529 College Savings Plans: If you have a child in your life, whether it’s your own child, a grandchild, or your favorite niece or nephew, you’re probably wondering how you can invest in their future. One way to do that is through a 529 college savings plan, in which you can use that money to help them pay for tuition. In this comprehensive guide, we’ll cover all the ins and outs of what a 529 plan is, its benefits, the potential drawbacks, and where to open one.

What Is a 529 College Savings Plan?

A 529 plan is a type of investment account in which you can contribute after-tax dollars and put it into the stock market to let that investment grow over time. The key advantage is that you can then take withdrawals tax-free and use that money to pay for qualifying education expenses.

Qualifying Education Expenses

The money you withdraw from a 529 plan can be used for a variety of qualifying education expenses, including:

- Tuition and fees for undergraduate, graduate, or vocational school.

- Tuition and fees for K-12 expenses (a new rule that allows this).

- Books and school supplies.

- Off-campus housing.

- Campus food and meal plans.

- Laptops, computers, software, and equipment for educational purposes.

- Special needs and accessibility equipment.

- Paying off student loans.

Contribution Limits

At the federal level, there are no contribution limits, which is great news for parents or anyone opening a 529 plan. However, contribution limits are controlled by the state, so you should check with your specific state to see what those limits are. In most cases, these limits are quite high, ranging from $200,000 to $500,000 or more.

Eligibility to Open a 529 Plan

Anyone can open a 529 plan for the beneficiary. However, if you open the plan under your name and want to transfer ownership, you must have a family connection with the beneficiary. It’s usually best to open the plan under the child’s name when they have a social security number to avoid ownership transfer complexities.

Benefits of a 529 Plan

These are some points that are Benefits of a 529 Plan, Read Below

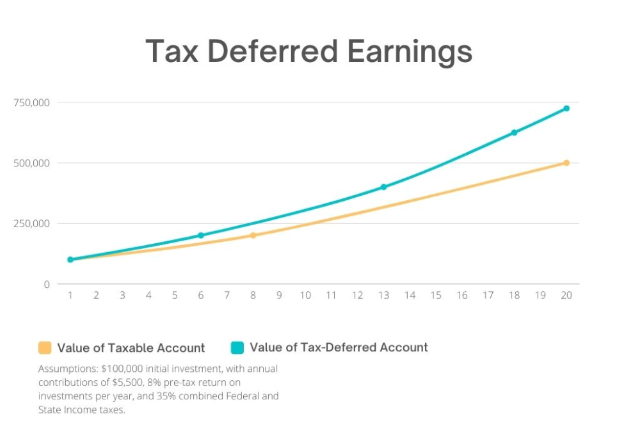

Tax-Free Growth

The money invested in a 529 plan grows tax-free, which means your investments can potentially earn more over time compared to taxable accounts.

Tax-Free Withdrawals

You can take withdrawals from the 529 plan tax-free, as long as the money is used for qualifying education expenses.

Investment Options

You can invest the money in various stocks, bonds, and mutual funds, offering flexibility in your investment strategy.

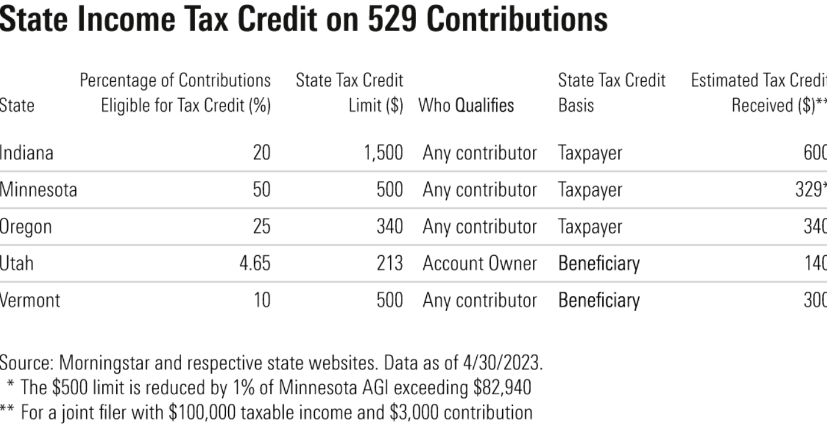

State Tax Deductions

While there’s no federal tax deduction for contributions, many states offer tax deductions for 529 plan contributions. Check with your state to see if you qualify for this benefit.

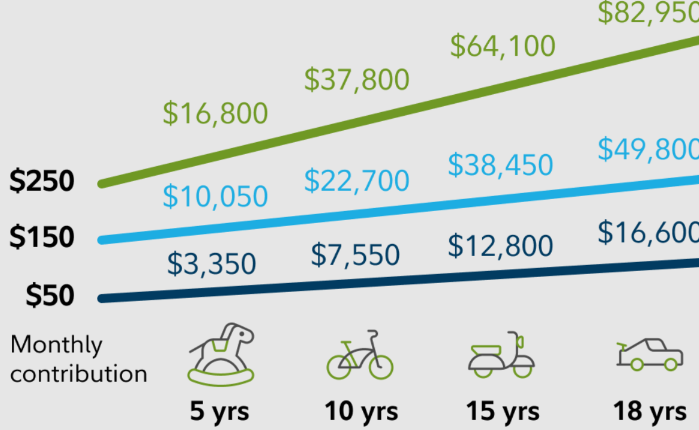

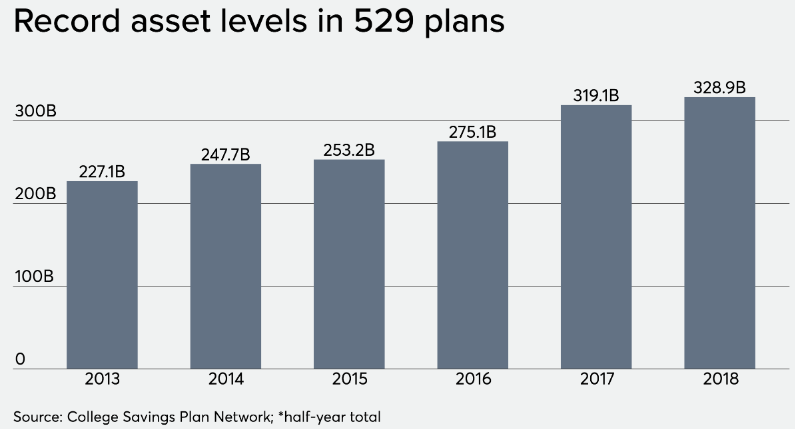

Faster College Savings

529 plans typically provide a better rate of return than traditional savings accounts or bonds, helping you build college savings more quickly.

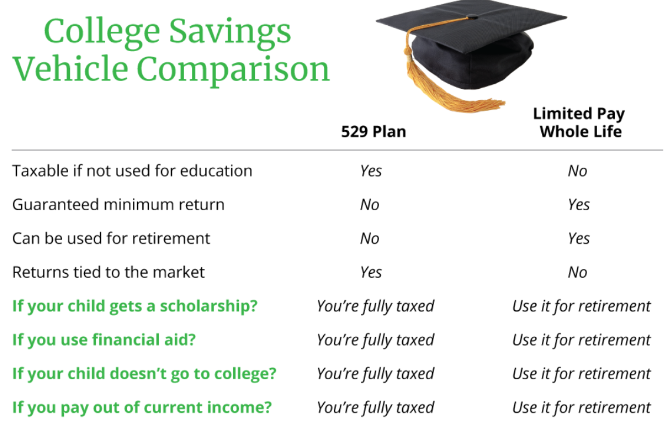

Drawbacks of a 529 Plan

These Are Some Drawbacks of 520 Pla , Which are as Followed,

Limited Use

You can only use the money for qualifying education expenses, so it can’t be used for non-educational purposes like buying a car or funding a wedding.

Reduced Financial Aid

If you anticipate needing federal financial aid, be aware that having a 529 plan can reduce the amount of aid your student is eligible for. However, the reduction is relatively small (around 5%).

Why Choose a 529 Plan?

A 529 plan offers an easy way to build college savings or save for any education expenses for a child. It provides an investment with a potentially higher rate of return compared to traditional savings accounts, ensuring your child’s educational future is financially secure.

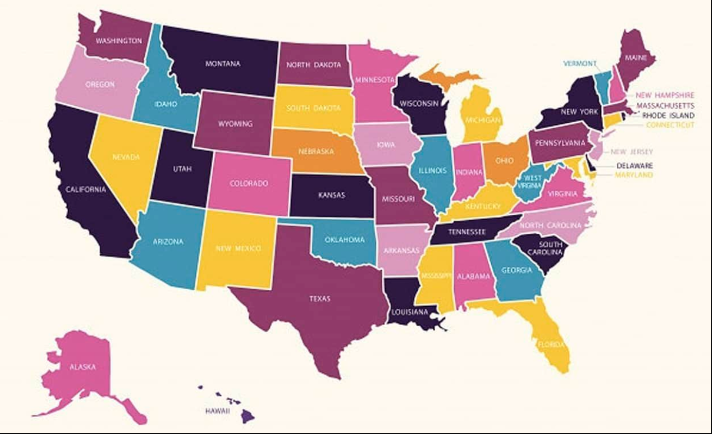

Where to Open a 529 Plan

You can open a 529 plan in your state or choose from various brokerage accounts. State-specific plans may offer tax deductions on state tax returns, so consider your options based on your specific circumstances, You can Check here

Conclusion

A 529 college savings plan is a powerful tool to invest in a child’s education. It provides tax advantages, a range of investment options, and the peace of mind that comes with knowing you’re financially prepared for your future. While there are some limitations, the benefits far outweigh the drawbacks. Start saving for your child’s education today with a 529 plan and give them the gift of a bright and debt-free future.

Frequently Asked Questions

What is a 529 college savings plan, and how does it work?

A 529 plan is a tax-advantaged investment account designed to help individuals save for education expenses. It works by allowing you to contribute after-tax dollars, which can then be invested in various assets like stocks and bonds. The earnings in the account grow tax-free, and you can withdraw the money tax-free when used for qualifying education expenses.

Who can open a 529 plan, and who can be the beneficiary?

Anyone can open a 529 plan, and the beneficiary can be your child, grandchild, or even yourself. There are no age limits for beneficiaries, and you can change the beneficiary to another family member if needed.

What expenses qualify for 529 plan withdrawals?

Qualified expenses typically include tuition and fees for eligible educational institutions, K-12 tuition (in some states), books, school supplies, off-campus housing, and more. You can also use the funds to pay off student loans. It’s essential to check the specific rules in your state and with your plan provider.

Can I use a 529 plan for education expenses at any college or university?

Yes, you can use the funds from a 529 plan at most accredited colleges, universities, and vocational schools in the United States. It’s not restricted to in-state institutions, and you can often use it for out-of-state or even international schools.

What happens if my child doesn’t use all the money in their 529 plan?

If the beneficiary decides not to pursue higher education or has leftover funds, you have several options. You can change the beneficiary to another eligible family member without penalties. You can also leave the money in the account in case the beneficiary decides to use it for future education or transfer it to your own education. Additionally, you can withdraw the remaining funds, but earnings on non-qualified withdrawals may be subject to taxes and penalties.