Are you tired of low income and high expenses? If you also run out of money by the end of the month, then budgeting your earnings is essential. Budgeting for beginners is the foundation of financial stability, yet many people overlook this crucial aspect of managing their money. If you’ve ever wondered how to create a budget and take control of your finances, you’re in the right place. In this comprehensive guide, we’ll walk you through the step-by-step process of budgeting for beginners, providing valuable insights and a free spreadsheet to get you started.

Budgeting For Beginners: A Step By Step Process

A successful budget is one where your spending consistently falls below your income. It’s a tool that enables you to save, invest, and achieve your financial goals. With dedication and the right approach, you can use your budget to enrich your life and secure your financial well-being. Let’s explore easy steps for budgeting for beginners.

Step 1: Get Set Up

Get set up for financial success by collecting your recent financial statements, such as bank and credit card statements. Budgeting with a spreadsheet is your essential tool for the journey ahead. If you’re wondering how to save money on a low income, these materials are vital to understanding your financial situation and making informed decisions.

- Bank Statements: When preparing your budget, collect statements from your bank, credit card, and debt accounts for the past month. These statements not only help you track your expenses but also ensure you choose the best credit card for students based on your financial history.

- Spreadsheet Method: Spreadsheet Method will be your budgeting tool, helping you organize your finances effectively. Get set up for financial success by collecting your recent financial statements, such as bank and credit card statements.

Step 2: Track Your Expenses

Creating a budget requires tracking and recording all your expenses from the previous month. The spreadsheet will guide you through this process. Here’s how to fill out the columns: How to Create a Budget, follow this process:

- Date: Record the date of each purchase.

- Expense: Specify what you purchased (e.g., phone bill, dental insurance, rent).

- Expense Category: Categorize expenses using the provided options (e.g., monthly bill, health insurance, rent).

- Spending Type: Differentiate between fixed (e.g., rent, car payment, debt) and variable expenses (e.g., groceries, gas, eating out).

- One/Need: Determine whether the expense is a need (essential) or a want (non-essential).

- Amount: Enter the exact amount spent on each item or service.

This meticulous tracking will give you a clear picture of your financial situation.

Step 3: Subtract Spending from Income

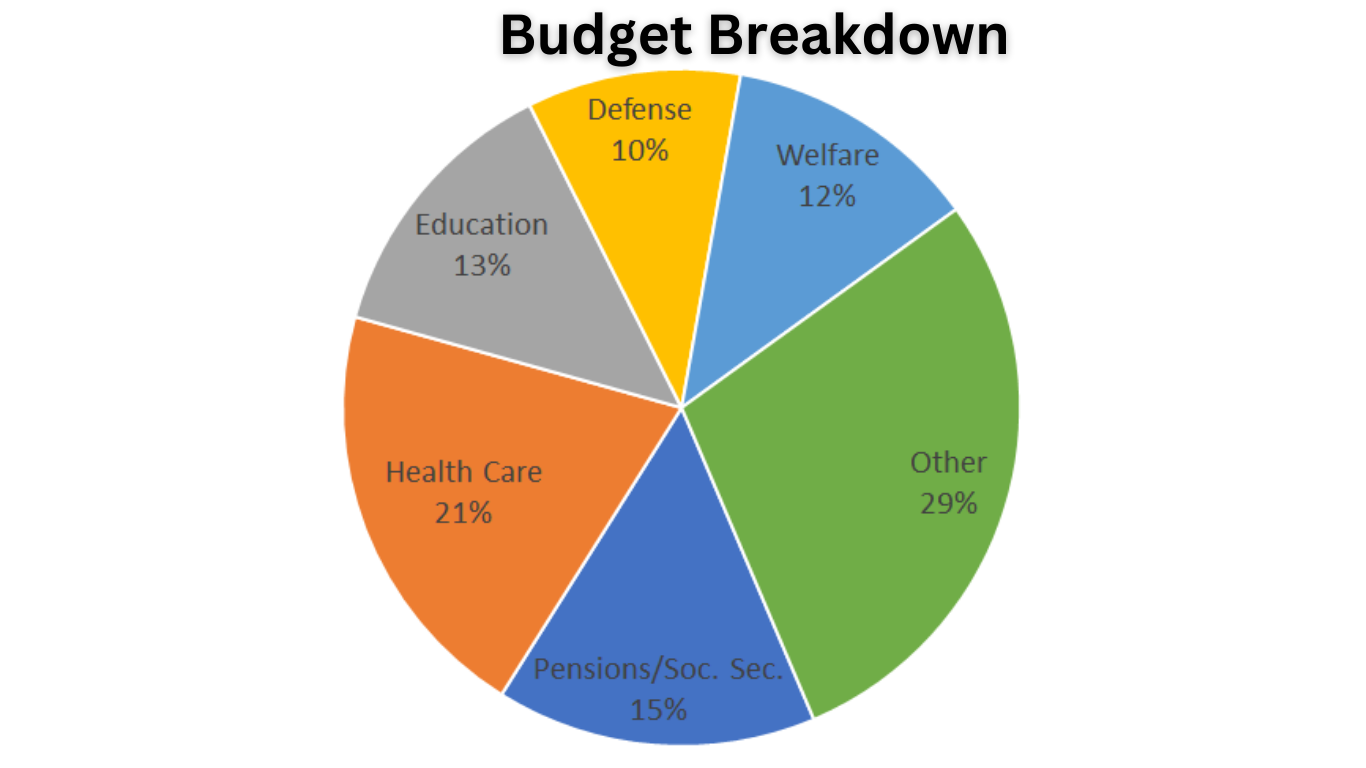

A successful budget means spending less than you earn. Use the Budget Breakdown tab in the spreadsheet to calculate your monthly income after taxes. Then, check whether your spending exceeds your income. Ideally, you want a positive balance, indicating that you’re saving money.

Step 4: Analyze Your Expenses

If your spending surpasses your income, it’s time to scrutinize your expenses. The spreadsheet will help you with this. Here’s what to focus on:

- One/Need Spending: Identify high spending on wants and consider cutting down on non-essential items like eating out, subscription services, or unnecessary purchases.

- Variable Expenses: Analyze variable expenses (e.g., gas, groceries) to find ways to reduce or eliminate them. Record potential savings in the provided table.

- Fixed Expenses: Review fixed expenses (e.g., rent, car payment) for opportunities to lower costs. Record potential savings in the fixed expenses table. By identifying areas where you can cut expenses, you’ll work towards a more sustainable budget.

Step 5: Create Saving Goals

With a sustainable budget in place, you can allocate the extra money towards your financial goals. In the “Savings Goals” tab, record your objectives, whether it’s building an emergency fund, contributing to a retirement account, or saving for a specific purpose. This step ensures you have a clear roadmap for your financial future.

Step 6: Constantly Revisit and Revise

Remember that budgeting is an ongoing process. Your lifestyle and income will change over time, so your budget must adapt accordingly. The key to success is maintaining a budget where you consistently spend less than you earn.

Budgeting for beginners is a valuable financial skill that takes time to master. By following these steps and using the provided spreadsheet, you can create a budget that empowers you to take control of your finances and achieve your financial goals.

Frequently Asked Questions

1. Why is budgeting for beginners is essential?

Budgeting is essential for beginners because it provides a clear understanding of your financial situation. It helps you track your spending, control your expenses, save money, and work toward your financial goals. Without a budget, it’s challenging to manage your finances effectively.

2. How do I start budgeting as a beginner?

As a beginner, start by gathering your financial statements, tracking your expenses, and using a budgeting tool like the provided spreadsheet. Categorize your spending, analyze your expenses, and ensure that your spending is less than your income. Create savings goals to give your budget purpose.

3. What’s the difference between fixed and variable expenses?

Fixed expenses are regular, predictable costs that typically remain the same each month, such as rent or mortgage payments, car loans, or debt repayments. Variable expenses are costs that fluctuate, like groceries, dining out, or entertainment. Distinguishing between the two is crucial when budgeting.

4. How often should I revisit my budget?

It’s recommended to revisit your budget regularly, ideally at the end of each month. This allows you to adjust for any changes in your income or spending patterns. Major life events, like a new job or a move, may also necessitate immediate budget revisions.

5. What if my expenses exceed my income in my budget?

If your expenses exceed your income in your budget, it’s a sign that you need to make adjustments. Analyze your spending to identify areas where you can cut back or find additional sources of income. The goal is to achieve a positive balance, allowing you to save and work toward your financial objectives.

Conclusion

Budgeting for beginners can seem daunting, but it’s a crucial step toward financial empowerment and security. By following the steps outlined in this guide and utilizing the provided spreadsheet, you can embark on a journey to a more stable and prosperous financial future. Creating a budget isn’t a one-time task; it’s an ongoing commitment. Your financial situation will evolve, and so should your budget.