Vidya Lakshmi Portal

Vidya Lakshmi Portal has been launched by the central government. Students can now apply for education loans via online only just accessing the official Vidya Laxmi Portal, which is open to everybody. The Central Government is receiving and accepting online applications for education loans through the website vidyalakshmi.co.in.

Those students who want to take loan for education can visit the Vidyalakshmi Portal from anywhere, anytime and apply for the loan online. After applying for the loan students can track their application easily by the help of Vidya Lakshmi Portal 2021.

The entire procedure of applying for an education loan through the Vidya Laxmi Portal is pretty simple. There are several steps involved, including registering on the Vidyalakshmi portal, filling out a standard loan application form, and applying to several institutions. The complete steps to loan application form at Vidya Lakshmi Portal 2021 has been provided in this article.

Page Overview

| Scheme Name | Vidya Lakshmi Portal 2021 |

| Authority | Central Government |

| Beneficiaries | Indian Students |

| Objective | Provide Education Loan For higher studies |

| Official Website | https://www.vidyalakshmi.co.in/Students/ |

This article is designed for students who want to study overseas or in India and are interested in knowing about education loans. The Finance Ministry of India launched the vidya lakhmi portal on August 15, 2015, and it has been operating since then. The Vidyalakshmi education loan portal, which is backed by the Government of India and has 40 banks enrolled with it, is a valuable resource.

Currently, the Vidyalakshmi portal for education financing offers 77 different education loan packages. To apply for the loan, student must first register on the portal and then log in to the same by using the ID and password that they created.

Following that, the applicant must complete the Common Education Loan Application Form (CELAF), which is approved by all registered financial institutions. Following the completion and submission of the application form, the student will be able to search among the various Vidya Lakshmi education loan plans that are available to him or her. After that, you can select the loan programme that best suits your needs and submit an application for an educational loan.

Through the Vidyalakshmi platform, you will be able to submit an application for an education loan to the top three banks in the country. The site allows you to keep track of the progress of your application. If the status of your loan application is “on hold,” it signifies that additional information must be submitted by you before the loan application can be processed and sanctioned. In addition, all the small updates like documents requires, rejection of form and more will be checked by thsi portal.

Other Loan Schemes

Eligibility For Vidya Lakshmi Education Loan

- Applicants must belong to India and must be Indian citizens.

- Applying aspirants must have completed their higher secondary examination or an equivalent qualification to apply.

- You must have an offer letter/admission letter from the college/ institution you want to study in.

- Your parents or co-applicant must demonstrate that they meet the income requirements established by the lending institutions.

- The Vidyalakshmi scheme does not have a minimum score required to be eligible for an education loan.

- For the loan up to INR. 7,50,000/- bank will not ask for any collateral security.

Features Of Vidya Lakshmi Loan 2021

- The Lakshmi education loan is a government-sponsored loan that allows students to continue their education after high school.

- Students can apply for an education loan through the Vidya Lakshmi application portal.

- With a single application form, candidates can submit applications to up to three different banks.

- The interest rate on a Vidya Lakshmi education loan begins at 8.40 percent and goes up from there.

- It is possible to obtain an education loan up to Rs. 4 lakh without offering any collateral for a period of up to 15 years.

- The documents required for obtaining the loan include id documentation, proof of residency, academic records, proof of income, and so on.

- The loan money is disbursed within 15 days of the application form being received by the lender.

Other Banking Article

Benefit Of Vidya Lakshmi Portal Loan 2021

- One of the most advantageous aspects of obtaining an education loan through this program is that the application may be completed entirely online through their website. As a result, it makes the initial loan application process more convenient. Following the submission of the application form, you will be required to attend the bank for the submission and verification of your supporting documentation.

- 34 public and private sector banks are currently participating in the Vidya Lakshmi loan initiative, launched in 2009. For the education loan, you can apply to up to three different banks. In this way, it provides various possibilities for obtaining the loan at the most advantageous interest rate. If one bank declines to accept your application, you still have the option of applying to the other two banks.

- If you apply for an education loan with three different banks, you will only need to fill out one standard application form, which is available on the Vidya Lakshmi platform. This eliminates the need to fill out multiple applications for different banks, which can be time-consuming.

- It is possible to browse through the many education loan schemes offered by the registered banks, compare them and select the most appropriate one for your educational requirements by using the portal’s search function.

- Following the submission of your loan application, you can track the progress of your loan through the portal provided by the lending institution.

- As directed by the Indian Banks Association, the education loan is disbursed within 15 days of submitting the application form and is repaid with interest. Consequently, it offers prompt financial aid to those who are in need while pursuing a higher degree.

- Sending in grievances and inquiries is simple. You can submit any issues or questions about your education loan to the relevant bank using the portal or by sending an email to the address listed on the website. The bank’s customer service representatives will contact you and address your concerns.

Vidya Lakshmi Portal Documents Required

Students Documents:

- Application Form (Duly filled)

- 04 recent Passport size photo

- Aadhar card and PAN card

- Mark sheets of previous education from 10th onwards

- Passport

- IELTS certificate (In case of global education if required)

- Letter of admission from the recognised college or university

- Fee structure of all years and duration of course

Co-applicant Documents:

- 04 recent Passport size photo

- Aadhar card and PAN card

- Last 03 years ITR

- Form 16 from the employer or IT return, both of the last two years

- Bank statement of last 01 year

Steps To Apply Education Loan At Vidya Lakshmi Portal 2021

You can simply apply for the loan by just following the below steps-

- Open the Vidya Lakshmi portal (https://www.vidyalakshmi.co.in/Students/)

- Now press the “Register” link available at the top right of the page.

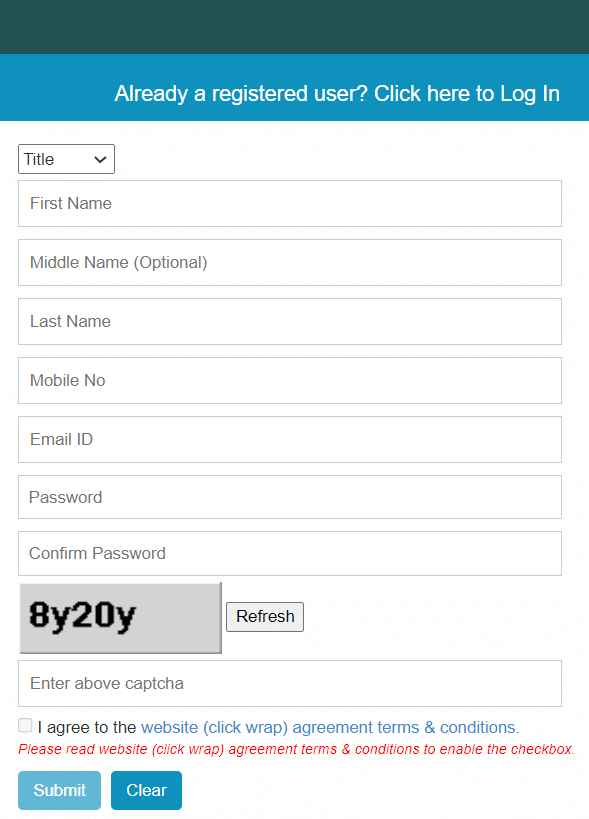

- Fill out the registration form on the portal by providing your personal information and the security captcha code. If you’ve already registered, log in with your username and password.

- Compare the education loans offered by various financial institutions and shortlist three financial institutions as per your suitability.

- Please fill out the Common Education Loan Application Form (CELAF) and send it to the appropriate lending institution.

- Following receipt of your application, the three selected banks will make you competitive offers on school loans.

- Compare the options, taking into account the interest rate and the other terms and conditions, and then choose the one that best meets your needs.

- As soon as you’ve decided on a bank, go to the branch nearest you and turn in the completed application form, together with any supporting documentation, for verification.

- The loan money will be released into your provided bank account within 15 days of receiving your application.