Wouldn’t it be great to make money while you sleep, walk to your mailbox to find a check waiting for you, or wake up to money deposited directly into your bank account? If you’re looking for ways to generate passive income, you’re in the right place. In this article, we’ll explore five reliable methods to boost your earnings, and you don’t need to quit your day job to do it.

1. Car Advertising with Rapify

One of the easiest ways to earn passive income is by putting stickers on your car, thanks to platforms like Rapify. Rapify pays you to advertise various brands and businesses on your vehicle. According to their website, you can earn up to $400 per month, which could cover your entire car payment. To get started, simply download the app, track your driving, and wait for campaign notifications in your area. It’s a simple way to earn money without much effort.

2. Rent Out Your Space with Neighbor

If you’re a homeowner looking to make some extra cash, consider renting out your unused space on platforms like Neighbor. You can offer your garage, shed, driveway, or storage space for rent. You set your own rates or follow the recommended price range based on similar listings in your area. Renting out your space can earn you a few hundred dollars without much hassle, making it a great way to generate passive income.

3. Invest in Established Websites

Investing in established websites on platforms like Flippa and Empire Flippers can turn into a lucrative source of passive income. These websites are already generating revenue through dropshipping, affiliate marketing, or direct sales. By acquiring one of these sites, you can collect a check without much effort. While this method does require an initial investment, it can be a worthwhile way to make passive income if you have some experience in online business or do thorough research.

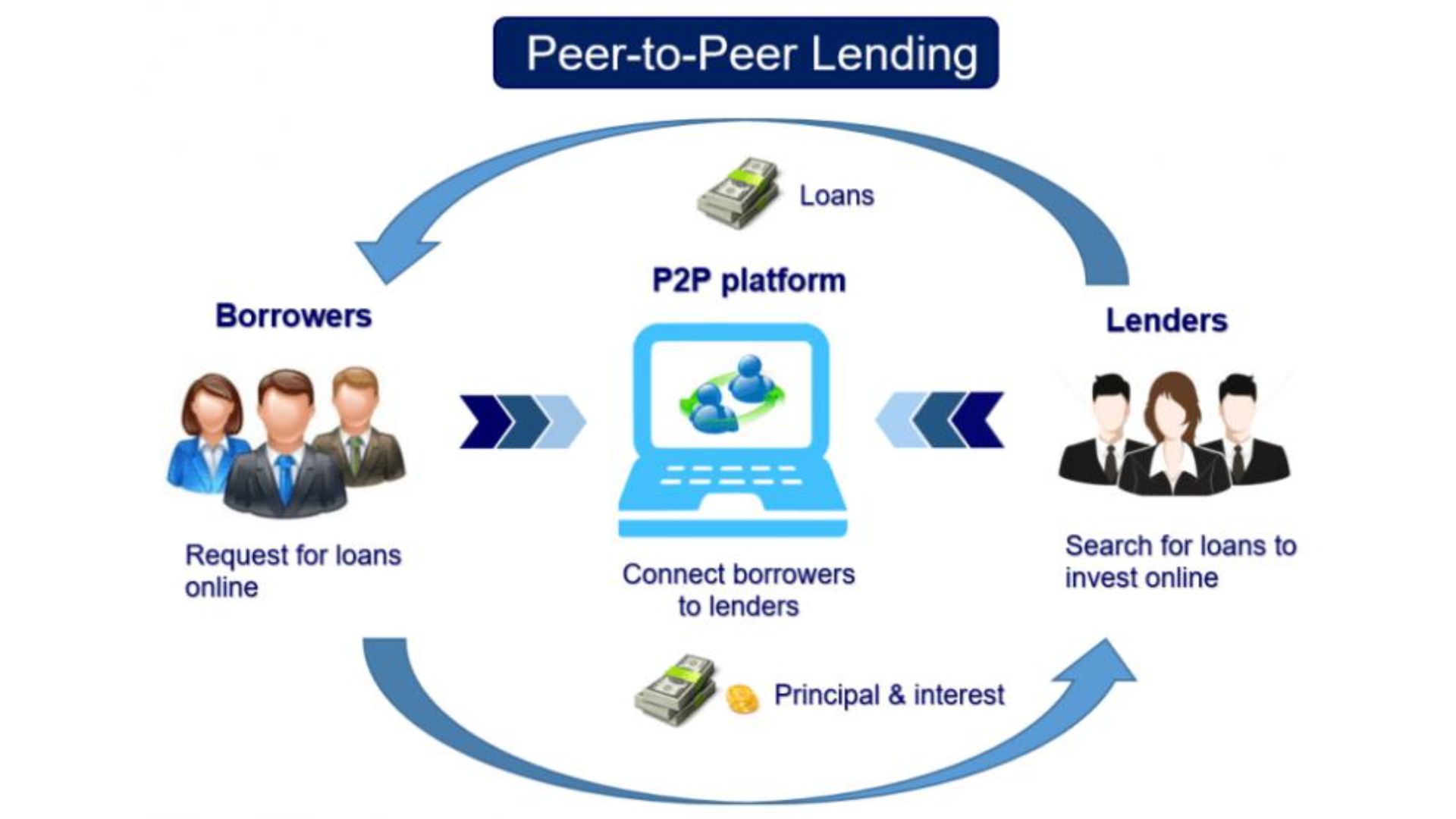

4. Peer-to-Peer Lending with Prosper, LendingClub, and Groundfloor

Peer-to-peer lending (P2P) allows you to fund consumer loans and earn returns as a lender. Platforms like Prosper, LendingClub, and Groundfloor facilitate P2P lending. You can start with as little as $25 and either fund entire loans or pool your money with others to fund larger loans. Depending on the platform and the level of risk you’re comfortable with, you can earn a decent return on your investment. Just remember that all investments carry some level of risk, so only invest what you can afford to lose.

5. Rent Out Your Vehicle on Turo and Getaround

Renting out your car through platforms like Turo and Getaround can be a semi-passive income opportunity. While it requires an extra vehicle, it’s a great way to earn money from a car that would otherwise sit idle. However, keep in mind that for this to be truly passive, you’ll need at least one additional vehicle for personal use. Some ambitious individuals even finance a vehicle solely for renting it out, potentially turning it into a profitable fleet. And you can also take information about free cremation for low-income. It is helpfull information and a complete guide.

Conclusion

In conclusion, these five passive income apps and platforms offer various opportunities to boost your earnings without working tirelessly. While some may require upfront investments or additional resources, they can be a path to financial independence and increased income. Remember to do your due diligence and consider your risk tolerance before diving into any passive income venture.

Frequently Asked Questions

What are passive income apps?

Passive income apps are mobile applications or online platforms that allow individuals to earn money with minimal effort or active involvement. These apps typically offer various ways to generate income, such as renting out assets, investing, or participating in affiliate marketing, with the goal of making money while you sleep or go about your daily routine.

How can I trust passive income apps?

When considering passive income apps, it’s essential to do your research. Look for reputable platforms with positive reviews and a track record of paying their users. Read user testimonials, check for app store ratings, and explore online forums or communities to gather information about the app’s legitimacy. Always exercise caution and be wary of apps that promise unrealistic returns.

What are some examples of passive income apps?

Examples of passive income apps include:

- Rapify: An app that pays you to advertise on your car.

- Neighbor: A platform that allows you to rent out your unused space, such as a garage or storage area.

- Flippa and Empire Flippers: Websites where you can purchase established online businesses that generate passive income.

- Peer-to-Peer Lending Platforms: Apps like Prosper, LendingClub, and Groundfloor that enable you to lend money to borrowers and earn interest.

- Turo and Getaround: Platforms that let you rent out your vehicle to earn extra income.

Are passive income apps a guaranteed way to make money?

No, passive income apps are not a guaranteed way to make money. While they offer opportunities for additional income, there are risks involved, and earnings can vary. The level of success you achieve with these apps depends on factors like your initial investment, market conditions, and your ability to manage and optimize your passive income streams. It’s essential to approach them with realistic expectations.

Do I need specialized knowledge to use passive income apps?

The knowledge required to use passive income apps varies depending on the specific app and method you choose. Some apps, like car advertising or renting out space, require minimal expertise and are accessible to most users. However, for more complex options like investing in online businesses or peer-to-peer lending, it’s advisable to have some knowledge or seek guidance to make informed decisions and reduce risks. Always educate yourself before getting involved in any passive income venture.