If you’re considering getting a credit card, the Apple Credit Card is worth your attention. In this comprehensive guide, we’ll explore why the Apple Card has become a top choice, especially for first-time credit card owners. From its seamless software experience to impressive rewards, a high-yield savings account, and exceptional security, this card has a lot to offer.

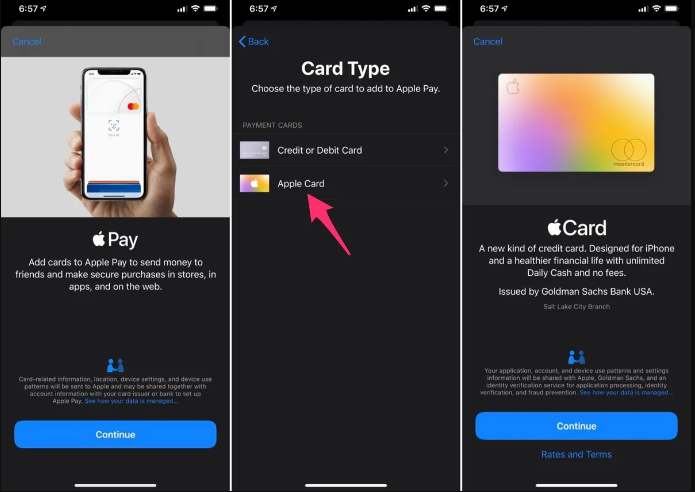

The Easiest Sign-Up Process

The Apple Credit Card Website, much like any other Apple product, is designed for simplicity. All you need is an iPhone, and after a few clicks in the Wallet app, you can find out if you’re approved for the Apple Card. The sign-up process is straightforward. If approved, you’ll receive a sleek titanium card within a week. Best of all, you can start using the Apple Card right away, both online and in stores that accept Apple Pay. With Apple Pay’s widespread acceptance, this card is a convenient choice, even for everyday purchases.

Streamlined Software Experience

The software experience with the Apple Credit Card is a game-changer. Unlike other credit cards that require additional apps and countless security codes, the Apple Card’s interface is seamlessly integrated into your Wallet app. It’s quick, responsive, and user-friendly. The card even categorizes your spending, making it easy to track your expenses. Plus, the card changes color based on your spending habits, providing a visual cue to help you manage your finances effectively.

Transparent Payment System

Understanding how to make payments is often confusing for new credit card users. Apple simplifies this with a transparent payment system. It clearly shows you the amount you need to pay each month to avoid interest charges. This feature is a valuable addition for those who are unfamiliar with credit card terms like APR. Moreover, the Apple Credit Card doesn’t impose late fees, and it has a predictable payment date at the end of each month.

Consistent Rewards

While the Apple Credit Card might not offer the highest rewards compared to some other cards, it excels in providing consistent cashback. By using Apple Pay, you can enjoy a steady 2% cashback on all your purchases. The card’s 3% cashback category includes the Apple Store, App Store, Apple Music, and select partner merchants like Walgreens and Uber. These rewards are not just bonuses; they function more like discounts, thanks to Apple’s “Daily Cash” feature.

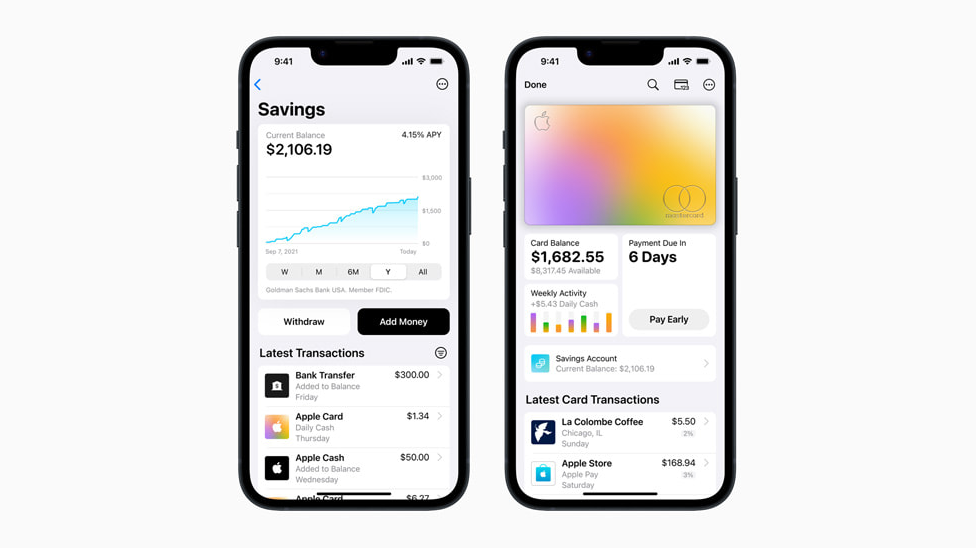

High Yield Savings Account

One of the most remarkable features of the Apple Credit Card is the high-yield savings account. You can choose to have your rewards deposited directly into this account, earning an impressive 4.15% interest. This account operates as a separate savings account, complete with its account and routing numbers. The power of compound interest means your money grows faster the longer you keep it in this account. It’s a risk-free way to encourage savings and investments, setting the Apple Card apart from other cards that solely promote spending.

Exceptional Security

Apple’s focus on security extends to its credit card. In the unfortunate event of fraudulent activity, the Apple Credit Card’s fraud protection is top-notch. You’ll receive instant notifications on your phone, and you can easily reach a representative through iMessage, bypassing the hassle of lengthy phone calls. Apple swiftly resolves issues and refunds fraudulent transactions. Additionally, the card offers the feature of periodically changing the security code, enhancing security even further. If you want to know more about credit cards you can check more credit card companies to find the best credit card for you.

Conclusion

The Apple Credit Card is not just a credit card; it’s a complete financial tool designed with user experience, security, and savings in mind. If you’re looking for a credit card that combines simplicity, transparency, and security with a valuable rewards system and a high-yield savings account, the Apple Card is the right choice for you. It’s a versatile financial companion that can help you manage your money efficiently and grow your savings over time. Make the smart choice in 2023 and consider the Apple Card for your financial needs.

Frequently Asked Questions (FAQs)

How do I apply for the Apple Credit Card?

To apply for the Apple Credit Card, you need an iPhone and the Wallet app. Open the app, tap on the “+” button to add a card, and follow the on-screen instructions. The process is straightforward, and you’ll receive a response on your application’s approval status within minutes.

What is the interest rate on the Apple Credit Card?

The Apple Credit Card offers variable interest rates, which can vary depending on your creditworthiness. For the most accurate and up-to-date information on interest rates, it’s best to check the terms and conditions provided during the application process.

Can I use the Apple Credit Card internationally?

Yes, you can use the Apple Credit Card internationally. It’s accepted wherever Mastercard is accepted. Keep in mind that some foreign transactions may incur foreign transaction fees, so it’s a good idea to check the terms to understand these fees.

Is the high-yield savings account associated with the Apple Credit Card safe?

Yes, the high-yield savings account offered with the Apple Credit Card is safe. It is provided by partner banks and is typically insured by the Federal Deposit Insurance Corporation (FDIC) up to certain limits, ensuring the safety of your deposits.

What happens if my Apple Credit Card is lost or stolen?

If your Apple Credit Card is lost or stolen, you can use the Wallet app to lock the card to prevent unauthorized use. You can also contact Apple Support or Goldman Sachs, the card’s issuing bank, to report the loss and request a replacement card. Apple’s robust fraud protection measures can help quickly resolve any unauthorized transactions.