In the quest for financial preparedness and the assurance of a stable future for your cherished ones, the set up a trust fund emerges as a pivotal milestone. Beyond the mere notion of financial instruments, trust funds symbolize a promise—a promise to safeguard your assets and ensure the prosperity of those you hold dear. In the following sections, we embark on an enlightening journey to delve deep into the intricate world of trust funds, shedding light on their profound significance.

This article acts as your compass, guiding you through the labyrinthine passages of trust fund creation. It elucidates not only the ‘hows’ and ‘whys’ but also the myriad possibilities that trust funds offer. We invite you to explore the compelling universe of trust funds, emphasizing that their pertinence extends far beyond the realm of wealth.

Why Set Up a Trust Fund

As the famous adage goes, “The only things certain in life are death and taxes.” While discussing death may be uncomfortable, it is essential to understand why establishing a trust fund is a smart move. Contrary to a common misconception, trust funds are not exclusive to the wealthy; they serve a vital purpose for individuals with varying financial resources.

Ensure a Smooth Transition

When you pass away, your assets and property will need to be managed and distributed. Setting up a trust fund allows you to determine how your assets will be handled after your passing. This ensures a smooth transition of your property and avoids potential disputes among family and friends during an already emotional time.

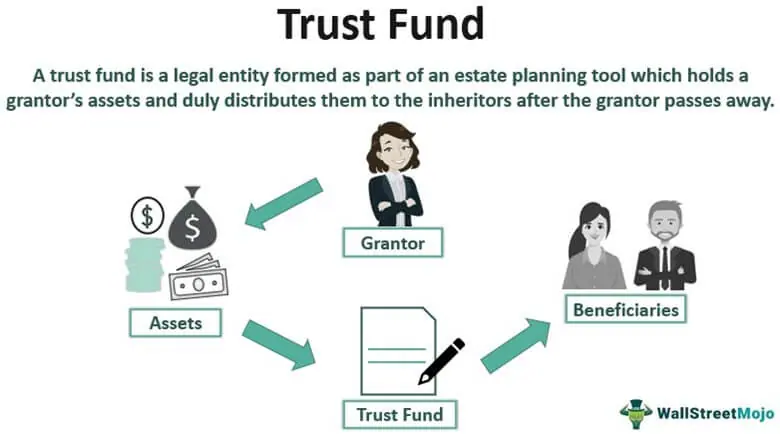

What is a Trust Fund

A trust fund is essentially a legal document that specifies how your assets and personal property will be managed and distributed upon your demise. It’s a comprehensive plan that encompasses everything you own, from your house and investments to your bank accounts and personal possessions. By creating a revocable living trust, you retain control over these assets even after you’re no longer here. Your assets can be a liability if you don’t know how to save money and use it wisely.

Avoid State-Imposed Decisions

If you don’t have a trust fund or a will in place, your state of residence will decide how your property is distributed. This can lead to complications and potentially strained relationships among your heirs, as the state’s decisions may not align with your intentions. By establishing a trust fund, you regain control over the destiny of your assets.

Terms to Include in Your Trust Fund

When you embark on the journey of setting up a trust fund, you are granted the power to sculpt the very foundation of how your assets are not only managed but also thoughtfully distributed. This remarkable flexibility is your canvas for creativity, enabling you to meticulously design your trust fund to perfectly suit your individual preferences and adapt to your specific life circumstances. Your trust fund can encompass a wide range of terms, each of which plays a pivotal role in shaping the legacy you leave behind. Whether it’s specifying beneficiaries, establishing conditions for asset distribution, or defining unique criteria, your trust is your masterpiece, reflecting your values and ensuring your wishes are met with precision.

Beneficiary Designations

Within the intricate framework of your trust fund, you wield the authority to intricately specify which assets and properties find their place. This extensive list can encompass far more than just your primary residence or investment accounts; it is a comprehensive catalog of your financial world. From businesses that you’ve painstakingly built to side hustles that reflect your entrepreneurial spirit, your trust fund can extend its protective umbrella to virtually any asset you desire to include. By meticulously delineating beneficiary designations, you ensure that every facet of your financial legacy is preserved and thoughtfully distributed according to your wishes, creating a profound impact that resonates for generations to come.

Conditions for Asset Distribution

One of the most significant advantages of a trust fund is the ability to set conditions for when and how beneficiaries receive their share. For instance, you can establish age requirements, educational achievements, or even personal milestones that must be met before assets are distributed. This ensures that your assets are used responsibly and in line with your wishes.

Creating the Legal Document

After meticulously defining the beneficiaries and terms of your trust fund, the time comes to give your vision a tangible form. This crucial step involves the creation of a legally binding document that will serve as the backbone of your trust fund. Here, you are presented with two distinct pathways, Hiring an attorney and Trust fund Yourself.

Pros of Hiring an Attorney:

-

Legal Expertise: Attorneys specialize in trust and estate planning, offering a deep understanding of complex legal requirements and potential pitfalls.

- Tailored Guidance: Legal professionals can provide personalized advice and insights, ensuring that your trust fund is meticulously customized to your unique circumstances.

-

Legal Compliance: An attorney can guarantee that your trust fund adheres to all relevant legal regulations, minimizing the risk of legal complications.

Cons of Hiring an Attorney:

-

Cost: Engaging an attorney typically involves a significant financial investment, which may not be feasible for everyone.

-

Dependency: Relying on an attorney means you may have less hands-on control over the document’s creation and may need to coordinate with the attorney throughout the process.

Pros of Creating a Trust Fund Yourself:

-

Cost-Effective: Crafting the document independently can be more budget-friendly, as you save on legal fees.

-

Hands-On Involvement: You have complete control over the document’s creation, allowing for a more hands-on approach.

Cons of Creating a Trust Fund Yourself:

-

Complexity: Creating a legally sound trust fund document can be intricate and challenging, especially if you lack legal expertise.

-

Research Requirement: Crafting the document yourself necessitates extensive research to ensure it aligns with legal requirements, potentially consuming a significant amount of time and effort.

Appointing a Trustee

While you are alive, you serve as the trustee, managing your trust fund. However, when you pass away, you need to appoint a trustee who will oversee the distribution of assets to your beneficiaries. The trustee plays a crucial role in ensuring that your trust terms are carried out according to your wishes.

Executing the Trust

To breathe life into your trust fund, a crucial step awaits – the official execution. This pivotal process necessitates your signature, witnessed by a public notary and an impartial observer. This meticulous ritual ensures not only the legality and validity of your trust fund but also marks the point at which your carefully crafted plans transition from intention to concrete reality. It’s the moment where your financial legacy begins to take shape and your wishes gain the force of law, guaranteeing the secure future you’ve envisioned for your loved ones.

Trust Fund vs Will

You may be wondering about the differences between a trust fund and a will. Both serve the purpose of guiding the distribution of your assets after your passing. If you’d like to learn more about the distinctions between these two estate planning tools, please let us know in the comments, and we’ll create an in-depth video to address your questions.

Conclusion

Setting up a trust fund is not just a financial strategy reserved for the affluent; it’s a prudent and considerate step that every individual should seriously consider. By establishing a trust fund, you take charge of your financial legacy and ensure that your loved ones are safeguarded in the event of your passing. This proactive approach allows you to maintain control over your assets, prevent potential conflicts within your family and circle of friends, and guarantee that your wishes are upheld.

It’s never too early to begin planning for your future, and a trust fund is a vital component of that plan. So, don’t delay; take the initiative to create your trust fund today. By doing so, you’re not just securing your own financial legacy; you’re providing peace of mind and financial stability for your loved ones, ultimately leaving a lasting legacy of responsibility and care.

Frequently Asked Questions (FAQs)

Who can benefit from a trust fund?

Trust funds can be designed to benefit a wide range of individuals or entities, including family members, friends, charities, or even specific businesses. The beneficiaries can be tailored to your preferences and financial goals.

Do I need a lawyer to create a trust fund?

While it’s not a legal requirement to hire a lawyer, seeking legal advice is often recommended, especially for complex trusts. An attorney can ensure that your trust fund is in compliance with relevant laws and tailored to your specific needs.

Can I change the terms of my trust fund after it’s established?

Yes, in most cases, you can amend or revoke a revocable living trust if circumstances change. However, the process for making changes should be clearly defined in the trust document and comply with legal requirements.

How does a trust fund affect taxes?

Trust funds can have tax implications. While the specifics depend on the type of trust and the applicable tax laws, some trusts may offer tax advantages. Consulting a tax professional or attorney is essential to understand and optimize the tax benefits of your trust fund.

What happens if I don’t establish a trust fund or a will?

Without a trust fund or a will, your assets will typically go through the probate process, and the state will decide how your property is distributed. This can lead to delays, additional expenses, and a distribution that may not align with your wishes. Establishing a trust fund or a will allows you to maintain control over your estate and avoid such situations.