If you’re a Ford enthusiast or someone looking for a unique automotive credit card, you’ll want to pay attention to the Ford credit card. This new credit card, launched by Ford, offers a host of exciting features and rewards that can enhance your automotive experience. In this article, we’ll delve into the Ford Pass Rewards Visa card and explore its benefits, including an extraordinary perk that sets it apart from other automotive credit cards.

Introducing the Ford credit card

Ford Pass Rewards Visa is not just another automotive credit card; it’s a gateway to exclusive rewards tailored for Ford enthusiasts. With this card, you’ll earn valuable points that can be used towards future Ford vehicle purchases, parts, and service. However, what makes this card truly remarkable is an often overlooked feature that can significantly enhance its appeal.

Let’s break down the card’s features and uncover the unique element that makes it stand out.

Leveraging the Ford Pass Rewards Program

Before we dive into the Ford Pass Rewards Visa card, it’s essential to understand the existing Ford Pass Rewards program. This program enables Ford customers to earn rewards for their purchases at Ford dealerships, whether it’s a new vehicle, parts, or service. Each point you earn in the program is worth half a penny when redeemed. For instance, 10,000 points translate to $50.

The Ford Pass Rewards Visa builds upon this foundation, allowing you to accumulate points from the original program and earn additional points as a cardholder.

Reward Structure of the Ford credit card

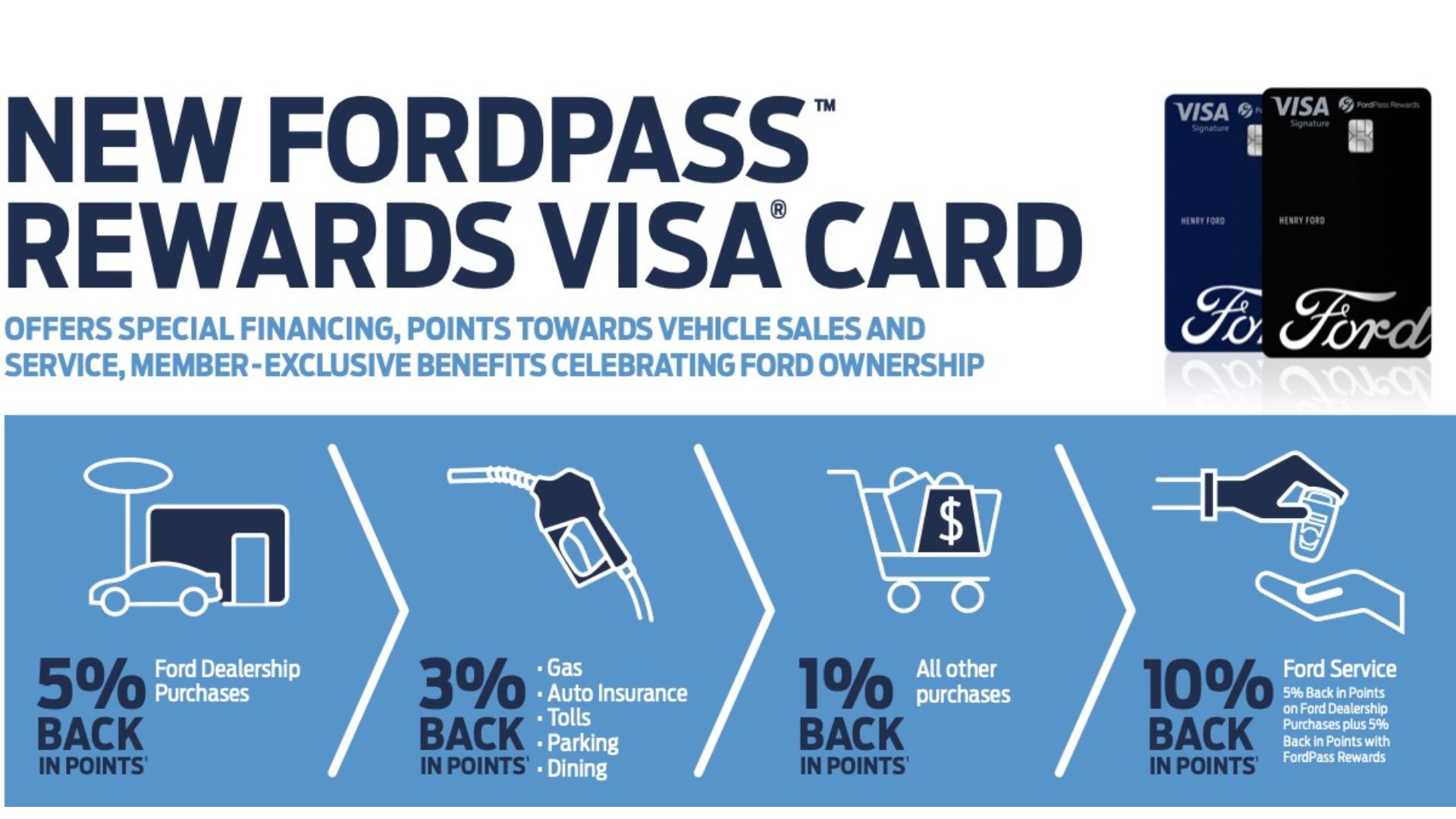

The Ford Pass Rewards Visa is an annual fee-free credit card that provides rewards through the following structure:

- Ford Dealership Purchases: You earn 10 points per dollar, which equates to 5 cents due to the point value. This means you get a 5% reward on Ford dealership purchases.

- Ford Service Purchases: These purchases offer even higher rewards, with 20 points per dollar, translating to 10 cents or a 10% reward.

- Bonus Categories: The card offers three percent (6 points per dollar) rewards in categories like dining, gas, auto insurance, tolls, and parking.

- All Other Purchases: You receive two points per dollar spent, which is equivalent to a one percent reward.

Notably, the points you earn can only be used for Ford-related expenses, such as the purchase or lease of a new Ford vehicle, or for Ford parts and services.

Unlocking Exciting Bonuses

As a new Ford Pass Rewards Visa cardholder, you can enjoy various bonus opportunities:

- First-Time Card Usage: When you use your Ford Pass Rewards Visa for the first time, you’ll instantly receive 11,000 points in the Ford Pass Rewards program, which equates to $55 in value. These points can be redeemed towards Ford-related expenses.

- Spend $3,000 in the First Three Months: If you spend $3,000 or more with your card within the first three months of ownership, you’ll be eligible for a $100 statement credit.

- Annual Spending Bonus: By using the Ford Pass Rewards Visa for at least $6,000 in purchases within a card year, you’ll receive a $200 statement credit. Keep in mind that a card year is not a calendar year but rather the 12 months following your card activation date.

Issuer and Backing Bank

The Ford Pass Rewards Visa is issued by First Bank Card, a division of the First National Bank of Omaha. This bank provides backing for several other automotive credit cards, including the Jeep, Dodge, Chrysler, and Mopar credit cards. Many community banks across the United States also use First Bank Card to offer credit cards to their customers. The parent company, First National Bank of Omaha, is a regional bank that offers its own set of rewards cards. Additionally, you can collect information about ikea credit card, a resource of considerable value that essentially acts as a comprehensive guide. rewrite this line

Fees and Interest Rates

One of the most appealing aspects of the Ford Pass Rewards Visa is its lack of an annual fee. When it comes to interest rates, your rate will vary based on your credit history. Rates range from 15.99% for those with good credit to 26.99% for individuals with lower credit scores. The card also features a zero percent offer on Ford purchases of $499 or more, providing six months of interest-free financing. However, there are no other zero percent offers with this card.

Card Customization

If you’re someone who values the aesthetics of your credit card, you’ll be pleased to know that the Ford Pass Rewards Visa is available in two attractive colors at launch: Model A Black and Blue Oval Blue. Moreover, Ford plans to introduce customized cards, starting with versions inspired by the Ford Bronco and the F-150.

The Unique Advantage

Now, let’s revisit the unique aspect of the Ford Pass Rewards Visa. As previously mentioned, this card offers an outstanding feature that distinguishes it from other automotive credit cards: a $200 statement credit. To qualify for this annual statement credit, you need to spend at least $6,000 with the card within a card year (12 months from your card activation date).

Consider this scenario: You spend exactly $6,000 with your Ford Pass Rewards Visa, earning the $200 statement credit. Additionally, you earn rewards points on your purchases. Suppose you receive an average of four points per dollar spent, which corresponds to a two percent reward. This means you’ll accumulate $120 in rewards that can be used for Ford-related expenses.

In summary, if you reach the $6,000 spending threshold, you’ll receive a $200 statement credit and $120 in rewards, providing a total return of $320 on a $6,000 spend. This results in an impressive 5.33 percent overall reward on your purchases. Even if you’re not particularly interested in Ford vehicles, this card can be an appealing choice for achieving that $6,000 spend and enjoying the $200 statement credit. Furthermore, you have the opportunity to gather information about sears credit card, a resource of significant value that essentially functions as a comprehensive guide.

How to Apply for the Ford Pass Rewards Visa

Applying for the Ford Pass Rewards Visa is a simple and convenient process. Here’s a step-by-step guide to help you navigate the application:

- Visit the Official Website: Begin by visiting the official website of Ford Pass Rewards Visa or First Bank Card, the issuing bank.

- Review Card Details: Take some time to explore the card’s features and benefits to ensure it aligns with your financial needs and preferences. Familiarize yourself with the rewards structure, bonuses, fees, and interest rates mentioned in the article.

- Check Eligibility: Review the eligibility criteria for the card. This usually includes factors like credit score, income, and age. Ensure that you meet these requirements before proceeding.

- Start the Application: Look for a prominent “Apply Now” or “Get Started” button on the website. Click on it to initiate the application process.

- Provide Personal Information: The application will prompt you to enter personal details such as your name, contact information, Social Security number, and employment information. Make sure to provide accurate information.

- Financial Details: You’ll need to share financial details, including your annual income and housing expenses. This helps the issuer evaluate your creditworthiness.

- Read and Agree to Terms: Carefully review the terms and conditions of the credit card, including the cardholder agreement and privacy policy. Once you’re satisfied, accept the terms and conditions.

- Submit Your Application: After completing all required fields, submit your application. The issuer will typically perform a credit check to assess your eligibility.

- Wait for Approval: The issuer will review your application and credit history. If approved, you’ll receive your Ford Pass Rewards Visa in the mail.

- Activate Your Card: Upon receiving your card, follow the activation instructions provided by the issuer. Once activated, you can start using your card to earn rewards and enjoy the benefits mentioned in the article.

Applying for the Ford Pass Rewards Visa is a quick and hassle-free process, opening the door to a world of automotive rewards and bonuses. Remember to manage your credit responsibly and make the most of the unique features this card has to offer.

Conclusion

The Ford Pass Rewards Visa is not just an ordinary automotive credit card. It offers a unique combination of rewards, bonuses, and the opportunity to benefit from the $200 statement credit. Whether you’re a dedicated Ford enthusiast or someone looking for a versatile cashback card, the Ford Pass Rewards Visa has something to offer.

This card’s versatility and the chance to get a significant cashback return make it a standout choice in the realm of automotive credit cards. Additionally, the colorful card options and future customization possibilities further enhance its appeal.

Consider the Ford Pass Rewards Visa if you want a credit card that goes beyond the ordinary, delivers tangible benefits to Ford enthusiasts, and provides an opportunity to maximize your rewards while enjoying the open road in your favorite Ford vehicle.

Frequently Asked Questions

What is the Ford Pass Rewards Visa?

The Ford Pass Rewards Visa is a credit card designed for Ford enthusiasts and anyone looking for a rewarding automotive credit card. It allows cardholders to earn points that can be used for Ford-related expenses, such as vehicle purchases, parts, and services.

Is there an annual fee for the Ford Pass Rewards Visa?

No, the Ford Pass Rewards Visa does not have an annual fee, making it an attractive option for those looking to maximize their rewards without the burden of yearly charges.

How do I earn rewards with this card?

You can earn rewards with the Ford Pass Rewards Visa in several ways. For Ford dealership purchases, you’ll receive 10 points per dollar spent, equivalent to a 5% reward. Ford service purchases offer even higher rewards at 20 points per dollar, which is a 10% reward. The card also provides three percent cashback on dining, gas, auto insurance, tolls, and parking, and two points per dollar on all other purchases.

How can I qualify for the $200 annual statement credit?

To qualify for the $200 annual statement credit, you need to use the Ford Pass Rewards Visa for at least $6,000 in purchases within a card year. The card year is defined as the 12 months from the date you activate your card. Meeting this spending threshold will earn you the valuable statement credit.

Where can I apply for the Ford Pass Rewards Visa?

You can apply for the Ford Pass Rewards Visa by visiting the official website of Ford Pass Rewards Visa or the issuing bank, First Bank Card. The application process is straightforward and can be completed online. Make sure to review the card details, eligibility criteria, and terms before applying.