Tanishq Golden Harvest Scheme

Tanishq is a famous Indian jewellery brand; it has always strived for reliability in the quality of products and enhancing the client experience. The brand is famous for its various schemes and products; one of the most popular schemes is Tanishq Golden Harvest Scheme. The primary aim of this scheme is to deliver gold to every individual. This scheme allows the individuals to deposit the fixed amount every month with Tanishq and use the same money for purchasing the jewellery after a particular period.

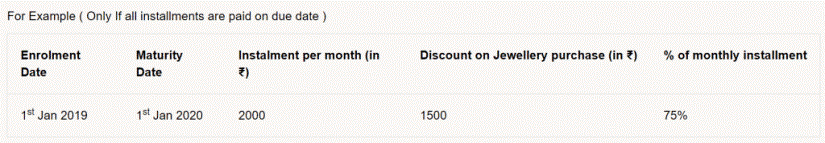

In other words, the golden harvest scheme Tanishq allows individuals to shop jewellery by paying some simple installments. The installments period will be 06 months and 10 months, and the minimum amount for the Installment is INR 2000. This scheme also offers a discount of up to seventy-five percent of the first Installment during purchasing jewellery. Customers can choose the EMI amount and the duration of EMI as per their needs and suitability.

Loan Schemes

Features Of Tanishq Golden Harvest Scheme 2021

- The Tanishq gold scheme (Golden Harvest) is accessible for both a 10-month and a six-month duration.

- The installments must be paid very month on a fixed date in this Tanishq gold investment schemes.

- The least Installment must be INR 2000/-, while the customer can select the maximum amount as per their suitability.

- An individual can purchase the product after paying the complete installments.

- The golden harvest scheme Tanishq also offers a discount of up to 75% on 01 Installment at the time of maturity.

- You can also pay the Tanishq golden harvest scheme payment online directly going through official website.

Guidelines Of Tanishq Golden Harvest Scheme 2021

- Individuals must require to deposit a sum of rupees two thousand for ten months or 06 months as per their pocket and requirement to be eligible for the scheme’s benefits. There is no limit for the maximum amount for installments.

- Individuals must close their account and purchase jewellery within 421 days and 235 days for ten-month and 06-month plans, respectively.

- Customers cannot use this money in buying other things; this money can be used only for gold and diamond jewellery. Tanishq will not allow the customer to purchase silver or gold coins.

- The scheme will be cancelled if anyone fails to pay the payment or a breach in Installment for more than two months. In addition, the scheme holder will entitle to receive a refund of the principal money deposited by them.

- Customers will be able to pay only one Installment per month; they will not be able to pay numerous installments in a single month.

Benefit Of Tanishq Gold Jewellery On EMI (Golden Harvest Scheme)

- Anyone can buy purchases in convenient payments.

- Tanishq golden harvest scheme online payment instalments start at Rs. 2000/-, which is affordable to ordinary individuals. On the other hand, persons can choose to increase the amount of the instalment as per their pocket.

- Moreover, a discount of up to 75% on their one instalment payment will also provide.

Tanishq Golden Harvest Scheme Online Payment (gold schemes in Tanishq)

Tanishq Golden Harvest Jewellery Purchase Scheme (How To Pay Instalment Amount)

Tanishq is providing all the facilities to their customers to paying their instalments; three major options for the instalments are-

- Pay the Installment directly to the Tanishq store nearby your location.

- Open the official portal of the Tanishq that is tanishqgoldenharvest.co; you are required to select the “Instant Pay” button visible there; for your convenience, we have shown the same in below image.

- You also have the additional option of the “Auto Debit” via online mode. With this facility, the specific amount will be auto-debited from your account on the scheduled date.

Note:

For more information, connect to us, and we will surely help you as soon as possible.

Banking Article