Atal Pension yojana 2021, Atal Pension Yojana Online Apply, APY 2021, Apply Online, Atal Pension Scheme Benefits: As we all know, how important is it for us to save some amount of money from securing our future. Every Indian citizen has to save money for the benefit of their future. You can save money in the form of several government yojanas where you may be started to invest from a lower amount to a more considerable amount of money. Let’s inform you all that the Atal Pension Yojana has begun with the Prime Minister Narendra Modi of our country on 1.June.2015. Below this yojana, every applicant can get a total pension of Rs.1000 to Rs.5000 every month after completing the age of 60 years. Below this yojana, as per the investment & age invested from the applicants, the total pension amount will be fixed. This article will discuss everything related to the Atal Pension Yojana, Amount Chart, registration process, eligibility conditions, required documents, etc. Interested applicants should read this article very carefully.

| Topic Name | Atal Pension Yojana 2021: Invest Rs.7 Daily, Get Rs.5000 Pension Every Month |

| Article Category | Atal Pension Yojana 2021 Atal Pension Scheme 2021 Atal Pension Yojana Objective Advantages of Atal Pension Yojana 2021 Contribution Chart of Atal Pension Scheme Atal Pension Yojana Apply Procedure Frequently Asked Questions |

| State Name | Central Government |

| Official Website | Click Here |

| APY User Guidelines | Click Here |

| Atal Pension Yojana FAQ | Click Here |

Atal Pension Yojana 2021

Every applicant whosoever applied for this yojana must pay a premium every month. When you start to pay a premium every month, everyone will get financial assistance in a monthly pension for all old age group people. This pension will get after completing the age of 60 years. In this Pension Yojana, all applicants will not only get the pension amount after paying less premium, but their family members will also be benefited from this yojana after the applicant’s unfortunate death.

Also Read: Children Education Allowance

APY New Update

Let’s inform you all that below APY Scheme, applicant pension will increase or decrease anytime during the year. There are around 2.28 crore subscribers, or applicants registered below APY Scheme will get several facilities. The new facility will announce on 1 July. PFRDA has recently announced that all banks can decrease or increase pension anytime during the year. You will be able to get to this facility only once a year.

Overview of Atal Pension Yojana 2021

| Name of Scheme | Atal Pension Yojana |

| Started On | 2015 |

| Governed By | Central Government |

| Beneficiaries | People from unorganized areas of the country |

| Main Objective | To Provide Pension |

Atal Pension Scheme 2021

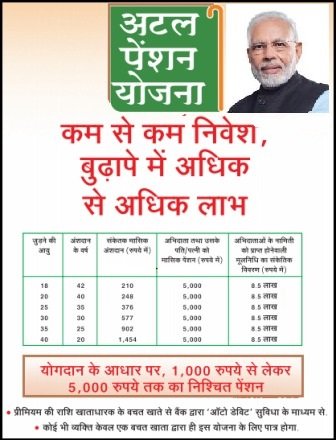

Let’s inform you that if you want to apply for Atal Pension Scheme, your age should be 18 years to 40. Between the mentioned age, only you will be able to benefit from this government scheme. If any applicant is ready to join this yojana at the age of 18, they will have to pay the premium amount of Rs.210 per month. If an applicant whose age is 40 years join this yojana, they will have to pay the premium amount of Rs.297 to Rs. 1454 per month. Below Atal Pension Yojana, all applicants need to have a bank account, and it should be get linked with Aadhaar Card. Those applicants who did their job in the government or income taxpayers did not benefit from this yojana. All interested applicants who want to join Atal Pension Yojana should visit any nearest bank and open their bank account of Atal Pension Yojana.

Also Read: LIC Kanyadan Scheme

Plan investment

Here we will explain the investment plan of APY 2021. In this government yojana, if someone saves Rs.7 daily or invest Rs.210 every month, then he will be able to get the pension of sixty thousand rupees annually. This investment should be made from the candidate at the age of 18 years. It also provides a tax exemption on investing below the 80 section of the Income Tax Act. Let’s tell you all that this particular government scheme has been managed by the Pension Fund Regulatory & Development Authority with the National Pension Scheme (NPS) help. Any interested applicant who wants to join this yojana may apply for it as soon as possible.

Atal Pension Yojana Objective

Here we will explain the main objective of APY 2021. It is a pension scheme that is started to protect our future by providing pension to all unorganized sector workers. From this yojana, they become self-reliant and do not depend on others. This scheme is a type of social security yojana whose primary aim is to start social security benefits. PM Atal Pension Yojana’s primary purpose is to empower every person by providing a pension.

Pradhan Mantri Atal Pension Yojana 2021

As we all know, after proper investment in the Atal Pension Yojana, every applicant will get a pension per month after 60 years. Every applicant has to live great by this pension scheme. Below this yojana, if a person dies, the total amount of pension will be given to the applicant’s nominee. This rule has been governed by the Pension Fund Regulatory & Development Authority [PFRDA], which now behaves as a Nodal Agency.

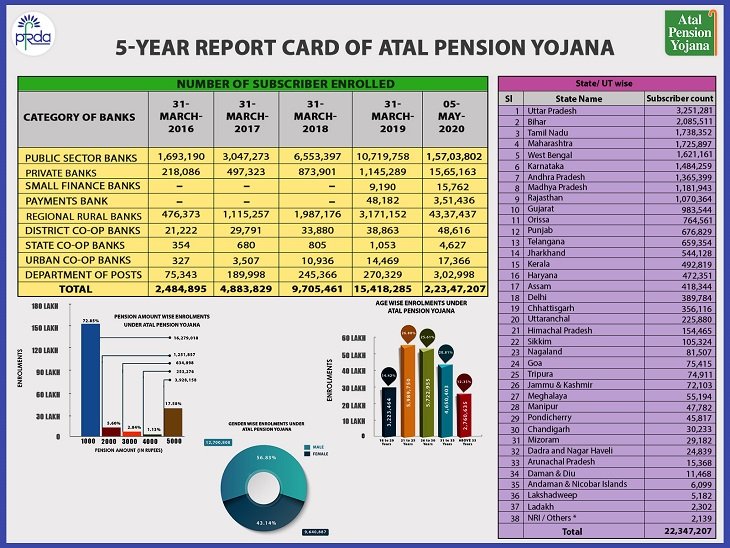

PM Atal Pension Scheme

Let’s inform you all that the central government Atal Pension Yojana has finished five years. This government yojana was run under the Pension Fund Regulatory & Development Authority [PFRDA]. As per the PFRDA, there are around 2.23 crore men & women connected with this yojana. Let’s tell you all that below PM Atal Pension Scheme, every man or woman whose age is above sixty years have been provided atal pension for the last five years. On 09 May 2021, the total registered people would be increased to 2,23,54,028. Atal Pension Yojana played an essential role in every citizen’s life and proved beneficial for all of us. Below this yojana, the male to female ratio has divided as follows 57:43 in the last five years.

Advantages of Atal Pension Yojana 2021

Here we will explain to you the advantages of APY 2021. The steps are as follows:

- For this scheme, people should live in India only.

- Below this Atal Pension Scheme, every applicant will get the monthly pension of Rs. 1000 to Rs.5000, only after finishing the age of 60 years.

- All applicants will get a particular pension based on the total investment rate and age below Atal Pension Yojana.

- Like the PF account, every central government will give some amount of money to this ongoing yojana or scheme on its own.

- If you are 18 years old and want to apply for this scheme, you have to pay Rs.210 per month for 42 years. By doing this, you will get a pension of Rs.1000 per month after finishing 60 years of age.

- Along with this, people aged 40 years and ready to apply for this scheme, then they have to pay the premium of Rs.297 to Rs.1454. In this manner, you will be able to get an advantage of Atal Pension yojana 2021.

Who are not eligible to get government coordination below APY?

All statutory social security schemes applicable to applicants are not suitable to get the advantage of government coordination below APY. Now, we have shared some of the government acts, which are not provided by government coordinations. The Acts are as follows:

- The Employees Provident Fund and Miscellaneous Provisions Act, 1952.

- APY Contribution Chart

- The Coal Mines Provident Fund and Miscellaneous Provisions Act, 1948.

- Any other statutory social security scheme.

- Simmons Provident Fund Act, 1966

- Jammu and Kashmir Employees Provident Fund and Miscellaneous Provisions Act, 1961.

- Assam Tea Garden Provident Fund and Miscellaneous Provisions, 1955.

Required Documents

Here we will explain the required documents for Atal Pension Scheme 2021. The documents are as follows:

- Applicants should be a resident of India.

- Applicant Mobile Number

- Passport size photo

- Applicant age should be in between 18 to 40 years.

- Aadhaar Card

- Applicant Identity Card

- Residence Document

- The resident should have a bank account, and that must be linked with the Aadhaar Card.

Contribution Chart of Atal Pension Scheme

Here we will explain to you all details of the Contribution of Atal Pension Scheme as a monthly-wise pension, year of contribution, and etc. The table is shown as follows:

| Entry Age | Contribution Year | Monthly pension of Rs.1000/- | Monthly pension of Rs.5000/- | Monthly pension of Rs.2000/- | Monthly pension of Rs.4000/- | Monthly pension of Rs.3000/- |

| 18 | 42 | 42 | 210 | 84 | 168 | 126 |

| 19 | 41 | 46 | 224 | 92 | 183 | 138 |

| 20 | 40 | 50 | 248 | 100 | 198 | 150 |

| 21 | 39 | 54 | 269 | 108 | 215 | 162 |

| 22 | 38 | 59 | 292 | 117 | 234 | 177 |

| 23 | 37 | 64 | 318 | 127 | 254 | 192 |

| 24 | 36 | 70 | 346 | 139 | 277 | 208 |

| 25 | 35 | 76 | 376 | 151 | 301 | 226 |

| 26 | 34 | 82 | 409 | 164 | 327 | 246 |

| 27 | 33 | 90 | 446 | 178 | 356 | 268 |

| 28 | 32 | 97 | 485 | 194 | 388 | 292 |

| 29 | 31 | 106 | 529 | 212 | 423 | 318 |

| 30 | 30 | 116 | 577 | 231 | 462 | 347 |

| 31 | 29 | 126 | 630 | 252 | 504 | 379 |

| 32 | 28 | 138 | 689 | 276 | 551 | 414 |

| 33 | 27 | 151 | 752 | 302 | 602 | 453 |

| 34 | 26 | 165 | 824 | 330 | 659 | 495 |

| 35 | 25 | 181 | 902 | 362 | 722 | 543 |

| 36 | 24 | 198 | 990 | 396 | 792 | 594 |

| 37 | 23 | 218 | 1087 | 436 | 870 | 654 |

| 38 | 22 | 240 | 1196 | 480 | 957 | 720 |

| 39 | 21 | 264 | 1318 | 528 | 1054 | 792 |

| 40 | 20 | 291 | 1454 | 582 | 1164 | 873 |

Atal Pension Yojana Apply Procedure

Here we will explain the procedure online apply in Atal Pension Yojana. The steps are as follows:

- All interested applicants ready to take advantage of this government yojana should always open a savings bank account in any of the nearest national banks.

- After opening a bank account, fill an application form as provided by the bank. Fill all asked information in the Pradhan Mantri Atal Pension Yojana, such as mobile number, Aadhaar Card, etc.

- After correctly filling this Atal Pension Yojana Application Form, submit this form to the bank manager. Then, your form will be verified, and after that, your Atal Pension Yojana Bank Account will be opened.

Important Points of APY

- When you make your savings bank account and apply for the APY Scheme 2021, your bank account will deduct the particular amount. You have to keep enough balance in your account.

- According to your choice, you may get an increase in your pension. For this, you have to go to the bank and change it with a bank manager’s help and make all the necessary changes.

- If you cannot pay the payment, then there will be a penalty on you. Let’s inform you all that there will be a penalty of Rs.1 every month for Rs.100 and vice versa.

- In some cases, if you cannot pay a payment for six months, then your account will be frozen. And if it continues to twelve months, it may be closed, and the remaining amount will be paid to the subscriber.

- There will be no option for an early withdrawal process. It is possible only in the cases of ultimate death or terminal illness, the nominee or subscriber will get the full amount back.

- If somehow you close this scheme before finished the age of 60, then only saving amount plus interest will give you. You did not get the extra government benefits and earned interest.

I hope you will understand this article very well and are ready to take advantage of it. Suppose you face any problems related to the Atal Pension Yojana, Amount Chart, registration process, eligibility conditions, and required documents. In that case, you may ask your queries in the given comment box.

Frequently Asked Questions

Is it essential to make a savings account in any national bank to apply for Atal Pension Yojana?

Yes, all applicants must have a saving bank account in any national bank. Then only they will be eligible for the Atal Pension Yojana.

Name all required documents that will be needed while applying for APY Scheme 2021?

The necessary documents are as follows Applicants should be the resident of India, Applicant Mobile Number, Passport size photo, Applicant age should be in between 18 to 40 years, Aadhaar Card, Applicant Identity Card, Residence Document, and Resident should have a bank account, and that must be linked with the Aadhaar Card.

What are the minimum and maximum age to apply for Atal Pension Yojana 2021?

The minimum age should be 18 years, and the maximum age is 40 years to apply for Atal Pension Yojana.