As you contemplate the possibility of acquiring the Ritz Carlton credit card in 2023, a critical question arises: Is it still a worthwhile asset for your financial portfolio? The landscape has shifted, with the welcome offer now exclusively available to existing cardholders. However, don’t dismiss this card just yet. In the following article, we delve deep into the Ritz Carlton credit card, dissecting its benefits, and assisting you in the decision-making process. We aim to empower you to make an informed choice that aligns seamlessly with your unique financial objectives and travel preferences.

The Welcome Offer

Let’s address the elephant in the room first: the welcome offer. Unfortunately, it’s no longer available to new applicants. However, there’s a workaround if you’re determined to get your hands on this card. You can still acquire it through a product change. Start by obtaining one of the lower-tier Marriott cards from Chase. In the past, there were only two options, but now you have three: the Marriott Bonvoy Bold, the Marriott Bonvoy Boundless, and the Marriott Bonvoy Business. The process for the product change remains the same, so if you’re interested, you can check out the step-by-step guide in our previous article.

Ongoing Rewards Structure

The Ritz Carlton credit card offers an impressive rewards structure. You’ll earn six points per dollar spent at Marriott Hotels, three points per dollar on dining, car rentals, and airline purchases, and double points on all other purchases. With an annual fee of $450, it’s a more affordable option than the Marriott Bonvoy Brilliant, which comes with a $650 annual fee.

However, it’s essential to note that Marriott has transitioned to a dynamic pricing model for award redemptions, meaning the value of your points can fluctuate significantly. On average, one Marriott point is worth approximately 0.7 cents. So, 50,000 Marriott Bonvoy points would be worth around $350 towards a hotel stay.

Benefits Galore

The Ritz Carlton credit card truly shines when it comes to benefits. It’s loaded with perks that can enhance your travel experiences. Let’s break down the key benefits into six sections.

1. Annual Travel Credit

The card offers a $300 annual travel credit for airline incidental purchases. This credit covers various expenses, such as airline lounge day passes, yearly airline lounge memberships, seat upgrades, baggage fees, in-flight internet or entertainment, and in-flight meals. To redeem this credit, contact JPMorgan Priority Services via the number on the back of your card. It resets every calendar year on January 1st.

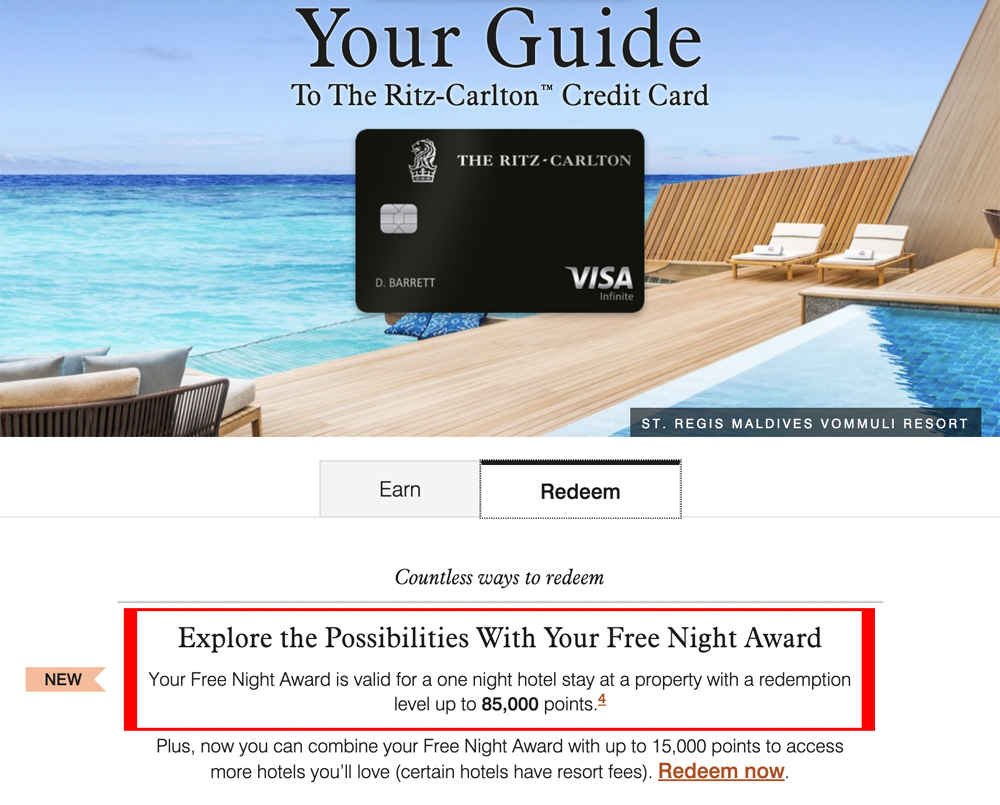

2. 85K Free Night Award

The 85K Free Night Award is a significant upgrade from the previous 50K award. You’ll receive one annual free night certificate, which you can use for a room with a value of up to 85,000 points. This certificate is valid for the room rate, most fees, and taxes (excluding resort fees), and it renews every account anniversary year.

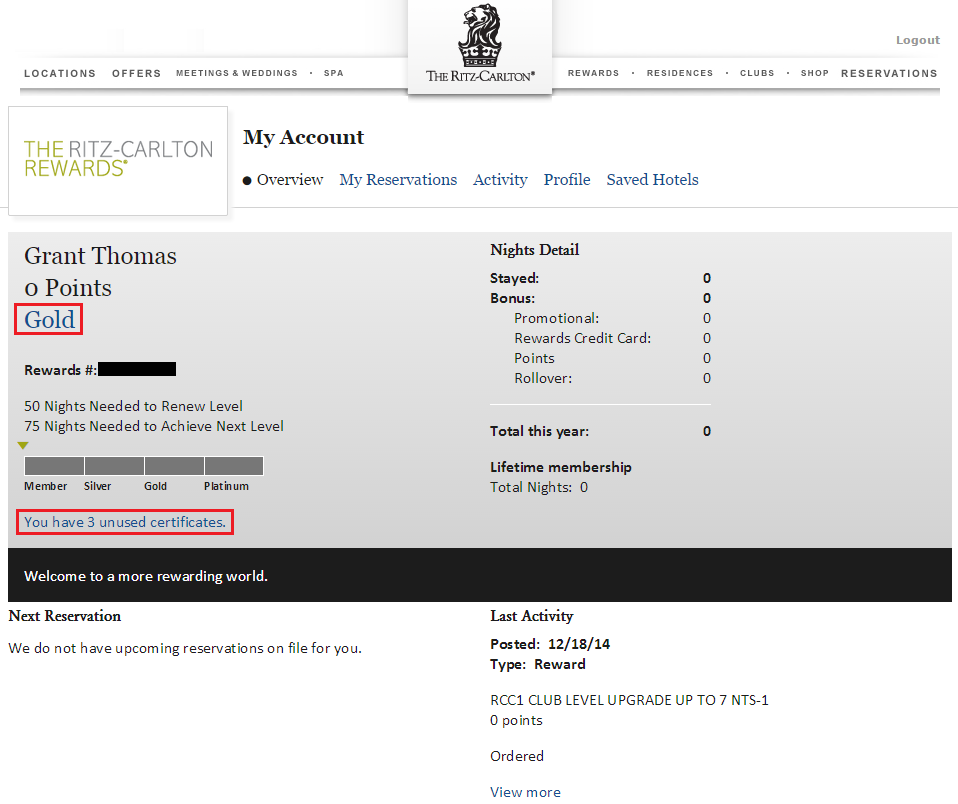

3. Gold Elite Status

Cardmembers automatically receive Gold Elite status. This status comes with various benefits, although it doesn’t include Elite night credits. To achieve higher status levels like Platinum, you’ll need to stay a specific number of nights. However, the 15 Elite night credits provided by the card can make reaching higher status levels more manageable.

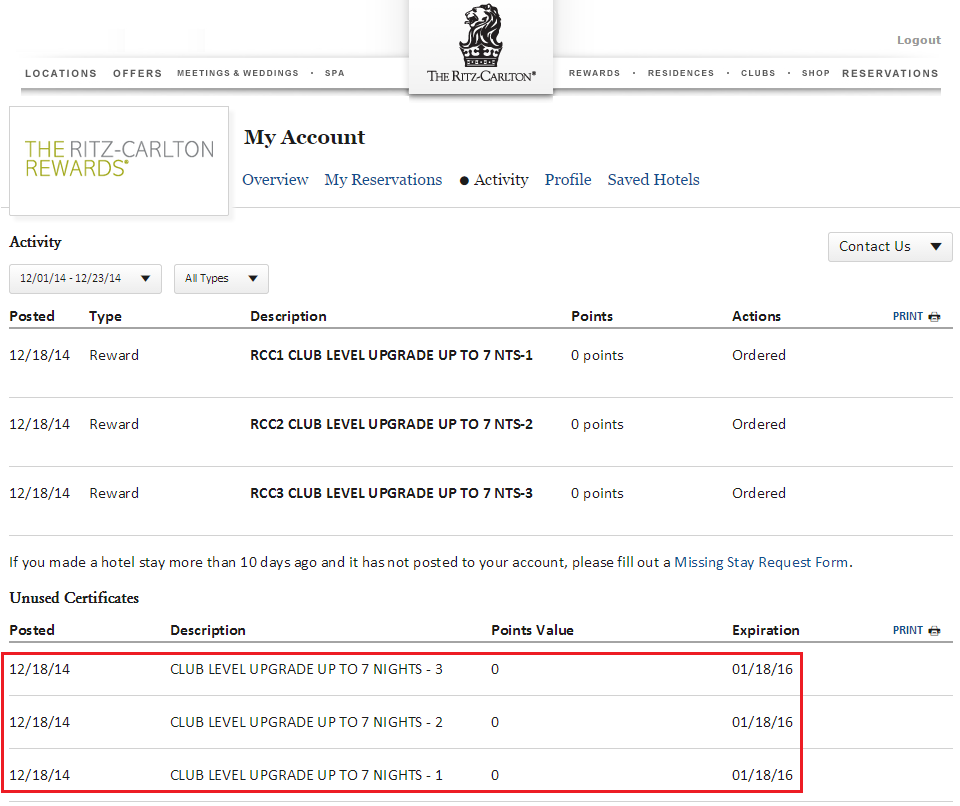

4. Club Level Upgrade E-Certificates

The Ritz Carlton credit card offers three annual Club Level upgrade e-certificates. These certificates grant you access to the exclusive club level at Ritz-Carlton hotels. The club level offers enhanced amenities and services, including multiple food presentations throughout the day. To use these certificates, simply call the number on the back of your card and follow the redemption process.

5. $100 Hotel Credit

This benefit is available at Ritz Carlton and St. Regis properties. A two-night minimum stay is required. The credit can be used for various expenses, but it cannot be applied to room rates, alcohol, taxes, or gratuities. To redeem the benefit, you must book the “100 Property Credit Luxury Credit Card Rate” and pay with your Ritz Carlton credit card. The credit will be applied as a statement credit on your hotel bill upon checkout that’s why its a best hotel credit card.

6. Priority Pass Membership

One of the standout benefits of the Ritz Carlton credit card is the Priority Pass membership. This membership not only grants access to over 1,300 airport lounges worldwide but also includes access to participating restaurants, spas, and retail locations within the Priority Pass network. You’ll receive meal credits at the restaurants, which can be especially valuable when traveling with guests.

Moreover, the card allows for unlimited guest access, making it an excellent option if you frequently travel with companions. Authorized users on your card also receive their own Priority Pass membership with the same guesting privileges.

Global Entry or TSA Pre-Check Fee Credit

Cardholders receive a fee credit for Global Entry or TSA Pre-Check, covering the application fee for either program. You can use this benefit every four and a half years, allowing you to renew or pay for your fee before the five-year expiration period. This credit adds convenience to your travel experience and expedites security and customs procedures.

Other Perks

The Ritz Carlton credit card offers additional benefits, including auto rental collision damage waiver, baggage delay insurance, emergency evacuation and transportation, lost luggage reimbursement, roadside assistance, travel accident insurance, travel and Emergency support, coverage for trip cancellations and interruptions, and compensation for trip delays.

Retail and Purchase Protection

Cardholders also benefit from extended warranty coverage, purchase protection, and return protection. These perks provide added security when making purchases, ensuring that your investments are well-protected.

No Foreign Transaction Fees

The card doesn’t charge foreign transaction fees, making it an excellent choice for international travel. With Visa’s global acceptance, you can use this card with confidence worldwide.

Is the Ritz Carlton Credit Card Worth It?

So, is the Ritz Carlton credit card worth it in 2023? It depends on your travel and spending habits. Here are some factors to consider:

Reasons to Say Yes:

- You stay at Marriott properties regularly.

- You can maximize the $300 annual travel credit.

- You can make use of the 85K free night award.

- You value Gold Elite status and the 15 Elite night credits.

- You appreciate the three Club Level upgrade e-certificates.

- You want a top-tier Priority Pass membership with unlimited guest access.

- You desire comprehensive insurance coverages.

Reasons to Say No:

- You don’t stay or spend with Marriott often.

- You don’t use airline incidental purchases.

- You prefer an everyday or at-home credit card.

- You prefer cash back rewards.

- You want more flexible travel rewards.

- You are averse to high annual fees.

Conclusion

The Ritz Carlton credit card is packed with benefits that can enhance your travel experiences. If these benefits align with your travel and spending habits, it could be a valuable addition to your wallet. However, it’s essential to weigh the annual fee against the benefits you’ll actually use. If the card’s perks align with your needs, it can be a rewarding choice for frequent travelers and Marriott enthusiasts.

Frequently Asked Questions (FAQs)

How Can I Get the Ritz Carlton Credit Card in 2023?

To acquire the Ritz Carlton credit card in 2023, you can still do so via a product change if you currently hold one of the lower-tier Marriott Bonvoy cards from Chase, such as the Marriott Bonvoy Bold, Boundless, or Business. There is no welcome offer for new applicants.

What Is the Value of Marriott Bonvoy Points in 2023?

The value of Marriott Bonvoy points has become more dynamic, making it challenging to provide an exact value. On average, one Marriott point is worth approximately 0.7 cents. However, it can vary significantly depending on the specific redemption.

Is the Ritz Carlton Credit Card Worth the Annual Fee in 2023?

Whether the Ritz Carlton credit card is worth the annual fee of $450 depends on your travel and spending habits. If you can fully utilize the card’s benefits, such as the $300 annual travel credit, free night award, and Priority Pass membership, it can justify the fee.

Can I Share Priority Pass Benefits with Authorized Users?

Yes, authorized users on your Ritz Carlton credit card account receive their own Priority Pass membership with the same guesting privileges as the primary cardholder. This means they can also bring in unlimited guests to participating Priority Pass lounges and locations.

What Are the Global Entry and TSA Pre-Check Fee Credits?

The Ritz Carlton credit card provides a fee credit for Global Entry or TSA Pre-Check application fees. You can use this benefit every four and a half years. Global Entry expedites customs and immigration processes, while TSA Pre-Check speeds up security screening at airports, making your travel experience smoother and more efficient.