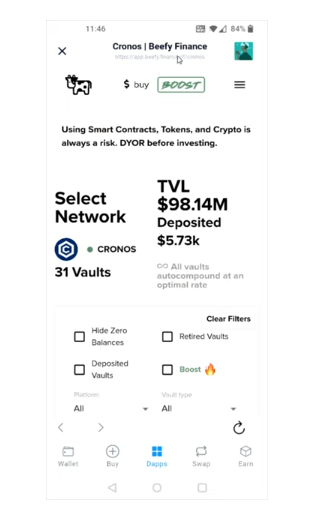

If you’re looking to optimize your yield farming experience in the world of decentralized finance (DeFi), Beefy Finance is a powerful tool you should consider. In this comprehensive guide, we’ll walk you through the steps of using Beefy Finance, a popular DeFi platform accessible through the Crypto.com DeFi Wallet. Please remember that this article is not investment advice, and it’s crucial to conduct your research and assess the risks before diving into the crypto space.

Getting Started with Beefy Finance

1. Accessing Beefy Finance

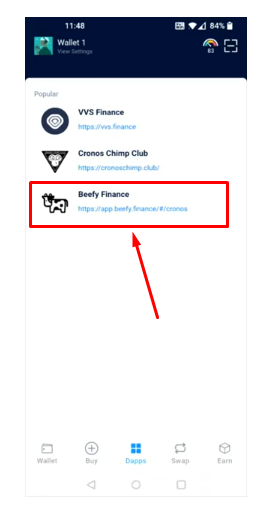

- To begin your journey with Beefy Finance, open the Crypto.com DeFi Wallet on your smartphone.

- From the DeFi Wallet’s home page, scroll down and click on “DApps.”

- Here, you’ll find a list of popular DeFi applications available within the Crypto.com DeFi Wallet.

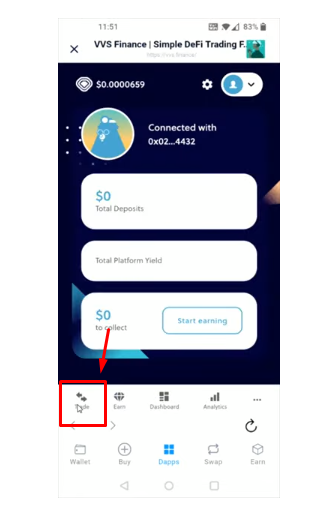

2. Why Choose Beefy Finance Over VVS Finance

You might be wondering why you should opt for Beefy Finance instead of VVS Finance. Both platforms offer attractive options, but the main distinction lies in automation. While VVS Finance requires manual harvesting and management of rewards, Beefy Finance takes a more hands-off approach. It automatically reinvests your rewards back into the liquidity pool, offering hassle-free compounding. If you prefer a set-and-forget strategy, Beefy Finance is an excellent choice.

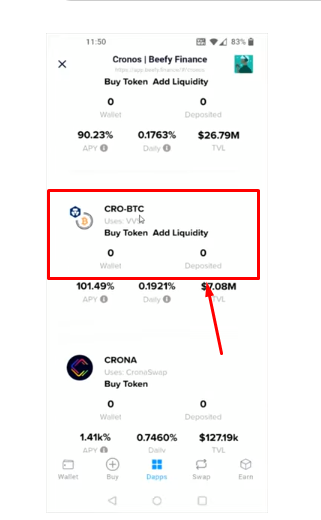

3. Choosing Your Asset Pair

Navigating Beefy Finance may seem overwhelming at first glance, but it’s relatively straightforward, especially if you’re starting with liquidity pool tokens from VVS Finance. We recommend selecting an asset pair that uses VVS, making the transition smoother.

4. An Example: Crypto.com Coin and Wrapped Bitcoin

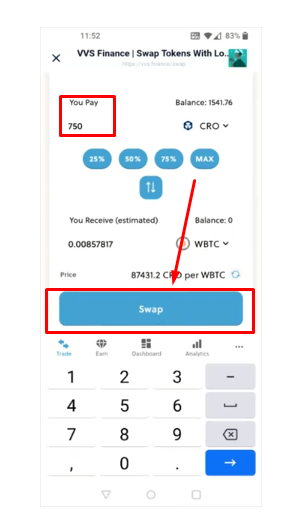

For demonstration purposes, let’s use the Crypto.com Coin (CRO) paired with Wrapped Bitcoin (WBTC). To start, head back to VVS Finance, click on “Trade,” and ensure you have a sufficient balance of CRO.

For this example, we’ll leave about 40 CROs in your balance and transfer 750 CROs to WBTC. Complete the swap and return to the main VVS Finance page.

5. Providing Liquidity

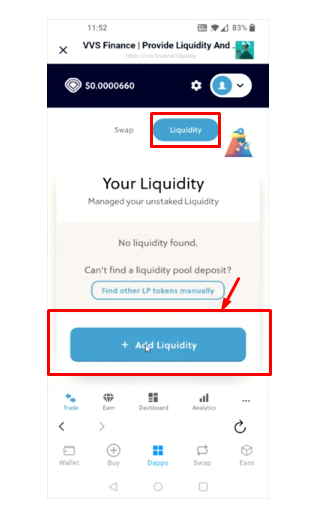

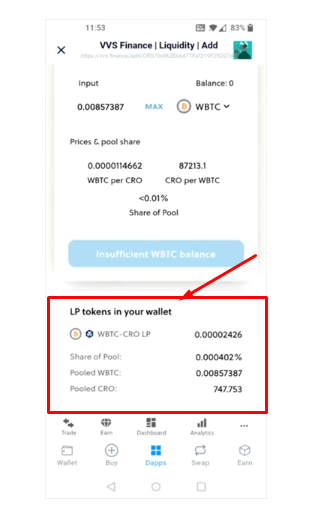

Next, click on “Liquidity” and select “Add Liquidity.” Choose the two tokens you’d like to provide liquidity for, which, in our case, are CRO and WBTC.

Supply the maximum amount of WBTC you have, and confirm the supply. Once confirmed, you’ll receive liquidity pool tokens.

6. Moving Liquidity to Beefy Finance

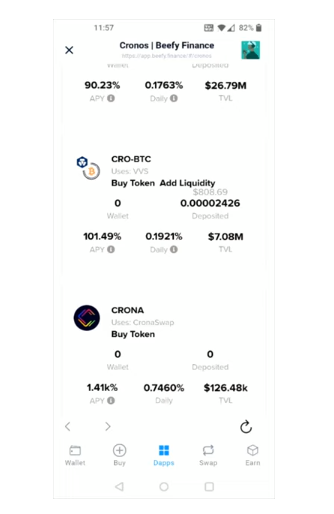

- Now, return to the Crypto.com DeFi Wallet and access Beefy Finance.

- Find the Crypto.com Coin and Wrapped Bitcoin pairing that uses VVS.

- Click on the pairing, approve the transaction, and deposit your balance.

7. Auto-Compounding Rewards

With your assets in Beefy Finance, you’re all set. Your rewards will automatically compound, reinvesting back into your deposited liquidity pool. This auto-compounding feature sets Beefy Finance apart from VVS Finance, where you would have to manage rewards manually. After all this process if you want to sell it, you can sell your crypto on the Binance platform.

Conclusion

Beefy Finance offers a user-friendly way to maximize your DeFi earnings through automated reward compounding. While VVS Finance remains a viable choice, Beefy Finance’s hands-off approach simplifies the process for those seeking a more convenient option. Remember to stay informed, do your research, and manage your risks carefully in the crypto space.

Frequently Asked Questions

Is Beefy Finance safe to use?

Beefy Finance is considered safe, but like any DeFi platform, there are risks involved. Ensure you understand the risks associated with yield farming and use caution.

Can I use Beefy Finance on platforms other than Crypto.com DeFi Wallet?

Currently, Beefy Finance is primarily accessible through the Crypto.com DeFi Wallet, but it may expand to other platforms in the future.

How often are rewards compounded on Beefy Finance?

Beefy Finance compounds rewards automatically, ensuring continuous growth of your deposited assets.

What are the fees associated with using Beefy Finance?

You may encounter network fees when using Beefy Finance. These fees cover transaction costs on the blockchain.

Can I withdraw my assets from Beefy Finance at any time?

Yes, you can withdraw your assets from Beefy Finance at any time, allowing you to access your funds when needed. Keep in mind that gas fees may apply.