In this Rapid Finance review, we will provide you with a thorough understanding of the small business loan program. We will evaluate whether Rapid Finance aligns with your specific financial requirements, its legitimacy as a funding source, and assess its strengths and weaknesses. Additionally, we will present alternative financing options to ensure you have a well-rounded perspective. By the end of this review, you will gain insights into how Rapid Finance can not only facilitate business growth but also support operational expansion and provide effective solutions for overcoming financial constraints.

Exploring Rapid Finance

You’re looking at the Rapid Finance homepage, previously known as Rapid Advance. You might wonder if there’s a correlation between the two. The answer is simple: they rebranded. Rapid Finance offers various financing solutions, and we’ll explore each of them individually.

Here’s an overview of what you’ll find:

- Small Business Loan

- Merchant Cash Advance

- Line of Credit

- Bridge Loan

- SBA Loans

- Invoice Factoring

- Asset-Based Loans

- Commercial Real Estate Loans

But before we dive deeper into these options, let’s see what you can expect right on the homepage – up to a million dollars or more in small business funding. Sounds great, doesn’t it?

One important note: Rapid Finance primarily caters to non-startup businesses. If you’re a startup or in the early phases of your business, you may need a different solution. For startup resources and a free six-step pre-approval lending checklist, check the description below. This checklist will guide you through the process and save you time and frustration.

Merchant Cash Advance – A Closer Look

One financing solution that stands out is the Merchant Cash Advance (MCA). This is a quick overview, but we’ll delve deeper into it. An MCA involves lenders deducting a percentage of your future credit and debit card sales, essentially using your receivables to repay the advance. Rapid Finance offers MCAs ranging from $5,000 to $500,000.

The advantages of Rapid Finance’s MCA include:

- Fast access to capital, potentially on the same day.

- Flexible repayment options based on your receivables.

- No fixed payment term, which is a key benefit compared to some other MCAs.

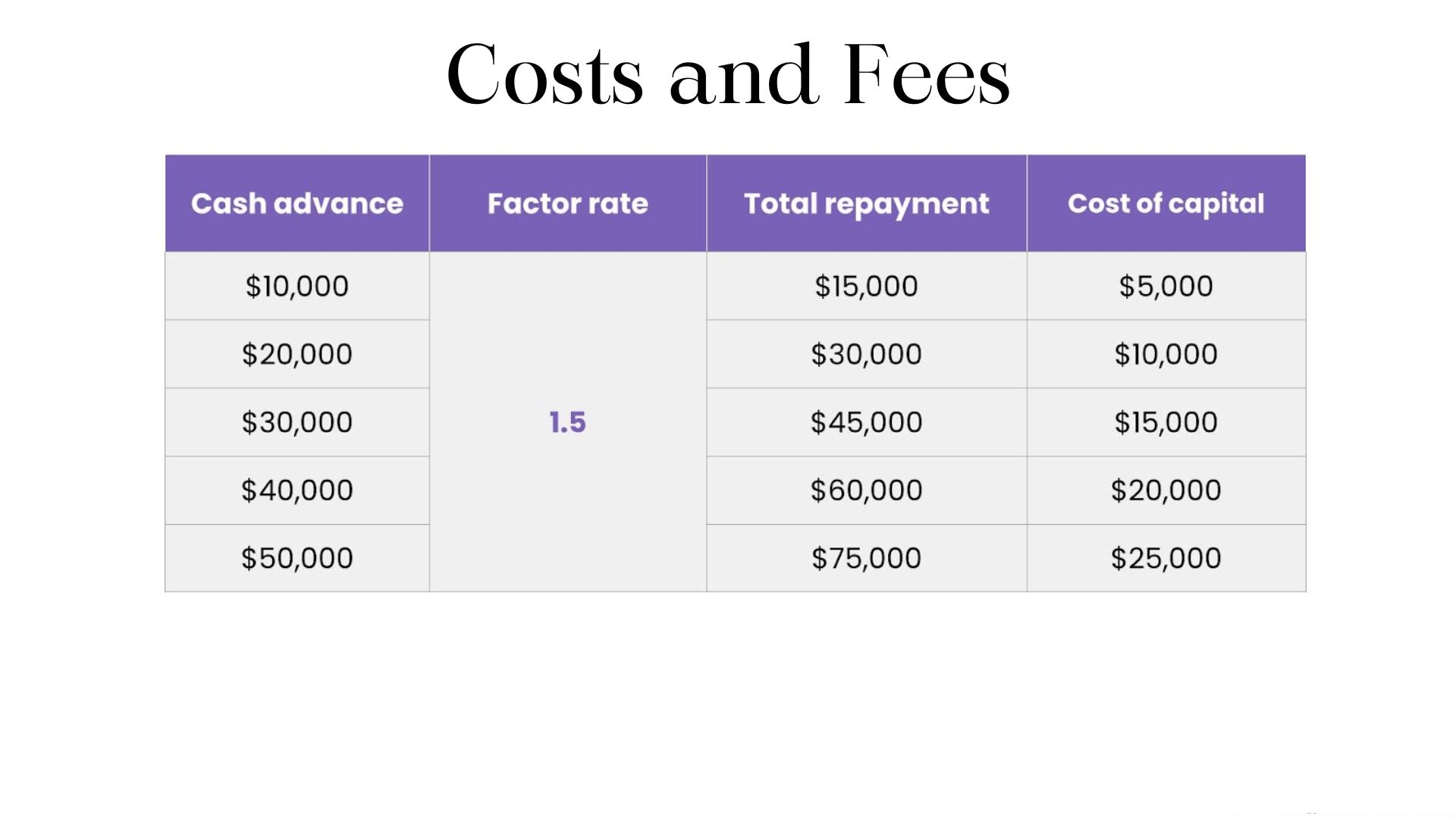

Costs and Fees

In an MCA, receivables are purchased at a discounted price, and fees may be charged and deducted from the advanced amount. Make sure to review the details carefully. To apply for an MCA, you’ll need the following:

- Form of identity validation

- Business bank account number and routing number for deposit

- Last three months of business bank statements

- Last credit card processing statements

These requirements may vary slightly depending on your specific circumstances, but having these documents ready will expedite the process.

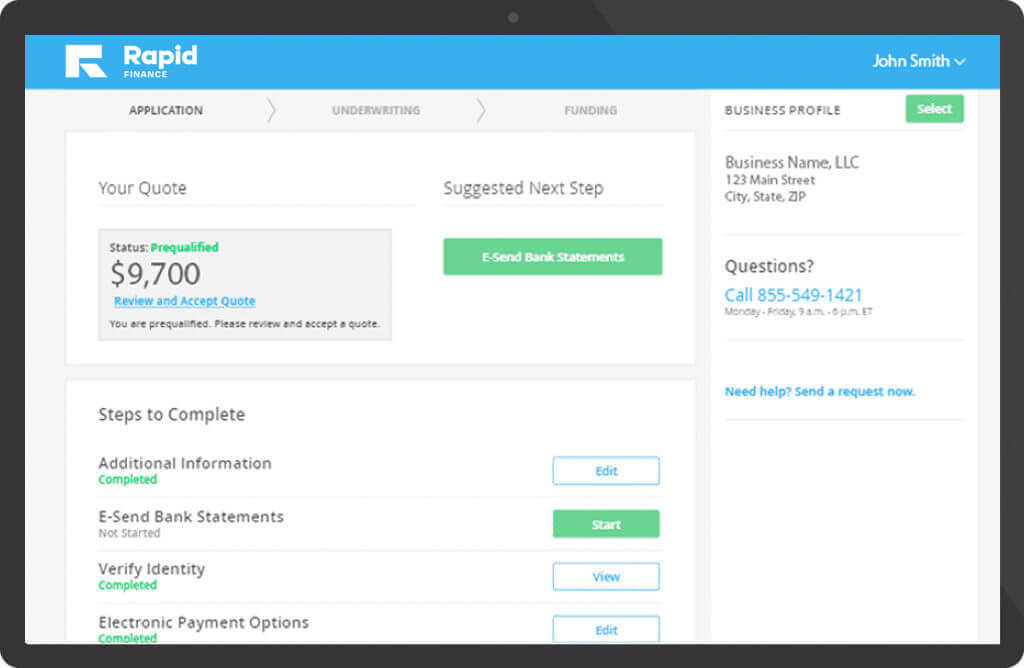

Application Process

Rapid Finance’s application process is straightforward and user-friendly. Here are the steps:

- Apply online from anywhere on your device.

- Provide details about your company and goals.

- Collect the necessary documentation.

Rapid Finance’s Merchant Cash Advance

Now, let’s explore the details of Rapid Finance’s MCA:

- Maximum loan amount: $5,000 to $500,000

- Loan terms: 3 to 12 months

- Interest rates starting at 1.22 (factor rates)

- Qualifications: $5,000 in annual revenue, personal credit score of 550, and at least three months in business

These qualifications make Rapid Finance’s MCA accessible, particularly for businesses that are just getting started.

Comparing Options

Let’s compare Rapid Finance’s MCA with another reputable option, David Allen Capital. They offer up to $2 million, which is a significant advantage. Additionally, they use a revenue-based funding model, which means there are no interest rates. Instead, you repay based on a fixed total payback amount, making it a more flexible and transparent option.

Key benefits of David Allen Capital include:

- Funding up to $2 million

- No interest rates, only a fixed total payback

- No collateral required

- Revenue-based funding

- Early pay discounts

If you’re interested in learning more about this alternative, check the description for additional resources and videos.

Pros and Cons

Pros of Rapid Finance:

- Potentially same-day funding

- Faster process compared to traditional banks

- Electronic loan agreement signing

- Higher approval rates than many other direct lenders

Cons of Rapid Finance:

- May affect your credit history

- Won’t take a secondary position to direct competitors

- Some products require four years in business

- Some products have daily or weekly repayments, which can strain your cash flow

Business Financing Solutions

Rapid Finance offers a range of business financing solutions, including:

- Commercial Real Estate Loans

- Short-term Standard Loans

- Short-term Selected Loans

- Short-term Preferred Loans

- Line of Credit

- Bridge Loan

- SBA Loans

- Invoice Factoring

- Asset-Based Loans

These options provide flexibility in terms, allowing you to choose the solution that best fits your specific business needs.

Conclusion

Rapid Finance offers a variety of financing solutions to meet your business’s unique requirements. Whether you’re seeking a Merchant Cash Advance, a short-term loan, or any other financial product, Rapid Finance may have the answer. With potential same-day funding, they’re a valuable resource for businesses in need of quick capital.

If you have any questions or concerns, feel free to leave a comment below. It will guide you through the process and help you prepare for your application. Financial success is within reach, and Rapid Finance is here to help you achieve it.

Frequently Asked Questions (FAQs)

What is Rapid Finance, and how does it work?

Rapid Finance is a financial institution that provides various small business financing solutions. They offer options like Merchant Cash Advances, Short-term Loans, Line of Credit, and more. Their services allow businesses to access capital quickly to support various financial needs.

What is a Merchant Cash Advance (MCA), and how does it differ from traditional loans?

A Merchant Cash Advance (MCA) is a type of financing where a lender advances funds to a business in exchange for a percentage of its daily credit card sales. Unlike traditional loans, MCAs do not have fixed monthly payments and are repaid based on daily credit card receivables.

Can I qualify for Rapid Finance’s financing solutions if I have bad credit or a new business?

Rapid Finance offers various financing options, including some with lenient credit requirements and shorter time in business requirements. For example, their Merchant Cash Advance may be accessible with a personal credit score of 550 and as little as three months in business.

How quickly can I expect to receive funding from Rapid Finance?

Rapid Finance is known for its fast funding. Depending on the specific financing product and the completeness of your application, you may receive funding as quickly as the same day or within 24 hours, making them a great choice for businesses in need of immediate capital.

What is the difference between short-term standard loans and short-term preferred loans offered by Rapid Finance?

Rapid Finance provides various short-term loan options. Short-term standard loans typically have loan terms of 4 months to 1 year, while short-term preferred loans have loan terms ranging from 6 to 15 months. The key difference is the duration of the loan, which can impact your repayment schedule and the overall cost of financing.