In a world of ever-rising insurance costs and endless choices, finding the perfect insurance provider can feel like an overwhelming puzzle. But what if we told you there’s a solution that combines affordability, comprehensive coverage, and a history of excellence? Enter Safeco Insurance—a hidden gem in the insurance landscape. In this in-depth exploration, we will unravel Safeco’s rich history, pricing prowess, customer experiences, coverage options, and money-saving discounts, ensuring you have the knowledge to secure your financial future confidently. Discover how Safeco Insurance can be your key to unlocking both savings and security in a single policy.

A Glimpse into Safeco’s History

Safeco Insurance is no newcomer to the insurance industry. Established in 1953, it has weathered the test of time, boasting a long and storied history. Interestingly, Safeco’s origins are tied to a company called “The General,” a name that might not ring a bell today. However, it’s essential to clarify that the name “The General” is now associated with a different company, distinct from Safeco.

Over the years, Safeco has transformed from being part of a larger conglomerate into its own independent entity. In a significant move in 2008, Safeco became part of the Liberty Mutual family of companies. This transition marked a turning point in Safeco’s journey, solidifying its presence in the insurance industry.

One of Safeco’s distinctive features is its commitment to the independent side of insurance. Unlike some other industry giants, Safeco operates primarily through a network of independent agents. This approach enables them to offer a diverse range of insurance products and provide customers with choices tailored to their specific needs.

The Pricing Competitiveness of Safeco Insurance

When considering an insurance provider, pricing is often a primary concern. Safeco Insurance shines in this area, particularly for specific demographics. Let’s break down their pricing competitiveness based on different customer profiles:

1. Young Drivers – A Competitive Edge

Young drivers, typically aged between 14 and 25, often face the challenge of high insurance premiums. However, Safeco Insurance emerges as a compelling choice for this demographic. Check out the cheapest car insurance options for all age drivers. If you have a decent insurance score, a clean claims history, and you are generally considered a safe driver, Safeco can offer you remarkably competitive rates.

On average, Safeco provides annual premiums of approximately $1,700 for young drivers. This figure significantly undercuts competitors like State Farm ($2,400), Progressive ($2,000), and Geico ($2,100) for similar driver profiles.

It’s important to note that Safeco’s competitiveness for young drivers can vary from state to state. Therefore, if you fall into this category, obtaining multiple quotes is advisable to ensure you secure the best possible rate.

2. Married Couples (Aged 40 and Up) – A Favorable Choice

Safeco Insurance aims to attract more mature, married clients, specifically those aged 40 and above. If you fit this demographic, Safeco can be an appealing option.

Their annual premiums for married couples in this age group typically average around $2,973. While not the absolute cheapest, this rate compares favorably to competitors like State Farm ($3,038), Progressive ($3,200), and Geico ($2,962). Safeco’s pricing, combined with its coverage options, can make it an attractive choice for married couples seeking insurance.

Coverage Options and Discounts Offered by Safeco Insurance

Safeco Insurance distinguishes itself by offering a wide array of coverage options and discounts, enhancing its appeal as an insurance provider. Let’s explore some of the coverage options and discounts available:

1. Accident Forgiveness

Safeco Insurance includes accident forgiveness as part of its insurance packages. This inclusion is particularly advantageous, as it can be more affordable than adding accident forgiveness as an optional extra. Accident forgiveness can provide peace of mind, knowing that your rates won’t skyrocket after a single accident.

2. Cash Back Incentive

Safeco goes the extra mile by offering a cash-back incentive for policyholders who remain claims-free. This incentive encourages safe driving habits and responsible behavior on the road. The cash-back amount can be significant, ranging from 2.5% to 5% of your annual premium, depending on the selected coverage package.

3. Discounts Galore

Safeco Insurance provides a variety of discounts to help policyholders save on their premiums. Some notable discounts include:

- Advance Quote Discount: Planning ahead can pay off when it comes to insurance. Safeco rewards policyholders who obtain a quote at least 10 days in advance with an additional discount.

- Low Mileage Discount: If you’re a low-mileage driver, Safeco’s low mileage discount can be advantageous. This discount is particularly relevant for young drivers and those who drive less than 8,000 miles per year.

- Length of Prior Insurance Discount: Safeco values long-term customer relationships. The longer you’ve been with your current insurance provider (often referred to as a “10-year” customer), the larger the discount you’ll receive with Safeco.

4. Right Track Telematics – A Unique Approach

Safeco Insurance offers a telematics program called “Right Track.” Telematics programs have become increasingly popular in the insurance industry, as they allow insurers to gather data about policyholders’ driving habits. However, Safeco’s Right Track program stands out for a unique reason—it doesn’t track distracted driving.

Most telematics programs monitor various aspects of driving behavior, including distracted driving, which involves activities like using a mobile phone while driving. Safeco’s Right Track, focuses on monitoring only three driving behaviors, excluding distracted driving from the equation.

This approach can be appealing to individuals who occasionally use their phones for tasks like listening to music, checking messages, or receive mails.

A Closer Look at Customer Reviews

When evaluating an insurance company, customer reviews can provide valuable insights. Safeco Insurance receives a mix of feedback, and it’s important to understand the nuances of these reviews.

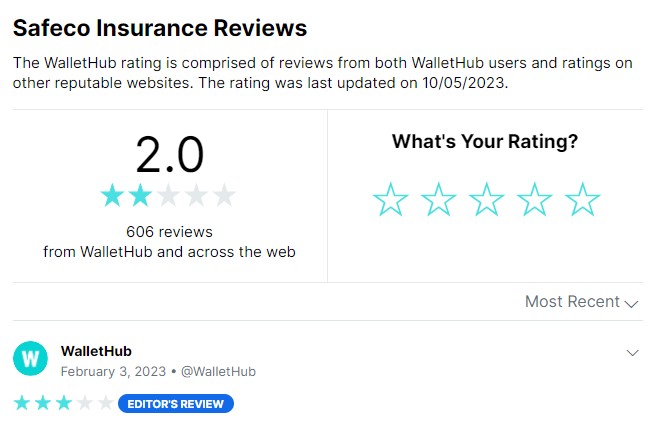

1. Wallet Hub Reviews (Home Insurance)

Wallet Hub’s ratings for Safeco Insurance are relatively low, with an average rating of 2.2 out of 5 stars. However, it’s essential to note that many negative reviews primarily pertain to Safeco’s home insurance offerings rather than its auto insurance.

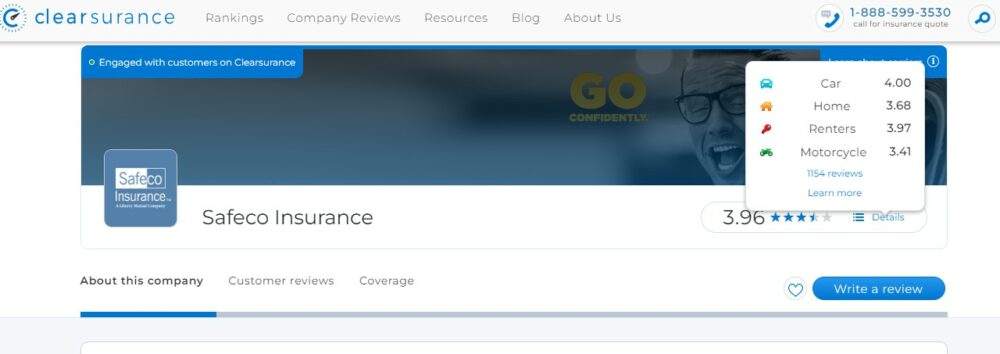

2. Clearsurance Reviews – A Balanced Perspective

Clearsurance provides a more balanced view of Safeco Insurance. Approximately 80% of reviews are positive, falling into the “excellent” or “great” categories. This suggests that Safeco fares considerably better in customer satisfaction when it comes to auto insurance.

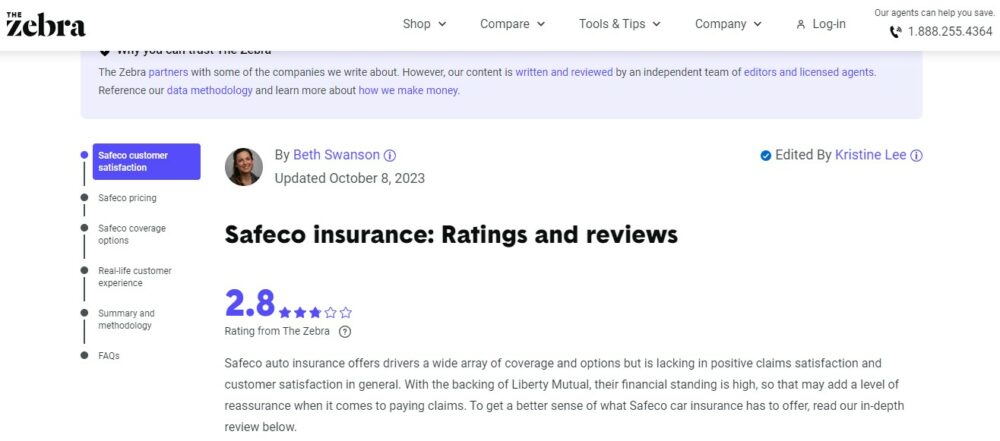

3. The Zebra Reviews – A Respectable Rating

The Zebra, another review platform, gives Safeco Insurance a rating of 3.5 out of 5 stars. In the context of the insurance industry, this rating is quite respectable. It indicates that Safeco generally meets the expectations of a significant portion of its customers.

It’s crucial to remember that customer reviews can be subjective and may reflect individual experiences. Furthermore, customers are more likely to leave reviews when they have concerns or issues, making positive reviews less common. Therefore, a balanced approach to assessing reviews is advisable.

Overall, Safeco Insurance appears to be reasonably well-received in customer reviews, particularly for its auto insurance offerings. To make an informed decision, it’s essential to delve deeper into reviews and consider your specific insurance needs and priorities. Explore mercury insurance which offers discounts and coverage like Safeco Insurance.

Conclusion

Safeco Insurance presents a compelling option for various insurance needs. With competitive pricing, a range of coverage options, and a cash-back incentive, it appeals to a wide audience. While customer reviews vary, its strengths in auto insurance make it worthy of consideration. Evaluate your specific requirements and explore Safeco as a potential insurance partner.

Frequently Asked Questions (FAQs)

What types of insurance does Safeco offer?

Safeco Insurance offers a variety of insurance types, including auto, home, renters, condo, umbrella, boat, motorcycle, and more. They cater to diverse insurance needs, providing options for both personal and property coverage.

How does Safeco’s accident forgiveness work?

Safeco’s accident forgiveness is included in some of their insurance packages. It means that, in the event of an accident, your rates won’t increase as a result of that accident. It provides peace of mind and helps maintain stable premiums after a claim.

What discounts are available with Safeco Insurance?

Safeco offers several discounts, including an advance quote discount for proactive customers, a low mileage discount for those who drive less, and a length of prior insurance discount for long-term policyholders. They also provide a cash-back incentive for claims-free years.

Is Safeco Insurance available nationwide?

Yes, Safeco Insurance operates in most states across the United States. However, the availability of specific coverage options and discounts may vary by state, so it’s advisable to check with a local Safeco agent for precise information.

How can I obtain a quote from Safeco Insurance?

You can obtain a quote from Safeco Insurance by visiting their official website, contacting a local Safeco agent, or using an independent insurance comparison platform. Comparing quotes from multiple sources can help you find the most competitive rates for your insurance needs.