If you’ve ever considered joining a credit union like Navy Federal but feel like you’re missing out, PenFed Credit Union is worth exploring. Today, we’re embarking on a journey to uncover why PenFed is a compelling choice for your financial needs. Whether you’re a seasoned financial expert or just beginning your financial journey, you’re in for an informative ride. So, let’s delve into the world of PenFed and discover what makes it a standout option.

PenFed : Your Gateway to Financial Success

PenFed, short for Pentagon Federal Credit Union, caters primarily to military and government workers. However, here’s the great part – you don’t need any specific affiliation to join PenFed. They offer a multitude of reasons to become a member:

- No Documentation or Income Requirements: PenFed provides products that don’t require extensive documentation or proof of income.

- No Fees for Cash Advances: Unlike some financial institutions, PenFed doesn’t charge fees for cash advances.

- Generous Cash Advance Limits: You can even get a cash advance up to the credit limit of your credit card, making it highly flexible.

- Credit-Friendly Approach: PenFed is known for being friendly towards individuals with bad credit, fair credit, and even previous bankruptcies. They are committed to helping you build or rebuild your credit.

- Relationship Banking: As a credit union, PenFed believes in building strong, long-lasting relationships with its members.

Joining PenFed

Joining PenFed is a straightforward process. All you need to do is provide your basic information and open a savings account with just a $5 deposit. While the majority of people won’t experience this, there is a possibility of a hard pull from Equifax when you apply, so keep this in mind. Ensure your information aligns correctly, as any discrepancies could require additional documentation. For most people, joining PenFed should be hassle-free. you can visit the website of PENFED.

Checking Accounts

PenFed offers two primary checking accounts:

Free Checking: With a low $25 minimum deposit to open, this account is hassle-free, with no other fees or minimum balance requirements.

Access America Checking: While this account comes with a $10 monthly fee, you can avoid it by setting up a direct deposit of $500 or maintaining a daily balance of $500 or more. This account offers slightly higher interest rates.

Both accounts grant you access to online banking, early pay with direct deposits, and access to over 85,000 fee-free ATMs. However, unlike Navy Federal, PenFed doesn’t reimburse ATM fees from non-network ATMs.

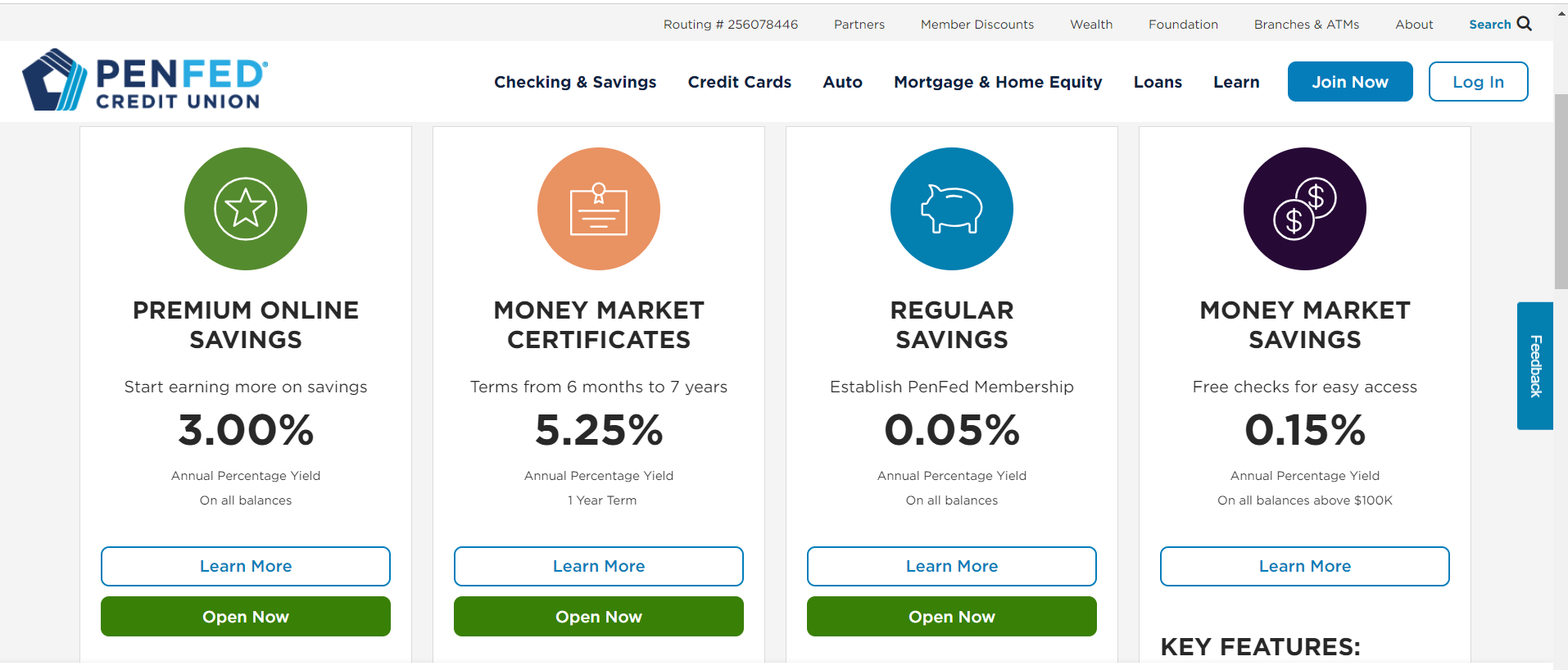

Savings Accounts

PenFed offers four types of savings accounts, with the Premium Online Savings account being the recommended choice for higher interest rates. While they also provide money market accounts with competitive rates, consider exploring alternatives like Ally Bank for higher interest without tying up your money for an extended period.

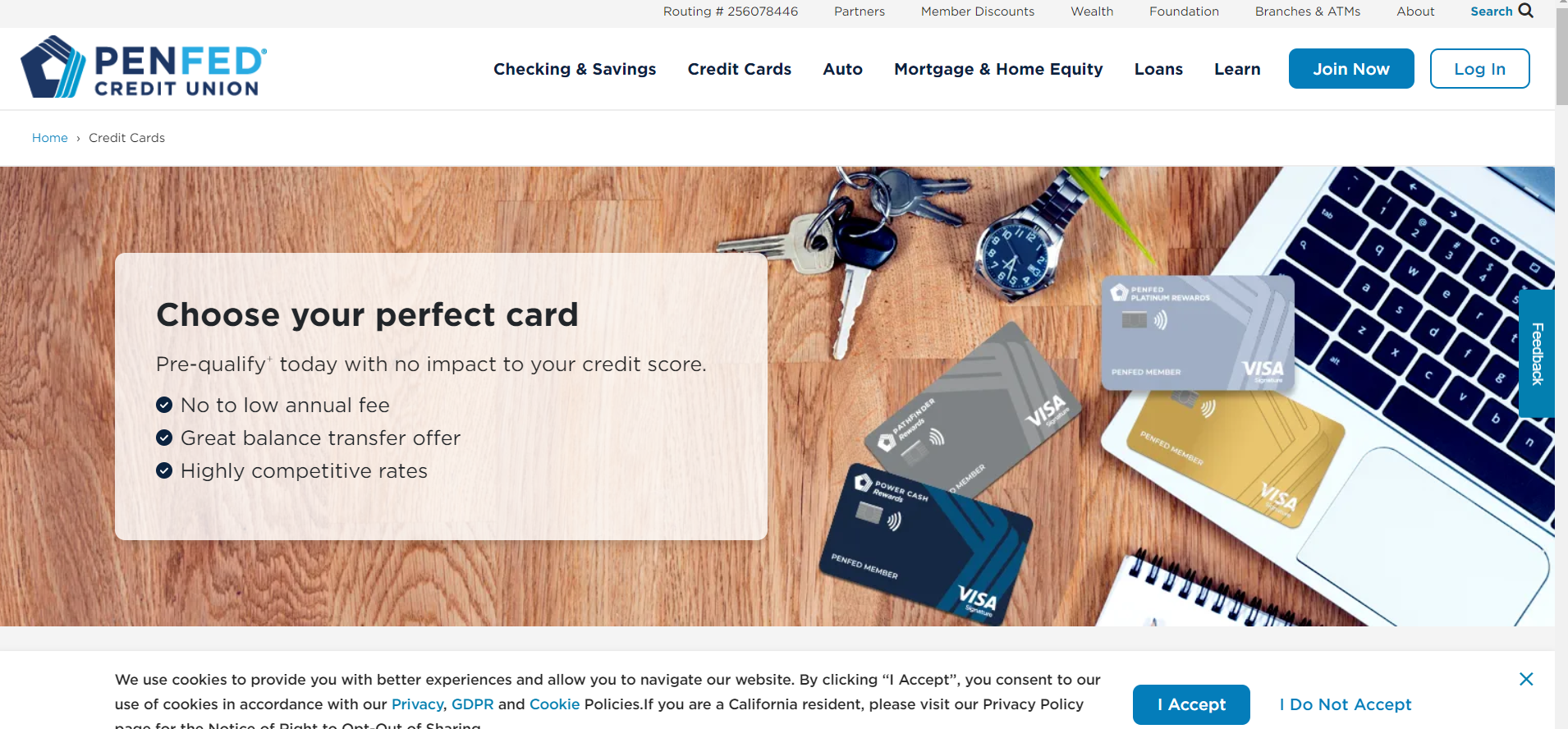

Credit Cards

PenFed’s credit cards are noteworthy for several reasons:

- No Annual Fees: Most of their credit cards have no annual fees. To avoid the annual fee on the Pathfinder Rewards Visa, simply open a free checking account.

- Credit Score Flexibility: Although they typically ask for good to excellent credit, PenFed has approved individuals with fair credit (between the high 500s to lower 600s) and even those with discharged bankruptcies (8 to 12 months post-discharge).

- Cash Back and Rewards: PenFed’s credit cards offer enticing cash back and rewards programs, making them a fantastic choice for various needs.

Platinum Rewards Visa: Offers a generous 15,000 bonus points and provides up to 5x points on gas and EV charging station purchases.

Power Cash Rewards Visa: Gives a $100 bonus statement credit and offers 2% cash back for PenFed Honors Advantage members (1.5% for non-members).

Gold Visa Credit Card: Features a 0% intro APR on purchases and balance transfers for 15 months.

Pathfinder Rewards Visa: Offers 50,000 bonus points worth about $425, a 0% intro APR on balance transfers for the first 12 months, and various travel perks. good APR is essential when evaluating credit card offers. The 0% introductory APR is a fantastic feature, as it allows you to pay off your existing credit card debt without incurring additional interest charges for an entire year.

Pre-Qualification: The best part is that you can pre-qualify for PenFed credit cards without impacting your credit score.

- Credit Limit Flexibility: PenFed allows you to use your credit cards for cash advances without additional fees. However, be mindful of the impact on your credit utilization.

Loans: Unleash Your Financial Potential

PenFed is more than just a credit card provider; they offer a variety of loans, including auto loans, mortgages, home equity lines of credit, and personal loans. Here are some highlights:

Auto Loans

Competitive Rates: PenFed often offers more competitive auto loan rates compared to Navy Federal and other credit unions.

Up to 125% Financing: You can finance up to 125% of the vehicle’s cost, making it easier to cover taxes and fees without a down payment.

Quick Approval: Many borrowers have secured auto loans with minimal documentation, often requiring only ID and address verification.

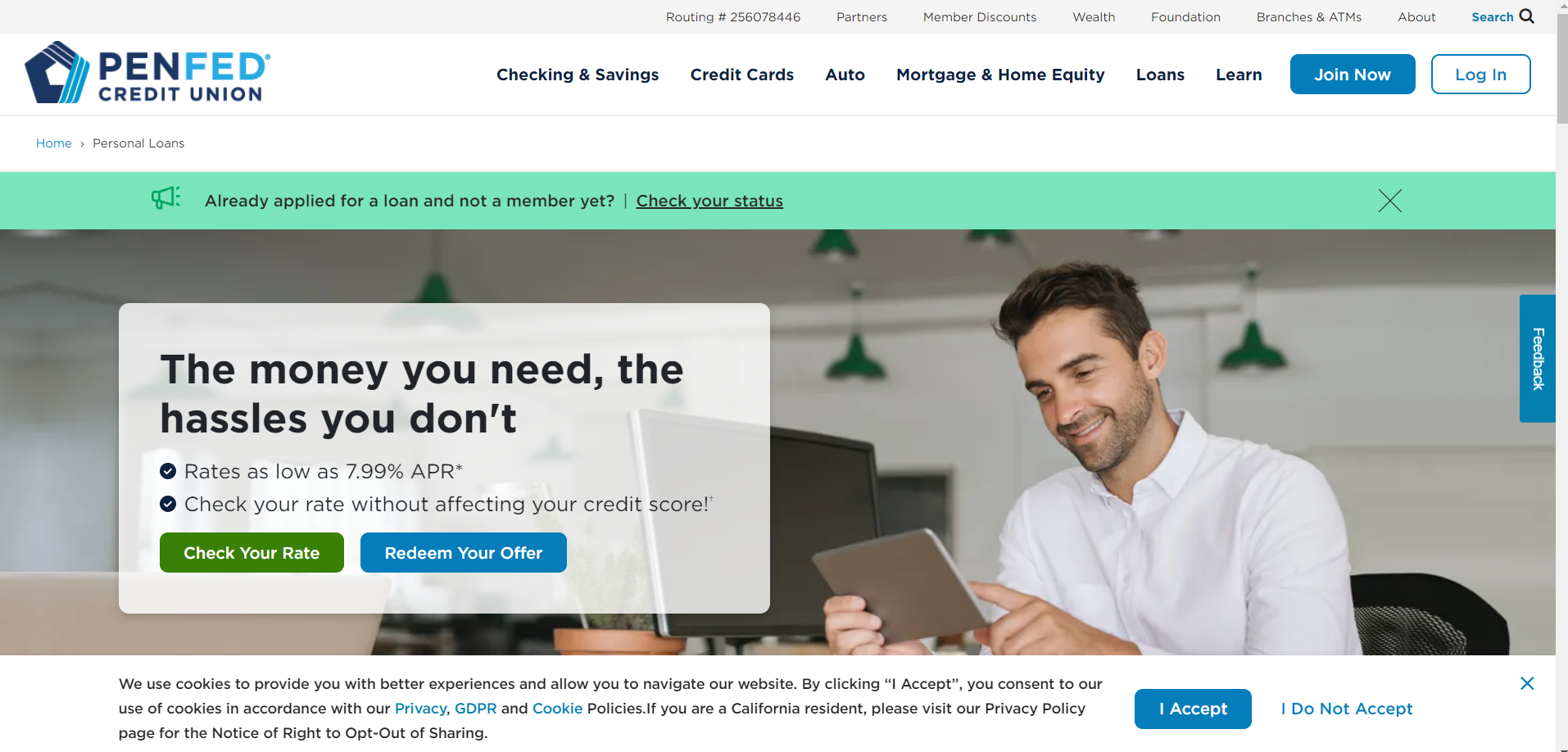

Personal Loans

Competitive Rates: While interest rates can vary, PenFed’s personal loans typically offer competitive terms, and there are no early payoff penalties or hidden fees.

Pre-Qualification: You can check your rate and pre-qualify before becoming a PenFed member.

Flexible Approval: Even individuals with credit scores in the 600s can potentially secure a personal loan, depending on their relationship with PenFed.

No Origination Fees: There are no origination fees, making these personal loans a convenient option for various financial needs.

Experian Credit Pull: PenFed typically pulls credit reports from Experian for loan approvals, so ensure your Experian report is in good shape.

Building a Strong Financial Relationship

Before applying for a loan with PenFed, consider waiting for at least a month to build a relationship. While they offer attractive terms, establishing trust with the credit union can improve your approval odds. Always pre-qualify to assess your chances.

Conclusion

PenFed Credit Union presents a compelling alternative to Navy Federal. Their diverse range of financial products, competitive credit card offerings, and flexible loan options make them an attractive choice. Whether you’re looking for a credit card, a loan, or a financial partner for your future, PenFed is a credit union worth considering.

Frequently Asked Questions

Who is eligible to join PenFed Credit Card?

PenFed Credit Card is primarily focused on military and government workers. However, eligibility has expanded over the years, and many individuals, regardless of military affiliation, can join. Common eligibility routes include joining certain organizations or associations or making a one-time donation to one of PenFed’s designated charities.

What are the benefits of joining PenFed over other financial institutions?

PenFed offers a range of competitive financial products, from credit cards to personal loans, and often provides more favorable terms compared to traditional banks. Membership also grants access to their online and mobile banking services, as well as fee-free ATMs at various locations.

How do I apply for a PenFed Credit Union, and what credit score do I need for approval?

Applying for a PenFed credit card is typically done online. While they may specify a preference for good to excellent credit, PenFed has been known to approve individuals with fair credit, typically in the high 500s to lower 600s. Factors beyond your credit score, such as your relationship with PenFed, also play a role in approval decisions.

Are there any fees associated with PenFed credit cards?

Most PenFed Credit Union cards do not have annual fees. However, the Pathfinder Rewards Visa card does have a $95 annual fee. If you open a free checking account with PenFed, you can avoid this fee.

How does PenFed compare to other credit unions, like Navy Federal?

PenFed and Navy Federal are both prominent credit unions with a focus on military and government members. The choice between the two often comes down to specific preferences and financial needs. While Navy Federal offers some unique benefits like ATM fee reimbursements, PenFed stands out with its competitive credit card offerings and more flexible eligibility requirements.