Many individuals struggle with understanding the intricacies of loan repayments. The idea of mortgages, their functioning, and the interest associated with them can often seem difficult. The urgency to eliminate monthly installments and become debt-free is a common sentiment. Well, there’s more to it than just making regular payments; one needs to grasp the loan’s terms, conditions, and potential hidden charges.

If your goal is to speed up your loan repayment process, it’s crucial to familiarize yourself with these fundamental concepts beyond just the basics. This guide is crafted for individuals like you, aiming to simplify the mortgage repayment process. Dive in to unravel the methods to efficiently and effectively clear your mortgage.

How Do Mortgages Work?

Before we delve into the tips, let’s clarify how mortgages function. Imagine you have a $300,000 fixed-rate mortgage with a 4% interest rate over 30 years. Your monthly payment consists of two components: principal and interest. The bank uses an amortization schedule to determine the exact monthly payment you must make.

Over the 30-year term, the payment remains constant, but the portions allocated to principal and interest change each month. Most of your payment initially goes towards interest, while a smaller portion reduces the principal. As you pay down the principal, the interest amount gradually decreases.

How to Pay off Your Mortgage Faster?

A mortgage is typically the largest debt most homeowners have, so reducing it as quickly as possible is a goal for many. Before diving into strategies, it’s important to understand the components of your mortgage:

- Principal: The amount borrowed or still owed on the loan.

- Interest: The cost of borrowing money, usually expressed as a percentage.

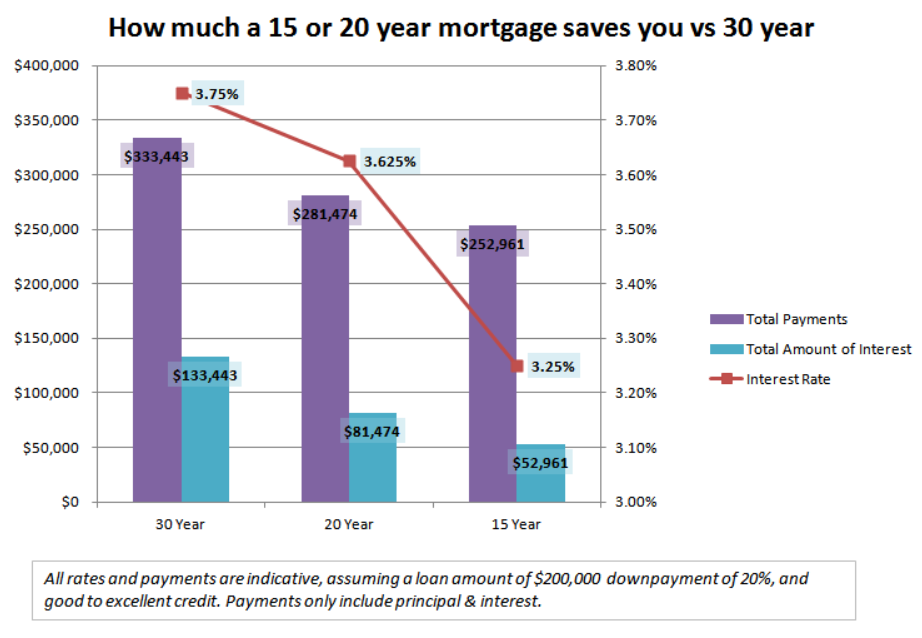

- Term: The length of the loan, often 15, 20, or 30 years.

Here are some tips that you can follow to escalate the speed of repayments.

Tip 1: Make Extra Principal Payments

The most straightforward way to pay off your mortgage faster is by making extra principal payments whenever possible. Whenever you have surplus funds, visit your bank and explicitly instruct them to apply the payment towards the principal. This simple strategy can significantly reduce the overall interest you’ll pay and help you become mortgage-free sooner.

Tip 2: Switch to Biweekly Payments

Switching from monthly to biweekly payments can also accelerate your mortgage payoff. By making 26 biweekly payments each year (equivalent to 13 full payments), you’ll reduce the principal balance faster, effectively shortening the loan term.

Tip 3: Make Payments as if It’s a 15-Year Mortgage

If you’re committed to paying off your mortgage Fatser but still prefer the flexibility of a 30-year term, consider making payments as if you had a 15-year mortgage. This approach allows you to pay more towards the principal when you have extra funds while providing the option to revert to the lower 30-year payment if needed.

Read More : $500 Cash advance no credit check Direct Lender

Tip 4: Explore Refinancing

Given the historically low-interest rates, it’s worth exploring refinancing options. Calculate the potential interest savings over the life of the loan and weigh it against the closing costs. If you plan to stay in your home for an extended period, a lower interest rate can be highly beneficial.

Tip 5: Use a Home Equity Line of Credit (HELOC) Wisely

Contrary to popular “velocity banking” strategies, using a HELOC to pay off your mortgage can be risky and confusing. Instead, consider using your emergency fund savings (earning minimal interest) to make extra principal payments on your mortgage. Meanwhile, keep the HELOC as a backup emergency fund, but avoid borrowing against it to reduce financial risks.

Frequently Asked Questions

Q1. Why should I consider paying off my mortgage faster?

Paying off your mortgage faster offers several advantages. First, it reduces the total interest you’ll pay over the life of the loan, saving you money in the long run. Additionally, being mortgage-free provides a sense of financial security and frees up your budget for other investments and expenses. Lastly, it can help you build equity in your home quicker, which can be valuable if you plan to sell or borrow against your home in the future.

Q2. Should I prioritize paying off my mortgage over other debts like credit cards or student loans?

It depends on the interest rates and terms of your other debts. Generally, high-interest debts like credit cards should be prioritized for repayment because they cost more over time. However, it’s essential to strike a balance between paying off debts and saving for emergencies and retirement. Before deciding, compare interest rates and consider consulting a financial advisor to create a personalized plan.

Q3. Can I still pay off my mortgage faster if I have a fixed-rate mortgage?

Yes, you can pay off your mortgage faster, even with a fixed-rate mortgage. While the interest rate remains constant, you can still make extra payments towards the principal, which will reduce the overall term of the loan. Be sure to check with your mortgage provider to ensure there are no prepayment penalties, as some mortgages may charge a fee for paying off the loan early.

Conclusion

While there may not be a magical trick to pay off your mortgage fatser overnight, following these five tips can help you achieve your goal sooner. Remember, the key is discipline and consistency in making extra payments to the principal. Evaluate each strategy carefully and choose the one that aligns best with your financial goals.