Credit card management can sometimes feel like navigating a maze, especially for those new to the world of credit cards. One common point of confusion is understanding the difference between the Statement Balance vs Current Balance. In this article, we will clarify the distinctions between these two balance types and explain which one you need to pay to avoid interest charges.

Statement Balance vs Current Balance: The Basics

When you access your credit card account online or through a mobile app, you will encounter both the Statement Balance and the Current Balance. Here’s what you need to know:

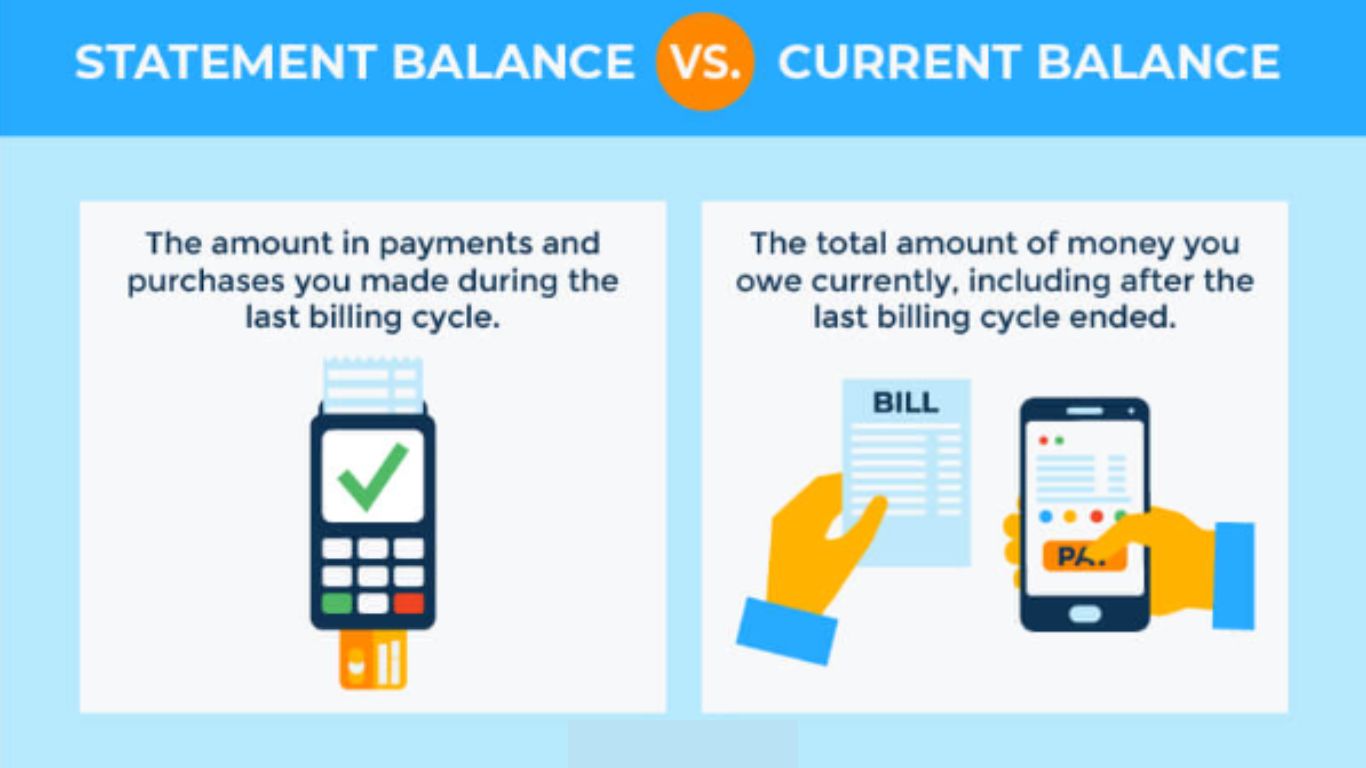

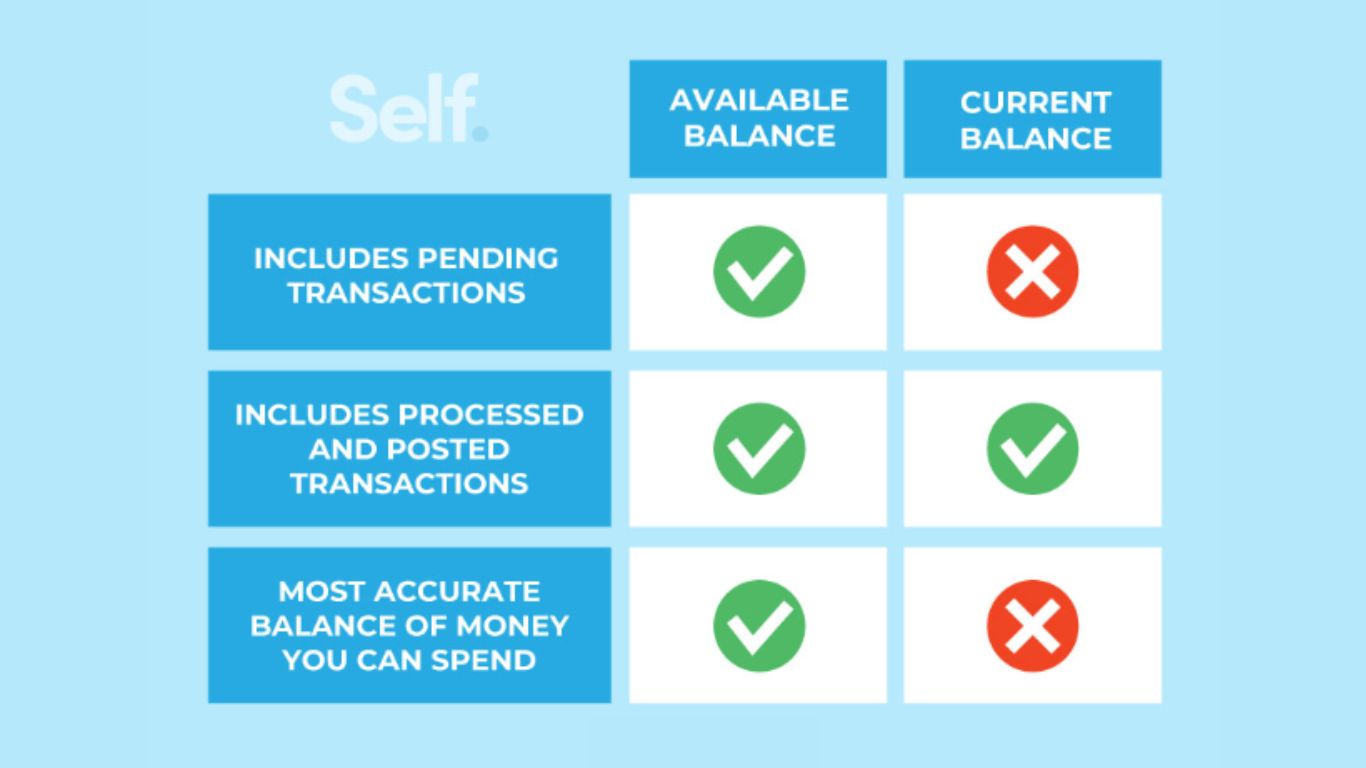

- Statement Balance: This is the amount you owe on your credit card as of the last statement date generated by your credit card company. It includes all charges from the statement period. If you had an outstanding balance before that period, it will also be included in the Statement Balance.

- Current Balance: Your Current Balance is the amount you owe today. It represents all your outstanding charges, including those made after the last statement was generated. Since the statement date is in the past, the Current Balance accounts for any new charges between that date and the present.

To simplify, think of the Current Balance as the Statement Balance plus any new charges and potential interest if you’re carrying a balance from month to month.

Paying Your Credit Card Bill

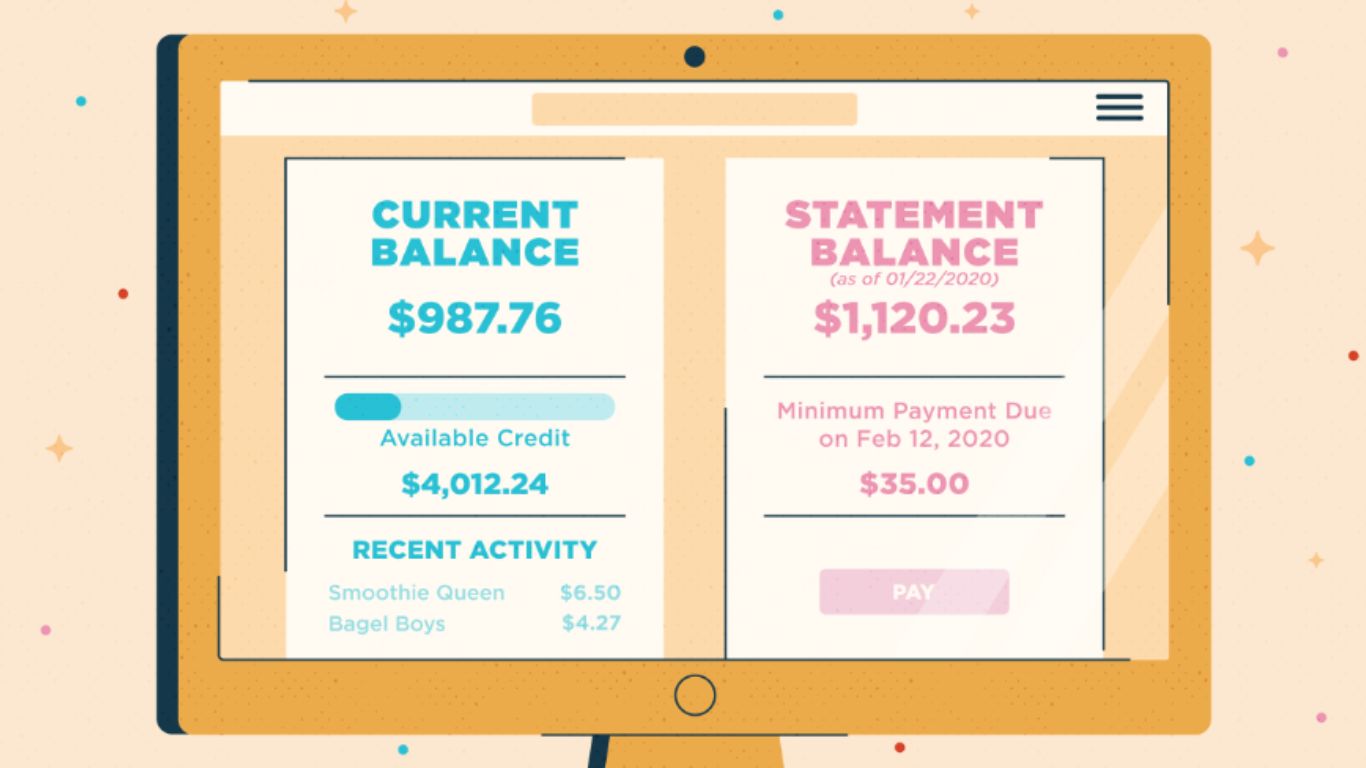

The question often arises: “Which balance should I pay to avoid interest charges?” The answer is straightforward: If you want to pay off your credit card in full and avoid interest, you only need to pay the Statement Balance. You do not need to pay the Current Balance.

Example: Let’s say your Statement Balance is $155.34, and your Current Balance is $299.84. If you want to avoid interest charges, you only need to pay the $155.34.

Understanding the Difference

To further illustrate the distinction, subtracting the Statement Balance from the Current Balance reveals the new charges made since the last statement was issued. In our example, it would be $144.50. However, you do not need to pay this new charge to avoid interest if you start from a zero balance.

Why Credit Card Companies Show Both Balances

Credit card companies display both balances for a couple of reasons:

- Courtesy: It’s helpful to see your Current Balance to understand how much you’ve spent since the last statement, especially if you’re not keeping track mentally.

- Interest Calculation: If you carry a balance and incur interest charges, knowing your Current Balance is crucial. Interest is calculated based on your average daily balance, so even if you pay the Statement Balance, you might still accrue daily interest on the Current Balance.

Delay in Balance Updates

After making a payment, you might notice that your Statement Balance vs Current Balance (check website) does not change immediately. This is because there’s a delay between when you make the payment and when it’s credited to your account. The credit card company needs to ensure the funds are available before updating your balances. Therefore, don’t panic if you don’t see an immediate change; check back after some time.

Conclusion

Comprehending the distinctions between the Statement Balance vs Current Balance on your credit card is vital for maintaining control over your finances and avoiding unnecessary interest charges. When it comes to making payments, remember that settling the Statement Balance in full is the key to steering clear of interest expenses. The Current Balance reflects all outstanding charges, including those made after the last statement, and paying it off entirely is typically not necessary to prevent interest accrual.

Frequently Asked Questions (FAQs)

What is the Statement Balance on my credit card?

The Statement Balance is the amount you owe on your credit card as of the last statement date. It includes all charges from the previous statement period and any outstanding balance from before that period.

How is the Current Balance different from the Statement Balance?

The Current Balance is the total amount you owe on your credit card today, encompassing all charges made after the last statement was generated. It represents your current outstanding debt.

Which balance should I pay to avoid interest charges?

To avoid interest charges, you typically only need to pay the Statement Balance. Paying the Current Balance is not necessary unless you wish to pay off new charges immediately.

Why do credit card companies display both Statement and Current Balances?

Credit card companies show both balances to provide a clear overview of your financial situation. It helps you keep track of new charges and, if applicable, calculate interest for those carrying a balance.

Why don’t my balances update immediately after making a payment?

There is often a delay between making a payment and seeing your balance update. Credit card companies ensure the availability of funds before applying your payment to your account. Balance updates may take some time.