In the ever-evolving world of finance, more companies are introducing their versions of credit builder cards, each with a unique twist. Today, we’ll delve into one of my favorites in the fintech industry, Varo Credit Card, and their latest offering, the Varo Believe Credit Builder. Let’s explore the features that set this card apart from the others in the market.

The Rise of Credit Builder Cards

If you haven’t been keeping up with credit builder products, several companies like Chime, Extra, and various business fintech firms have recently launched credit builder cards. These cards aim to help you build or repair your credit score without the potential drawbacks associated with traditional credit cards.

Varo Credit Card Modern Approach

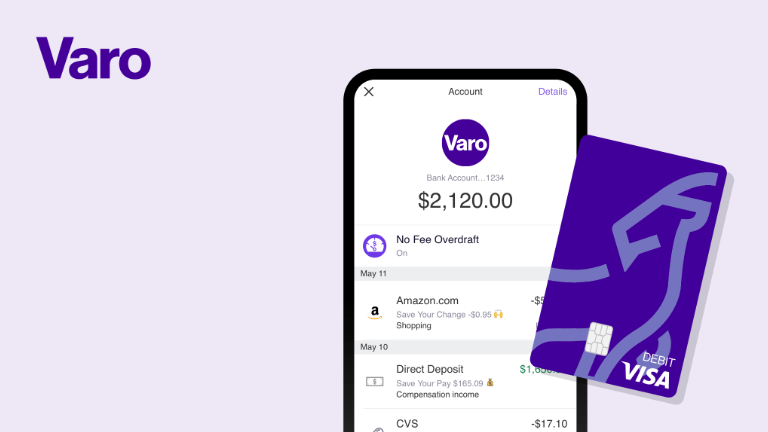

Varo, known for its modern and futuristic style, has entered the fray with the Varo Credit Card Believe Credit Builder. This card stands out not only for its unique look but also for its user-friendly approach to credit building.

Funding Flexibility

One significant advantage of the Varo Believe card is that you don’t need a Varo bank account to fund it. You can preload the card with funds from any external bank account. This flexibility can be a game-changer, especially when compared to Chime’s credit builder, which requires a Chime savings account.

Simple Credit Building Process

Once you open your Varo Believe secured account, preload it with a predetermined amount from your external bank account. Then, use the card for your regular purchases, just like a credit or debit card. Afterward, use the funds you set aside to pay off the card. Varo Credit Card reports these on-time payments to the major credit bureaus—Equifax, TransUnion, and Experian—accelerating the improvement of your credit score.

Developing Responsible Habits

Unlike some similar products, the Varo Believe card requires you to make payments, which you’ll need to do manually. While this might seem like a minor inconvenience, it fosters the habit of responsibly managing your credit. This discipline can prove invaluable when you eventually transition to a traditional credit card, where missed payments can result in high fees and interest charges.

Fee Structure

The Varo Believe Credit Builder is free to use, and it’s impossible to accrue interest or debt. However, there is a $15 late fee if you miss a payment. While no one likes fees, this one serves as a reminder to stay on top of your payments. By maintaining good habits, you can easily avoid this fee.

No Credit Check or Security Deposit

Applying for the Varo Believe card does not trigger a hard credit check, so it won’t negatively impact your credit score. Additionally, there’s no need for a security deposit. This sets it apart from secured credit cards, where you typically need to deposit funds as collateral.

No Traditional Credit Limit

Unlike traditional credit cards, the Varo Credit Card Believe card doesn’t have a fixed credit limit. You can spend as much as you preload into your account. While this means Varo can’t report a low credit utilization, it’s not a significant drawback since the primary focus is building a positive payment history.

ATM Access

The Varo Believe Credit Builder offers access to over 55,000 free-to-use ATMs, making it easy to make on-time payments without incurring additional expenses.

Conclusion

The Varo Believe Credit Builder is a straightforward yet effective tool for building or repairing your credit. While it may not offer groundbreaking features compared to other credit builder cards, its simplicity is by design. It provides a hassle-free way to enhance your credit score without accumulating debt or interest.

If you already have a Varo bank account or appreciate Varo’s approach, the Varo Believe Credit Builder is worth considering for your financial journey.

Frequently Asked Questions (FAQs)

What is the Varo Believe Credit Builder card?

The Varo Believe Credit Builder card is a financial product offered by Varo, a fintech company. It is designed to help individuals build or repair their credit scores without the risks associated with traditional credit cards.

How does the Varo Believe Credit Builder card work?

To use the Varo Believe card, you preload it with a predetermined amount of money from your external bank account. You then use it for everyday purchases like a regular credit or debit card. The money you’ve set aside is used to pay off the card balance. Varo reports your on-time payments to the major credit bureaus, helping improve your credit score over time.

Do I need a Varo bank account to get the Varo Believe Credit Builder card?

No, you do not need a Varo bank account to fund the Varo Believe card. You can fund it from any external bank account, providing flexibility for users who may not bank with Varo.

Is there an annual fee for the Varo Believe Credit Builder card?

No, there are no annual fees associated with the Varo Believe Credit Builder card. It is designed to be a cost-effective way to build credit.

What happens if I miss a payment with the Varo Believe card?

If you miss a payment on the Varo Believe Credit Builder card, there is a $15 late fee. While fees are generally not desirable, this fee can serve as a reminder to maintain responsible payment habits.

Does the Varo Believe Credit Builder card have a traditional credit limit?

No, the Varo Believe card does not have a traditional credit limit. You can spend up to the amount you preload into your Varo Believe account. This unique feature gives users control over their spending.

Does applying for the Varo Believe Credit Builder card affect my credit score?

No, applying for the Varo Believe Credit Builder card does not result in a hard credit check, so it won’t negatively impact your credit score. Varo does not require a security deposit for this card.

Can I withdraw cash with the Varo Believe Credit Builder card?

Yes, you can use the Varo Believe card at over 55,000 free-to-use ATMs to withdraw cash. However, it’s essential to use this feature responsibly, as the primary purpose of the card is to build credit through on-time payments.

How does the Varo Believe Credit Builder card compare to other credit builder products?

While the Varo Believe Credit Builder card may not introduce groundbreaking features, its simplicity and flexibility make it a valuable tool for individuals looking to build or rebuild their credit scores. It offers an alternative to traditional credit cards without the risk of accruing debt or interest.

Is the Varo Believe Credit Builder card recommended?

The Varo Believe Credit Builder card is recommended for those who already have a Varo bank account or appreciate Varo’s approach to finance. However, whether it’s the right choice for you depends on your specific financial situation and goals.