PAN Form 61: As everyone knows the fact that how important is to make a PAN Card. As we see, there are a number of changes that were taken place in the world of the economy. Every type of transaction was recorded for any future references. So, to record details of every transaction, it is important for everyone to make a PAN [Permanent Account Number] Card, and it is necessary for all citizens. This type of document is governed by the Income Tax Department Office below the guidance of the Central Board of Direct Taxes. In this, it includes all basic information such as applicant name, father name, photograph. For those people who do not make a PAN Card and do a number of transactions will specifically need to fill Form 61. Here in this article, we will provide you all information related to the PAN Card Form 61, its framework, the process of filling, and different modules related to PAN Form 61.

| Topic Name | PAN Card Application Form 61: Meaning, Uses, & Documents |

| Article Category | Meaning of a PAN Card Form 61 Process of filling PAN Card Form 61 Important Documents need to submit with Form 61 Distinction Between PAN Form 60 and PAN Form 61 Frequently Asked Questions |

| Download PAN Form 61 | Click Here |

Meaning of a PAN Card Form 61

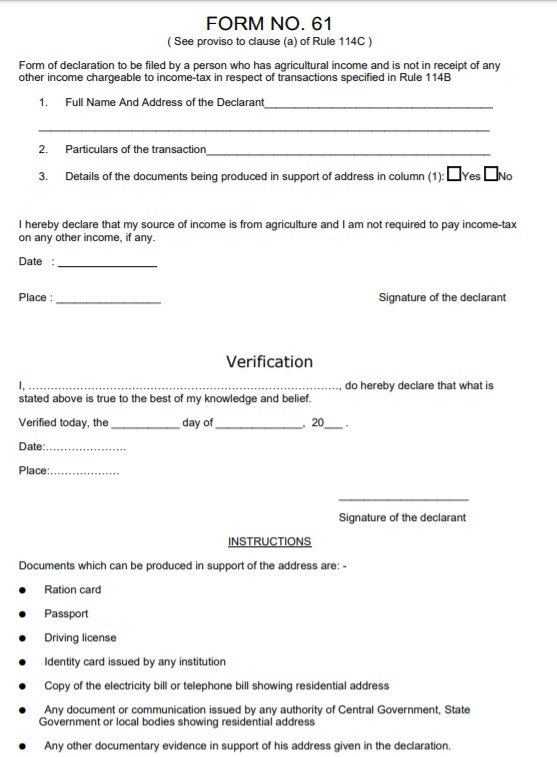

Let us tell you all that this PAN Card Form 61 is a type of declaration form which is duly filled by a citizen of India or any type of individual person who basically earns from agriculture and farming. They did not get any type of receipt or any transactions from the government side. So, they have to fill this PAN Form 61 according to Clause [A] to [H] of Rule 114B. Now, here we will discuss everything related to PAN Form 61. But, first, let us talk first about the uses of Form 61.

Uses of PAN Form 61

Here we will discuss all major uses of PAN Form 61. Let us tell you all that this type of form 61 is used instead of a required PAN Card. This type of form can be used to make transactions as per clause [A] to [H] under Rule 114 B. Uses are:

- Buy or sell any type of stationary vehicle and property which is of more than Rs.500000/-.

- Buy or sell any type of vehicle, which is other than 2 wheelers.

- An account with a fixed deposit that is more than Rs.50000 from any bank.

- An account with a fixed deposit that is more than Rs.50000 from any post office.

- Any type of contract which is similar to buy or sell any type of particular securities that is more than Rs.1000000/-.

- This type of PAN Form 61 is mostly used to start opening any bank account.

- This type of PAN Form 61 is mostly used to start a telephone connection which consists of any cellular connection.

- The form is used in all types of hotels and restaurants that are more than of Rs.25000/-.

For every type of small child or minors who did not submit any tax, so, in that matter need a parent’s, PAN Card.

Also, Get to Know More about Other Form

Process of filling PAN Card Form 61

Here we will discuss the process of filling a PAN Card Form 61. As we know that there are many rules & regulations that should follow during form 61 filling. It only seems that it has to be done very accurately, but not like that. Let us tell you all that this Form 61 can be filled with the help of an online or offline procedure. If you have done any mistake while filing, then your application form would get rejected. Follow all given below steps while applying for a PAN Card. Steps are:

- Applicant proper name with first name, middle name, and last name.

- Applicant Residence Full Address

- Any PAN transaction details of an applicant

- Applicant Address Proof

- Applicant signature, date, and place

It should be noted that every citizen has to sign it for a verification process. This verification shows that this form of detail should be true or not according to their information. In this, there are details related to the date and place also mentioned. Let us tell you all that this Form 61, have to submit at the time of a PAN transactions to all the people who are handling all types of the transaction amount, for example, manager at the bank.

Important Documents need to submit with Form 61

Here we will discuss all important documents that need to be submitted along with a PAN Card Form 61. So, here is given a table showing all the important documents that are required to submit.

- Applicant Aadhaar Card

- Applicant Passport

- Applicant Ration Card

- Applicant Driving License

- Applicant Electoral Photo Identification Card or EPIC

- Applicant every latest utility bills

- Applicant Identification document that is governed by any institution, that should include citizen residence address.

- Applicant Identification or any communication document that is governed by any Central or state government, that should include citizen residence address.

- Applicant any other legal document that verifies applicant residence address in the given declaration form.

Let us tell you all that all legal documents or papers that show proof of residence must be self-attested.

Important Note: If anyone wants to get to know more information related to the PAN Form 61 or about the Income Tax Department, then he or she must visit an official website of Income Tax. From here, you will get the information about Income Tax.

Distinction Between PAN Form 60 and PAN Form 61

Here we will discuss the distinction between two PAN Card Forms namely Form 60 and Form 61. As everybody knows that PAN Card is a type of an important document. From this, every citizen can easily track their transaction details. For those people who still have not PAN Card, they need to fill either of PAN Form 60 or Form 61 according to their choice.

PAN Form 60

This type of form can be submitted by any citizen of India who has not any PAN Card, but they tried their best to just enter and make transactions under Rule 114B. All applicants or citizens who do not acquire any General Index Register Number, but he or she just wants to grant cash according to the Clauses [A] to [H] of every transaction below the Rule 114B. Those people or citizens have to fill PAN Form 60.

PAN Form 61

This type of form can be submitted by any citizen of India who earns money from agricultural work. But, people or citizens of India do not get any income which is taxable. So, if they want to apply for a PAN Card as mentioned in Clauses [A] to [H] below the Rule 114B. So, according to the rules and regulations of a citizen’s needs, they will have to choose which type of form they want fo fill between PAN Form 60 or PAN Form 61.

PAN Form 60 and PAN Form 61

Let us tell you all that making a PAN Card has become a very important task for every citizen. Somehow, if anyone does not have any PAN Card, then they need to fill Form 61 for an agricultural basis. Through this PAN Form 61, everyone can fill or submit it for making transactions in agriculture.

I hope you will understand this article very well and are ready to take benefit from it. If you are facing any problems related to the meaning of a PAN Card Form, Different modules of Form 61, and Process of filling a PAN Card Form 61 then you may ask your queries in the given comment box.

Frequently Asked Questions

Name those people who are eligible for applying in a PAN Form 61A?

All type of taxpayers is eligible for applying for a PAN Form 61A. It is eligible for a particular financial year.

Mention the last date or proper time limit for applying in a PAN Card Form 61A?

The last date or exact time limit for applying Form 61A is between 30 days after the notice of service date was issued to people.

If there is any defect or problem while filling Form 61, then what type of action should be taken by the government?

In this type of problem, if there is any type of defect would occur, then it is important for every candidate to just report to the respective income-tax authority in between 10 days. It is just because to avoid any type of problem. Along with this, the government gave a time limit of 30 days to just improve any information in Form 61A.

What do you understand by the term Rule 114E?

According to the Income Tax rules and regulations in the year 1962 announced the statement that under Rule 114E, it is mandatory for all to submit all financial transactions below the sub section[1] of section 285BA Act.

Should I fill a PAN Card Form 61A?

No, it is not that important to apply for a PAN Card Form 61A below the section 258BA.