Credit Linked Subsidy Scheme, CLSS, Subsidy on Home Loan, Apply Online, CLSS Subsidy, PMAY CLSS, PMAY Credit Linked Subsidy Scheme: As everyone knows, the importance of the house in their living life. Everyone needs to know all the details of the government housing scheme. In June, the year 2015, below the Pradhan Mantri Awas Yojana [PMAY], the Ministry of Housing & Urban Poverty Alleviation [MoHUPA] has started Credit Linked Subsidy Scheme for all the citizens of India. This government scheme has begun for all Indian people so that they can get their dream home. Here in this article, we will discuss everything related to the Credit Linked Subsidy Scheme [CLSS], eligibility conditions, features, fees, etc. Interested applicants should read this article very carefully.

| Topic Name | Credit Linked Subsidy Scheme: Get Subsidy On Home Loan |

| Article Category | Design of CLSS PMAY CLS Scheme for Middle Income Group [MIG] Credit Linked Subsidy Scheme Apply Procedure Credit Linked Subsidy Scheme Status Check CLSS Acknowledged PLIs Frequently Asked Questions |

| State Name | Central Government |

| Official Website | Click Here |

CLSS is a type of subsidy scheme below the PMAY. It is for all Indian people for their house construction work, improvement, purchase house, etc. It plays an essential role below the Pradhan Mantri Awas Yojana. Credit Linked Subsidy Scheme has always focused on the procedure to give subsidy to all people who belong to the Economical Weaker Section [EWS], Middle Income Group [MIG], and Lower Income Group [LIG].

Also Read: UMANG App

Let’s inform you that the CLSS Scheme has been starting to develop an affordable housing scheme for all Indian citizens. As per the PMAY, this will become in reality till the 2022 end. The Indian government has started the Housing For All initiative until 2022. It is a crucial step towards the benefit of all ordinary people. The government has taken this work by beginning the Credit Linked Subsidy Scheme and will complete it until 2022.

Design of CLSS PMAY

Here we will discuss the basic design of CLSS PMAY. The steps are as follows:

- To contribute concession in the interest to all customers who want to get a home loan from the different institutions below Pradhan Mantri Awas Yojana [PMAY].

- To give finance of cheap house to all Indian citizens, 70 bank and non-bank institutions consist of housing finance companies, scheduled commercial banks, small finance banks, and regional rural banks along with the National Housing Bank [NHB].

- Below CLSS yojana, the total tenure on home loan will be of twenty years along with every citizen can avail the facility of loan, i.e., a maximum of six lakhs.

- Below CLSS yojana, it includes various Housing Finance Companies and all related institutions. They all are eligible for a subsidy interest rate of 6.50% for twenty years or at the time of tenure.

Here we provide you with a table that shows the various CLSS features for MIG, EWS, and LIG. Every applicant or citizen needs to check out all very carefully. Let’s tell you all that here only shows you the CLSS for Lower Income Group [LIG] and CLSS Economically Weaker Section [EWS]. The table is as follows:

| Category Name | EWS (Economically Weaker Section) | LIG (Lower Income Group) |

| Limit of Annual Income | 3 Lakhs Rupees | Between 3 Lakhs Rupees to 6 Lakhs Rupees |

| Limit of Loan for subsidy | 6 Lakhs Rupees | 6 Lakhs Rupees |

| Subsidy Interest | 6.50% | 6.50% |

| Period of Subsidy | 20 years or loan tenure, or less | 20 years or loan tenure, or less |

| Size of House | 30 Sq. Mtr. | 60 Sq. Mtr. |

| Subsidy Maximum Amount | 2.2 Lakhs Rupees | 2.2 Lakhs Rupees |

Important Features of CLSS for LIG and EWS

Here we will explain to you several important features of CLSS for LIG and EWS Scheme. The steps are as follows:

- If you want to get the amount of loan up to six lakh rupees, you can apply for this scheme.

- The total subsidy that you should get is around 2.67 lakhs rupees.

- It is available for only citizens who want to construct or buy their houses.

- If any wants to get the subsidy of six lakh rupees, they will not contribute to this particular amount.

- Only those citizens or applicants are eligible to apply for this scheme (PMAY) those who do not have their pucca house. In their family, none of the family members owns a pucca house anywhere in India are eligible for this scheme.

- If an applicant family member is already availing the benefit below the PMAY, they will not benefit from it.

Also Read: Pradhan Mantri Awas Yojana List

CLS Scheme for Middle Income Group [MIG]

| Category Name | MIG 2 (Middle Income Group) | MIG 1 (Middle Income Group) |

| Limit of Annual Income | Between 12 Lakh Rupees to 18 Lakh Rupees | Between 6 Lakh Rupees to 12 Lakh Rupees |

| Subsidy Interest | 3% | 4% |

| Limit of Loan for subsidy | 12 Lakh Rupees | 9 Lakh Rupees |

| Size of House | 200 Sq. Mtr. | 160 Sq. Mtr. |

| Period of Subsidy | 20 years or loan tenure, or less | 20 years or loan tenure, or less |

Important Features of CLSS for MIG (2 Salary Package)

Here we will discuss several important features of CLSS for MIG (2 Salary Package). The steps are as follows:

- For MIG 1: In this salary package, subsidy on home loans at the interest rate of 4% is up to nine lakh rupees.

- For MIG 2: In this salary package, subsidy on home loans should be given at the interest rate of 3% is up to twelve lakh rupees.

- The total subsidy you can avail is 2.35 lakh rupees.

Credit Linked Subsidy Scheme Apply Procedure

Here we will discuss the Apply procedure in CLSS [Credit Linked Subsidy Scheme]. Those who are ready to apply for CLSS or those eligible to apply for this scheme should visit Prime Lending Institutions [PLIs]. From there, you will get the verification of application sanction loans, and after that, you can claim subsidy from the Central Nodal Agencies [CNAs]. In this manner, you can avail of the contribution of the Credit Linked Subsidy Scheme. If anyone wants to gets apply for this CLSS PMAY Scheme Online, then follow all steps are as follows:

- For this, visit an official website of PMAY, which is as follows Click Here.

- The page will look like this.

- For apply online, start creating your account.

- After creating an account, now start login your account by just filling your username and passcode.

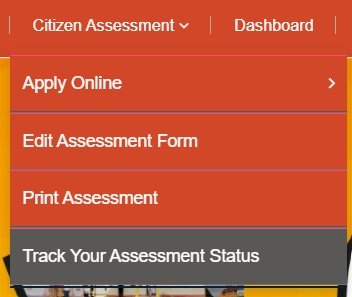

- Tap on the citizen assessment button, which is at the top of the webpage.

- Now, tap on the Apply Online button.

- Now, choose your option according to your wish.

- Fill all asked information on the given application form.

- In this manner, every citizen can submit your application form online.

Eligibility Conditions

Here we will discuss the eligibility conditions of CLSS. The steps are as follows:

- Any member of the family, such as wife, husband, and unmarried children, are eligible.

- They do not have any pucca house in the name of any family member or anywhere in India.

- Credit Linked Subsidy Scheme is used to avail the housing loans for buying or constructing houses such as if you want to add rooms, washrooms, etc.

- It is used for the increment house area.

- For all married ones, both husband and wife are eligible to apply for this scheme.

CLSS Fees

According to the PLIs, there will be no fee applicable. All eligible citizens can apply for this scheme anytime or anywhere. So, without any troubles, every interested citizen can use or plan their house on EMI and take advantage of it.

Important Documents

Here we will discuss the required documents that you need while applying for Credit Linked Subsidy Scheme. The steps are as follows:

- Applicant PAN Card

- Aadhaar Card

- Voter ID Card

- Passport

- Driving License

- Applicant Passport size photo

- Any Recognized Authority / Public Sector photo with letter

- Resident Address Proof Certificate

- Rent Agreement on stamp paper

- Address on Bank Passbook

- ITR slip

- Bank statement of last six month

- Salary slip of the previous two months

- Sale/purchase agreement, and

- Payment slip.

Credit Linked Subsidy Scheme Status Check

Here we will discuss the CLSS PMAY online status check. That citizen who gets apply for CLSS PMAY scheme has always ready to check the status of their application form. The steps are as follows:

- For this, visit an official website of PMAY, which is as follows Click Here.

- Now start Login your account here.

- After that, tap on the citizen assessment button, which is at the top of the webpage.

- Now, tap on the Track your assessment button over there.

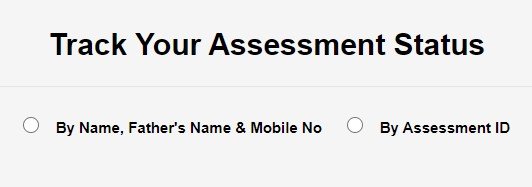

- The page will look like this.

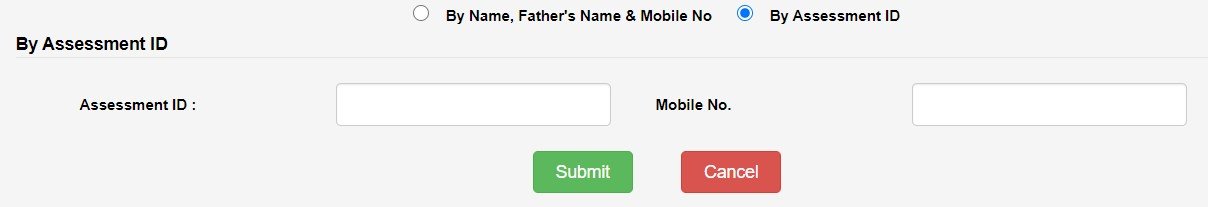

- Here, there are two choices available such as By Assessment ID or By Name, Father’s Name, & Mobile Number.

- Select any one of the two options to track your application form.

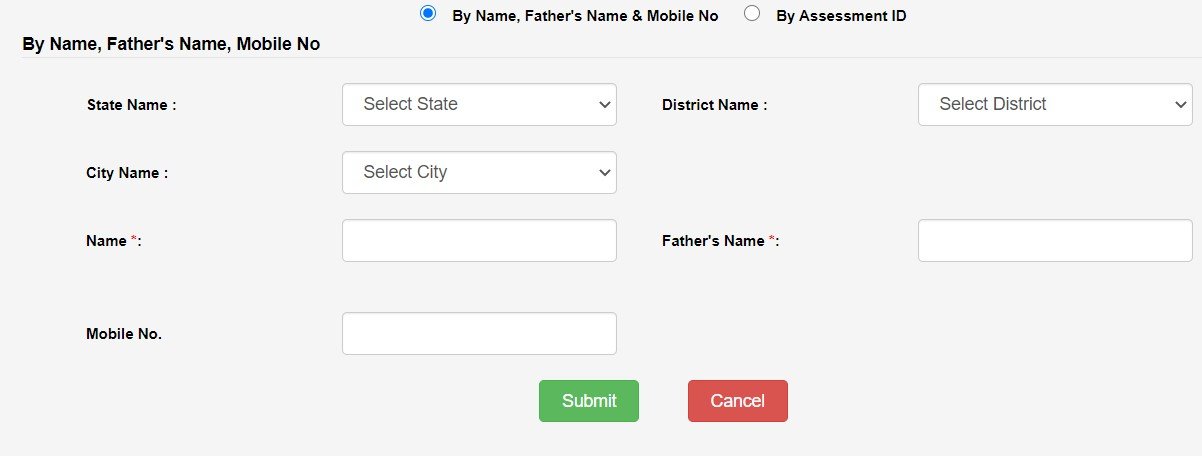

- If you are choosing the first choice, then the page will look like this.

- Now, here enter your district name, state name, city name, father’s name, mobile number, and name.

- If you are choosing a second choice, then the page will look like this.

- Now, here enter your assessment ID and Mobile Number.

- After entering all details, now tap on the submit button.

- In this manner, every citizen should be able to track their application status online.

CLSS Acknowledged PLIs

All small finance banks and NBFCs are acknowledged to attend the function as PLIs (Primary Lending Institutions) to maintain the execution scope of CLSS [MIG]. Moreover, every institution such as urban and state cooperative banks, regional rural banks, housing finance companies, and scheduled commercial banks are also acknowledged as PLI function.

Let’s inform you all that this particular scheme or yojana started below the Pradhan Mantri Awas Yojana, as this scheme promise to build all houses till 2022 end. From this scheme, every Indian citizen can take benefit of it very fast. These Indian citizens include the Lower Income Group, Economic Weaker Section, etc. Like we know, every people has a dream of having their own house. So, CLSS has given them this opportunity to build their own home and make their dreams come true.

CLSS Helpline Contact Number

Here we will give you a helpline number of CLSS. All citizens who want to know more information about CLSS may call the toll-free helpline contact number. Housing & Development Corporation [HUDCO] helpline contact number is as follows 1800116163. And, the National Housing Bank [NBC] helpline contact number is as follows 1800113377 and 1800113388.

I hope you will understand this article very well and are ready to take advantage of it. Suppose you face any problems related to the Credit Linked Subsidy Scheme [CLSS], eligibility conditions, features, fees. In that case, you may ask your queries in the given comment box.

Frequently Asked Questions

What does CLSS mean?

CLSS means Credit Linked Subsidy Scheme. It is a scheme for all people of India, especially for the Economical Weaker Section [EWS], Middle Income Group [MIG], and Lower Income Group [LIG] to provide the house. It is a housing scheme so that everyone can own their home.

Name all essential documents that you need while applying for Credit Linked Subsidy Scheme?

Essential Documents are as follows PAN Card, Aadhaar Card, Voter ID Card, Passport, Driving License, Passport size photo, Recognized Authority/ Public Sector photo with a letter, Resident Address Proof Certificate, Rent Agreement on stamp paper, Address on Bank Passbook, ITR slip, Bank statement of last six month, salary slip of previous two months, sale/purchase agreement, and Payment slip.

If I already avail of the benefit of the Credit Linked Subsidy Scheme, can I apply again on my son’s name below this CLSS?

No, you cannot apply for it again on the name of your son. This cannot exhibit the property of eligibility conditions.