Are you tired of paying too much for your car insurance in Georgia? Well, you’ve come to the right place. In this comprehensive article, we’ll introduce you to the cheapest car insurance in Georgia, the Root Car Insurance company that offers some of the best coverage at the most affordable prices in the state. By the end of this article, you’ll understand how Root Car Insurance can help you save hundreds of dollars on your car insurance premium. We’ll delve deep into what car insurance means in Georgia, explore the innovative approach of Root Car Insurance, and provide a step-by-step guide to sign up and start saving on your car insurance.

Why Car Insurance Matters in Georgia

Car insurance is a significant expense for many households in Georgia, often ranking as the second-largest cost after rent or mortgage payments. It’s not just an essential expense; it’s a legal requirement. In Georgia, like in most states, you must have minimum liability insurance coverage to legally operate a motor vehicle. This coverage is designed to protect you and others in case of an accident by ensuring that there’s financial compensation available for injuries and property damage.

Driving without insurance carries serious consequences such as fees, license suspension, and even jail time. So, having car insurance isn’t just about protecting your vehicle and your finances; it’s about abiding by the law.

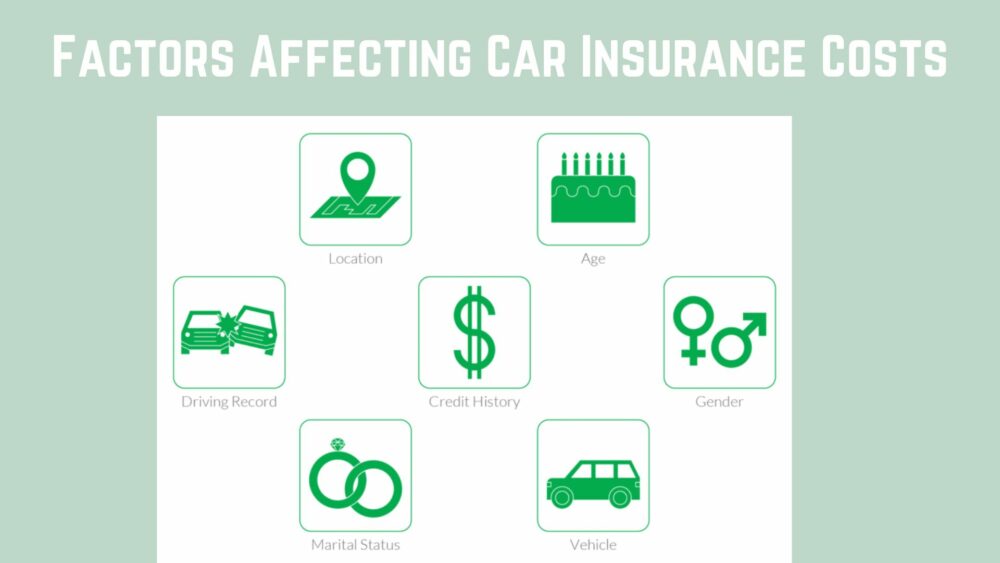

Understanding Car Insurance Costs

Costs for car insurance vary considerably depending on a number of variables, such as:

- Location: Where you live in Georgia can significantly impact your insurance premiums. Urban areas tend to have higher rates due to more traffic and increased likelihood of accidents.

- Driving Record: Your driving history plays a crucial role in determining your premium. Usually, safe drivers who don’t have any tickets or accidents pay less.

- Vehicle Type: The make and model of your car affect your premium. Expensive cars generally cost more to insure due to higher repair costs.

- Coverage Type: The type and amount of coverage you choose also affect your rates. Comprehensive and collision coverage are included in full coverage, which is more expensive than liability-only coverage.

- Credit Score: Some insurers use your credit score to assess your risk level. A higher credit score could lead to lower rates.

- Age and Gender: Younger drivers and males tend to pay higher rates because they are statistically more likely to be involved in accidents.

- Deductible: Your deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premium but increases your financial responsibility in the event of a claim.

With these factors in mind, finding the right car insurance provider in Georgia becomes crucial. While there are numerous options available like for low income car insurance, not all insurance companies offer the same level of service and value for your money.

Introducing Root Car Insurance

Amidst the sea of car insurance companies, Root Car Insurance stands out as a revolutionary and innovative choice for drivers in Georgia. Root doesn’t follow the traditional insurance model; instead, it employs a data-driven approach to set your rates. Root believes that good drivers should be rewarded with lower premiums, and their methodology reflects this commitment.

How Root Car Insurance Works

Root Car Insurance evaluates your driving habits to determine your insurance rate. Safe drivers receive lower rates, while those with reckless driving habits may not receive a quote at all. Here’s how Root Car Insurance works:

- Rate Based on Driving: Before offering you a quote, Root tracks your driving behavior using its mobile app. This data is then used to calculate your rate. The better you drive, the better your rate.

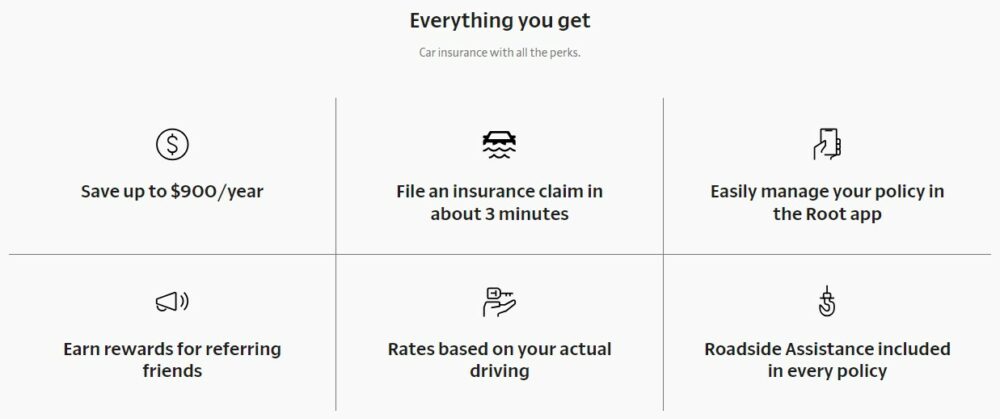

- Full and Liability Coverage: Root offers both full and liability coverage, so you can choose the insurance that suits your needs. Whether you want comprehensive coverage to protect your vehicle or just the minimum liability coverage required by Georgia law, Root has you covered.

- Mobile Convenience: Everything with Root can be managed from your mobile device. You can add drivers, change coverage, add or remove vehicles, and even file claims—all at your fingertips.

- Quick and Easy Claims: In case of an accident, filing a claim with Root takes just three minutes through their app. Snap pictures of the accident, press the “file claim” button, and you’re set.

- Free Roadside Assistance: Root includes free roadside assistance with every policy. If you’re stranded with a flat tire or facing bad weather, they’ve got you covered.

- Lyft Credits: Root provides credits for Lyft rides, ensuring you have a safe ride home on special occasions like New Year’s Eve.

- Digital Documentation: All your insurance documents, including your proof of insurance and policy details, are available on your mobile phone for easy access and sharing.

With Root Car Insurance, you have a car insurance provider that rewards you for being a safe and responsible driver. It’s a win-win situation—you get the coverage you need at a price that reflects your driving habits.

How Root Car Insurance Saves You Money

Let’s dive deeper into how Root Car Insurance can help you save money:

- Customized Rates: Root evaluates your driving habits before offering a quote. Safe drivers receive lower rates, ensuring you get the best price for your insurance. In fact, Root’s data-driven approach means that your driving behavior accounts for a significant portion of your rate—35%, to be exact.

- Full and Liability Coverage: Root offers both full and liability coverage, so you can choose the insurance that suits your needs. With this flexibility, you can avoid spending too much for insurance you don’t require.

- Mobile Convenience: The Root app makes managing your policy a breeze. You can add or remove drivers, adjust coverage, and even file claims—all from your mobile device.

- Swift and Easy Claims: Filing a claim with Root is remarkably easy and fast. In just three minutes, you can document the accident and initiate the claims process through the app.

- Free Roadside Assistance: Root includes free roadside assistance with every policy. Whether you’re stuck with a flat tire or need a tow, Root has your back.

- Lyft Credits: Root provides Lyft credits, allowing you to enjoy free rides on special occasions. It’s a convenient perk that ensures you can always get home safely.

- Digital Documentation: All your insurance documents, including your proof of insurance and policy details, are stored on your mobile phone. This makes it easy to provide proof of insurance when needed, whether it’s during a traffic stop or while sharing documents with others.

With these features, Root Car Insurance stands as a comprehensive solution for drivers in Georgia who want top-notch coverage without breaking the bank. The company’s commitment to data-driven pricing means you’re not just another policyholder; you’re an individual with unique driving habits.

How to Apply for Root Car Insurance

Getting started with Root Car Insurance is simple:

- Download the App: Download the Root Car Insurance app to your mobile phone. Both iOS and Android devices can use the application.

- Start Your Test Drive: Once you’ve downloaded the app, you can begin your test drive. During this process, Root will assess your driving habits to determine your potential savings. The more you save, the better driver you are.

- No Hassle: Root Car Insurance eliminates the need for extensive questionnaires, agent phone calls, or endless emails. You can start your policy in a matter of minutes. Root values simplicity and transparency in the insurance process.

Conclusion

Don’t let expensive car insurance drain your wallet. If you want to start saving money on your car insurance in Georgia, look no further than Root Car Insurance. Download the app, start your test drive, and discover how Root can help you save big on your car insurance premium. With Root, you can have confidence that you’re getting the coverage you need at a price that matches your skills behind the wheel. Say goodbye to overpaying for coverage and hello to affordable, customized car insurance that rewards safe drivers.

Frequently Asked Questions (FAQs)

What is Root Car Insurance and how does it work?

Root Car Insurance is an innovative insurance company that determines your insurance rate based on your driving behavior. To get a quote, you’ll need to download the Root app and go through a test drive period. During this time, the app tracks your driving habits, and your rate is calculated accordingly. Safe drivers are rewarded with lower premiums, while high-risk drivers may not receive a quote.

How can I sign up for Root Car Insurance?

Signing up for Root is easy. Simply download the Root Car Insurance app to your mobile phone, and start your test drive. The app will evaluate your driving habits, which will determine your potential savings.

What kind of coverage does Root Car Insurance offer?

Root Car Insurance offers both full and liability coverage, allowing you to choose the level of protection that suits your needs. Whether you’re looking for comprehensive coverage or just the state minimum, Root has you covered.

Are there any extra perks or benefits with Root Car Insurance?

Yes, Root Car Insurance offers several additional benefits. These include free roadside assistance, Lyft credits on special occasions, digital documentation for easy access to your insurance details, and a simple three-minute claims filing process through the app.

Is Root Car Insurance available only in Georgia, or can I get it in other states as well?

While Root Car Insurance initially gained popularity in Georgia, it has expanded to serve drivers in multiple states across the United States. Be sure to check if Root is available in your area by visiting their website or using the app.