In today’s fast-paced world, financial emergencies can strike when you least expect them. Whether it’s a sudden car repair, an overdue rent payment, or an unexpected medical bill, the need for quick cash can be pressing. While payday loans might seem like a convenient solution, they often come with exorbitant interest rates and can trap you in a cycle of debt. But fear not! In this article, we’ll explore the seven best payday loan alternatives that can provide you with a better financial lifeline, all while helping you avoid those crippling interest rates.

What Are the Best Payday Loan Alternatives?

Payday loan alternatives are financial services designed to provide you with quick access to cash without the predatory terms of traditional payday loans. These alternatives typically have lower fees, and no interest charges, and offer various additional benefits to help you manage your finances effectively. Also, get quick 1 hour payday loans.

Let’s dive into these seven alternatives that can be a lifesaver in times of financial need:

1. Empower: Your Financial Empowerment

Empower is a financial service that offers a cash advance of up to $250 without the need for a credit check or a lengthy application process. Unlike payday loans, Empower charges just a modest $3 fee when transferring the money to your bank account. However, here’s the kicker: you can skip even that fee by signing up for the Empower card, where you’ll receive the advance directly to your card for free. Plus, you can access your cash at over 37,000 ATMs in the Empower network without additional fees.

Empower doesn’t stop there – it also provides a 10% cashback on everyday purchases, lets you choose your reward category, and offers online savings accounts with no overdraft fees or minimum balance requirements. Additionally, you can set up automatic savings transfers with ease.

While Empower does have an $8 monthly fee, you can enjoy the service for free during the first 14 days, making it an attractive and cost-effective payday loan alternative.

2. MoneyLion: Your Financial Lifeline

MoneyLion, much like Empower, provides access to a $250 cash advance without credit checks or excessive fees. The only time you’ll face a fee is for expedited transfers, which can be avoided by planning ahead. MoneyLion also offers early access to your paycheck, providing you with greater financial flexibility.

3. Chime: More Than Just Banking

Chime is an online banking service that offers cash advances along with a range of additional features. After setting up a Chime account and direct deposit, you’ll gain access to your paycheck two days earlier. Chime’s robust app allows you to receive transaction alerts, instantly disable your card if needed, and take advantage of their fee-free “SpotMe” service for up to $100.

What sets Chime apart is its commitment to no monthly fees, transaction fees, or minimum balance requirements, making it an attractive option for those seeking financial freedom.

4. PayActive: Workplace Benefits

PayActive is a unique payday loan alternative offered as an employee benefit by many employers. If your employer provides PayActive, you can take advantage of “Earned Wage Access” (EWA), allowing you to access wages you’ve already earned, up to $500. This money can be transferred to your checking account or used for cash advances.

PayActive goes beyond payday loans, offering financial coaching, bill payments, Amazon payments, and prescription drug discounts. The best part? You only pay a small $5 fee when you use the service, and there are no other charges.

5. Dave: Banking Without Overdraft Fees

Dave is an online checking account with zero minimum balance requirements and zero overdraft fees. When you’re about to overdraft, Dave intervenes by declining the transaction and offering you an advance of up to $200. There are no interest charges, no credit checks, and no extra fees. Dave also provides a built-in budgeting tool and offers the opportunity to build credit by reporting rent payments to major credit bureaus for regular deposits of $200 or more.

Dave’s fee is just $1 per month, and while they encourage you to leave a tip when you take an advance, it’s entirely optional.

6. Bridget: Flexibility at Its Best

Bridget is one of the most flexible payday loan alternatives available. You don’t need to open a new bank account – Bridget works with your existing checking account. You can borrow up to $250, and Bridget determines your eligibility based on your regular earnings, without requiring a credit check or charging servicing fees.

Bridget automatically deducts loan repayments from your account when your next direct deposit arrives, but here’s the kicker: you can delay your repayment up to three times, offering unparalleled flexibility. Bridget offers a free basic plan, or you can opt for Bridget Plus at $10 per month for added features.

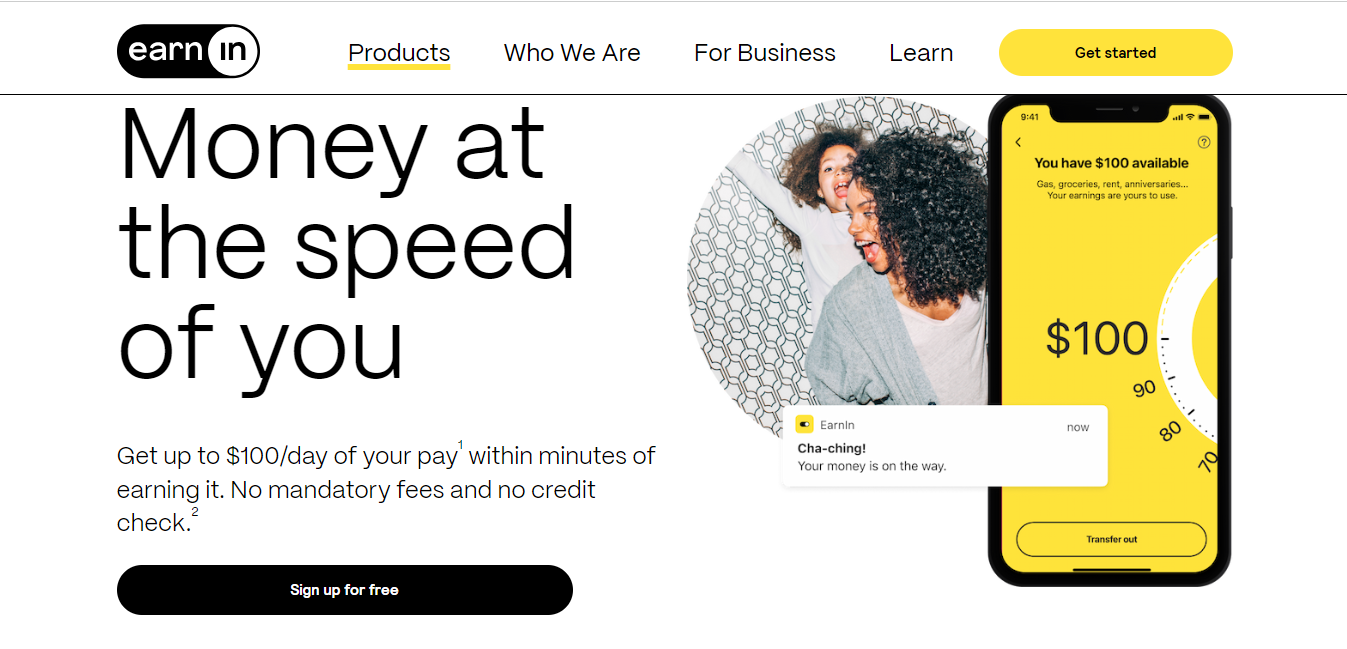

7. Earnin: Your Payroll Advance Pioneer

Earnin, formerly known as ActiveHours, is the world’s first payroll advance app. It works similarly to Bridget by monitoring your bank account and allowing you to access a maximum loan of $100 (up to $500 per pay period). Earnin charges no fees, but they do offer an optional tipping feature, with tips helping to support their services.

In addition to payday advances, Earnin provides a balance shield feature to monitor your account balance and automatic cash advances when needed. You can also link your credit card to earn cashback rewards and take advantage of a savings account feature called “Tip Yourself.” Also, check 10 Payday Loans Online No Credit Check Instant Approval.

Conclusion:

In the fast-paced world of personal finance, the need for quick cash can be both unpredictable and urgent. Traditional payday loans might seem like the only option, but their high interest rates and unfavorable terms can lead to financial pitfalls. Fortunately, there are seven stellar payday loan alternatives that empower you to secure the funds you need while avoiding the debt trap.

These alternatives, such as Empower, MoneyLion, Chime, PayActive, Dave, Bridget, and Earnin, offer a wide range of benefits, from cash advances with minimal fees to early paycheck access and innovative financial management tools. Each option caters to specific needs and preferences, providing a lifeline when unexpected expenses arise.

Frequently Asked Questions (FAQs)

What Are Payday Loan Alternatives, and Why Should I Consider Them?

Payday loan alternatives are financial services designed to provide quick access to cash without the high interest rates and unfavorable terms of traditional payday loans. They offer lower fees, flexible repayment options, and additional financial perks. Considering these alternatives is essential for avoiding the debt trap associated with payday loans and maintaining better financial stability.

How Do Payday Loan Alternatives Compare to Traditional Payday Loans?

Payday loan alternatives offer several advantages over traditional payday loans. They typically have lower fees, no interest charges, and provide more flexibility in repayment. Additionally, many of these alternatives offer features like early paycheck access, cashback rewards, and financial coaching, enhancing your overall financial well-being.

Do Payday Loan Alternatives Require a Credit Check?

Most payday loan alternatives do not require a credit check. These services focus on your income and financial stability rather than your credit score, making them accessible to individuals with varying credit histories.

Are There Any Hidden Fees or Charges Associated with Payday Loan Alternatives?

Payday loan alternatives are transparent about their fees. While some may charge small fees for specific services, such as expedited transfers or optional tips, these fees are generally modest and clearly communicated. It’s important to review the terms and fees of the specific alternative you choose.

Which Payday Loan Alternative Is Right for Me?

The choice of payday loan alternative depends on your individual financial needs and preferences. Consider factors such as fees, flexibility in repayment, early paycheck access, and additional features like cashback rewards when selecting the alternative that best suits your situation. Evaluate your priorities and explore the alternatives to find the one that aligns with your goals.