Paying your credit card bill on time is a cornerstone of maintaining financial stability and safeguarding your credit score. Continental Finance understands the importance of timely payments and offers a range of convenient options to ensure that your credit card obligations are met accurately and efficiently. In this Pay Your Credit Bill with Continental Finance guide, we will walk you through the various methods for making payments, including Auto Pay, phone payments, online payments, mail-in options, and guaranteed funds like money orders, MoneyGram, and Western Union. Additionally, we’ll explore the benefits of e-statements and provide insights into payment processing and temporary holds. By following these guidelines, you can take control of your credit card payments and secure a healthier financial future.

Payment Importance

Before we explore the different payment options, let’s emphasize why paying your credit card bill is so essential:

- Maintaining Good Credit: Your payment history is the most significant factor influencing your credit score. Consistently paying your credit card bill on time helps build and maintain a positive credit history.

- Avoiding Interest Charges: By paying your bill in full each month, you can avoid interest charges. Only making the minimum monthly payment leads to interest accruing on the remaining balance, potentially increasing your overall debt.

- Budget Management: Understanding your budget and spending limits is crucial to ensure you can make substantial payments toward your credit card bill.

Now, let’s explore the six payment methods offered by Continental Finance:

1. Auto Pay

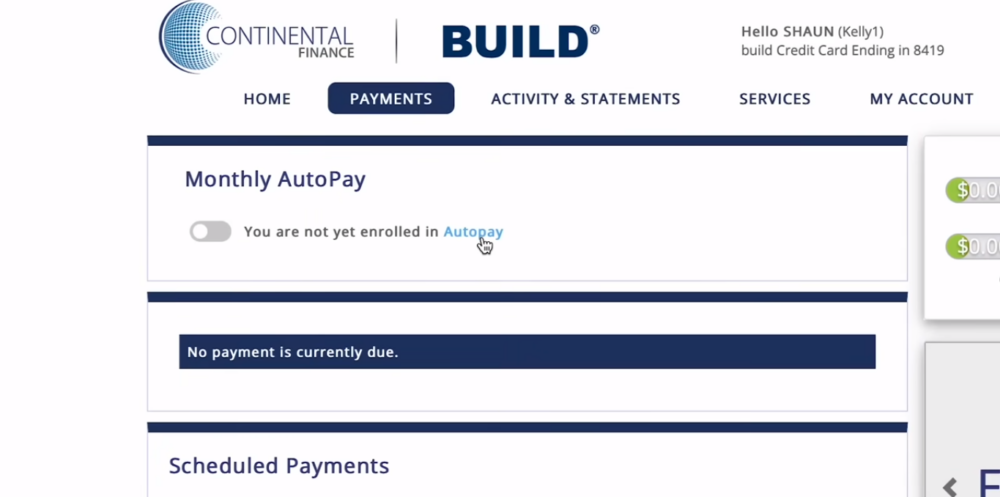

Auto Pay is a hassle-free feature that allows you to set up a recurring monthly payment for your credit card statement. This method ensures that your payments are automatically withdrawn every month, offering peace of mind and accuracy in your payments. Here’s how to set it up:

- Log in to Your Account: Visit YourCreditCardInfo website.

- Access the Payments Section: Click on “Payments.”

- Set Up Auto Pay: Choose the “Setup Auto Pay” button.

- Choose Payment Amount: Decide if you want to auto-debit the full balance, minimum due, or a custom amount each month.

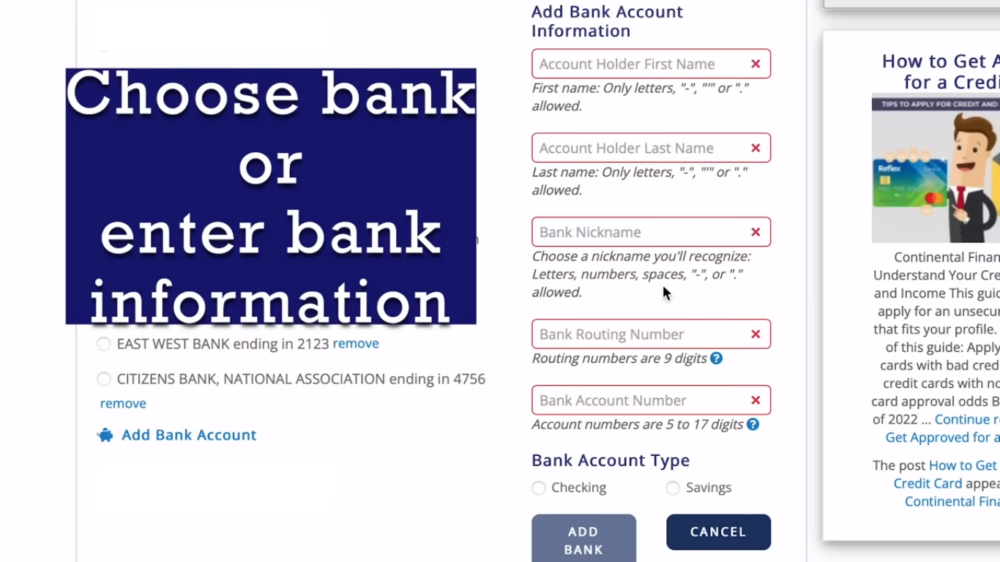

- Select Payment Account: Choose the bank account from which the payments will be deducted. If you haven’t added a bank account, click “Enter Bank Account” and provide the required information.

- Review and Confirm: Verify that the information displayed is correct and click “Confirm” to schedule your payment.

The advantages of Auto Pay include the peace of mind in knowing your credit card bill will be paid accurately and on time, without the need for manual payments each month. Once you set it up, the Auto Pay feature will automatically debit your payment on your bill’s due date.

2. Phone Payments

When it comes to making over-the-phone payments with Continental Finance, you have two options: speaking with live agents or using a virtual assistant

Live Agent Assistance:

- Expedited Payment Fee: Note that there may be an expedited payment fee for same-day processing.

- Process: Provide your routing number and account number or debit card information in a private automated system. You’ll then be directed back to a live agent who will confirm your payment registration.

Virtual Assistant:

- Once registered with a live agent, future payments can be made directly through the virtual assistant, following its prompts and guidelines.

3. Online Payments

Making payments online offers an independent and straightforward way to manage your credit card transactions. Follow these steps:

- Log in to Your Account: Visit YourCreditCardInfo website.

- Access the Payments Section: Click on “Payments.”

- Enter Payment Amount: Input your desired payment amount.

- Choose Payment Date: Select your preferred payment date.

- Select Payment Account: Pick the bank account from which you want to make the payment. If you haven’t added a bank account yet, click “Enter Bank Account” to provide the required information.

- Review and Confirm: Ensure the information displayed is correct and click “Confirm” to schedule your payment.

Online payments are efficient and can be made at your convenience. Payments submitted before 5 PM Eastern Time will be processed the same day and posted to your account the next business day.

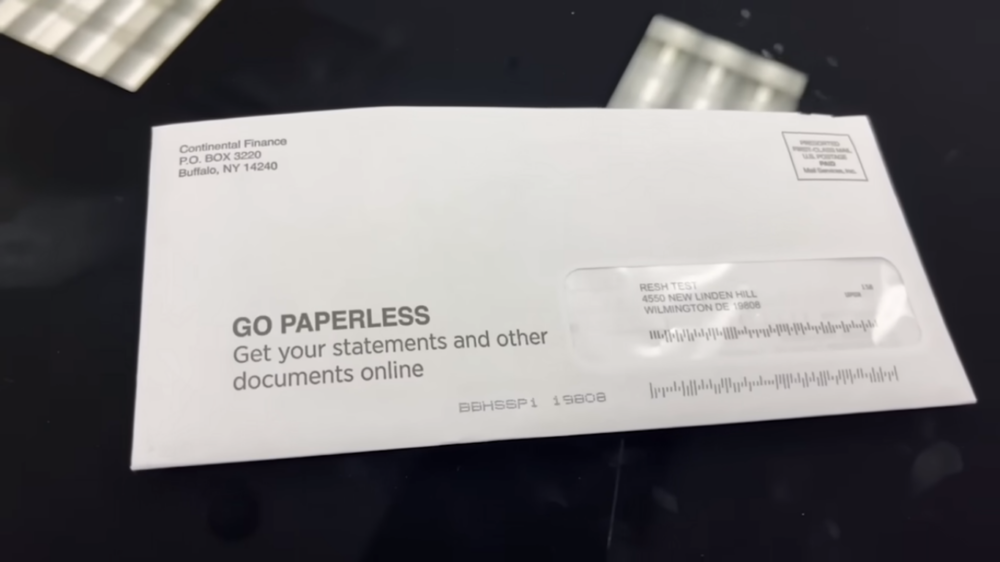

4. Mail-In Payments

If you receive paper statements by mail, you can make payments through the traditional method. Here’s how:

- Fill Out the Remittance Slip: Included in your statement, you’ll find a remittance slip. Complete the form with your payment details.

- Address Changes: If you’ve had a name or address change, complete the back of the remittance slip.

- Prepare the Envelope: Place your check or money order in the envelope with the remittance slip facing outward. Ensure that the return address on the slip aligns with the envelope window.

- Add a Stamp: Place a stamp on the envelope.

- Send Your Payment: Mail the envelope to the specified address.

This method is ideal for those who prefer physical documentation and are comfortable with the traditional mail-in process.

5. Guaranteed Funds

Continental Finance accepts three types of guaranteed funds for payments: money order, MoneyGram, and Western Union.

Money Order:

- Processing Time: Takes 2-3 days to process.

- Payment Address: Use the payment mail address provided on your statement.

MoneyGram:

- Processing Time: Takes 3-5 days to process.

- Receive Code: 9637

- Company: Continental Finance

- City and State: Newark, Delaware

- Account Number: Use your reference number or the last four digits of your Social Security number.

Western Union:

- Processing Time: Takes 3-5 days to process.

- Payment to: Continental Finance

- City Code: CFC Deposit

Please be aware that processing times may vary, and your bank may require additional time to reflect the payment in your account.

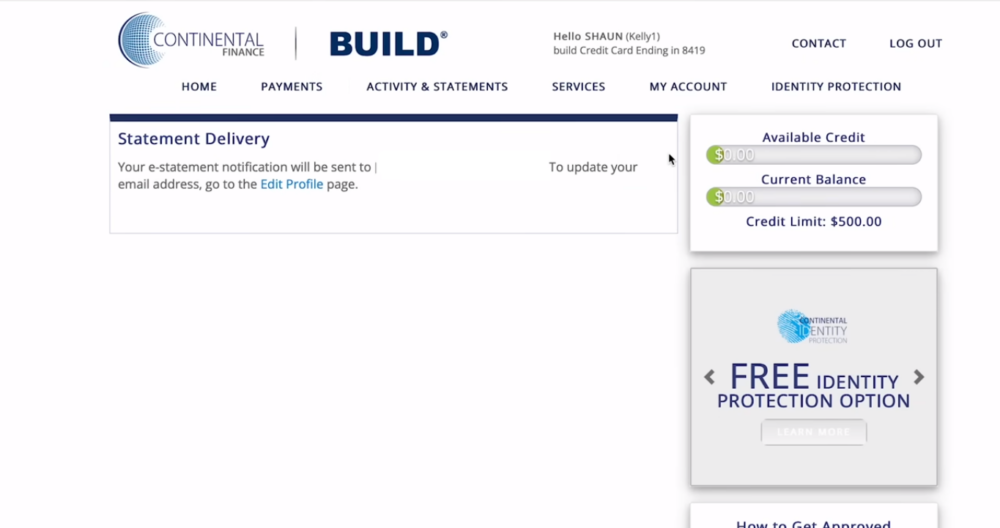

6. E-Statements

Enrolling in e-statements offers a fast and efficient way to manage your credit card account, and it’s entirely free. Here’s how to activate this feature:

- Navigate to My Account: Log in and go to the “My Account” section.

- Select Statement Delivery: Choose “Statement Delivery.”

- Turn On E-Statements: Enable e-statements to receive an electronic version of your monthly statement. E-statements can be found in the “Activity” and “Statements” sections of your account.

In addition to providing a convenient way to access your statements, e-statements also offer a free monthly credit score, which can be a valuable tool for monitoring your credit health.

Additional Payment Information

- Temporary Holds: Payments made within six months of account opening may be subject to a temporary hold on ACH payments. After establishing a six-month history of good payments, you should no longer experience this hold.

- Processing Times: Payments made by checking or savings account may be held for seven days before being reflected in your available credit. Payments submitted before 5 PM Eastern Time will be processed the same day and posted to your account the next business day.

Conclusion

Continental Finance provides multiple convenient options for paying your credit card bill. By choosing the method that best suits your preferences and lifestyle, you can ensure that your payments are made accurately and on time. These options offer flexibility, convenience, and the peace of mind that comes with knowing your credit card bills are being managed effectively.

Frequently Asked Questions (FAQs)

How can I set up Auto Pay for my Continental Finance credit card?

To enable Auto Pay, log in to your account at (www.yourcreditcardinfo.com), click on “Payments,” and select the “Setup Auto Pay” option. You can choose the payment amount, whether it’s the full balance, minimum due, or a custom amount, and link your preferred bank account for automatic withdrawals.

Are there any fees associated with over-the-phone payments through live agents?

Yes, there may be an expedited payment fee for using live agents to process your payment. They will inform you of any applicable fees before processing the payment.

How can I enroll in e-statements for my Continental Finance credit card?

You can activate e-statements by navigating to your account settings on the Continental Finance website and selecting the statement delivery preference. E-statements provide fast delivery of statements and free monthly credit scores for monitoring your credit health.

What is the processing time for guaranteed funds payments like money orders, MoneyGram, and Western Union?

The processing time varies for guaranteed funds payments: money orders typically take 2-3 days, MoneyGram payments take 3-5 days, and Western Union payments also take 3-5 days.

Why might my available credit not reflect a recent payment made to my Continental Finance credit card?

If your payment hasn’t updated your available credit, it could be due to protection measures. Payments made within six months of account opening may be subject to a temporary hold. However, after six months of good payment history, you should no longer be subject to this hold.