Are you facing the challenge of a low credit score, grappling with the aftermath of bankruptcy, or simply in need of a lifeline to rebuild your credit? Look no further. The Surge MasterCard is tailored precisely for individuals like you, who may have encountered credit hurdles. In this comprehensive guide, we will delve deep into the intricacies of the Surge Credit Card, exploring its features, benefits, and potential drawbacks. By the end of this article, you’ll have all the information you need to make an informed decision about whether the Rebuilding Credit is the right choice for your financial journey.

Why Choose the Surge Credit Card?

Let’s start by understanding the unique selling points of the credit recovery card and why it might be an attractive option for individuals with less-than-ideal credit profiles.

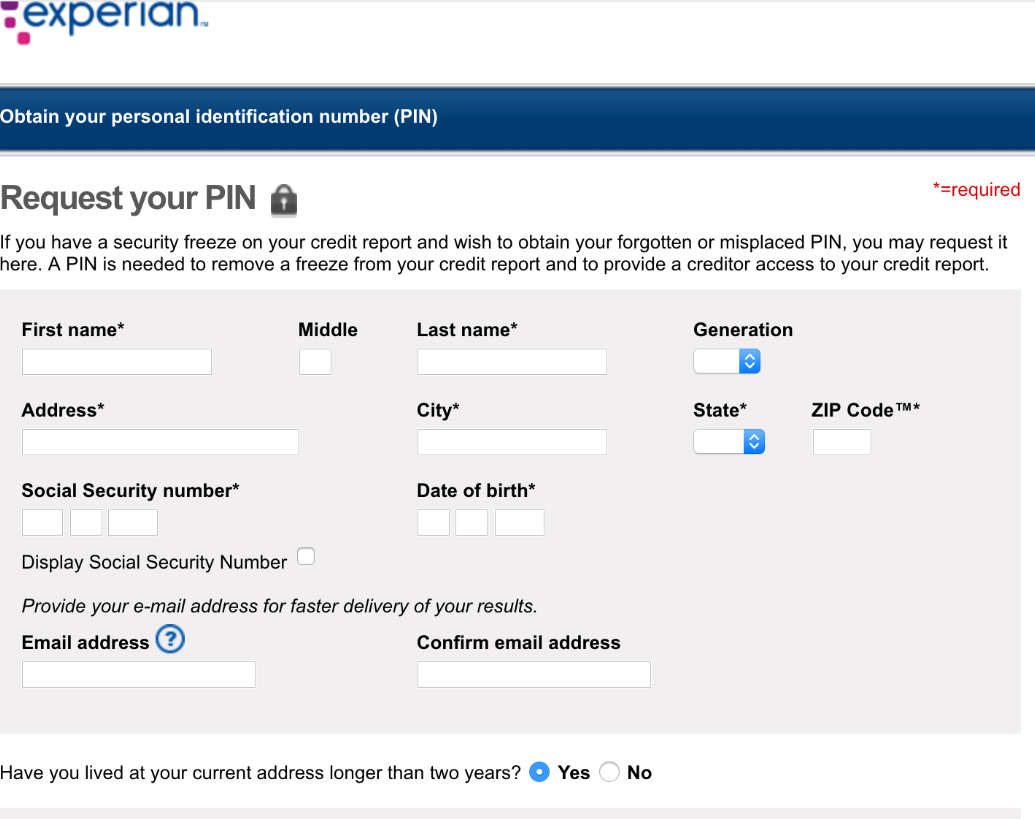

1. Soft Pull through Experian

One of the first things you’ll appreciate about the Rebuilding Card is its application process. Unlike some credit cards that perform hard inquiries, potentially harming your credit score, the Surge Card employs a soft pull through Experian. What does this mean for you? It means that checking your eligibility for this card won’t negatively impact your credit score. This soft inquiry offers you the peace of mind to explore your options without worrying about credit score repercussions.

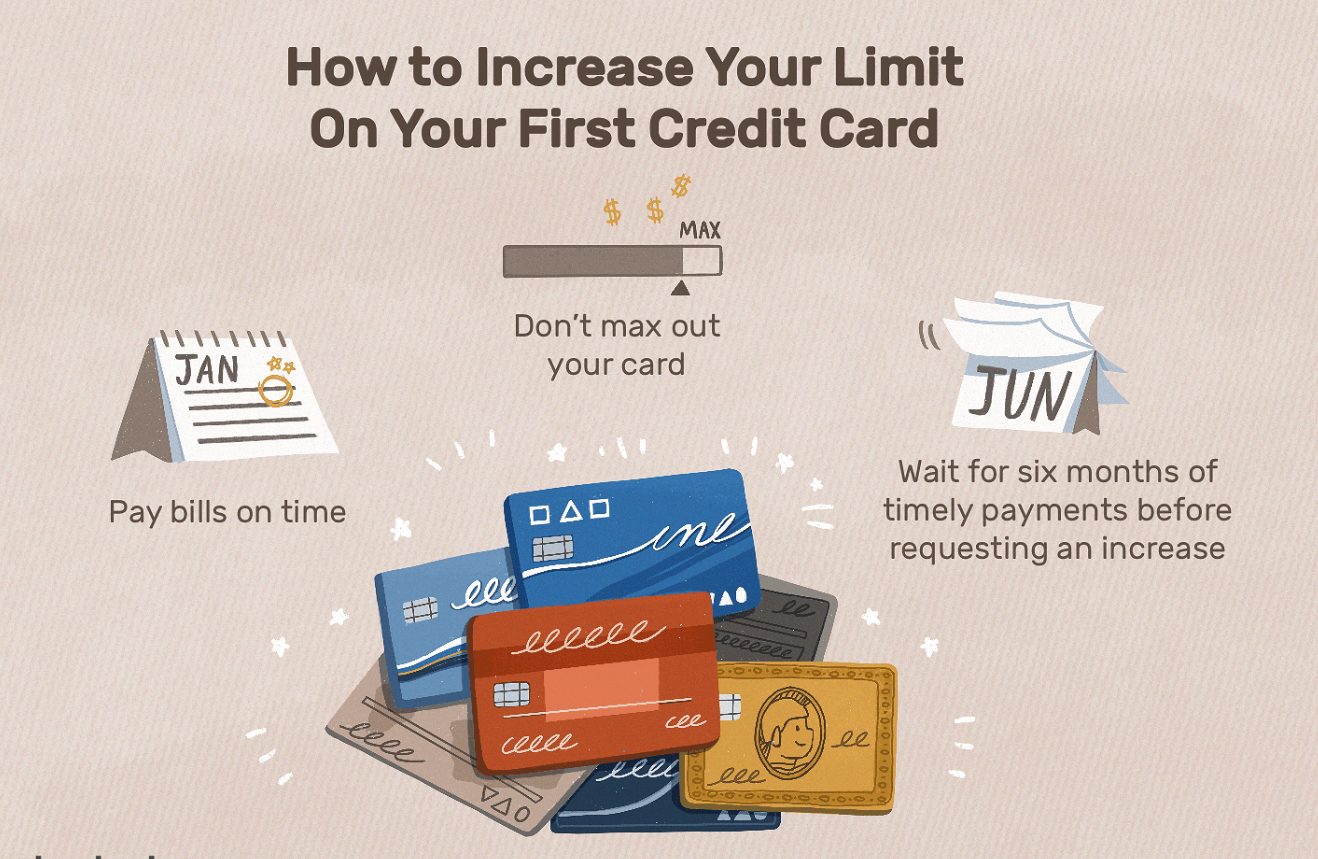

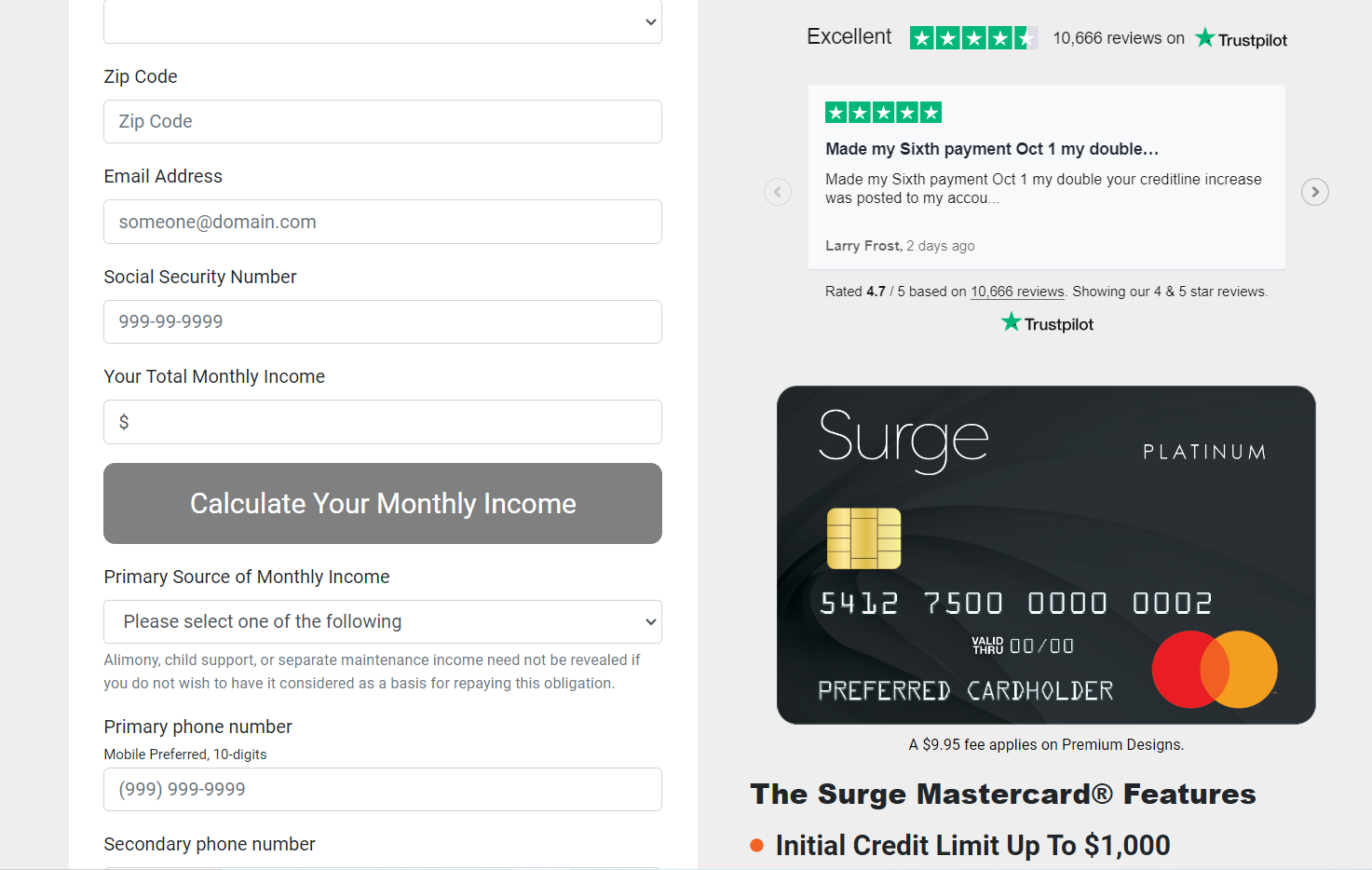

2. Initial Credit Limit and Doubling Potential

Upon approval, the credit recovery Card extends an initial credit limit to cardholders. This initial limit can be as modest as $300. However, the unique feature of this card is its potential to double your credit limit to $2,000 within just six months. How can you make this happen? The key lies in responsible credit management. Maintain a low credit utilization ratio, ensure on-time payments, and avoid maxing out your card. By demonstrating financial responsibility, you’ll unlock the card’s full potential and enjoy increased buying power.

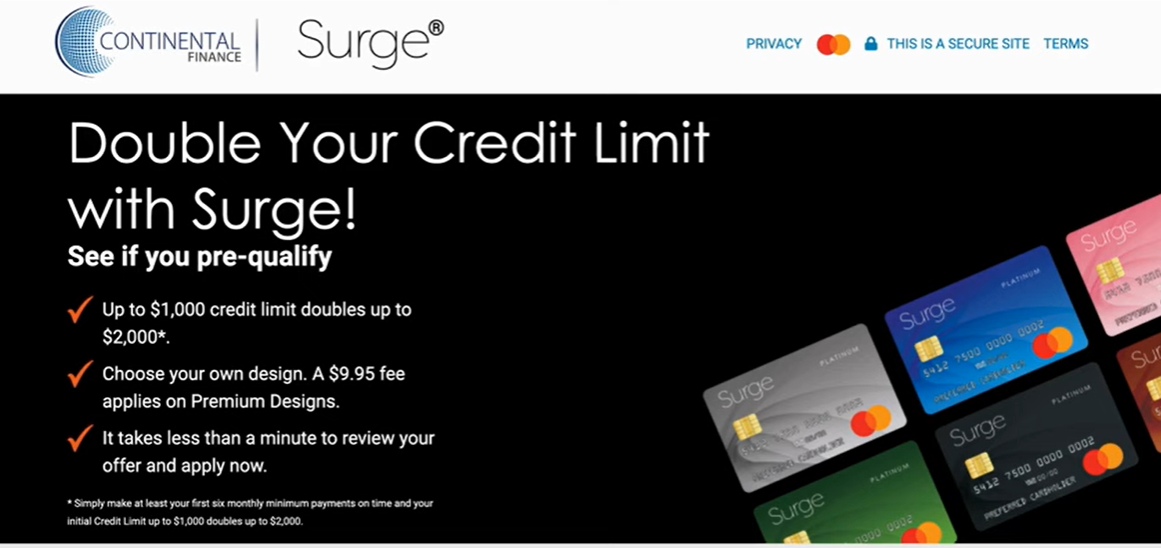

3. Flexible Card Design

Personalization is a significant draw for the Rebuilding Credit and Destiny Credit Card. For a one-time fee of $9.95, you can select your preferred card design from a range of options. This customization allows you to choose a card that reflects your style and personality while also serving as a valuable financial tool.

4. Pre-Qualification

The application process for the credit recovery card includes a pre-qualification step. This pre-qualification feature provides you with insight into your approval odds before you submit a formal application. For instance, if you receive a pre-qualification offer for a $500 credit limit, you can decide whether to proceed with the application. This transparency empowers you to make informed choices about your financial future.

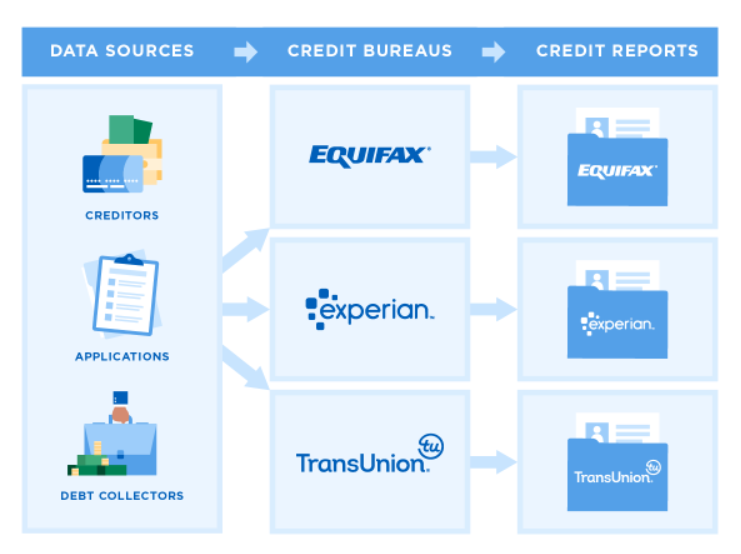

5. Reporting to All Three Credit Bureaus

Perhaps the most compelling advantage of the Surge Credit Card is its commitment to helping you rebuild your credit. The card reports your financial activity to all three major credit bureaus: Experian, Equifax, and TransUnion. This means that every responsible use of the card, from on-time payments to maintaining a low credit utilization ratio, will have a positive impact on your credit history. For individuals with a tarnished credit history, this reporting can be a game-changer.

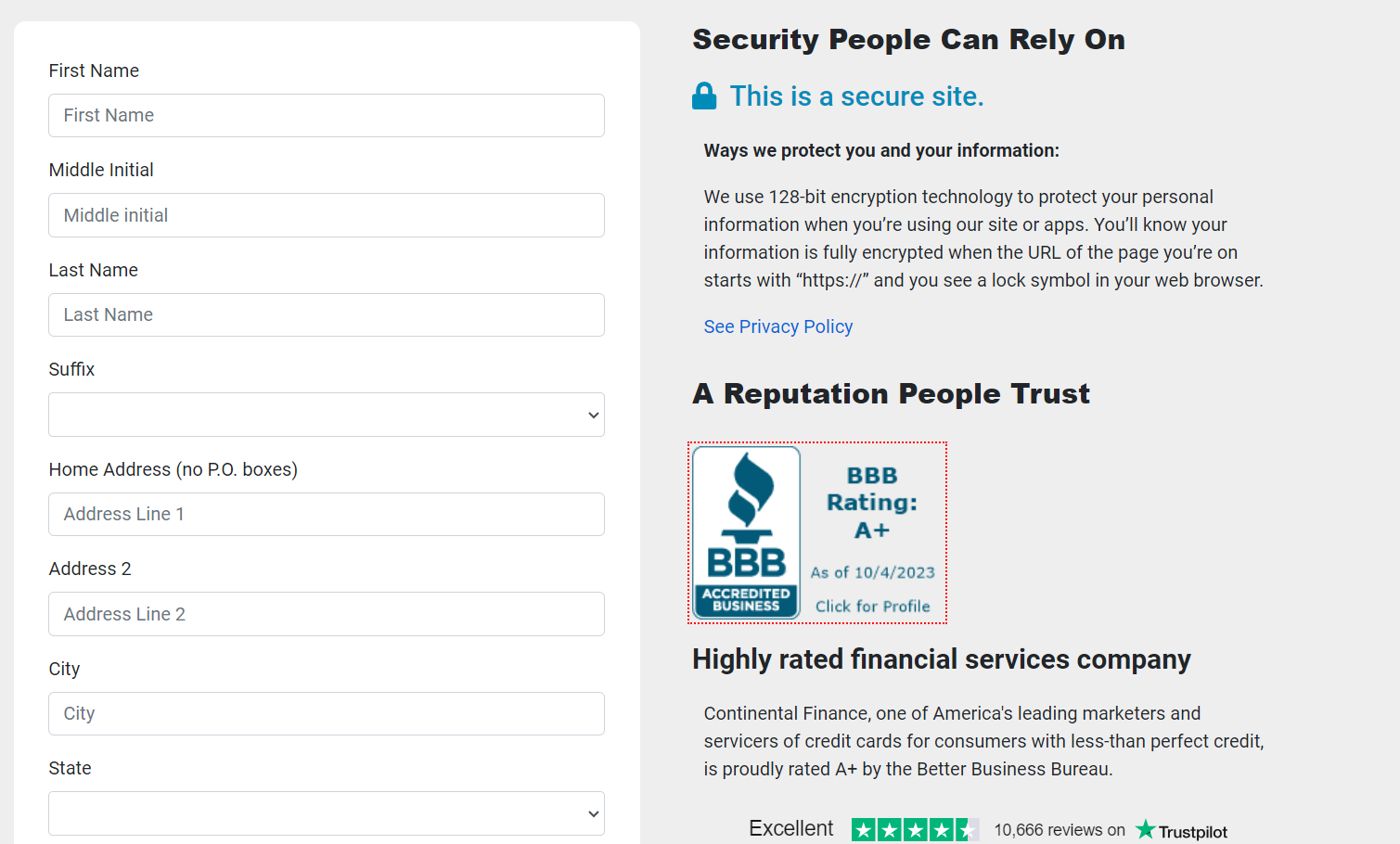

The Application Process

Now that you’re intrigued by the Rebuilding Credit benefits, let’s walk through the application process. Understanding what’s required and what to expect can make the process smoother.

Application Requirements

To apply for the credit recovery card, you’ll need to provide the following essential information:

- Your first name, middle name (if applicable), and last name.

- Your current residential address.

- An active email address for communication purposes.

- Your Social Security Number (SSN): This is crucial for identity verification and is a standard requirement for most credit card applications.

- Information about your primary source of monthly income: If you share finances with a spouse, partner, or significant other, you can include their income to strengthen your application.

- A valid phone number for contact purposes. for more information you can visit the website of credit card.

Authorization for Pre-Qualification

When completing the application, you’ll encounter an important checkbox. It’s labeled “I authorize pre-qualification.” This checkbox is a crucial step in the application process. Checking this box allows the card issuer to assess your creditworthiness without a hard credit inquiry. Before proceeding, carefully review all terms and conditions to avoid misunderstandings during the application.

Key Terms and Fees

Understanding the terms and fees associated with the Rebuilding Credit is essential to assess its true value. Let’s break down the key terms and fees you should be aware of:

1. Annual Percentage Rate (APR)

The APR for the credit recovery card is set at 29.99%. It’s important to note that this APR is relatively high compared to cards designed for individuals with excellent credit. However, for those seeking credit solutions while managing less-than-ideal credit histories, such rates are common. Consider this factor carefully and be prepared for the associated costs if you choose to carry a balance on the card.

2. Annual Fee

The annual fee for the credit recovery card varies based on your creditworthiness. Depending on your situation, you may encounter an annual fee of $75 or $125. It’s essential to understand that this fee is billed annually and will affect your overall card expenses.

3. Maintenance Fee

Another significant cost associated with the credit recovery card is the monthly maintenance fee. While it’s billed monthly, it effectively adds up to an annual expense. The maintenance fee is set at $10 per month, totaling $120 over the course of a year. This fee is in addition to the annual fee, so it’s crucial to factor it into your budget when considering this card.

4. Additional Card Fee

If you require an additional card for a family member or partner, there is a fee of $30 associated with obtaining an extra card. Keep this in mind if you plan to share the benefits of the credit recovery card with a loved one.

5. Late Payment Fee

Timely payments are crucial to avoid additional fees. The Rebuilding Credit imposes a late payment fee of $41 if you fail to make your minimum payment by the due date. Staying on top of your payment schedule is essential to prevent unnecessary costs.

Conclusion

The Rebuilding Credit can serve as a valuable tool on your journey to credit recovery. However, it’s essential to weigh its benefits against the associated fees and carefully consider your financial situation before applying. While the card does come with costs, it offers the opportunity to rebuild your credit and pave the way for a stronger financial future. Remember that credit repair begins with responsible financial habits. While cards like the credit recovery card can provide opportunities, your long-term success depends on your commitment to managing your finances wisely. As you work to improve your credit, consider exploring other credit options that may become available to you in the future.

Frequently Asked Questions

Who is the Surge Credit Card designed for?

The credit recovery card is designed for individuals with less-than-ideal credit profiles, including those with low credit scores, a history of bankruptcy, or those looking to rebuild their credit.

What is a soft pull through Experian?

A soft pull is a credit inquiry that does not negatively affect your credit score. In the case of the Rebuilding Credit, the application process involves a soft pull through Experian, meaning that checking your eligibility won’t harm your credit score.

How does the Surge Credit Card’s initial credit limit work?

The credit recovery card typically starts with an initial credit limit as low as $300. However, with responsible credit management, such as making on-time payments and keeping your credit utilization low, this limit can double to $2,000 within six months.

Does the Rebuilding Credit report to all three major credit bureaus?

Yes, one of the significant benefits of the Rebuilding Credit is that it reports your financial activity to all three major credit bureaus: Experian, Equifax, and TransUnion. This reporting can help improve your credit history over time.

What are the key fees associated with the credit recovery card?

The credit recovery card has several fees to be aware of, including an annual fee (which varies based on your creditworthiness), a monthly maintenance fee of $10, an additional card fee of $30 if you need an extra card, and a late payment fee of $41 for missed payments.