If you’re a business owner, freelancer, or contractor who’s gearing up for tax season, you’ve likely heard about the 1099 NEC Instructions. This essential document helps you report non-employee compensation to the IRS. In this guide, we’ll walk you through the process of filling out the 1099 NEC form step by step and provide valuable insights to ensure you meet all the necessary requirements.

What is Form 1099 NEC?

Form 1099 NEC, also known as the “Non-Employee Compensation” form, is used to report payments made to individuals, partnerships, estates, or in some cases, corporations, for services rendered in the course of your trade or business. This form is crucial for tax reporting purposes and helps the IRS track income earned by individuals who are not classified as employees.

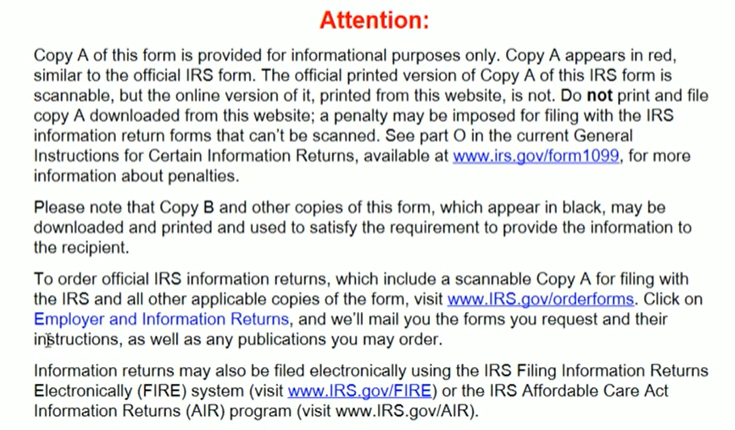

Ordering the Official IRS Information Return

Before diving into the specifics of filling out Form 1099 NEC, it’s essential to understand that the PDF version of the form available on the IRS website is not the one you’ll submit to the IRS. To obtain the official IRS Information Return, which includes a scannable copy for filing with the IRS, follow these steps:

- Visit the IRS website at irs.gov/order forms.

- Click on the “Employer and Information Returns” section.

- Request the forms you need, and the IRS will mail them to you, along with detailed instructions.

Now, let’s explore the key parameters you need to meet when deciding whether to file Form 1099 NEC.

Conditions for Filing Form 1099 NEC

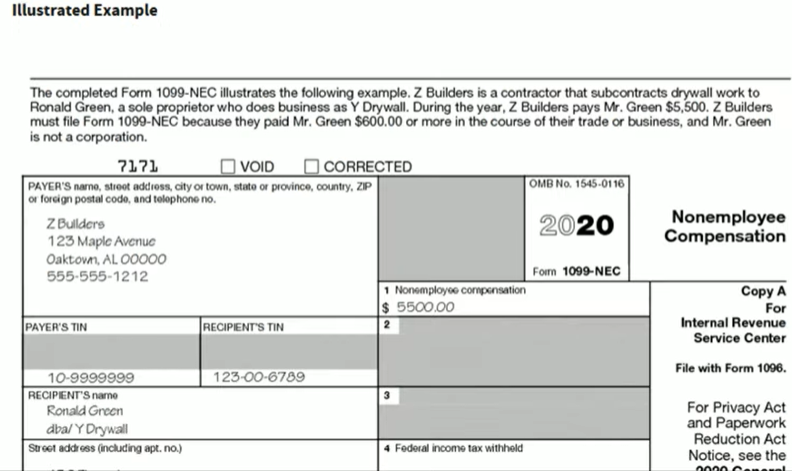

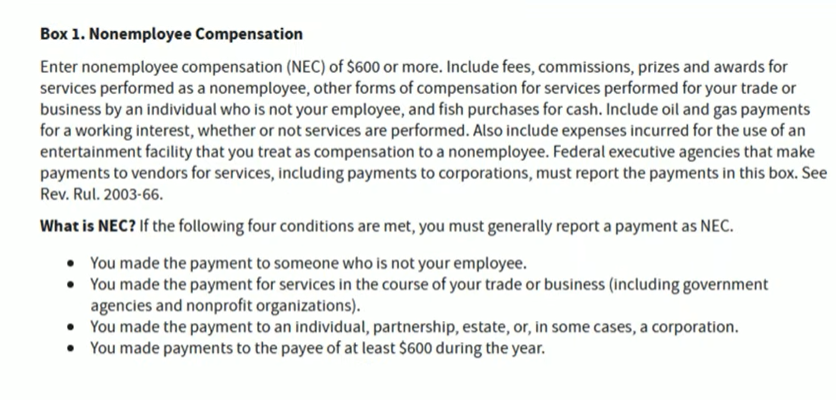

You should generally report a payment as NEC or non-employee compensation if the following conditions are met:

- Payment to Non-Employee: You made the payment to someone who is not your employee.

- Payment for Services: The payment was made for services provided in the course of your trade or business.

- Recipient Type: The payment was made to an individual, a partnership, an estate, or, in some cases, a corporation.

- Minimum Payment: You made payments to the payee totaling at least $600 during the tax year.

If your situation aligns with these conditions, it’s time to fill out Form 1099 NEC.

Filling Out Form 1099 NEC

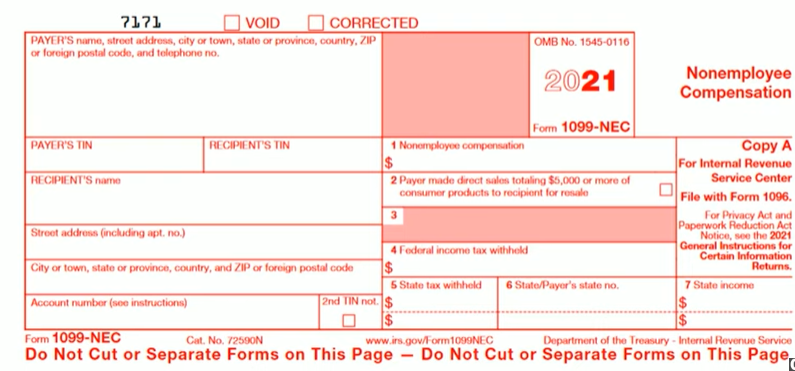

Let’s break down the form’s sections step by step:

Payer’s Information (Box 1)

- Payer’s Name and Address: Enter your business’s name and address in this section. Include a phone number for contact purposes.

- Payer’s Tax Identification Number (TIN): Provide your TIN, which could be your Employer Identification Number (EIN) or Social Security Number (SSN).

Recipient’s Information

- Recipient’s Tax Identification Number (Box 2): Enter the recipient’s TIN, which may be their EIN or SSN.

- Recipient’s Name and Address (Box 3): Fill in the recipient’s name, street address, city or town, state or province, country, and ZIP or foreign postal code.

Non-Employee Compensation (Box 1)

- Amount Paid (Box 1): Enter the total amount of non-employee compensation you paid to the recipient during the tax year. This figure should be equal to or greater than $600.

Other Boxes

The remaining boxes on Form 1099 NEC, such as Box 4 (Federal Income Tax Withheld) and Box 5 (State Taxes Withheld), may not apply to most scenarios. If applicable, follow the IRS instructions for filling out these boxes. You can also check online the Death Certificate form.

Conclusion

Form 1099 NEC is a vital component of your tax reporting obligations when you’ve made payments to non-employees for their services. Remember, the PDF available on the IRS website is for reference only. To file an official copy, order it from the IRS directly. For more detailed instructions and additional information, please refer to the IRS Instructions page. To obtain the official IRS Information Return forms.

What is Form 1099 NEC used for?

Form 1099 NEC, or the “Non-Employee Compensation” form, is used to report payments made to individuals, partnerships, estates, or certain corporations for services rendered in the course of your trade or business. It helps the IRS track income earned by non-employees.

Do I need to file Form 1099 NEC for payments less than $600?

No, you generally do not need to file Form 1099 NEC for payments that are less than $600 during the tax year. You are required to report payments of $600 or more to the IRS.

Where can I get an official Form 1099 NEC?

To obtain the official IRS Information Return, which includes a scannable copy for filing with the IRS, you can visit the IRS website at irs.gov. Follow the instructions provided on the website to request the necessary forms.

What is the deadline for filing Form 1099 NEC?

The deadline for filing Form 1099 NEC with the IRS is typically January 31st of the year following the tax year in which the payments were made. You should also provide a copy of the form to the recipient by the same deadline.

What if I made a mistake on Form 1099 NEC?

If you make a mistake on Form 1099 NEC, you may need to file a corrected form, known as a “1099 NEC Correction” or “1099 NEC Correction Form.” Ensure that you provide the corrected information to both the IRS and the recipient as soon as possible to avoid any penalties or issues.