal credit score, you’ll want to know how much it can affect your insurance premiums. State Farm typically charges around $3,309 annually for policyholders with poor credit. In contrast, Farmers Insurance takes a more lenient stance, with an average annual premium of $2,813 for individuals with poor credit.

Average Credit

Moving up the credit score ladder, if you have an average credit rating, you can expect to pay an annual premium of approximately $1,656 with State Farm. Farmers Insurance, for the same credit profile, tends to be slightly higher, with an average premium of around $1,987.

Good Credit

Policyholders with good credit scores tend to enjoy more favorable rates. If you fall into this category, State Farm offers annual premiums averaging $1,457, while Farmers Insurance comes in at approximately $2,000.

Excellent Credit

For those with excellent credit scores, both State Farm and Farmers Insurance offer competitive rates. State Farm provides an annual premium of around $1,126, while Farmers Insurance quotes an average of $1,694 per year.

It’s essential to note that premium rates can vary significantly based on your specific location and circumstances. Therefore, it’s highly advisable to obtain personalized quotes to determine the actual cost of coverage for your unique situation.

Age Matters: Impact on Premiums

Age is another significant factor that can influence your insurance premiums. Insurers often charge higher rates for younger drivers due to the perceived higher risk they represent. Let’s explore how both State Farm and Farmers Insurance approach different age groups in terms of premiums.

Age 16

At the age of 16, insurance premiums tend to be high for new drivers. State Farm charges an average annual premium of approximately $2,077 for 16-year-olds, while Farmers Insurance is slightly higher at around $2,685.

Age 18

Insurance premiums typically skyrocket when young drivers reach the age of 18, as they are considered higher risk. State Farm’s average premium for 18-year-olds is approximately $4,137, while Farmers Insurance’s rate increases substantially to around $6,488.

Age 25

As you reach the age of 25, a noticeable shift occurs, and premiums start to decline. State Farm offers an average annual premium of $1,694, while Farmers Insurance’s rate is approximately $2,254.

Age 30 and Above

The trend continues as you get older. By the time you reach age 30, State Farm’s annual premium remains competitive at $1,494, compared to Farmers Insurance’s rate of around $2,023.

Age 60

By the time you reach age 60, the differences in premiums between the two insurers begin to narrow. State Farm offers rates around $1,327, while Farmers Insurance quotes an average of approximately $1,700.

It’s important to note that these premium rates are approximate and can fluctuate based on your specific location and individual circumstances.

Driving Record: Impact on Premiums

Your driving record is perhaps one of the most influential factors in determining your insurance premiums. Insurers typically charge higher rates to drivers with a history of accidents or traffic violations. Let’s delve into how both State Farm and Farmers Insurance handle different driving records.

No Violations

If you have a clean driving record with no violations, you can expect favorable rates. State Farm charges an average annual premium of around $1,457, while Farmers Insurance’s rate is approximately $2,000.

Speeding Ticket

For individuals with a single speeding ticket, State Farm charges an average premium of $1,590, while Farmers Insurance is slightly higher at around $2,378.

At-Fault Accident

When it comes to at-fault accidents, State Farm maintains its competitive edge with an average premium of approximately $1,657, while Farmers Insurance’s rate is around $2,647.

DUI

Drivers with a DUI on their record can expect to pay higher premiums due to the increased risk they pose. State Farm charges an average annual premium of $2,201 for individuals with a DUI, while Farmers Insurance quotes an average of around $2,760.

It’s worth noting that Farmers Insurance tends to be more lenient toward high-risk drivers, as reflected in their pricing for individuals with speeding tickets, at-fault accidents, and DUIs. In contrast, State Farm maintains a competitive edge for drivers with clean records and good credit.

Discounts and Programs

Insurance providers often entice customers with discounts and programs to sweeten the deal. Both State Farm and Farmers Insurance offer various opportunities to save on premiums. Let’s explore the discounts and programs offered by each insurer.

State Farm Discounts and Programs

-

Drive Safe & Save: State Farm’s “Drive Safe & Save” program rewards policyholders for safe driving habits. By using telematics devices, drivers can receive discounts based on their actual driving behavior.

- Good Driver Discounts: State Farm also offers discounts for drivers with a clean driving record, making it an attractive option for those who prioritize safe driving.

-

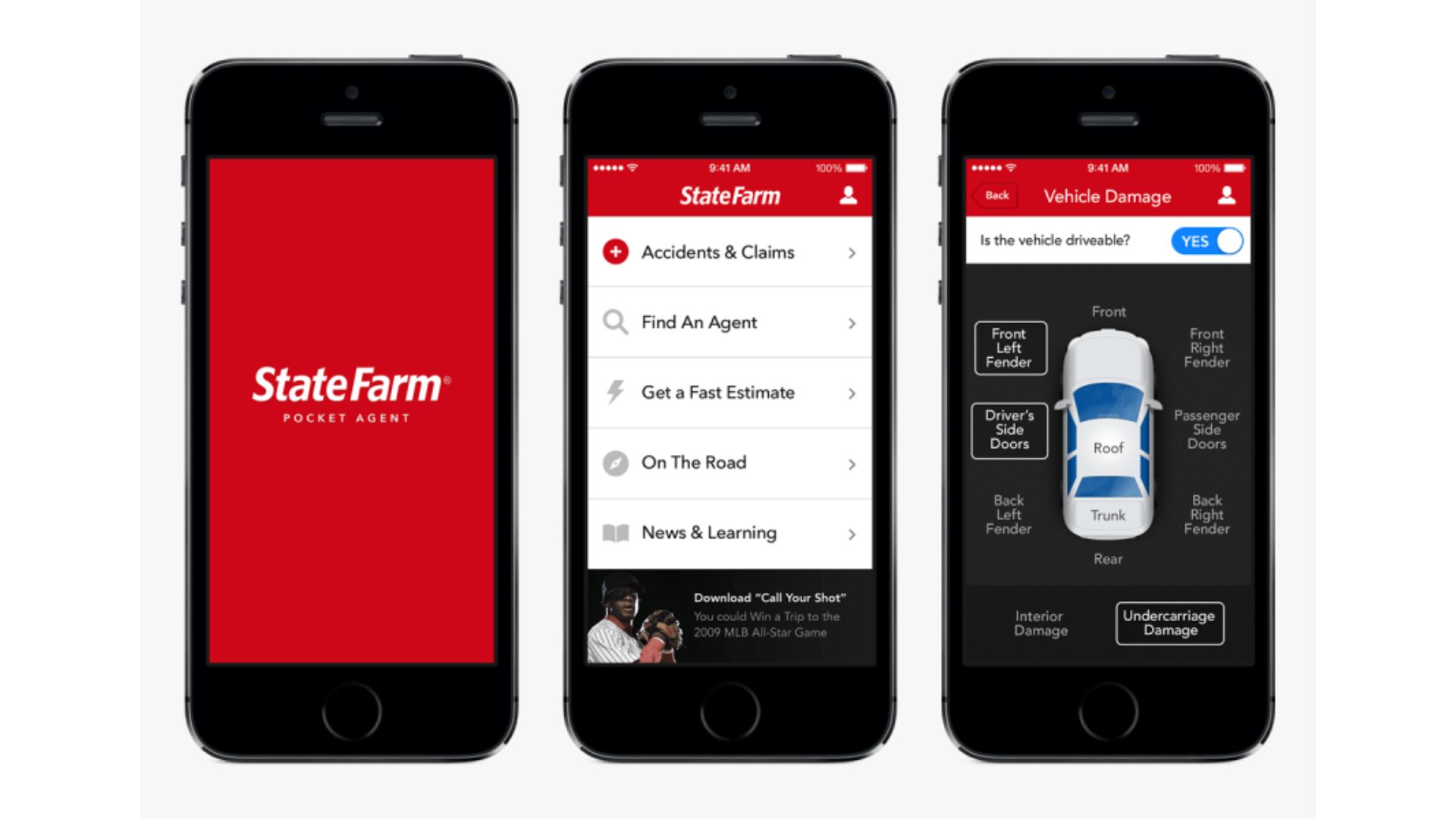

Tech-Savvy Options: State Farm provides a user-friendly mobile app with a high rating on both the App Store and Google Play Store. This app enables policyholders to access ID cards, request policy changes, and even file claims online.

Farmers Insurance Discounts and Programs

-

Signal Program: One of Farmers Insurance’s standout features is the “Signal Program.” This innovative program monitors driving behavior through telematics and offers discounts based on safe driving habits. Policyholders can receive up to 10-15% off their premiums. Moreover, this program even rewards top-performing drivers with gift cards or credits, adding an extra incentive to drive safely.

- 55 and Alive: Farmers Insurance offers a discount specifically tailored for mature drivers aged 55 and older. This discount is part of their strategy to attract customers who may also be interested in additional insurance products like homeowners and life insurance.

Both insurers have a range of discounts and programs to cater to various driver profiles and preferences. The choice between them may come down to the specific discounts that align with your needs and driving habits.

Tech-Savvy Options

In today’s tech-driven world, insurers must offer user-friendly mobile apps that allow policyholders to manage their policies seamlessly. Let’s see how State Farm and Farmers Insurance fare in this regard.

State Farm

State Farm offers a highly-rated mobile app, scoring 4.8 out of 5 stars on both the App Store and Google Play Store. This indicates that State Farm’s app is well-received by users and provides a convenient way to manage policies.

Farmers Insurance

Farmers Insurance takes it a step further, boasting an even higher rating of 4.9 out of 5 stars on the Google Play Store. This indicates that Farmers Insurance’s app excels in user-friendliness and functionality.

Both apps allow policyholders to perform essential tasks, such as accessing ID cards, requesting policy changes, and even filing claims online. These tech-savvy options reflect a commitment by both insurers to meet the expectations of modern consumers.

Conclusion

As you reach the end of this comprehensive comparison, you are armed with a wealth of information about Farmers Insurance and State Farm. While each insurer has its strengths and weaknesses, your ultimate choice will depend on your specific needs, priorities, and circumstances.

State Farm, as the nation’s largest insurance group, offers competitive rates for good drivers with excellent credit. It excels in serving drivers with clean records and maintaining a high level of customer satisfaction. If you value telematics-based discounts and a strong financial foundation, State Farm is an excellent choice.

On the other hand, Farmers Insurance has a competitive edge for drivers with less-than-perfect records, offering more lenient premiums for individuals with violations on their records. Their innovative “Signal Program” provides a unique opportunity to earn discounts based on safe driving habits, and their app has received exceptional user ratings.

Frequently Asked Questions (FAQs)

What factors should I consider when choosing between Farmers Insurance and State Farm?

When deciding between these two insurance giants, consider factors such as your location, driving record, credit score, age, and specific insurance needs. Additionally, take into account the discounts and programs each insurer offers to find the best fit for your situation.

Do Farmers Insurance and State Farm offer discounts for safe driving?

Yes, both Farmers Insurance and State Farm offer discounts for safe driving. State Farm has its “Drive Safe & Save” program, while Farmers Insurance has the “Signal Program.” These programs use telematics to monitor your driving behavior and reward safe habits with discounts.

How do credit scores affect insurance premiums with Farmers Insurance and State Farm?

Your credit score can significantly impact your insurance premiums. State Farm typically offers lower rates for policyholders with good to excellent credit scores. Farmers Insurance tends to be more lenient for those with lower credit scores, offering competitive rates even for individuals with less-than-perfect credit.

Are there age-specific considerations when choosing between these insurers?

Yes, age plays a significant role in determining insurance premiums. Younger drivers, such as those aged 16 or 18, tend to face higher rates due to their perceived higher risk. Premiums gradually decrease with age and driving experience. Consider your age and how it might affect your premiums when comparing Farmers Insurance and State Farm.

How do I obtain personalized insurance quotes from Farmers Insurance and State Farm?

To get personalized insurance quotes, you can visit the official websites of Farmers Insurance and State Farm and request quotes online. Alternatively, you can contact local agents from both companies who can provide you with customized quotes tailored to your specific needs and circumstances. Additionally, consider using insurance comparison websites and services to gather quotes from multiple insurers, including Farmers Insurance and State Farm, for a more comprehensive view of your options.