PAN Form 60: As everyone knows the fact that how important is to make a PAN Card. It is a type of mandatory government legal document for every individual people who still have not any PAN Card but they do transactions below the Income-tax department Rule 114B as announced in the year 1962. PAN Card is widely used in the process of income-tax. It usually helps out every applicant for their identification. Along with this, it supports all important information about the total tax paid, pending tax, and tax refund issued. In fact, this PAN [Permanent Account Number] Card has become a necessary document in India for every type of transaction. This process is good for every type of fraud in taxes, track tax evasions, and any illegal transactions.

| Topic Name | PAN Card Application Form 60: Module and Framework |

| Article Category | Significance of PAN Form 60 Necessary Information to Fill PAN Form 60 The Framework of Form 60 Process of filling PAN Card Form 60 Important Documents need to submit with Form 60 Frequently Asked Questions |

| Download PAN Form 49AA | Click Here |

According to the transaction in Rule 114B, they do not have any type of PAN Card. For this, everyone needs to fill a PAN Card Application Form 60 which is duly signed and filled by the applicant. This application form can be filled along with all important documents. Here in this article, we will provide you all information related to the PAN Card Form 60, its framework, the process of filling, and different modules related to PAN Form 60.

Significance of PAN Form 60

Here we will tell you all information related to PAN Form 60. So, it is a type of declaration form which is fully filled by any applicant or individual. If an applicant follows all the rules & regulations under the Income-tax department of Rule 114B, then it is their duty to fill Form 60 and apply for a PAN card. Let us tell you all that making of a PAN Card has become mandatory for all of us. Now, here we will discuss all the important essential features of PAN Form 60. Given the below table showing you all essentials of Form 60.

Let us tell you all that this Form 60 can be created from an individual who has not any PAN Card. In spite of all, according to the Income-tax department rule, he or she must have involved in any of the bank transactions. Here we discuss the transaction nature and its amount as per the Income Tax Rule which was governed in the year 1962. The table is shown given below:

| S.No. | Transaction Nature | Transaction Value |

| 1 | Buy or sell any type of vehicle, except for two-wheeler vehicles. But, exhibits only detachable side cars whose wheels are already joined together with vehicle. | Any Amount |

| 2 | Open Demat Bank Account | Any Amount |

| 3 | Buy or sell any stationary vehicle or property | Rs.10 lakh or higher |

| 4 | Linked with any bank and has a Fixed deposit | Rs.50,000 or higher |

| 5 | Money saved in a Post Office | Rs.50,000 or higher |

| 6 | A particular amount of contract for buy or sell of any securities | Rs.1 Lakh for each transaction |

| 7 | Open Bank Account as with any of bank or monetary institution | Any Amount |

| 8 | Get register for a debit or credit card | Any Amount |

| 9 | Buy any overseas currency, Deposit various hotels, restaurants bill, or any overseas travel | Rs.50,000 or higher in only one time |

| 10 | Mutual Funds Payment | Rs.50,000 or higher |

| 11 | Payment of Life insurance premium plan | Rs.50,000 or higher in a particular year |

| 12 | Buy or sell a number of shares which is not included in any of the reputed stock exchange company. | Rs.1 Lakh or more according to per transaction |

| 13 | Buy or sell a number of services or good which is not included in the given list. | Rs.2 Lakh or more according to per transaction |

Important Note: If anyone wants to get to know more information related to the PAN Form 60 or about the Income Tax Department, then he or she must visit an official website of Income Tax. From here, you will get the information about Income Tax. If there is any minor applicant wants to open a bank account in a savings account, there is a need for any guardian PAN Card. If there is not any available guardian, then the applicant needs to fill PAN Form 60. As it is an important rule.

Necessary Information to Fill PAN Form 60

Here we will discuss all the important information that needed to fill a PAN form 60. In this Form 60, it is around a total of 24 things which have to fill and around 20 things which have to fill by all individual people. So, all the necessary information is:

- Applicant First name, middle name, and surname

- Birthdate as per DDMMYYYY layout

- Applicant Father’s Name that includes first name, middle name, and surname

- Full address as per in the government documents such as floor number, flat number, name of the owner, block, street, state, city, district, town, pin code, area, and etc.

- Contact details such as mobile and telephone number

- Transaction amount

- Transaction Date as per DDMMYYYY layout

- If there are any joint transactions, then the name of all people included in it.

- Transaction mode

- Aadhaar Card

- Proof of identification in detail

- Proof of Residence in detail

- PAN application date and acknowledgment

- If you are not applied in any PAN Card, mention the total estimated income for a particular transaction year.

Submission of PAN Form 60

Let us tell you all that this Form 60 should be submitted either online or offline according to the government rules & regulations. This form declaration has to be done with the help of your transactions. Let us take an example when you were opening an account in a bank then you have to submit all important documents which are fully signed by applicant or authorization. When this process is going on, if you receive a PAN card, then make sure you have to inform the bank about all details.

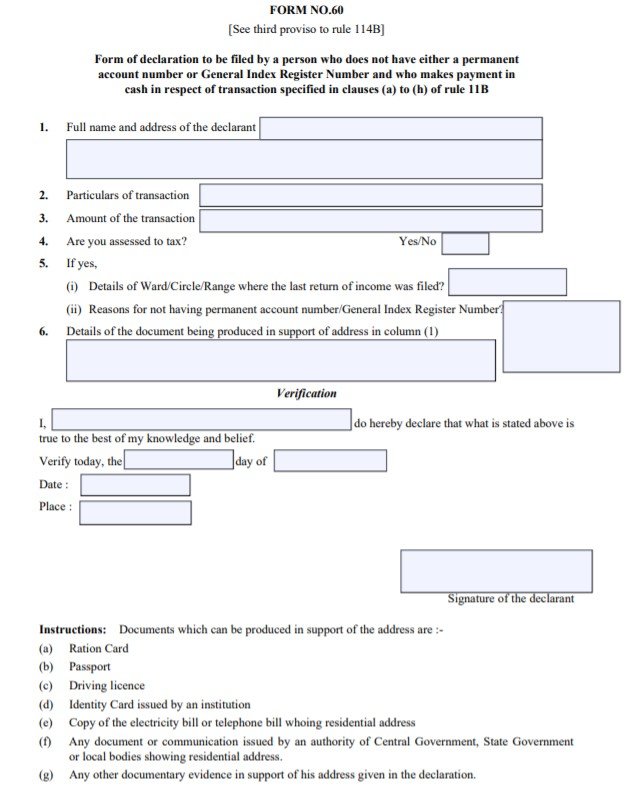

The Framework of Form 60

Here we discuss the various framework of Form 60. As you already know that this Form 60 has broadly part in various types of sections along with a number of subsections. Here are given various details related to PAN Form 60 are:

- Name of Area or nearest Locality

- Name of state

- Applicant First Name, Middle Name, and Surname

- Applicant Birth Date in DDMMYYYY layout

- Applicant Father’s Name which includes Father’s first name, middle name, and surname

- Applicant Residence address

- If it is a floor, then mention floor number, flat number, and etc.

- Apartment or house name

- Name and number of Block

- Name of the city

- Name of State

- Name of District

- Pin code

- Applicant Contact number with STD code

- Applicant mobile number

- Applicant Aadhaar Card

- Amount of transaction

- Transaction Date in a DDMMYYYY layout

- Detail of every person who is involved in this PAN transaction.

- Payment Mode

- An important document that shows as proof of Address details

- An important document that shows as proof of Identity details

- Need to mention an agricultural income, non-agricultural income for full-year while applying for a PAN Card.

- Need to mention an acknowledgment number when you were applied but still not yet received in a DDMMYYYY layout.

- Need to mention a declaration form with properly signed on it with the mentioned date.

Also, Get to Know More about Other Form

Process of filling PAN Card Form 60

Here we will discuss the process of filling a PAN Card Form 60. As we know that there are many rules & regulations that should follow during form 60 filling. It only seems that it has to be done very accurately, but not like that. If you done any mistake while filing, then your application form would get rejected. Follow all given below steps while applying for a PAN Card. Steps are:

- In this, there is a need to mention all details related to the applicant’s full name and resident address.

- Need to fill an applicant’s birth date and name of the father.

- Need to fill an applicant contact number and address.

- If there is any transaction, then need to fill a transaction history (includes amount)

- Name of the place where you will fill any income tax return.

- Need to fill an applicant Aadhaar Card details.

- Need to fill an acknowledgment number as well as the date when you applied for a PAN Card if you do not find any PAN Card.

Important Documents need to submit with Form 60

Here we will discuss all important documents that need to be submitted along with a PAN Card Form 60. So, here is given a table showing all the important documents that are required to submit. The table is shown below:

| Important Document Name | Residential Proof | Identification Proof |

| Voter Identity Card | Yes | Yes |

| Bank, or Post office passbook with photo | Yes | Yes |

| Applicant Aadhaar card | Yes | Yes |

| Applicant Ration card with photo | Yes | Yes |

| Applicant Passport | Yes | Yes |

| Driving License | Yes | Yes |

| All Pension card with photo | Yes | Yes |

| Domicile/ Residential, Caste certificate with photo | Yes | Yes |

| NREGA Job card | Yes | Yes |

| Electricity Connection Bill | Yes | No |

| Water Connection Bill | Yes | No |

| Landline Bill | Yes | No |

If any candidate or applicant wants to register for a PAN Card, then it is compulsory for all to get ready with the required documents. If you are already applying for a PAN Card Form 60, then it is not compulsory.

Important Note: If anyone wants to get to know more information related to the PAN Form 60 or about the Income Tax Department, then he or she must visit an official website of Income Tax. From here, you will get the information about Income Tax.

I hope you will understand this article very well and are ready to take benefit from it. If you are facing any problems related to the meaning of a PAN Card Form, Different modules of Form 60, and Process of filling a PAN Card Form 60 then you may ask your queries in the given comment box.

Frequently Asked Questions

What happens if we fill the wrong information on PAN form 60?

If someone fills any wrong information on PAN form 60, then it costs a very high punishment. For filing wrong information, an applicant will be sent to jail for around three months to 2 years. Not only this, but this will charge some amount of fine also.

What happens if we fill the wrong information on PAN Form 60 where an amount is increased to Rs.25 Lakh?

If someone fills any wrong information on PAN form 60 and their transaction amount will rise to around Rs.25lakh, then it costs a very high punishment. For filing wrong information, an applicant will be sent to jail for around six months to 7 years. Not only this, but this will charge some amount of fine also.

If I register for a PAN Card, but there is no allocation of a PAN Card. So, what are all important documents needed for the submission of a PAN Card Form 60?

For this, every applicant needs to submit this form as proof of an application.

Name the specific people who wish they were not registered to submit this PAN Form 60?

For this, every individual people who want to get submit their form 60 is one and only non-residents. Notwithstanding, this type of process is applying for a credit card and debit card.

If any minor wants to make a PAN Card i.e. transaction, then what type of work they can do?

If any minor parent’s want to make their child PAN Card, then they can do so by showing their own PAN Card. But, if any child wants to do any transactions, then they have to make a PAN Card. Everybody can make a PAN Card by just filling a Form 60.