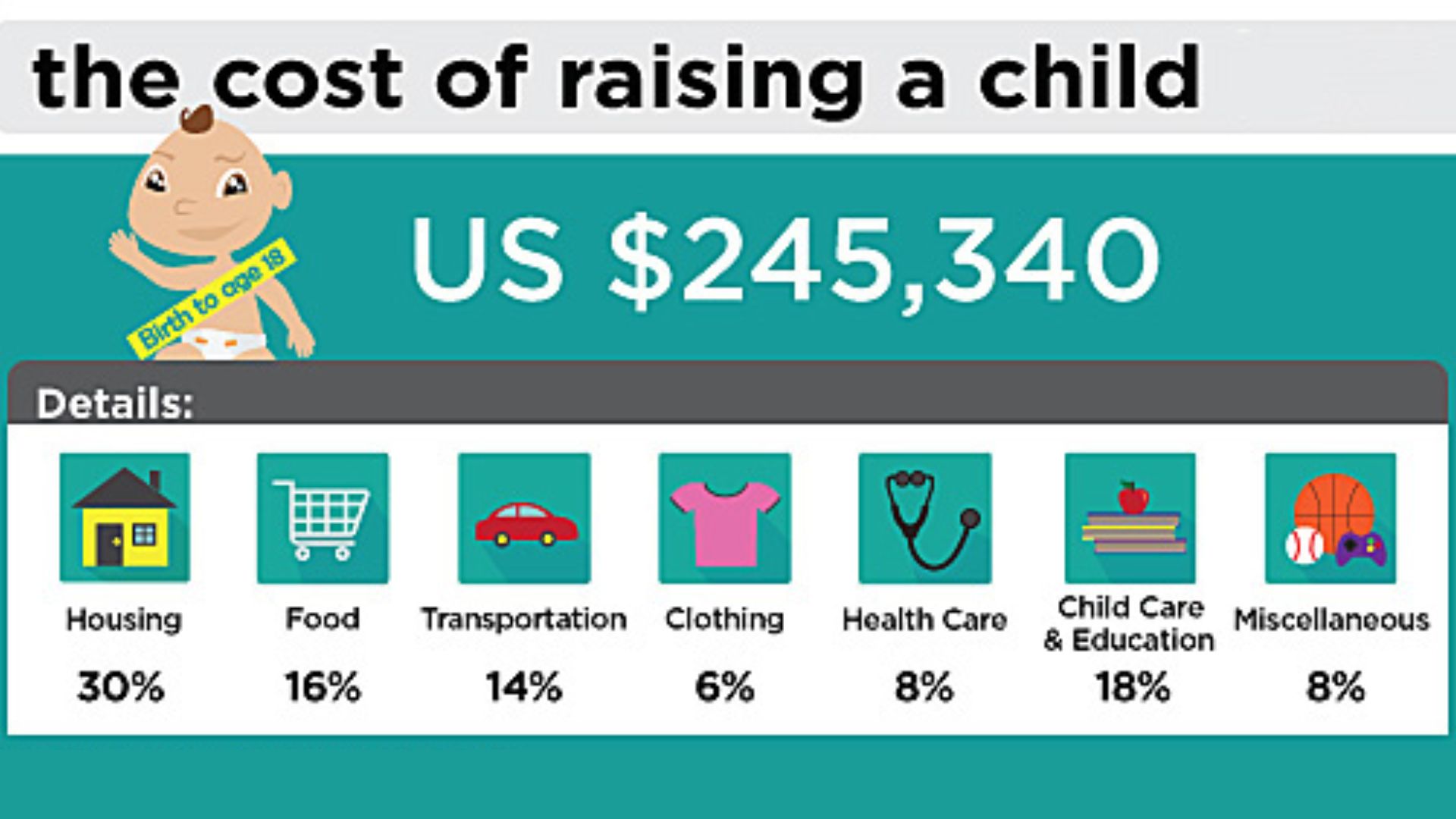

Bringing a child into the world is a momentous occasion, filled with boundless love and joy. However, it’s also a journey that comes with its own set of financial responsibilities. If you’re a new parent or expecting a child, it’s essential to understand and plan for the financial aspects of parenthood. In this informative guide, we’ll explore in detail How much does it cost to raise a child in America, providing you with valuable insights to help you prepare for this incredible journey.

Preparing for Parenthood

Preparing for parenthood goes beyond baby showers and nursery decor. It’s about establishing a solid financial foundation to support your growing family. In this section, we’ll delve into the essential steps you should take to ensure a smooth financial transition into parenthood. From health insurance considerations to planning for unexpected expenses, we’ll guide you through the vital preparations needed to embark on this incredible journey with confidence.

Health Insurance and Prenatal Care

Your journey into parenthood begins with effective communication with your partner. It’s crucial to be on the same page and prepared for the financial responsibilities that lie ahead. Start by assessing your health insurance coverage and determining how much you’ll need to spend on prenatal care.

-

Health Insurance: Understanding your health insurance coverage is paramount. Check whether your policy covers maternity care and childbirth expenses. Some policies may require additional premiums or have specific deductibles for maternity care, you can also enroll in free health care services.

-

Prenatal Care: The journey starts with prenatal care. Consider factors like doctor’s visits, ultrasounds, and routine check-ups. The costs can vary, so it’s essential to budget for these expenses accordingly.

Choosing the Birth Setting

Another vital consideration is the setting in which you plan to give birth. Your choice can significantly impact the overall cost.

- Hospital Birth: If you opt for a hospital birth, it’s important to research which hospital you plan to deliver at and inquire about the associated costs. Hospitals typically have a finance department that can provide you with an estimate of what to expect. Feel free to get in touch and inquire if you have any questions.

- Home Birth: Some parents choose the intimate setting of home births, which can be cost-effective. However, you’ll need to budget for a certified midwife or doula, as well as any necessary equipment for the birth.

-

Water Birth: Water births are becoming increasingly popular. Consider the costs associated with renting or purchasing a birthing tub and any additional fees for midwives or specialists.

Preparing for the Unexpected

While planning for childbirth, it’s also essential to prepare for unexpected situations. Complications during pregnancy or birth may necessitate a C-section delivery. Understanding the financial aspects of such procedures in advance can help you stay calm during challenging moments.

The Journey After Birth

Once your child is born, the financial journey continues. From childcare expenses to the ever-increasing demands of a growing child, this section explores the economic aspects of raising a family. Discover how to make informed choices when it comes to childcare, budgeting for diapers and clothing, and addressing the evolving needs of your child as they progress from infancy to early childhood. Parenthood is a lifelong adventure, and understanding the financial implications is key to ensuring a secure and prosperous future for your family.

Single Income vs. Dual Income

For dual-income families, a significant decision arises – do both parents continue to work, or does one parent stay at home to care for the child? Transitioning from a dual-income to a single-income family is a financial consideration itself.

- Staying Employed: If both parents choose to continue working, it’s essential to budget for childcare expenses. High-quality childcare is not only crucial for your child’s well-being but also comes with its own costs.

-

Stay-at-Home Parent: Opting for one parent to stay at home is a cultural, lifestyle, and financial decision. It’s vital to recognize the financial responsibilities associated with this choice and plan accordingly.

Childcare Expenses

If both parents decide to continue working, childcare expenses become a reality. Here’s a closer look at what to consider:

- Daycare Costs: The cost of daycare can significantly impact your budget. It’s not just about cost but also finding a trusted caregiver for your child. Research daycare options in your area and choose one that aligns with your budget and meets your child’s needs.

-

Ongoing Expenses: From infancy to age five, you’ll need to budget for items like diapers, clothing, and increased food consumption. As your child grows, family vacations may require purchasing full adult tickets, adding to your expenses, check best hotel credit cards for staying during vacations.

The Early Years: Ages Zero to Five

These formative years are a whirlwind of development and discovery, and they come with unique financial considerations. From establishing essential routines to managing the day-to-day costs of diapers, clothing, and food, this section provides valuable insights into the financial aspects of raising a young child. Learn how to strike a balance between providing the best for your child’s well-being and planning for future expenses as they grow. These early years lay the foundation for a lifetime of learning and growth, and understanding the associated costs is vital for responsible parenthood.

Establishing Routines

In the early years of your child’s life, it’s essential to establish routines. Just like you have a workout routine or a diet routine, you’ll develop routines for eating, sleeping, and playing with your child.

- Sleep Routine: Establishing a sleep routine is crucial for both you and your child. Quality sleep is essential for a child’s development, and setting a consistent sleep schedule can be a game-changer.

-

Eat-Sleep-Play Routine: Your child’s daily schedule will revolve around eating, sleeping, and playing. Creating a balanced routine that nurtures their growth and development is key.

Preparing for the Future: Ages Six to Eighteen

As your child enters the school years and beyond, new financial responsibilities emerge. This section guides you through the educational choices you’ll face, whether it’s public school or private education. Explore considerations like transportation costs and the importance of instilling financial independence in your child. From sports to college planning, these years shape your child’s future, and understanding the financial aspects is essential for providing the best opportunities while maintaining financial stability.

As your child grows, their needs and activities evolve, and so do the financial responsibilities.

Educational Costs

-

Public School vs. Private School: Consider your options for your child’s education. While many families choose public school, others opt for private schools or charter schools. Each choice comes with its own financial implications, so make sure to plan accordingly and check about Student loan forgiveness.

-

Transportation Expenses: As your child gets older, transportation becomes a consideration. You may need to budget for expenses like buying a car, insurance, and gas. Deciding whether to assist your child with these costs or have them take on the responsibility is an important financial decision.

Encouraging Financial Independence

As your child enters their teenage years, it’s an excellent time to start teaching them about financial independence and responsibility.

- Teaching Financial Literacy: Educate your child about money management, budgeting, and saving. Encourage them to work part-time jobs or internships to gain financial independence.

-

Transportation Costs: While you may help with the initial expenses of buying a car, consider having your child cover ongoing costs like insurance and gas. This teaches them financial responsibility.

College and Beyond

As your child approaches adulthood, the topic of college and post-secondary education becomes significant. Here are some key points to consider:

- Saving for College: Starting an Education Savings Account (ESA) or a 529 plan when your child is young can significantly reduce the financial burden of college tuition. The earlier you begin saving, the more manageable the costs will be.

- Alternatives to College: While college is a common path, it’s not the only one. Some individuals choose trade schools, vocational training, military service, or entrepreneurship. Explore alternative paths that align with your child’s interests and goals.

-

The Value of a College Education: Despite the rising costs of higher education, statistics still show that a college degree can be a valuable investment in your child’s future. Encourage your child to pursue higher education if it aligns with their career aspirations.

Conclusion

The journey of raising a child in America is a remarkable one, filled with love, laughter, and priceless memories. However, it’s also a journey that requires careful financial planning and consideration. Every family’s situation is unique, and the costs associated with parenthood can vary significantly based on choices and circumstances.

By understanding and planning for these costs, you can ensure a bright and secure future for your child. Whether you’re budgeting for prenatal care, childcare expenses, or college tuition, making informed financial decisions will help you navigate the path of parenthood with confidence.

Parenthood is an adventure that comes with its own set of financial challenges, but with careful planning and responsible financial management, you can provide your child with the best possible start in life. Embrace the journey, cherish the moments, and prepare for a future filled with endless possibilities.

Frequently Asked Questions (FAQs)

How much does it cost to have a baby in a hospital in the United States?

The cost of giving birth in a hospital in the United States can vary significantly depending on factors like your location, your health insurance, and the specific medical services you require. On average, hospital childbirth costs, including prenatal care and delivery, can range from several thousand dollars to tens of thousands of dollars. Health insurance coverage plays a critical role in determining the final cost, so it’s essential to understand your policy’s maternity benefits.

What are the main expenses to consider when raising a child in America?

Raising a child involves various expenses, including healthcare, childcare, education, and everyday living costs. Some of the key expenses to consider include prenatal care, hospital delivery costs, childcare or daycare expenses, food, clothing, education (public or private school, college), transportation, and extracurricular activities. Each family’s financial situation and choices can impact the overall cost of raising a child.

How can I prepare financially for parenthood?

Financial preparation for parenthood is essential. Start by reviewing your health insurance coverage to understand maternity benefits. Create a budget that accounts for anticipated expenses, such as prenatal care, hospital costs, and ongoing childcare. Consider establishing a savings plan, such as an Education Savings Account (ESA) or a 529 plan, to save for your child’s education. Additionally, build an emergency fund to cover unexpected expenses that may arise during your child’s upbringing.

Is it more cost-effective to stay at home with the child or continue working after becoming a parent?

The decision to stay at home or continue working after becoming a parent is a personal one that involves both lifestyle and financial considerations. Staying at home can reduce childcare expenses but may impact the family’s income. Consider factors like your current financial situation, career aspirations, and childcare options. For some families, finding a balance between work and parenting is the best choice.

What are the options for financing a child’s college education in the United States?

Financing a child’s college education in the United States can be a significant financial challenge. There are several options available, including:

- Education Savings Accounts (ESAs): These tax-advantaged accounts allow you to save for educational expenses, including college tuition.

- 529 Plans: These state-sponsored savings plans offer tax benefits and can be used to cover qualified education expenses.

- Scholarships and Grants: Encourage your child to apply for scholarships and grants to help offset the cost of college.

- Federal Student Loans: Your child may be eligible for federal student loans with favorable terms.

- Work-Study Programs: Some colleges offer work-study programs that allow students to earn money while attending school.

Remember that the best financing option for your child’s college education will depend on your financial situation and your child’s academic goals. Planning ahead and exploring these options can help make college more affordable.