Pets are beloved members of our families in the modern world; they are more than just animals. We pamper them with affection, treats, and toys, ensuring they have a happy and healthy life. However, when it comes to their healthcare, there’s one question that often arises: Is pet insurance worth it? Welcome to this comprehensive guide in which we’ll explore the world of pet insurance in-depth, addressing common questions and providing insights from a veterinarian’s perspective.

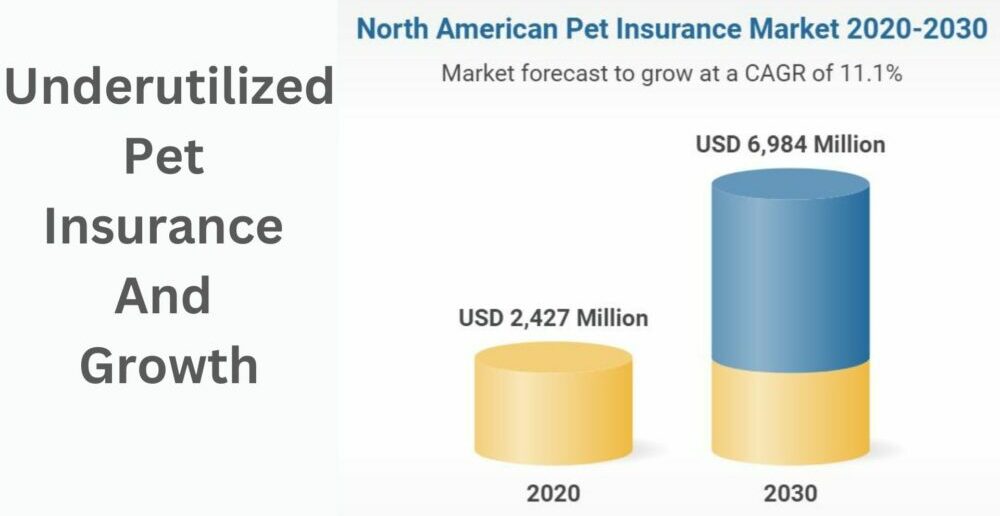

The Underutilized Pet Insurance

Pet insurance, a valuable safeguard for your pet’s well-being, is remarkably underutilized in North America. Astonishingly, only three percent of pet owners in North America have some form of coverage, while in Europe, the number tops a staggering 50 percent. This discrepancy raises a significant question: Why are pet owners in North America hesitating to embrace pet insurance?

To answer this question, it’s essential to explore the factors that influence the decision to insure or not to insure one’s pets.

A Personal Decision

Deciding whether to invest in pet insurance is a deeply personal choice. It involves considering both emotional and financial factors, and ultimately, it boils down to how much of a risk-taker you are.

The Financial Aspect

Imagine your beloved pet suddenly falls seriously ill or gets injured, and you’re presented with a massive veterinary bill. Can you afford to pay for it? While everyone hopes for their pet’s good health, it’s essential to consider the possibility of a critical injury. Pet insurance can provide a safety net, ensuring that you won’t have to make difficult decisions about your pet’s health based solely on financial constraints.

The Emotional Aspect

Pets become cherished members of our families, and their well-being is a top priority. Knowing that you have insurance can offer peace of mind, allowing you to make healthcare decisions based on what’s best for your pet rather than what you can afford.

Types of Pet Insurance

Pet insurance comes in various forms, each tailored to specific needs and preferences. Understanding these options is crucial when deciding which policy is right for you and your pet.

1. Accident-Only Insurance

Accident-only insurance is precisely what it sounds like—it covers unexpected mishaps and accidents. This type of insurance is well-suited for those who want financial protection in case of unforeseen events, such as accidents or injuries. In the event that your pet takes a leap of faith similar to the cat in our story or ingests foreign objects, like the kung fu grip-loving dog, this insurance can provide financial relief when you need it most.

2. Medical and Accident Insurance

Medical and accident insurance like Pumpkin pet insurance goes beyond covering accidents to include various health issues. This can include infections, toxins, heart disease, diabetes, behavioral therapy, and dental cleanings, among others. However, policies in this category can vary significantly in terms of coverage percentages, maximum payouts, and co-pays. Careful consideration and comparison of policies are essential to find the one that aligns with your pet’s healthcare needs.

3. Comprehensive Coverage

At the top tier of pet insurance options is comprehensive coverage. This policy is the most extensive and often the most expensive. It covers not only accidents and medical issues but also preventative care. This includes expenses such as vaccines, flea treatments, and routine check-ups. If you want to ensure that you can afford all aspects of your pet’s healthcare, this policy might be worth considering.

Factors Affecting Policy Costs

Several factors can influence the cost of your pet insurance policy:

Age of Your Pet

Just like with human insurance, the age of your pet plays a significant role in determining premiums. Generally, it’s more cost-effective to purchase insurance when your pet is young, as premiums tend to increase with age. Starting early can lock in a lower rate, providing long-term financial benefits.

Pre-Existing Conditions

Pets with pre-existing conditions may have limited coverage options or face higher premiums. It’s essential to disclose any existing health issues when purchasing insurance to ensure transparency and accurate coverage.

Breed

Certain breeds are predisposed to specific health issues. Insurance costs may vary depending on your pet’s breed. For instance, breeds with known health challenges, such as bulldogs, might have higher premiums due to their susceptibility to breathing problems, skin infections, and joint disorders.

What Pet Insurance Doesn’t Cover

- Pre-Existing Conditions: Pet insurance typically excludes any health issues your pet had before purchasing the policy. These are considered pre-existing conditions and won’t be covered.

- Routine Wellness Care: Basic and routine care such as vaccinations, flea prevention, and annual check-ups are usually not covered. However, some policies offer wellness packages as add-ons for an additional cost.

- Cosmetic Procedures: Pet insurance doesn’t cover elective or cosmetic procedures. This includes non-essential treatments like tail docking or ear cropping.

- Breeding and Pregnancy Costs: Expenses related to breeding, pregnancy, and birthing are usually not covered. This includes prenatal care, cesarean sections, and other breeding-related expenses.

- Behavioral Issues: While some policies cover behavioral therapy, it’s essential to review the details. Coverage may vary, and not all behavior-related expenses, such as training, are included.

- Certain Hereditary Conditions: Some policies may exclude coverage for specific hereditary conditions or breed-specific ailments. It’s crucial to check your policy for any breed-related limitations.

- Experimental Treatments: Experimental or unproven treatments and medications may not be covered. Most policies focus on established and evidence-based veterinary care.

Understanding these limitations is crucial when evaluating pet insurance policies. It’s essential to read your policy documents carefully, ask questions, and consult with your veterinarian to make an informed decision.

Consult Your Veterinarian

Veterinarians play a pivotal role in guiding pet owners toward making informed decisions about choosing the right pet insurance policy and provider. Veterinarians have the expertise to assess your pet’s unique health needs and can offer valuable recommendations based on their knowledge of your pet’s breed, age, and any pre-existing conditions. They can help you understand the nuances of different insurance policies, such as coverage limits, deductibles, and premiums.

Additionally, many insurance companies offer free trial periods, allowing you to test a policy before committing. Your veterinarian can likely sign you up for such trials, providing you with a risk-free opportunity to evaluate the policy’s effectiveness.

While veterinarians may not receive kickbacks for their recommendations, their primary concern is your pet’s well-being. Consulting with your veterinarian ensures that you’re making a choice that aligns with your pet’s health and specific needs.

Conclusion

Pet insurance may seem complex and costly, but it’s a worthwhile investment in your pet’s health and your peace of mind. So, take a cue from the experts and seriously consider pet insurance. It’s a relatively small cost compared to the potentially hefty bills that can come with unexpected health issues. Your pet’s well-being is worth it, and insurance can help ensure they receive the care they need when they need it. Remember, the peace of mind that comes with knowing you can provide the best possible care for your furry family member is truly priceless.

Frequently Asked Questions (FAQs)

What is pet insurance, and how does it work?

A financial product called pet insurance can help with the cost of veterinarian treatment for your animals. It typically works on a reimbursement basis. You pay the veterinary bill upfront, then submit a claim to the insurance provider. They will reimburse you for eligible expenses based on your policy’s coverage.

Is pet insurance worth it for young and healthy pets?

Yes, pet insurance can be valuable for young and healthy pets. It ensures that you have financial support in case of unexpected accidents or illnesses. Plus, getting insurance while your pet is young can often lock in lower premiums.

What does pet insurance usually cover?

The coverage offered by pet insurance can vary depending on the policy. Typically, pet insurance plans cover accidents and illnesses. Some plans also include routine wellness care, such as vaccinations and preventive treatments. It’s essential to carefully read the fine print of the policy to comprehend what is and isn’t covered.

Are pre-existing conditions covered by pet insurance?

No, pre-existing conditions are typically not covered by pet insurance. Your pet had these health problems before you bought the insurance. It’s essential to be aware that existing medical conditions will likely be excluded from coverage.

How do I choose the right pet insurance policy for my pet?

Choosing the right pet insurance policy involves considering your pet’s age, breed, and specific health needs. It’s also essential to compare policy options, including coverage limits, deductibles, and premiums. Consulting with your veterinarian and reading reviews from other pet owners can also provide valuable insights when making your decision.