In today’s financial landscape, understanding your credit score is essential. Your credit score can influence various aspects of your life, from securing a loan to renting an apartment. Fortunately, there are numerous ways how to check your credit score and credit report for free online. In this guide, we’ll explore these methods, ensuring you have the knowledge to monitor and improve your credit health.

Why You Should Never Pay for a Credit Score

Before we delve into the various free methods to check your credit score, let’s address a crucial point: you should never pay to access your credit score. There’s a multitude of free options available, and utilizing them is a prudent financial choice.

1. Credit Card Providers

Many credit card issuers provide their customers with access to some form of credit score. This is often a FICO score, which is the type of score used by about 90% of lenders to make lending decisions. Here are a few examples:

- Capital One’s CreditWise: If you hold a Capital One credit card, you can use their CreditWise system to check your credit score. Capital One has made significant improvements in the accuracy of this tool.

- American Express: Cardholders of American Express cards, such as the SPG credit card, can access their credit score directly through the American Express website.

- Discover: Even if you don’t have a Discover card, you can use Discover’s credit score checking system by visiting creditscorecard. This tool provides not only your credit score but also additional information, including the number of open accounts, utilization, and factors affecting your score.

It’s important to note that while these credit score tools are useful, they may not provide a full credit report. Nevertheless, they offer valuable insights into your credit health.

2. Credit Monitoring Services

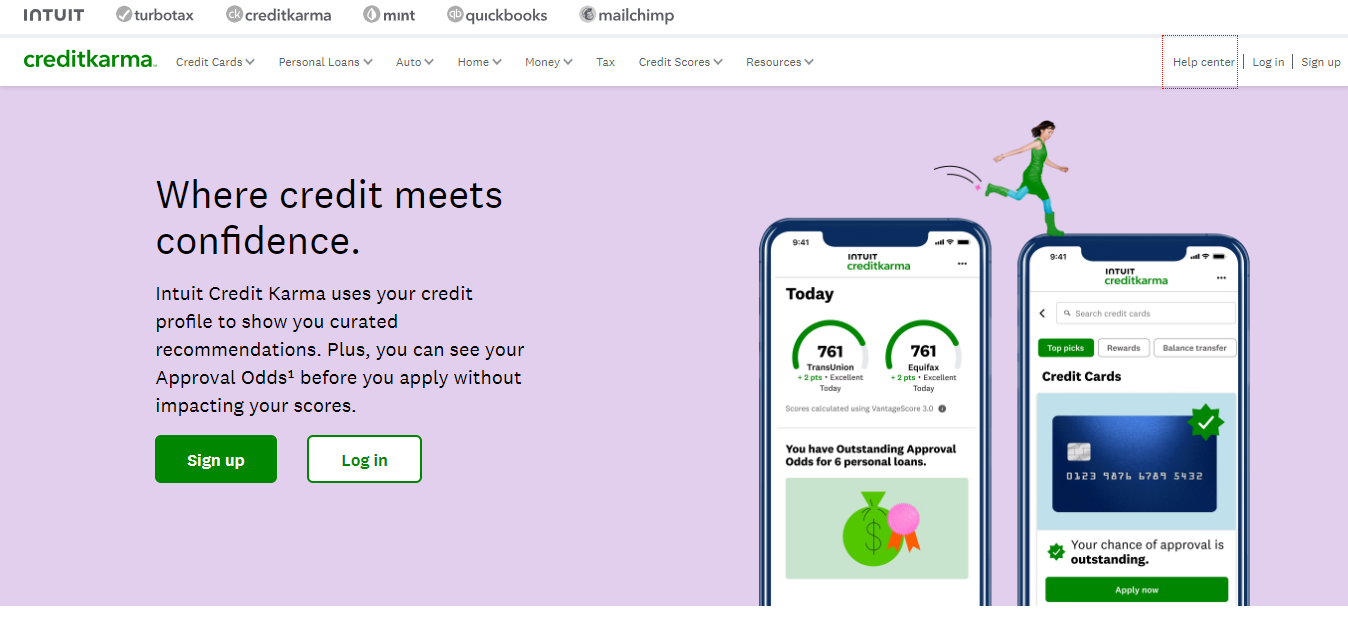

Several online resources provide both credit scores and comprehensive credit reports. One such resource is Credit Karma. Credit Karma offers credit scores from two major credit reporting bureaus, TransUnion and Equifax, and provides a full credit report from these bureaus.

These credit scores may differ slightly because different financial institutions report to different bureaus. For instance, the number of hard credit inquiries may vary between these reports, impacting your score.

While Credit Karma is an excellent option, keep in mind that it checks only two of the three major credit bureaus. The third major bureau, Experian, also offers a free credit report on their website, Experian.com. However, if you wish to obtain your FICO score from Experian, there is a nominal fee of $4.99. In most cases, it’s unnecessary to pay for a FICO score, as you can obtain it for free through other resources.

Experian’s free report is particularly valuable for checking hard credit inquiries since they are one of the major credit bureaus and are often preferred by banks such as Chase and American Express. Moreover, you can gather insights about How To Fix A BAD Credit Score, rendering this information immensely valuable as it acts as a comprehensive guide.

Using Credit Monitoring Websites

We’ve discussed various options for checking your credit score and report, but let’s delve a bit deeper into using a credit monitoring website like Credit Karma. These platforms provide a more comprehensive view of your credit health.

Credit Karma: A Detailed Look

Credit Karma is a popular choice for many individuals seeking to monitor their credit. Here’s how it works:

- Sign Up: To get started, you’ll need to create an account on Credit Karma. This typically involves providing some personal information and your social security number.

- Credit Scores from Two Bureaus: Once you’re registered, you can view your credit scores from both TransUnion and Equifax. It’s common for these scores to vary slightly due to differences in reporting.

- Full Credit Report: Credit Karma offers a comprehensive credit report from both bureaus, giving you detailed information about your credit history, open accounts, and more.

- Valuable Insights: The platform also provides insights into factors affecting your credit score. This information can help you understand what areas you need to work on to improve your credit standing.

Remember that the credit report obtained from Credit Karma contains sensitive personal information, so it’s advisable to keep this information secure.

Experian: Checking Hard Credit Inquiries

Experian: Checking Hard Credit Inquiries” is highlighted as a valuable resource for monitoring your credit. Experian, one of the three major credit bureaus, offers a free credit report on their website. While obtaining your FICO score from Experian comes with a nominal fee, the platform is particularly useful for tracking hard credit inquiries. Banks like Chase and American Express often favor Experian for their lending decisions, making it an essential tool for those concerned about these inquiries. Checking your Experian report is an effective way to stay informed about the factors influencing your credit score.

The Road to Better Credit

Maintaining a healthy credit score is a vital aspect of financial responsibility. By using these free resources, you can stay informed about your credit health and take necessary actions to improve it. Never underestimate the importance of knowing your credit score, as it can impact your financial future in significant ways.

Remember that these methods are just the beginning of your journey to building better credit. It’s crucial to regularly monitor your credit score, correct any errors, and establish good credit habits. Over time, your efforts will lead to an improved credit score and greater financial opportunities.

Conclusion

The process of “How to Check Your Credit Score For Free” is not only accessible but also crucial in today’s financial world. By utilizing the free resources mentioned in this guide, you can remain well-informed about your credit health, identify areas for improvement, and work toward a stronger financial future. Remember, there’s no need to pay for your credit score when these excellent free options are readily available.

As always, feel free to share your experiences with checking your credit score in the comments below. Your insights and stories can be invaluable to others on their journey to understanding and improving their credit. We’re here to help you on your path to better credit.

Frequently Asked Questions

Is it safe to use free credit monitoring websites like Credit Karma and Experian, which require my personal information and social security number?

The article mentions that it is generally safe to provide your personal information to reputable credit monitoring websites like Credit Karma and Experian. They employ strong security measures to safeguard your data.

Do credit scores from different credit bureaus significantly differ, and should I be concerned about these variations?

The article explains that credit scores from different bureaus, such as TransUnion and Equifax, may vary slightly due to differences in reporting. However, these variations are usually minor and not a cause for concern.

Does checking my own credit score frequently using free services negatively impact my credit score?

The article clarifies that checking your credit score using free services like Credit Karma does not negatively affect your credit score. These checks are considered soft inquiries, which do not impact your score.

What actions can I take to improve my credit score, as mentioned in the article?

The article outlines several steps to improve your credit score, including paying bills on time, reducing credit card balances, avoiding opening multiple new credit accounts, reviewing your credit report for errors, keeping older accounts open, and practicing responsible credit management.

Are there alternatives to Credit Karma for checking my credit score and report?

The article mentions Experian as an alternative to Credit Karma for checking your credit report. It notes that Experian provides a free credit report and explains the option to obtain a FICO score from Experian for a small fee.