Are you in need of quick and hassle-free financing options? Whether you’re shopping for jewelry, furniture, electronics, or more, Snap Finance has got you covered. In this article, we’ll delve into the world of Snap Finance, exploring how it works, its benefits, and how you can take advantage of this convenient financing solution. No matter your credit situation, Snap Finance offers you the opportunity to make your purchases without the burden of immediate high costs or interest charges.

What is Snap Finance?

Snap Finance is a convenient buy now, pay later financing option that allows you to get approved for up to $5,000, often within seconds. It’s an excellent solution for individuals who want to acquire items immediately and prefer not to pay substantial interest rates. Snap Finance offers a unique 100-day financing option, which means you can pay off your purchase over 100 days without incurring hefty interest fees. Here’s how it works:

Flexible Approvals

- Snap Finance provides an easy and hassle-free approval process. They don’t rely solely on your credit score. Instead, they use a third-party credit bureau, Clarity, to determine your eligibility. This approach makes it accessible to those with poor or no credit history. On average, customers are approved for around $3,000, making it an appealing option for a variety of purchases.

- Snap Finance can approve you for up to $5,000, depending on your creditworthiness.

- The approval process is quick, often providing an answer within seconds, so you can start shopping right away.

Expansive Selection of Retailers

- Snap Finance collaborates with over 150,000 retailers, both in physical stores and online. This vast network includes options for jewelry, furniture, electronics, automotive parts, tires, mattresses, and more. You can explore their website to find retailers in your area and choose the category that suits your needs.

- Snap Finance’s retailer network encompasses a wide range of industries, making it convenient for a variety of purchases.

- You can easily find approved retailers in your area by using the store locator on the Snap Finance website.

Paying Off Your Purchase

- The key to using Snap Finance effectively is to pay off your purchase as quickly as possible to minimize interest charges.

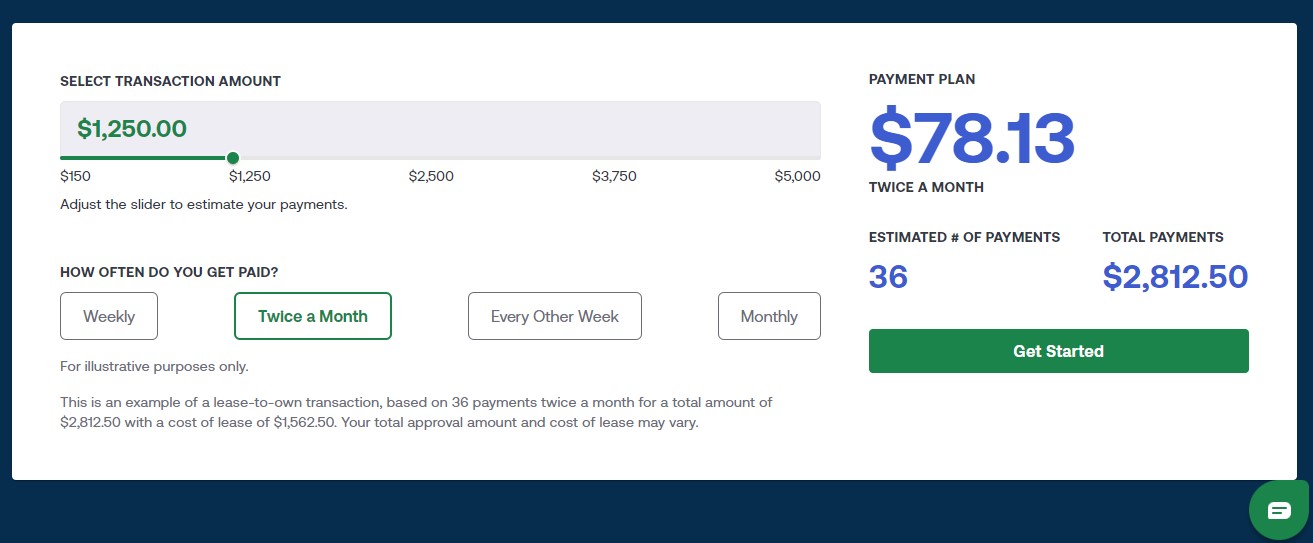

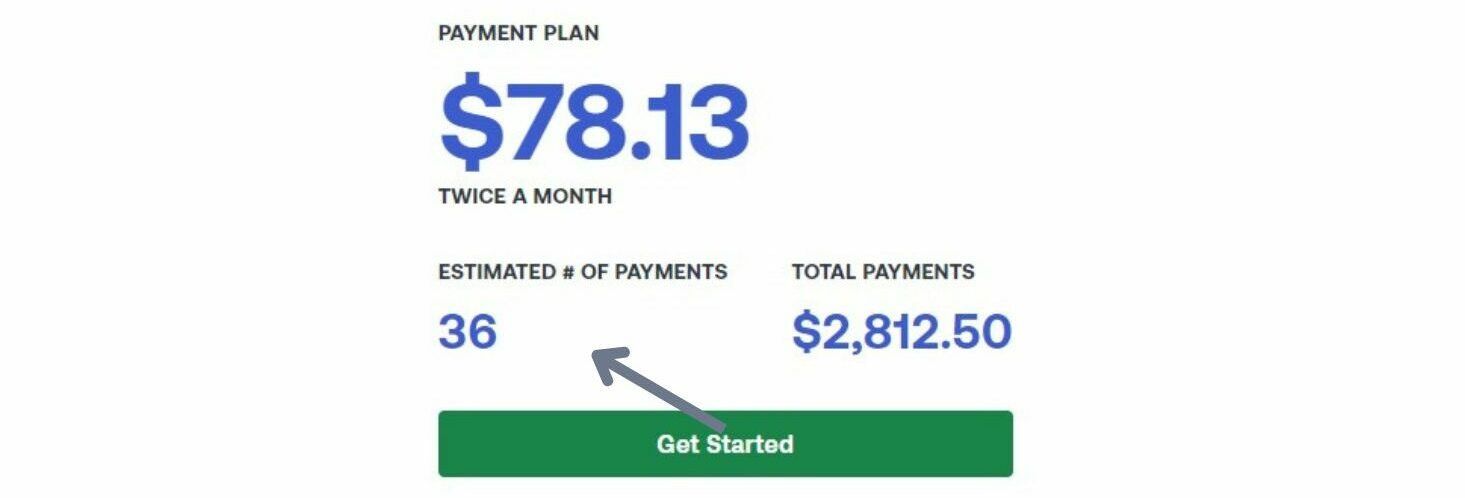

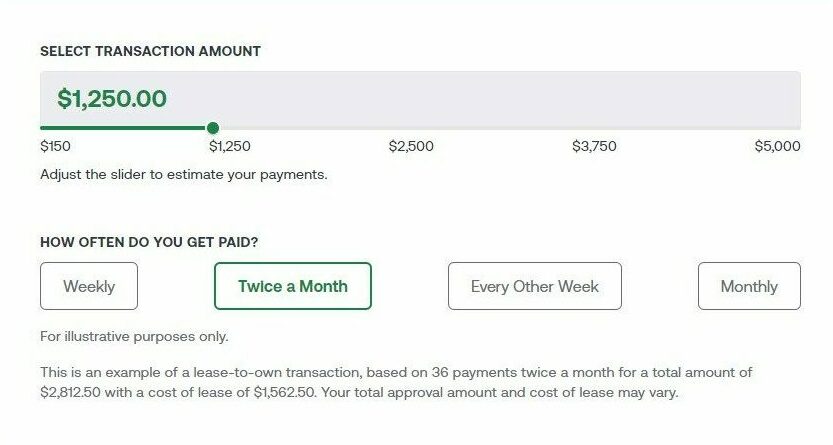

- Snap Finance allows you to choose from various payment options, including weekly, bi-weekly, and monthly payments.

- You can use their payment calculator to determine the payment plan that best fits your budget.

- It’s essential to keep in mind that interest is included in these payments, so the total amount you pay will be higher than your original purchase price.

The 100-Day Option

- One unique feature of Snap Finance is the 100-day option. If you choose this option, you must pay off your lease within the first 100 days.

- This can be a great way to avoid additional costs.

- The cost of this option includes the fee associated with the merchandise plus a leasing fee.

- Paying off your purchase within this time frame can save you money in the long run.

Finding Snap Finance Retailers

- Snap Finance has an easy-to-use store locator on their website. You can find approved retailers in your area by simply entering your city and state.

- You can also filter by category, allowing you to pinpoint the perfect store for your specific needs.

- The store locator tool makes it easy to discover the diverse range of retailers that partner with Snap Finance.

Act Now and Get the Items You Need

- If you’re struggling to secure traditional financing or credit, Snap Finance provides a flexible and accessible solution.

- Their quick approval process, diverse range of retailers, and manageable payment options make it an appealing choice for those who need items now without the financial stress.

- Whether you have good credit, poor credit, or no credit at all, Snap Finance is here to help you make your desired purchases without the financial stress.

- Start your Snap Finance journey today and enjoy the convenience of “buy now, pay later” financing.

Key Benefits of Snap Finance

Snap Finance offers a range of benefits that make it an attractive option for individuals seeking flexible financing solutions:

- Quick and Easy Approval: Snap Finance utilizes a third-party credit bureau, Clarity, rather than traditional credit checks. This means that individuals with less-than-perfect credit can often secure approval. The approval process is fast, often providing an answer within seconds, allowing you to start shopping immediately.

- Generous Credit Limits: With approval amounts of up to $5,000, Snap Finance can accommodate a wide range of purchase needs. On average, customers are approved for around $3,000, making it suitable for various items, from electronics to furniture.

- Diverse Retailer Network: Snap Finance has partnered with over 150,000 retailers, both online and in physical stores. This extensive network covers a wide range of industries, including jewelry, furniture, electronics, automotive parts, tires, and more. The store locator tool on their website makes it easy to find approved retailers in your area, offering you a broad selection of shopping options.

- Flexible Payment Plans: Snap Finance allows you to choose from various payment options, including weekly, bi-weekly, and monthly plans. Using their payment calculator, you can select a payment plan that suits your financial situation, making it easier to manage your purchases.

- 100-Day Financing Option: Snap Finance offers a unique 100-day financing option, which can help you save on interest charges. If you choose this option, you must pay off your lease within the first 100 days. The cost includes the merchandise fee and a leasing fee.

- Accessibility for All Credit Types: Snap Finance is accessible to individuals with good, poor, or no credit at all. The emphasis on a third-party credit bureau assessment allows those with less-than-ideal credit histories to secure financing. Whether you’re looking for a credit option that doesn’t heavily rely on your credit score or a solution for a quick, low-interest purchase, Snap Finance has you covered.

- Wide Range of Categories: Snap Finance’s retailer network includes numerous categories, such as jewelry, furniture, electronics, automotive parts, and tires. This broad selection means you can use Snap Finance for a wide array of needs. The store locator tool can help you find the perfect retailer for your specific requirements.

Getting Started with Snap Finance

If you’re interested in taking advantage of Snap Finance’s flexible financing options, here are the steps to get started:

1. Visit the Snap Finance Website

– Start by visiting the Snap Finance website. You can access the website on your computer or mobile device.

– Explore their user-friendly interface to learn more about the financing options and the retailer network.

2. Determine Your Needs

– Before applying for Snap Finance, decide what you need to purchase and how much financing you require.

– Take into account your budget and ensure that your purchases align with your financial capabilities.

3. Use the Store Locator

– If you’re interested in specific categories like jewelry, furniture, electronics, or automotive parts, use Snap Finance’s store locator tool.

– Enter your city and state to discover the approved retailers in your area. You can also filter by category to find the perfect store for your needs.

4. Apply for Financing

– Snap Finance offers a quick and straightforward application process. Click on the “Apply Now” or similar button on their website to start the application.

– You’ll need to provide some basic personal information to initiate the approval process.

5. Receive Your Answer

– Snap Finance often provides approval decisions within seconds. Once you receive your answer, you can proceed with your purchase.

– If approved, you’ll have access to the approved credit amount, allowing you to shop at the retailers within the Snap Finance network.

6. Choose Your Payment Plan

– Review the various payment options available, including weekly, bi-weekly, and monthly plans.

– Use the payment calculator to select the plan that aligns with your budget and financial preferences.

7. Start Shopping

– With your approved credit, you can start shopping for your desired items. Make informed and responsible purchase decisions, ensuring they fit within your budget and needs.

8. Keep Track of Payments

– After making your purchases, it’s crucial to keep track of your payment schedule.

– Make payments as agreed upon, and consider paying off your lease within the 100-day period to minimize interest costs.

9. Build Credit Responsibly

– If improving your credit is a goal, use Snap Finance as an opportunity to demonstrate responsible credit management.

– Ensure you make on-time payments and manage your finances prudently.

Conclusion

Snap Finance offers a convenient and accessible way to make essential purchases without the burden of immediate high costs or interest charges. Whether you have good credit, poor credit, or no credit at all, Snap Finance can be your key to flexible financing options. By following the tips and steps outlined in this article, you can make the most of Snap Finance and use it to manage your finances effectively.

Frequently Asked Questions (FAQs)

What is Snap Finance, and how does it work?

Snap Finance is a “buy now, pay later” financing option that provides quick and easy approval for up to $5,000. You can make flexible payments, and they offer a unique 100-day financing option to save on interest costs.

Who can apply for Snap Finance, and is there a credit check?

Snap Finance is accessible to individuals with various credit histories. They use a third-party credit bureau, Clarity, for assessment, making it inclusive for those with poor or no credit.

How do I find Snap Finance retailers in my area?

Use the Snap Finance website’s store locator tool by entering your city and state to discover approved retailers nearby. You can also filter results by category to match your needs.

What is the 100-day financing option, and how does it work?

Snap Finance’s 100-day option allows you to pay off your lease in 100 days to save on interest. Costs include the merchandise fee and a leasing fee.

How may Snap Finance assist me in enhancing my credit?

Snap Finance can aid in credit improvement if used responsibly. Making on-time payments and effective account management can demonstrate responsible credit behavior and potentially enhance your credit history over time.