If you’re a frequent Walgreens shopper, you’re in for a treat with the Walgreens Credit Card. In this guide, we’ll delve into the key features, rewards, and benefits of this card. Whether you’re a seasoned credit card enthusiast or just someone looking to save on your pharmacy and wellness expenses, this card might be the right choice for you.

What is the Walgreens Credit Card?

Walgreens, the renowned drugstore chain, has teamed up with Synchrony Bank and Mastercard to offer you an exclusive credit card. In a press release dating back to January 13th, 2021, Walgreens announced its expansion into the financial services business, promising a credit card and a store card in the second half of the year. Fast forward, and the Walgreens Credit Card is now a reality.

Key Features of the Walgreens Credit Card

The Walgreens Credit Card website offers two distinct cards: a credit card and a store card. Here’s what you need to know:

- Sign-Up Bonus: When you open an account and make your first purchase within 45 days, you’ll receive $25 in Walgreens Cash Rewards. There are no stringent spending requirements, making it accessible to all. While this might be on the lower side for sign-up bonuses, it’s still a reasonable incentive.

- Tier 2 Card: In our five-tier credit card system, we’d classify this card as a Tier 2. It stands out as it carries no annual fee and offers decent rewards.

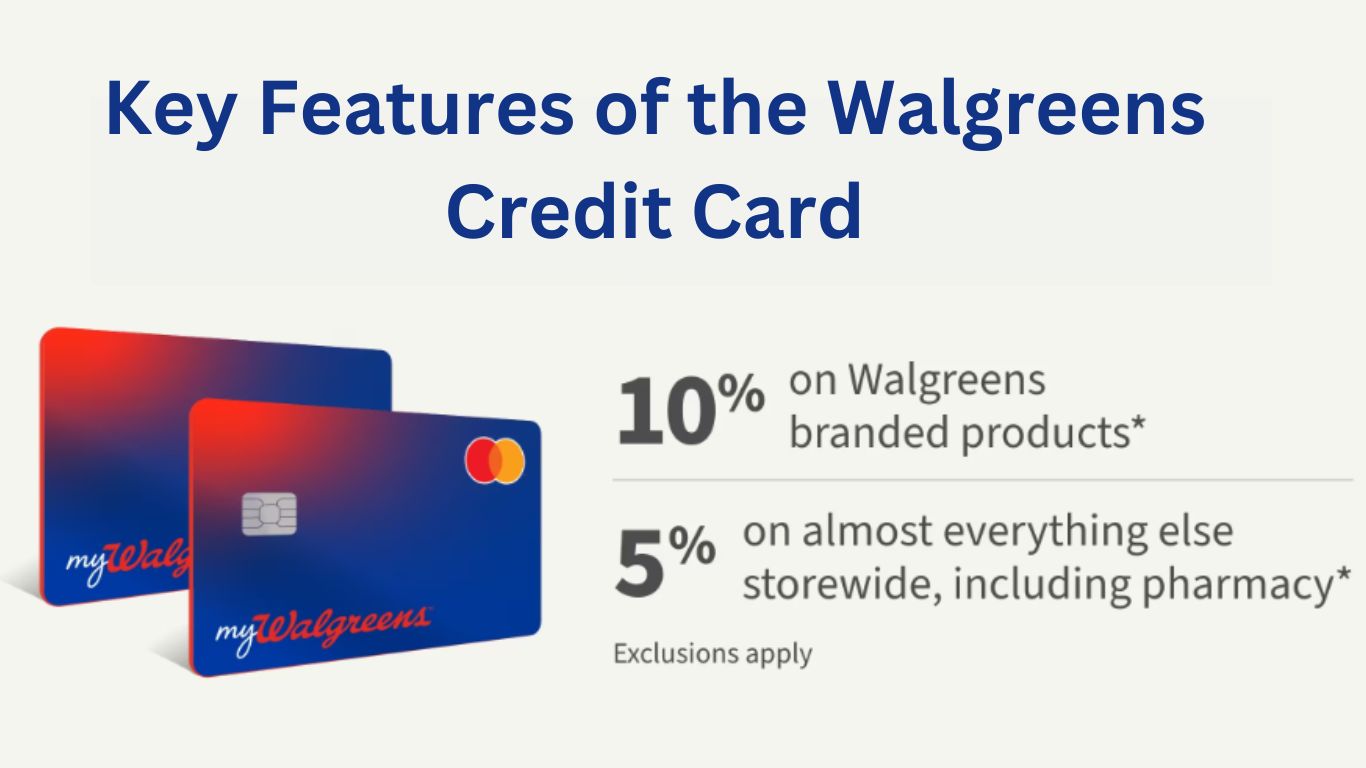

- Signature Benefits: For loyal Walgreens shoppers, the Walgreens Credit Card offers remarkable benefits. You get:

- 10% back on Walgreens branded purchases, which includes all products carrying the Walgreens brand. This is a fantastic way to save on everyday essentials.

- 5% in Walgreens Cash Rewards on all other Walgreens brands and pharmacy purchases. So, whether you’re buying Walgreens-branded products or medications, you earn rewards.

- Pharmacy Rewards: If you have ongoing medical needs, this card is especially valuable. Even with insurance, there are often co-pays, and these can add up. The Walgreens Credit Card offers a 5% reward on pharmacy purchases, which can make a significant difference in your healthcare expenses.

- Instant Reward Redemption: You can redeem your rewards instantly, making it easy to save on your Walgreens purchases.

- Healthy Activities Rewards: While the specifics of these rewards aren’t detailed, the card promises to reward you for healthy activities. It’s an intriguing benefit that might offer more value than meets the eye.

The Walgreens Mastercard

The key difference between the Walgreens Credit Card and the Walgreens Mastercard is the ability to use the latter outside of Walgreens. If you’re approved for the Walgreens Mastercard, you get:

- 3% back on grocery and health and wellness purchases made outside of Walgreens.

- 1% back on all other purchases outside of Walgreens.

This additional versatility can make the Walgreens Mastercard even more appealing for those who frequently shop for groceries or wellness products at other retailers.

How to Get the Walgreens Credit Card

When you apply for the Walgreens Credit Card, Synchrony Bank will assess your creditworthiness. Depending on your credit score, you’ll either be approved for the store card or the Mastercard. Both cards come with no annual fee, but the Mastercard offers more flexibility. For more options, you can also get the best Wells Fargo Credit Cards for rewards and more.

Conclusion

The Walgreens Credit Card is a tailored solution for loyal Walgreens customers and those seeking to save on healthcare expenses. While the sign-up bonus might not be the most generous, the ongoing rewards make up for it. If you’re a frequent Walgreens shopper or require regular pharmacy services, this card can be a valuable addition to your wallet.

Frequently Asked Questions (FAQs)

How can I apply for the Walgreens Credit Card?

To apply for the Walgreens Credit Card, you can visit the Walgreens website or apply in-store. The application process typically involves a credit check, and depending on your creditworthiness, you may be approved for either the store card or the Mastercard version.

Can I use the Walgreens Credit Card at locations other than Walgreens?

Yes, if you are approved for the Walgreens Mastercard, you can use it at locations outside of Walgreens. The Mastercard offers rewards for purchases made at other retailers, including groceries and health and wellness expenses.

What is the sign-up bonus for the Walgreens Credit Card?

The Walgreens Credit Card offers a $25 sign-up bonus in Walgreens Cash Rewards. To qualify, you need to open an account and make your first purchase within 45 days. There are no specific spending requirements beyond making that initial purchase.

Do I need to pay an annual fee for the Walgreens Credit Card?

No, the Walgreens Credit Card, both the store card and the Mastercard, do not charge an annual fee. This makes it a cost-effective option for those looking to save on their Walgreens purchases and healthcare expenses.

What are the benefits of using the Walgreens Credit Card for pharmacy purchases?

The Walgreens Credit Card offers a 5% reward on all pharmacy purchases, including medications and healthcare products. This benefit can be particularly valuable for individuals who regularly purchase prescription drugs or other medical necessities.