If you’re a fan of Target and looking to maximize your savings, you’ve come to the right place. In this article, we’ll delve into the Target Red Card and why it could be a game-changer for your wallet. Whether you’re a frequent shopper or just an occasional visitor, this card has some enticing perks you won’t want to miss. Let’s explore the Target Red Card and how it can help you save money while you shop.

What is the Target Red Card?

The Target Red Card is not your typical store credit card. Unlike traditional store cards that confine you to a single retailer, this card offers versatility. Think of it as a co-branded card, much like the Chase Amazon card. While you can use it at Target, you’re not limited to that store alone. It’s issued by TD Bank, and there are various versions available, including an Instant Approval credit card, a debit card, and a reloadable card. So, even if you’re not keen on a credit card, Target has you covered.

What Cash Back or discount Options Are Available?

The Target Red Card is a unique hybrid of a cashback and discount card. Instead of receiving cashback in the traditional sense, it applies a discount to your purchases. This discount is equivalent to a percentage of your order value, effectively giving you the same benefits. Furthermore, you can earn additional multipliers on the card for purchases outside of Target. These earnings are redeemable for Target gift cards, with a minimum redemption threshold of ten dollars. Importantly, your rewards never expire, making this card ideal for devoted Target enthusiasts.

Features of Target Red Card Credit Card

Now, let’s focus on the credit card version of the Target Red Card, which comes with some enticing benefits:

- No Annual Fee: You won’t have to worry about extra expenses with this card.

- 5x Target Discount: Enjoy a 5% discount on Target purchases, effectively putting more money back in your pocket.

- 2x Dining and Gas Stations: Get double the rewards when you dine out or fill up your tank.

- 1x on All Purchases: Even non-Target expenses earn you rewards.

- Additional Benefits: Cardholders also enjoy perks like two-day shipping, a 30-day return window extension, and special offers in the form of coupons. if you are frustrated with high interest rates then you can choose Zero interest rates credit cards.

Understanding the 5% Discount

The 5% discount on Target purchases is a unique feature of this card. It’s not the same as traditional cashback, as it applies as a direct discount to your order. While it may seem different, it effectively amounts to a 5% cashback reward. This discount covers various purchases at Target, including partner stores within Target locations. However, it’s essential to note that how these partner stores code your purchase may vary. To ensure you’re getting the discount, consider doing a test purchase.

Target Red Card Eligibility Criteria

Before applying for the Target Red Card, potential cardholders should ensure they meet the necessary eligibility requirements. These are some of the general criteria:

1. Age Requirement:

- Minimum Age: Applicants must be at least 18 years old. In certain states, the minimum age might be higher due to state regulations.

2. Residency Status:

- U.S. Residents: You should be a legal resident of the United States. Typically, both U.S. citizens and permanent residents are eligible.

3. Valid Social Security Number (SSN):

- For identity verification and credit check purposes, you’ll need to provide your SSN.

4. Credit Check:

- Credit Card Version: A credit check will be performed when applying for the Red Card credit card to assess creditworthiness. While Target doesn’t specify a minimum credit score, having a score in the mid-600s or above can be favorable.

- Debit Card Version: Since this version links to an existing bank account, the emphasis on credit score isn’t as stringent, but Target may still validate if the provided bank account is active and in good standing.

5. Income and Employment:

- While Target doesn’t specify a minimum income requirement, they may ask about your employment status and income. This information helps them evaluate your ability to repay potential credit card balances.

6. Valid Checking Account:

- Debit Card Version: To apply for the debit card version of the Red Card, you’ll need to have a valid U.S. based checking account. The account details will be required during the application process.

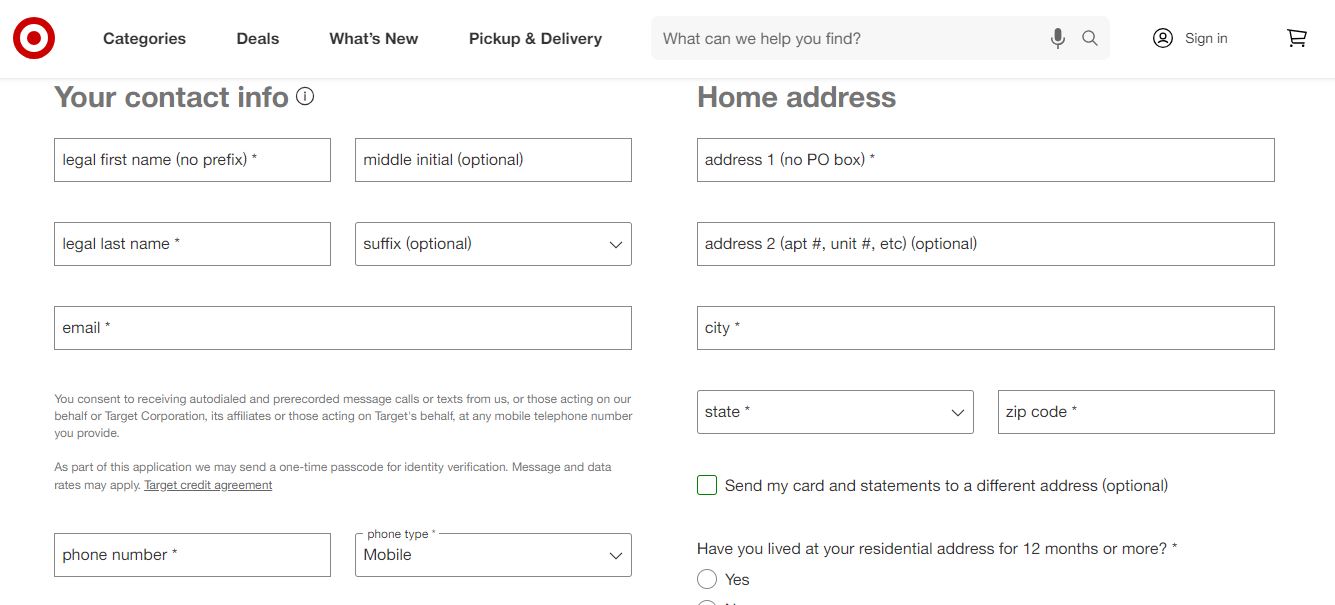

Target Red Card Application Process

Applying for the Target Red Card is straightforward and designed to offer potential cardholders an efficient way to access its benefits. Here’s a detailed walkthrough of the application process:

1. Choose Your Card Type:

- Target offers both a credit card and a debit card option. Decide which fits your needs. The debit card version links directly to your existing checking account, while the credit card allows you to carry a balance subject to interest rates.

2. Online Application:

- Navigate to Target’s official website. Here, you’ll find a dedicated section for the Red Card with an option to apply online.

- Fill in the required details, including personal information, income details, and employment status. For the debit card, you’ll also need your checking account details.

3. In-Store Application:

- If you prefer, you can apply in person at any Target store. Locate the customer service desk or ask any associate for a Red Card application form.

- Once completed, hand over the form to the associate who will guide you through the next steps.

4. Credit Score Requirements:

- While Target doesn’t publicly specify a minimum credit score for the Red Card, having a fair to good credit score can increase the likelihood of approval. Typically, scores in the mid-600s and above are favorable. For the debit card version, credit scores aren’t as influential since it links to an existing checking account.

5. Wait Time for Approval:

- Instant Approval: In many cases, especially for in-store applications, you may receive instant approval and can begin using your card for purchases immediately.

- Further Review: Sometimes, applications might require additional review. In such cases, expect a decision by mail, usually within 7-10 business days. This letter will either inform you of your approval status or provide reasons if the application was declined.

6. Activation:

- Once approved, you’ll receive your physical card in the mail. Before using it, you’ll need to activate the card, either online or by calling Target’s designated activation number.

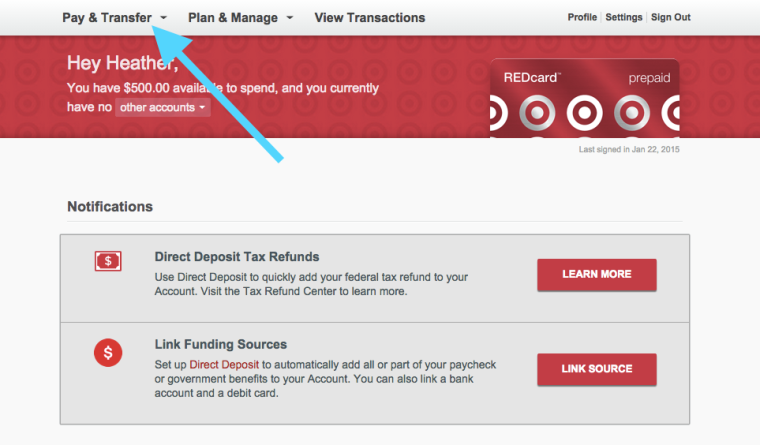

7. Setting Up Online Access:

- After activation, it’s advisable to set up online access for your Red Card. This allows you to monitor transactions, check balances, make payments, and set up alerts, among other features.

How to Make a Payment on the Target RedCard

1. Online Payment:

- Create/Register for an Account: If you haven’t already, visit the Target RedCard website and sign up for online account access.

- Login: Once registered, log in using your credentials.

- Navigate: Go to the ‘Payments’ section.

- Enter Details: Select the payment amount, choose the source bank account, and enter the relevant bank details.

- Confirm: Review the payment details and submit.

2. Target Mobile App:

- Download: If you haven’t done so, download the Target app from the App Store (iOS) or Google Play Store (Android).

- Login: Use your online account credentials to log in.

- Navigate: Access the RedCard section and look for payment options.

- Make Payment: Similar to online, choose the payment amount and enter/source the bank account details.

3. Mail-In Payment:

- Check or Money Order: Write a check or obtain a money order for the desired payment amount.

- Details: Ensure you include your Target RedCard account number in the memo section for proper allocation and then mail.

- Note: Always send your payment a few days in advance to ensure it arrives and gets processed before the due date.

4. Phone Payment:

- Call: Dial the number on the back of your RedCard or use the general Target RedCard customer service number: 1-800-424-6888.

- Follow Instructions: The automated system will guide you. Typically, you’ll need your account number and bank details.

- Verify: Ensure the payment has been scheduled and note down any confirmation number.

Explore Your Options

If the credit card isn’t your preference, don’t worry. Target offers alternatives to suit your needs. Alongside the credit card, you can opt for the debit card or the reloadable card. These options come with similar benefits, including a 5% discount, no annual fees, two-day shipping, and extended return windows. However, keep in mind that the debit card only allows you to link to a bank account, while the reloadable card offers cash withdrawal capabilities.

Frequently Asked Questions (FAQs)

What is the Target Red Card?

The Target Red Card is a credit card issued by TD Bank that offers discounts and rewards for purchases made at Target and, in some cases, partner stores within Target locations. It comes in various versions, including a credit card, debit card, and reloadable card.

How does the Target Red Card work?

The Target Red Card provides a 5% discount on eligible purchases at Target. This discount is applied as a reduction in your purchase total. It effectively acts as a form of cashback, saving you money on your Target shopping.

Can I use the Target Red Card outside of Target?

Yes, you can use the Target Red Card at places other than Target. However, the most significant rewards and discounts are earned when you use the card for Target purchases. There are also multipliers for dining and gas stations, but it’s primarily designed for Target shoppers.

What are the benefits of the Target Red Card credit card?

The credit card version of the Target Red Card offers several benefits, including:

- No annual fee.

- 5% discount on Target purchases.

- 2x rewards on dining and gas station purchases.

- 1x rewards on all other purchases.

- Additional perks like two-day shipping, extended return windows, and special offers.

How does the 5% discount work?

The 5% discount is applied directly to your purchase total when you use your Target Red Card. It effectively functions as a cashback reward, providing you with savings on your Target shopping.

Can I get a Target Red Card with no annual fee?

Yes, the Target Red Card credit card does not have an annual fee, making it an attractive option for those looking to save without extra costs.

Are there different versions of the Target Red Card?

Yes, in addition to the credit card version, there are two other options: the Target Red Debit Card and the Target Red Reloadable Card. These alternatives offer similar benefits, including the 5% discount, but with different features.

Can I withdraw cash with the Target Red Card credit card?

No, the credit card version of the Target Red Card does not allow cash withdrawals. Attempting to withdraw cash with a credit card can result in cash advance fees, so it’s best used for purchases at Target and other eligible locations.

Are there any minimum redemption requirements for rewards?

Yes, to redeem your rewards, you typically need a minimum of ten dollars in rewards. Keep in mind that these rewards are often in the form of Target gift cards.

Do my rewards on the Target Red Card expire?

No, one of the benefits of the Target Red Card is that your rewards do not expire, allowing you to accumulate savings over time.

Conclusion

The Target Red Card is a valuable addition to your wallet if you’re a frequent Target shopper. It’s not just a cashback card; it’s a discount card that ensures you save on every purchase. While it’s tempting to use it everywhere, it’s most rewarding at Target. If you’re considering this co-branded credit card, it’s worth exploring your options based on your spending habits.