When contemplating the use of your credit card to access cash, it’s imperative to grasp the intricacies of cash advances. This article delves deep into the process of How to get cash from credit card, shedding light on both the procedure and the potential pitfalls. Understanding the nuances of cash advances is crucial for making informed financial decisions. Discover why this method may not be the most prudent choice and explore alternative options that can help you manage your finances more effectively. Learn how to navigate the world of credit card cash advances wisely for a secure financial future.

The High Cost of Cash Advances

Cash advances come with a hefty price tag. The interest rates for cash advances are significantly higher than those for regular purchases made with your credit card which is like burden when we get cash from credit card. Let’s take an example: if your credit card has a purchase APR of 17.49%, the cash advance APR could be as high as 27.49%. That’s a substantial difference and should make you think twice about using this option.

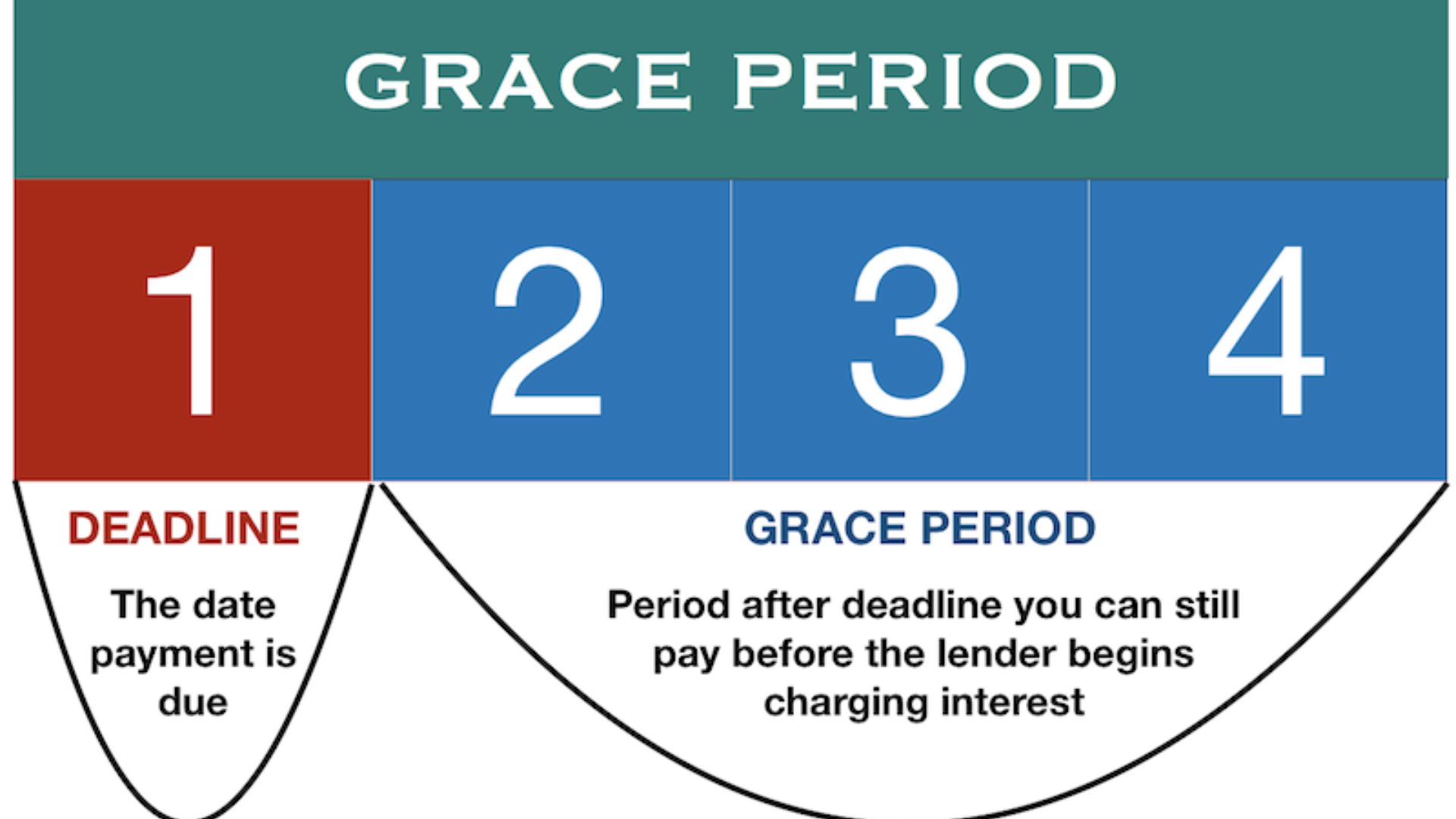

No Grace Period: Interest Starts Immediately

Unlike regular credit card purchases that offer a grace period for interest-free repayment, cash advances offer no such respite. When you make a standard credit card purchase, you typically enjoy a grace period during which you can settle your balance without incurring any interest charges, along with that use 0 interest credit cards. However, with cash advances, this privilege is absent. The moment you withdraw cash from an ATM using your credit card, interest begins to accumulate immediately. This means you’re instantly burdened with interest charges while get cash from credit card, providing no opportunity for a cost-free repayment window. Understanding this critical distinction can help you make more financially prudent decisions.

The Hidden Fees

In addition to the high-interest rate, credit card companies impose fees for cash advances. These fees typically range from 2% to 5% of the amount you withdraw. To make matters worse, if the fee is less than a certain threshold (e.g., $100), they may charge a fixed fee, which can be even higher. These fees can quickly add up, making cash advances an expensive option, all the fees were described to you at the time of credit card approval.

Debt Allocation: A Favorable Twist

Credit card debt allocation offers a silver lining worth noting. By law, credit card companies must allocate your minimum payment to the highest-interest debt component. If your card carries both regular purchases and cash advances, this rule works in your favor. Your minimum payment will be directed towards paying down the high-interest cash advance balance first. This strategic approach helps you reduce the most costly debt more quickly. Understanding this advantageous debt allocation principle empowers you to make more informed financial choices, ultimately saving your money and accelerating your path to financial stability.

The Catch: Paying Extra

But there’s a catch worth your attention. Should you choose to pay beyond the minimum requirement, credit card companies possess the discretion to assign the surplus to your lower-interest debt. This practice can inadvertently prolong the timeframe required to eliminate your cash advance balance. It’s a strategic move on their part to keep you servicing the higher-interest debt for an extended duration. Being aware of this practice enables you to make more informed payment decisions, ensuring your financial strategy aligns with your goals and minimizes interest costs in the long run, paying interests at time improved your bad credit score.

Exploring Better Alternatives

Considering the drawbacks associated with cash advances, it’s vital to seek out superior alternatives for obtaining the necessary funds. Peer-to-peer loans and lenders present attractive options with more favorable interest rates and flexible terms. Additionally, exploring the possibility of financial support from trusted friends or family members can be a wise choice during times of need. Their terms tend to be more accommodating and forgiving compared to credit card companies. By exploring these alternatives, you can access the cash you require while mitigating the financial burdens and disadvantages often associated with cash advances on credit cards.

Conclusion: Avoiding Costly Cash Advances

Using your credit card to get cash is rarely a wise financial decision. The high interest rates, immediate accrual of interest, and hidden fees make it an expensive way to get cash from credit card. Instead, explore more affordable options, such as peer-to-peer lending or seeking help from trusted individuals. By avoiding get cash from credit card, you can save yourself from the financial burden of high-interest debt.

Remember to always make informed financial decisions and prioritize your long-term financial well-being over short-term convenience.

Frequently Asked Questions (FAQs)

What is a cash advance on a credit card?

A cash advance on a credit card is a transaction where you use your credit card at an ATM to withdraw cash. Unlike regular credit card purchases, cash advances typically come with higher interest rates, immediate interest accrual, and additional fees.

Why are cash advances on credit cards costly?

Cash advances are expensive primarily due to their high-interest rates, which are significantly higher than the rates for regular credit card purchases. In addition to the interest, credit card companies also charge fees for cash advances, making them a costly way to access cash.

Is there a grace period for cash advances?

No, there is no grace period for cash advances. When you make a regular purchase with a credit card, you often have a grace period during which you can pay off the balance without incurring interest. However, with cash advances, interest begins accumulating immediately upon withdrawal from the ATM by which sometimes we hesitate to get cash from credit card.

Can I choose how my payments are applied to my credit card balance?

Credit card companies are required by law to apply the minimum payment to the debt with the highest interest rate. However, if you make payments above the minimum amount, the credit card company may allocate the extra payment to lower-interest debt, which can prolong the time it takes to pay off your cash advance balance.

What are some better alternatives to cash advances?

There are several alternatives to cash advances that are more cost-effective. Consider peer-to-peer lending platforms, which often offer lower interest rates and flexible terms. Additionally, reaching out to friends or family for financial support can be a more favorable option in times of need, as they may not charge interest or impose fees.