If you’re facing the challenge of renting a house with bad credit but high income, you’re not alone. Many individuals encounter this hurdle when trying to secure a new place to live. However, with the right approach and strategies, you can increase your chances of finding a suitable rental property. In this article, we’ll delve into why landlords care about credit, how to improve your credit, and effective tactics to secure your next home.

Why Landlords Care About Credit

Before diving into solutions, let’s understand why landlords place such importance on your credit history. Your credit score reflects your financial behavior, including your payment history, outstanding debts, and any negative incidents like late payments, collections, or bankruptcies. Landlords use this information to assess the likelihood of you paying rent on time and in full. Ultimately, they want tenants who can meet their financial obligations, allowing them to cover their own expenses like mortgage payments (You can make off your mortgage pay faster) and property taxes promptly.

Common Causes of Bad Credit

Poor credit can arise due to a range of factors, encompassing:

- Late Payments: Consistently missing bill due dates.

- Missed Payments: Failing to pay bills altogether.

- Charged-off Accounts: Debts written off by creditors due to delinquency.

- Collections: Accounts sent to collection agencies.

- Bankruptcy: A formal declaration of insolvency.

- Home Foreclosure: Losing a home due to mortgage default.

- Court Judgments: Legal judgments against you for financial obligations.

- Maxed-out Credit Cards: Utilizing your credit cards to their limit.

- Recent Court Judgments: Recent legal judgments impacting your financial standing.

It’s essential to remember that bad credit doesn’t make you a bad person; life can throw unexpected challenges our way. However, landlords rely on your credit history to evaluate your suitability as a tenant.

Strategies to Overcome Bad Credit

1. Review and Rectify Your Credit Report

Begin by obtaining a copy of your credit report, which you are entitled to receive for free once a year from each of the three major credit reporting agencies: TransUnion, Equifax, and Experian. Visit websites like Credit Karma or www.annualcreditreport.com to access your report. Check for any inaccuracies or errors, and if you find any, dispute them with the respective credit reporting agency.

2. Practice Responsible Credit Management

Engage in responsible credit management by adhering to the 30% rule for credit card usage. Ensure that your credit utilization remains below 30% of your available credit limit. This prudent financial approach has the potential to enhance your credit score gradually, improving your overall creditworthiness and increasing your chances of successfully renting a house with bad credit but high income.

3. Avoid Applying for New Credit Cards

Steer clear of applying for new credit cards, as each application triggers a hard inquiry on your credit report, potentially reducing your credit score. A wiser alternative is to explore secured credit cards offered by your bank. These cards enable you to establish or rebuild your credit without the risk of accumulating excessive debt. By opting for a secured credit card, you can demonstrate responsible credit usage and gradually enhance your creditworthiness(Creditworthiness also make you eligible to take $100 loan with no credit check), a valuable step when renting a house with bad credit but high income.

4. Address Past Evictions

To improve your chances of securing a rental despite past evictions, take proactive steps to address these issues. Reach out to your former landlords to initiate discussions aimed at resolving any outstanding matters. In some cases, you may be able to negotiate an agreement to have the eviction record removed from your history, which can significantly enhance your rental prospects. Demonstrating a commitment to rectifying past issues showcases your responsibility as a tenant and increases your appeal to potential landlords, especially when seeking to rent a house with a high income and prior eviction history.

5. Communicate Your Situation

Draft a letter explaining the circumstances behind your bad credit. Be honest about any past mistakes but also highlight the positive changes you’ve made. Submit this letter with your rental application to provide context to potential landlords.

6. Seek Landlords Who Don’t Emphasize Credit

In your quest for a rental property, actively seek out landlords who prioritize income verification over rigid credit score requirements. Many property owners place a higher emphasis on your capacity to comfortably meet rent payments than on your credit history. By targeting such landlords, you can increase your chances of securing a rental home, leveraging your high income as a testament to your ability to fulfill financial obligations. This approach opens up opportunities for individuals with a less-than-perfect credit history to find suitable housing arrangements that align with their financial stability. For repair for you house you don’t need to make your credit score good you can make your house fixed for free.

7. Offer a Higher Rent or Deposit

Enhance your rental application by proposing a higher monthly rent or an increased security deposit. This proactive approach can alleviate landlords’ concerns and underscore your dedication to meeting your financial responsibilities. By offering a higher rental rate or deposit, you showcase your commitment to ensuring timely payments and maintaining the property’s condition. This strategy not only mitigates concerns related to your credit history but also highlights your financial stability and reliability as a tenant, making you a more appealing candidate for securing the house or apartment you desire despite having a high income and less-than-perfect credit.

8. Pay Multiple Months of Rent Upfront

To bolster your rental application and instill confidence in potential landlords, consider proposing the payment of several months’ rent in advance. This proactive gesture not only builds trust but also serves as evidence of your financial stability. By offering to prepay rent for an extended period, you can alleviate any concerns related to your credit history and assure landlords of your commitment to meeting your financial obligations promptly. This approach showcases your readiness to maintain a positive tenant-landlord relationship and enhances your prospects of securing your desired house or apartment, despite a high income and past credit challenges.

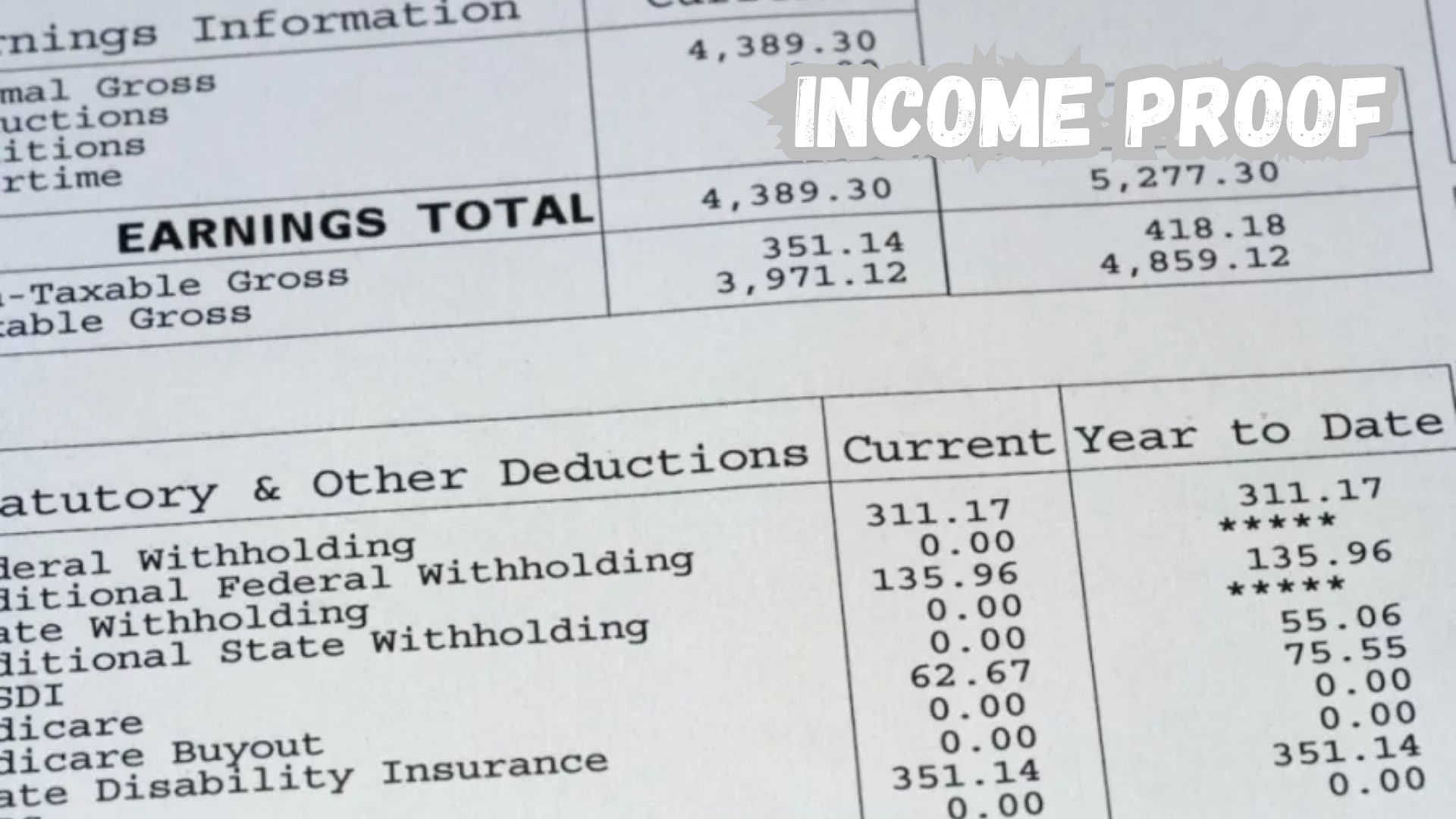

9. Provide Proof of Income

Strengthen your rental application by presenting comprehensive evidence of your income and financial stability. Include bank statements and other relevant documentation that clearly illustrates your ability to meet rent obligations without difficulty. This documentation serves as a tangible demonstration of your financial capacity and can significantly reassure potential landlords about your reliability as a tenant. By providing a clear and complete picture of your income and financial health, you enhance your credibility and increase your chances of securing the desired rental property, even if you have a high income and a less-than-perfect credit history.

10. Secure a Co-Signer

If possible, enlist a financially stable co-signer, such as a family member, who can vouch for your reliability. Co-signers are liable for rent payments if you default, which can increase your chances of approval.

11. Work on Improving Your Credit

Finally, consider actively working on improving your credit over time. Address outstanding collections, pay down debts, and manage your finances responsibly. A higher credit score can open up more rental opportunities in the future.

Conclusion

While renting a house with bad credit can present challenges, it’s not an insurmountable obstacle, especially if you have a high income. By implementing these strategies and demonstrating your commitment to responsible financial management, you can increase your chances of finding the perfect rental property for your needs. Remember that patience and persistence will be your allies in this process. Good luck on your journey to securing your next home!

Frequently Asked Questions (FAQs)

Can I still rent a house with bad credit but a high income?

Yes, it’s possible to rent a house with bad credit if you have a stable and sufficient income. Many landlords prioritize income and rental history over credit scores when considering applicants.

How can I improve my chances of getting approved with bad credit?

You can improve your chances by offering to pay a higher rent, a larger security deposit, or multiple months of rent upfront. Providing proof of income and a letter explaining your credit situation can also be beneficial.

Should I consider a co-signer if I have bad credit?

Yes, having a co-signer with good credit can significantly increase your chances of getting approved for a rental property. A co-signer is financially responsible if you fail to meet your rental obligations.

Are there landlords who don’t emphasize credit scores?

Yes, some landlords prioritize income and rental history over credit scores. Look for property owners who advertise that they consider other factors when evaluating applicants.

How long does it take to improve bad credit for renting purposes?

The time it takes to improve your credit score varies based on your specific financial situation and the steps you take. Some improvements can be seen within a few months, while significant changes may take a year or more. It’s essential to start working on your credit as early as possible to expedite the process.