PAN Card Acknowledge Number Search, Postal Address of PAN Card, Toll-free Customer Care Number of PAN Card, PAN Postal Address: As we know that the use of a PAN Card has become a very important task for all taxpayers in India. This consists of a ten-digit alphanumeric digit that is directly associated with the citizen information of the income tax department. Every citizen needs to get apply for a PAN Card if they want to pay tax. This rule has been announced by the Indian Government. If any citizen wants to make a new PAN Card, reprint, or replacement of PAN Card, or if they have any complaint regarding a PAN Card, they must have to visit these two government service providers which are NSDL or UTI Infrastructure Technology Services Limited [UTIITSL]. Here in this article, we will tell you all the important information related to the Customer care number of a PAN Card, PAN Card Complaints, Postal Address of a PAN card, and how to search PAN Acknowledge number. Kindly read this article very carefully and get to know all details about it.

| Topic Name | PAN Card: Customer Care Number, Acknowledge Number |

| Article Category | PAN Toll-Free Customer Care Number Postal Address of a PAN Card PAN Acknowledgement Number Search Track PAN Acknowledgment Number Frequently Asked Questions |

PAN Toll-Free Customer Care Number

Here we will discuss the toll-free customer care number of a PAN Card. As per the Indian Government, if anyone citizen has to face any issue regarding their PAN Cards such as if a customer wants to know anything related to a PAN Card or if they want to complain about it. Then they can do so by just call or contact on the given below toll-free customer care number of the official website of a PAN Card namely UTIITSL or NSDL. Here NSDL full form is Income Tax PAN Service Unit and UTIITSL full form is UTI Infrastructure Technology Services Limited.

| Customer Care Number of NSDL | 02027218080 |

| Contact Number of UTI Infrastructure Technology Services Limited [UTIITSL] | Toll-free Number: 1800220306

Customer Care Number: 022 67931300 |

It is for all citizens who want to make their new PAN Card by just filling an Application Form or for those who wish to contact you for any complaint regarding PAN Card. Here we will show you a table that represents you a state-wise contact number for a new PAN Card or PAN Card complaint.

| Name of City | Toll-free Customer Care Number |

| Mumbai | 02267931301, 02267931300, 02267931303, 02267931302, 02267931304 |

| Kolkata | 033 22108959, 03322424774 |

| New Delhi | 01123211387, 011 23211262, 01123211273, 01123211274, 01123211285, 01123211285, 01123211387, 01123211262, 01123211273, 01123211274 |

| Chennai | 04422500426, 04422500183 |

If there is any citizen who wants to ask any questions for complaint or registration about UTI schemes, then they will ask it by just call on the below-listed contact numbers.

| Name of City | Contact Number |

| Mumbai | 02267931010, 02267931200 |

| New Delhi | 01123211262, 01123211274, 01123211387, 01123211273, 01123211285 |

| Chennai | 04422500187 |

| Kolkata | 03322435258, 03322424775, 03322435425 |

It is not only important that citizens should call on the NSDL or UTIITSL toll-free or any customer care number. Other than this, the government has provided an online facility through which every citizen should ask their query or complaint on the UTI Infrastructure Technology Services Limited (UTIITSL) or Income Tax PAN Services Unit (NSDL) websites.

Postal Address of a PAN Card

Here we will discuss all important information related to the postal address of PAN Card. Whenever you shift to your new house, every individual needs to change or update his or her residence address on Permanent Account Number. You can make these changes by just filling a form of PAN Card Change Request Application Form. You can avail of this form by just visiting an official website of NSDL [National Securities Depository Limited] below the category of Income Tax PAN Service Unit.

Basic Guidelines for modification in PAN Information

- For any changes or modifications, go to an official website of NSDL and fill an application form properly and get it submitted online.

- After submission, if there is any type of error in your form, then it will show you an error message on your computer screen.

- If it happens, then you should not make any corrections.

- To do any modification or change then one and the only edit option is available. Otherwise, select the confirm button.

- If you want to change or modify your PAN information like residence address only, then you have to fill a new application form with a new residence address. After that, the citizen’s new residence address will get updated and that will be updated on the Income Tax Department for any kind of notifications.

- It is for all citizens who have only their Aadhaar Card Number other than residence address, they fill their Aadhaar Number only.

Required Fees for modification in a PAN postal address

- For any kind of modification in a PAN Card, you have to pay some particular fees.

- If you are living in India, then you have to pay a fee of Rs.110/- for a PAN application form. In this fee, it includes Rs.93.00 + 18.00% GST. Every citizen should pay their fees through debit card, credit card, demand draft, or net banking.

- If you are living in foreign countries other than India, then you have to pay a fee of Rs.1020/- for a PAN application form. In this fee, it includes Rs.93.00 + Rs.771 (for dispatch). At present, the PAN Card postal service is available for 105 countries. Every citizen should pay their fees through debit card, credit card, demand draft, or net banking which is pay to Mumbai. If you are paying your fees through the demand draft, then you have to visit the nearest NSDL PAN Card Center. Write your name and acknowledgment number on the demand draft.

- Fees should be submitted by using a debit card, net banking, and credit card of a citizen. A citizen can be spouse, parent, individual, children, partner of a partnership firm, director of the company, limited liability partnership, authorized signatory of trust, an association of person, individuals body, local authority, Karta of the Hindu Undivided Family.

- Let us tell you all that if you are paying your fees through net banking, then there is an additional charge of 4.00 plus GST.

- After successfully submit fees, now you will get an acknowledgment. Every citizen needs to save it and better to take a printout of this acknowledgment.

Payment & Application Acknowledgment

After submitting fees for an application of postal address change of a PAN card, now it’s time to get an acknowledgment. Now, let us tell you all that this acknowledgment consists of an applicant category, name, PAN number, father name, birth date, communication address, Aadhaar number, proof of identity, unique acknowledgment with fifteen number digits, and formation and incorporation of the individual’s body.

It is for everyone to send an acknowledgment to the NSDL PAN Card Center (postal address). Some of the citizens want to send their demand draft, then they will also send it to the same postal address. After applying online, every citizen identity proof, all documents, and acknowledgment have to reach NSDL PAN Card Center between 15 days.

PAN Acknowledgement Number Search

As everyone is aware of the fact that PAN [Permanent Account Number] has been governed by the Income Tax Department and it is an important document for all citizens of India. It works as a government document and identity proof. It consists of a ten-digit alphanumeric number. For those who are involved in financial transactions such as buy mutual funds and many more, they need to have a PAN Card. As we tell you that it works as an identity proof, so with the use of PAN number, it restricts from tax evasion. Now, here we will discuss the facts of an acknowledgment number that every citizen should know.

Acknowledgment Number

Here we will tell you about the acknowledgment number of a PAN Card. So, it is a type of number which is given to all individuals who wish to apply for a PAN Card through UTIITSL, e-mudra, and NSDL online websites. Every website generates different acknowledgment number. If you are applying through the NSDL website, it develops fifteen digit PAN Acknowledgment Number, while through the UTIITSL website, it develops a nine-digit application number. Let us tell you all that with the use of this number, everyone can check his or her PAN Card Application Status.

Also Read: Duplicate PAN Card

Search PAN Acknowledgement Number

Now here everyone can search their acknowledgment number through an online facility. Everyone who wants to check or search his or her acknowledgment number can do so with the help of acknowledgment slip or application form of PAN acknowledgment number. Let us tell you all that when someone applies for a PAN Card online, then their acknowledgment slip will be send it to the email. But if a citizen applies for a PAN Card offline, then an agent come and handover an acknowledgment slip to the citizen.

Now here we will discuss all the important points that how to download Acknowledgment PAN Card by using an online facility. As we all know the fact that this number is given by the Indian Government and only a one-time procedure. When this slip is reached on your email, then every citizen can save and download this slip for further proceedings. In fact, you can easily track the status of your PAN Card application form.

Track PAN Acknowledgment Number

Here we will discuss all important facts related to the tracking of a PAN Card Acknowledgment Number. We all know that if somebody makes his or her new PAN Card then sometimes they all need to correct or makes any changes to it. Now, due to the online facility, every citizen can easily track their PAN Card application form. For this, they only need to have an acknowledgment number of a PAN Card. To know how to track PAN Acknowledgment number, follow all steps.

- Go to an official website of a PAN Card such as NSDL. Now, click on the given link to track a PAN Acknowledgment Number TIN NSDL.

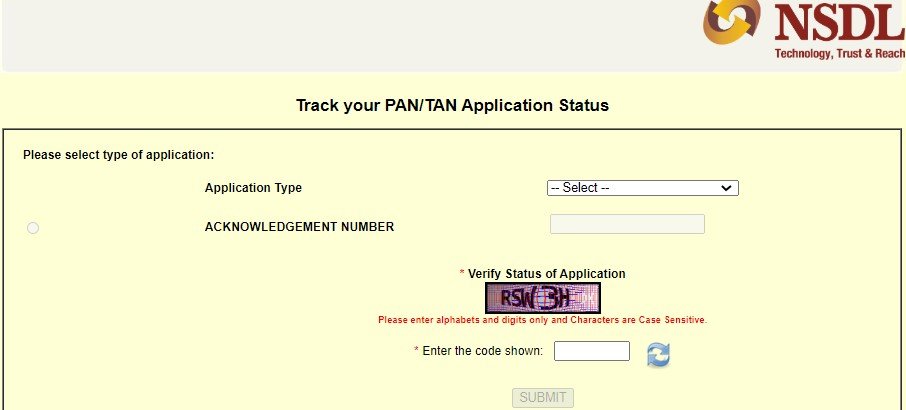

- The page will look like this.

- Now, here choose your type of application.

- Fill your acknowledgment number.

- Fill the captcha code as provided there.

- After this, tap on the submit option.

- In this manner, everyone can easily track their PAN acknowledgment number.

Track PAN Application Status without Acknowledgment Number

Let us tell you all that here we discuss all important facts that how would we check the application status if we don’t have an acknowledgment number. So, you can do so by just following all three points.

- If anyone doesn’t have their acknowledgment number, then they will check it by just entering an applicant name and birth date on an official website of PAN NSDL.

- After this, track PAN Application Status with the help of a coupon number on the UTIITSL website.

- Or, everyone can check an application status with the help of a PAN number on the UTIITSL website.

Track PAN Application Status by Coupon Number or PAN Number

Let us tell you all that here we discuss all important facts that how would we check the application status with the help of a PAN Number or Coupon Number. So, you can do so by just following all points.

- For this, go to an official website of UTIITSL. Now, go to a link as provided here PAN Online.

- The page will look like this.

- Here, according to your choice enter your Coupon Number or PAN Number.

- Now, fill your birth date.

- Now, properly fill the captcha code.

- Tap on the submit button.

- In this manner, everyone can track their application status having PAN Number or Coupon Number.

I hope you will understand this article very well and are ready to take benefit from it. If you are facing any problems related to the meaning of a PAN Customer Care Number, PAN Acknowledgment Number, Search PAN Acknowledgment Number then you may ask your queries in the given comment box.

Frequently Asked Questions

Name the various ways from which I can check PAN Card status?

After successfully register a PAN Card, its acknowledgment number has been transferred to your email automatically. This number has been issued by the Income Tax Department. And, this number is used to check or track the application form of a PAN Card. This number will be transferred to the applicant’s email ID or mobile number.

Can I open my bank account by using PAN Card Acknowledgment Slip?

Yes, you can open your bank account by using the PAN Acknowledgment slip. All you need is a photocopy of an acknowledgment number slip. For this, you have to fill an application form for opening a bank account.

Should I transfer PAN Acknowledgment Number Slip to the NSDL PAN Card Office in Chennai through speed post?

Yes, you can send it through speed post. Make sure that this paper should reach the office as soon as possible without any further delay.