When facing the loss of a spouse, the last thing on your mind may be Social Security benefits. However, understanding your rights and options regarding Social Security spousal death benefits is essential to ensure financial stability during these challenging times. In this article, we will delve into the key aspects of these benefits, helping you make informed decisions.

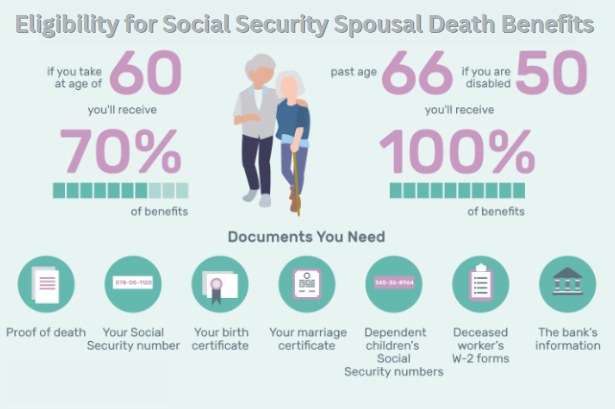

1. Eligibility for Social Security Spousal Death Benefits

To be eligible for Social Security spousal death benefits, there are specific criteria to consider. First and foremost, your marriage to the deceased must have lasted at least ten years. However, there is an exception: if your marriage lasted at least nine months and your spouse passed away, you may still qualify.

2. Age and Timing Matter

The age at which you claim your widow or widower benefits plays a crucial role. If you’re 60 or older, you’re eligible to receive these benefits. But keep in mind that if you have a minor child in your care, you could receive benefits earlier, which will continue until the child graduates high school. However, it’s important to note that benefits do not start until you reach 60.

3. Working and Earning Limits

If you plan to work while receiving Social Security widow benefits, be aware of the income limitations. In 2024, the earnings limit is $21,240 annually. Earning more than this threshold will result in a reduction of your Social Security benefits. For every $2 you earn above this limit, your benefits will be reduced by one dollar. If your income substantially exceeds this limit, it may be wise to delay claiming your widow benefits.

4. Remarriage and Its Impact

If you’re considering remarriage after the age of 60, you can do so without affecting your eligibility for widow benefits. This means you can remarry at 60 and still receive benefits based on your deceased spouse’s record.

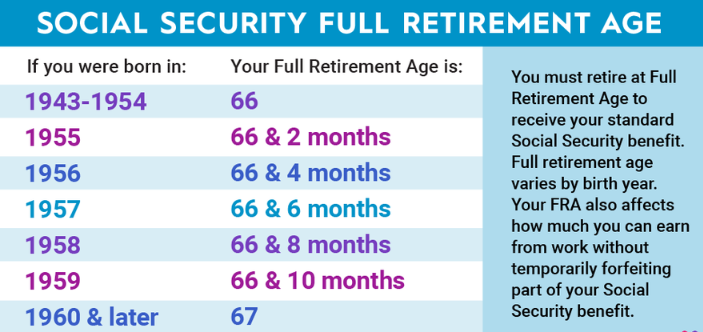

5. Benefit Amount and Full Retirement Age

The amount you can receive as a widow or widower depends on your full retirement age. To receive the full 100% of what your spouse would have received at their full retirement age, you must wait until you reach your full retirement age, typically around 67. Claiming benefits at age 60 will result in a reduced benefit amount, around 71.5%.

6. Locking in Your Benefit Amount

It’s essential to understand that the benefit amount you choose when you start claiming widow benefits is permanent for the rest of your life. Unlike some other retirement benefits, your widow benefit won’t increase as you get older. Any adjustments will typically come from annual cost-of-living increases.

7. Switching Back to Your Own Benefit

If you’ve been receiving widow benefits but your own Social Security benefit becomes more substantial due to delayed retirement credits, you can switch back to your own benefit at any time. This flexibility is a lesser-known strategy that allows you to maximize your retirement income.

Conclusion

Navigating Social Security spousal death benefits can be complex, but understanding the rules and options can help you make the best decisions for your financial future tutorial. To further assist you in making informed choices, consider downloading our 2024 Medicare and Social Security Cheat Sheet from our website. If you have any questions or need assistance with Medicare, don’t hesitate to reach out to us at The Medicare Family. We are here to guide you through this important aspect of your retirement planning.

Frequently Asked Questions (FAQs)

Who is eligible for Social Security spousal death benefits?

Eligibility for spousal death benefits typically requires a marriage of at least ten years, but there are exceptions for marriages of at least nine months. Understanding eligibility criteria is essential.

At what age can I start receiving widow or widower benefits?

You can start receiving widow or widower benefits as early as age 60. However, waiting until your full retirement age can result in a higher benefit amount.

Can I work and receive Social Security spousal death benefits?

Yes, you can work while receiving these benefits, but there are income limits. Earning more than the specified limit can reduce your Social Security benefits, so it’s crucial to be aware of these limitations.

What happens if I remarry after the age of 60?

If you remarry after turning 60, it generally doesn’t affect your eligibility for widow or widower benefits based on your deceased spouse’s record. You can still receive these benefits.

Is it possible to switch from widow benefits back to my own Social Security benefits?

Yes, you can switch from widow benefits to your own Social Security benefits if your own benefit becomes more substantial due to delayed retirement credits. This flexible option allows you to maximize your retirement income.